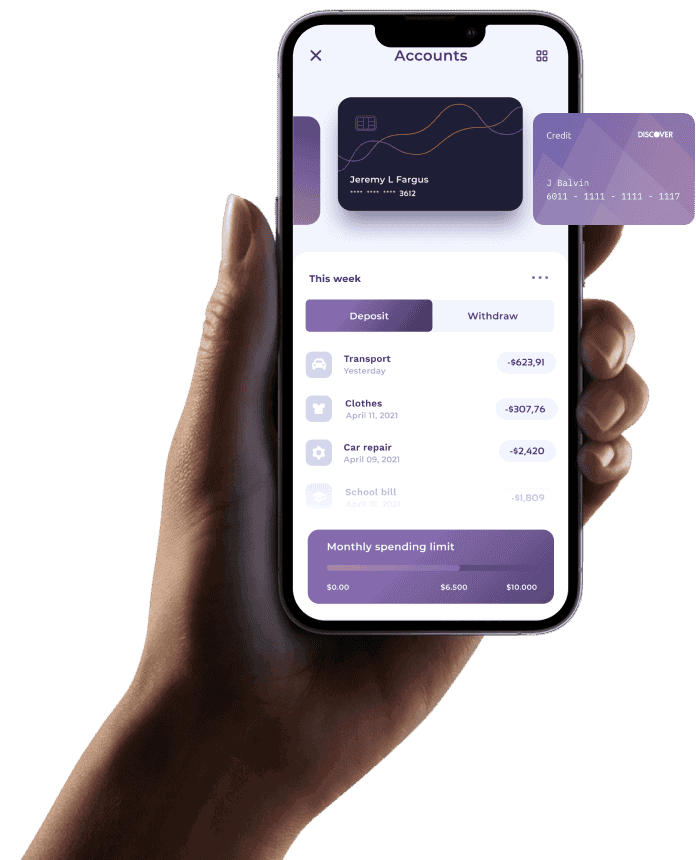

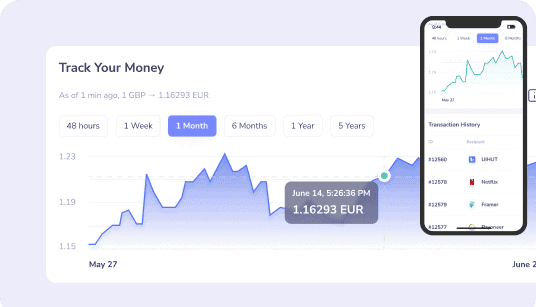

Creating Frictionless Banking Experiences

User-friendly Interfaces, Seamless Workflows, Powerful Integrations

Whether you need exceptional UI or workflows for neobanks, e-commerce sites, marketplace, or any fintech services , we’ve got you covered.

Trusted By Clients, Driven By Excellence For Two Decades

Solutions Tailored for

Your Sector

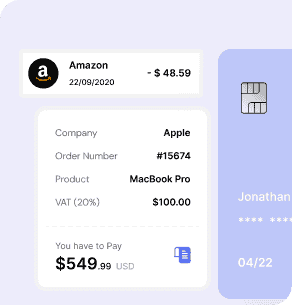

Beautiful Interfaces

Design interfaces that are visually stunning and super easy to navigate, making every interaction a breeze for your customers.

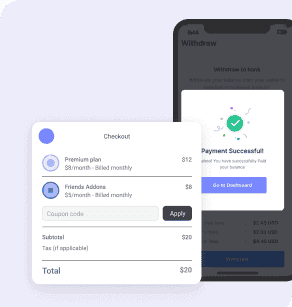

Efficient Workflows

Boost your operations with workflows that are streamlined, efficient, and user-friendly so everything runs smoothly.

White Labeled UI

With our customizable white label UI, you can keep your brand identity while delivering a top-notch user experience.

Powerful Integrations

Take advantage of our strong integration capabilities to connect with your existing systems and third-party services, enhancing overall performance.

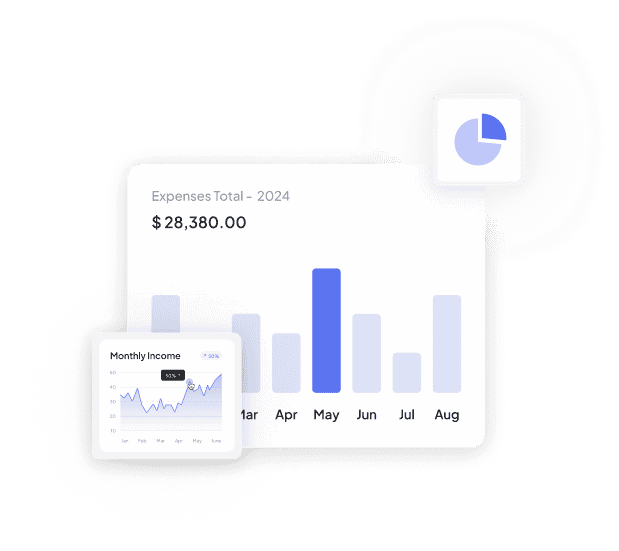

Helping You Navigate a Smooth Payment Experience

Beautiful Interfaces

Design interfaces that are visually stunning and super easy to navigate, making every interaction a breeze for your customers.

Efficient Workflows

Boost your operations with workflows that are streamlined, efficient, and user-friendly so everything runs smoothly.

White Labeled UI

With our customizable white label UI, you can keep your brand identity while delivering a top-notch user experience.

Powerful Integrations

Take advantage of our strong integration capabilities to connect with your existing systems and third-party services, enhancing overall performance.

At Fingent, We Guarantee

Scalability

Our solution scales with your business, so you always have what you need.

Increased Efficiency

Cut down on costs and save time with our streamlined payment processes.

Enhanced Customer Experience

Give your customers a smooth and enjoyable payment experience.

Helping Businesses since 2003

800+

Completed Projects

600+

Qualified Professionals

08 +

Center Of Excellence

95.3 %

Net Promoter Score

96 %

Quality Of Service

95.5 %

Time To Market

94.6 %

Cost Effectiveness

97.6 %

Willingness To Recommend

Upgrade Your Customers' Digital Banking Experience