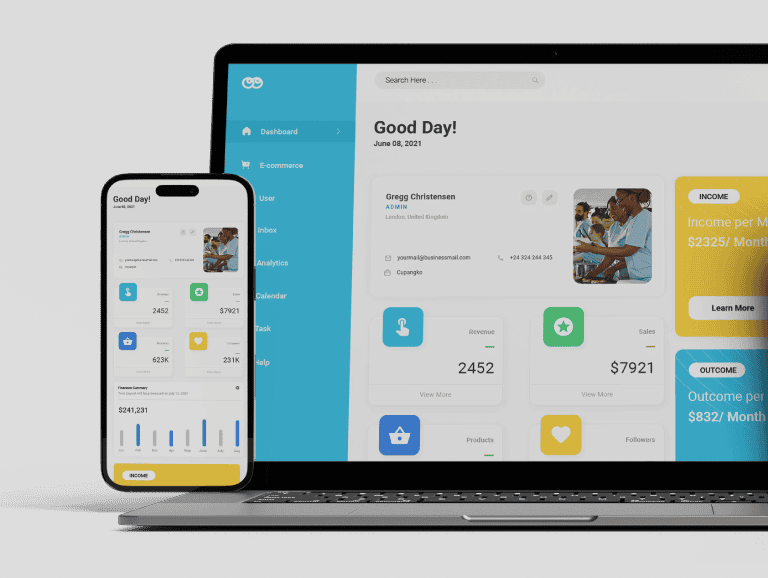

Custom Software Solutions for Streamlined Nonprofit Operations

- Build a budget-friendly solution that scales with your nonprofit's growth.

- Simplify volunteer, grant, and donor management with tools tailored to your needs.

- Protect your data with top-tier security and full regulatory compliance.

Trusted By Clients, Driven By Excellence For Two Decades

Drive Impact with Our Nonprofit Software Development Services

- Fund Accounting Software

- Donation Management Systems

- Financial Reporting Solutions

- Accounting and Bookkeeping Platforms

- Member Database Management

- Integration with CRM Systems

- Vendor Management

- Payment Processing and Invoicing

- Event Registration and Management

- Grant Application Management

- Dues Collection and Tracking

- Fund Allocation and Tracking

- Budget Management

- Automated Email Campaigns

- Lead Generation and Nurturing

- Social Media Analytics and Reporting

- Marketing Automation Workflows

- Digital Advertising Management

- Congregation Management

- Donation Tracking and Management

- Online Donations & Gifts

- Outreach and Community Engagement Tools

- Email Marketing Platform Integration

- Event Management System Integration

- Accounting Software Integration

- Social Media Platform Integration

- Volunteer Management System Integration

Case Study

Revolutionizing Children's Faith Education

Modernizing Legal Aid Services

Training App For Refugee Services

Transform Your Nonprofit with AI-Driven Solutions

Predictive Analytics for Fundraising

Grant Writing Assistance

AI-Driven Marketing Automation

AI-Based Fraud Detection

AI-Powered Donor Insights

Workflow Automation

Predictive Analytics for Fundraising

Use AI to analyze donor data and predict giving patterns, helping you target the right donors and maximize fundraising efforts.

Grant Writing Assistance

Save time and improve grant success rates with AI tools that help draft, edit, and optimize grant proposals for better results.

AI-Driven Marketing Automation

Automate your marketing campaigns with AI to better target your audience, increase engagement, and drive donations.

AI-Based Fraud Detection

Protect your organization from fraud with AI-powered tools that detect suspicious activities and ensure financial security.

AI-Powered Donor Insights

Gain deep insights into donor behavior and preferences, allowing you to personalize communication and build stronger relationships.

Workflow Automation

Streamline repetitive tasks and administrative work with AI, freeing up your team to focus on what truly matters, making a difference.

Take a Glimpse of Our Client Voices

5.0

"Fingent has been an amazing team, and the support we've received from them has been outstanding."

IT Project Manager, The Christian Broadcasting Network

5.0

“I’m very satisfied with the results and would work with Fingent again."

Jonathan Masters COO & CFO, Non-Profit Organization

5.0

"They’re an honest company to deal with ... they were always fair and reasonable."

Product Manager, DPS, Cru

5.0

"The feedback we’ve received from users has been great."

Design Strategist, OneHope

5.0

"Throughout that whole process, they’ve been patient and willing to give the focus required to achieve success."

CEO Product Ecosystem Dev for Life Coaching Startup

Smooth Integration with Popular Nonprofit Platforms

The Fingent Way of Nonprofit Digital Transformation

Connect & Collaborate

Reach out to us to discuss your needs and collaborate on crafting a clear vision for your software project.

Innovate & Develop

We’ll turn your ideas into reality through thoughtful ideation, development, design, and rigorous testing to ensure top-notch quality.

Support & Enhance

Benefit from our ongoing customer support to keep your software running smoothly and continuously evolving to meet your needs.

Your Trusted Software Development Company

Helping Businesses Since 2003

Making An Impact on Society

Transform Your Mission with Tailored Nonprofit Software

Accounting Solutions

Accounting Solutions Membership Management

Membership Management  Dues and Grant Management

Dues and Grant Management Social Media and Marketing Automation

Social Media and Marketing Automation Faith-Based Management

Faith-Based Management Third-party Integrations

Third-party Integrations