Tag: Banking and financial services

How AI and Machine Learning are Driving Cyber Security in FinTech?

Being a subset of the financial services domain, FinTech is targeted by hostile cyber villains. Industries thus require secure mechanisms to keep their data safe and secure. Preventing data losses are critical for Fintechs.

The World Economic Forum states that cyber-security is the Number One risk associated with the financial services industry.

Cyber Security Risks Associated With FinTech

Cybersecurity has remained a pressing concern for FinTech. Ever since the global financial crisis of 2008 that challenged the traditional financial institutions significantly, technology-driven start-ups have started evolving increasingly to cater to finance, risk management, digital investments, data security, and so on. Presently, we are in the FinTech 4.0 era.

The major cybersecurity risk that enterprises implementing FinTech face are from integration issues such as data privacy, legacy, compatibility, etc. Hackers target FinTech as they handle large volumes of customer data that include personal, financial, and other critical information.

FinTech offers a multitude of easily accessible services via its APIs. For instance, API banking. Here, the APIs are developed for the banks to access the FinTech platforms. It becomes open, API banking when open APIs enable third-party developers to build banking applications and services.

Let us walk through the major cybersecurity challenges triggered by FinTech.

-

Data Integrity Challenge

Mobile applications deployed for FinTech services play a predominant role in cybersecurity assurance. FinTech services require strong encryption algorithms to avoid integrity issues that can arise while transferring financial data.

-

Cloud Environment Security Challenge

Cloud computing services such as Payment Gateways, Digital Wallets including other secure online payment solutions are key enablers of the FinTech ecosystem. Though it is simple to make payments via cloud computing, it is equally crucial to maintain the security of data as far as banks are concerned. Appropriate cloud security measures are thus critical while dealing with sensitive information.

-

Third-Party Security Challenge

Third-party security challenges include data leakage, service challenges, litigation damages, and so on. Banks should be aware of FinTech service relationships while associating with third-parties.

-

Digital Identity Challenges

Major FinTech applications are web apps that have mobile devices working at the front-end. Banks and other financial institutions need to learn about the security architecture of the electronic banking services offered by these applications before implementing the FinTech application.

-

Money Laundering Challenges

The use of cryptocurrency for financial transactions makes FinTech-drive banks prone to money laundering activities. Thus, the FinTech ecosystem needs to be formally regulated based on global standards.

-

Blockchain Challenges

Private keys can be stolen in case of weak security in blockchain architecture. Cryptographic algorithms need to be strong and transactions need to be confidential.

The increase in the number of FinTech implementation of interfaces will cause a rise in the number of cybersecurity challenges as well.

How Artificial Intelligence And Machine Learning Enables Cyber Security For FinTech?

Artificial Intelligence is both reactive as well as proactive or preventative. AI reinvents FinTechs by bringing in behavioral biometrics solutions. These solutions are used to monitor customer and device interactions that take place during transactions that enhance security and authentication. BB or behavioral Biometrics with AI provides problem-solving capabilities for FinTechs. FinTechs utilize Artificial Intelligence is an expert system that enhances decision-making abilities using deductive reasoning. Big Data analytics is used here to focus on quality data.

The underlying technology in using Artificial Intelligence involves reasoning, learning, perception, problem solving, and linguistic intelligence to provide critical insights. It helps in understanding business in real-time operations.

In this digital era of increasing cybersecurity attacks and malpractices, AI can be used effectively to prevent risks and attacks. The following are major ways of how AI and ML protect FinTechs:

1. Fraud Detection

AI and machine learning algorithms are used to detect frauds in FinTechs by being able to identify transactions in real-time accurately. The traditional strategy of fraud detection involved analyzing large volumes of data against sets of defined rules using computers. This process was time-consuming and complex. Unlike this traditional method, more intelligent data analytics tools for fraud detection such as KDD (Knowledge Discovery In Databases), Pattern Recognition, Neural Networks, Machine Learning, Statistics, and Data Mining have evolved.

2. Controlling Access

Access control to critical data is crucial when it comes to security. Machine learning is used to derive critical insights from previous behavioral patterns such as geolocation, log-in time, etc to control access to endpoints. The risk scores are fine-tuned by combining supervised and unsupervised machine learning methods to reduce fraud and thwart breach attempts as well.

3. Smart Contracts

Smart contracts are coded in a programming language and stored on the blockchain. With blockchain, new contracts can be added to existing ones without having to change the individual contracts, in case of agreement expansion. Artificial Intelligence has become an integral part of FinTech as more traditional banks are teaming up with FinTechs to leverage the benefits of both worlds. For instance, when customers face issues with a poor credit history while applying for loans.

Artificial Intelligence is yet to be transforming the face of FinTechs in a multitude of ways. Drop-in a call right away and our strategists will guide you on how to leverage the benefits of AI and ML to secure operations and prevent breach attacks.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Evolution Of The Digital Twin Technology

What is a digital twin? Digital Twins can be best defined as digital copies or virtual replicas of physical assets. Data scientists can make use of digital twins to try and run simulations before they build and deploy actual devices. Digital Twin technology transforms the way in which the Internet of Things, Artificial Intelligence, as well as, Data Analytics is optimized.

The concept of ‘digital twin’ rewinds back to the year 1970 with the launch of Apollo 13. NASA’s digital twin model of Apollo 13 was a famous rescue mission to assess space monitoring conditions. The concept of Digital Twins later gained recognition in 2002 at the onset of a presentation by Challenge Advisory at the University of Michigan. According to Gartner, the digital twin is one of the top 10 strategic technology trends since 2017. Gartner estimates 21 billion connected sensors and endpoints by the end of the year 2020!

Related Reading: Checkout in detail, where and why should you invest in IoT.

Digital Twins: Enhancing IoT Enabled Industries

Data scientists build digital twins that can receive input from sensors that collect data from its real-world counterpart. The twin is then allowed to simulate in real-time. This process provides critical insights and feedback that helps in analyzing the actual system’s performance. For instance, a twin car can be built digitally by validating various inputs to check on factors such as safety, mileage, etc.

Digital Twins impact various IoT-enabled environments such as manufacturing, automotive, healthcare, financial services, urban planning and many more. The major IoT-enabled industries that can leverage the benefits of digital twin technology and how they benefit from it are as follows:

- Manufacturing Industry: The Digital Twin concept with the IIoT (Industrial Internet of Things) is implemented in the manufacturing domain. It can be designed and deployed in numerous ways such as in tracking and monitoring systems, evaluating production, troubleshooting equipment used, etc. As digital twins can predict failure chances, it helps in saving costs, time and in improving customer loyalty.

- Automotive Industry: The future of autonomous vehicles lies on well-connected road systems and vehicles. Critical data gathered from this network. The digital twins then act as simulated models that help engineers analyze the behavior of vehicles before they are used on roads.

- Healthcare: Medical monitoring technology is used to gather critical data such as heart rate, oxygen levels, etc. This data is used in the creation of digital simulations. Digital twins help the healthcare ecosystem in disease diagnosis, remote monitoring of patients, etc.

- Urban Planning Sectors: Vital data such as maps, blueprints of buildings, real-time data from sensors, etc are used to create digital twin models to improve urban planning services. These services include waste disposal, mobility services, providing resources like electricity and water, etc.

- Asset Management: Both worksite and remote industrial operations can be managed via digital twins with the help of remote asset monitoring services. Predictive maintenance of assets like machinery improves operational efficiencies and decreases disruption of business operations. Digital twins can also be converged with augmented and virtual reality techniques for better visualization of industrial workflows.

- Financial Services: Customer behavior can be easily monitored with digital twin technology. It helps in creating personalized profiles for individuals via data analysis of their previous behavior in buying decisions etc. It can also simulate cash flows and balance sheets. Client needs can be analyzed better by insurance firms and asset managers and can thus provide personalized experiences for their customers.

Digital Twin Technology: Fostering Innovation In IoT-Enabled Environments

According to Gartner digital twin will be used by 50 percent of the industries in 2021. This will result in a 10% improvement in operational efficiency in these IoT-enabled organizations. The digital twin technology is the most important Industry 4.0 technology that is available today.

It helps in automating decision-making processes, providing critical insights into dynamic recalibration of products and other equipment in the industries, monitoring the manufacturing processes and production lines, etc.

The digital twin technology helps in monitoring manufacturing components, assets, and critical processes in real-time. Also, it helps in improving OEE (Overall Equipment Effectiveness), increasing product quality, enhancing traceability, reducing wastage and boosting overall efficiency.

Main Data Elements in Digital Twin Technology: Key Benefits For Improved Innovation

There are three main elements in digital twins such as Past, Present and Future Data that improve efficiency in IoT-enabled industries. The past data is the data from the previous performance of individual machines etc. Present data is the real-time data from sensors, whereas the future data is the data received from machine learning algorithms and various inputs from engineers.

The key benefits of Digital Twin IoT enabled industries are as follows:

-

Automated Insights

It is important for an IoT-enabled environment to understand the relationship between different types of data within its network. This IoT data can be extracted and enhanced in the form of knowledge graphs. This helps in automating processes and improving decision-making.

-

Increased ROI Generation

A decline in revenue is mainly due to the downtime of machines. The digital twin technology can reduce downtimes, prevent failures, and increase the life-span of machines. This not only improves productivity but also brings down the operational costs significantly and improves revenue generation.

-

Predicting Failures

Digital twins provide a platform that enables IoT-enabled industries to be prompted constantly about production, operation and management activities. The virtual testing platform that it provides, simulate the real-world data into critical and meaningful insights. In addition to being a scalable solution, it also self-diagnoses problems. This makes it easy for industries to make human-machine interaction efficient and productive.

-

Digitizing The Whole Industry Ecosystem

There is a rapid adoption rate of digitizing operations by industries day-to-day in order to achieve positive business outcomes. This is made possible with the steady data flow from the environmental and operational sectors of the IoT-enabled industries.

This up-to-date and personalized data maximize profitability and productivity. In addition to being a high revenue opportunity, the digital twin technology also digitizes the working assets and processes in its entirety.

In a nutshell, the benefits that can be leveraged from digital twin technology for IoT-enabled industries are as follows:

- Reliable operations and management of equipment and production lines

- Increased Overall Equipment Effectiveness or OEE achieved via reduced downtime.

- Increased ability of customers to remotely configure products.

- Significantly reduced maintenance costs due to preventive measures taken that aid in finding out chances of failures or machine breakdown, etc.

- Improved production cycles leading to reduced downtimes.

- Better productivity

- Considerably reduced risks in areas of product availability, product failures, services, maintenance, etc.

- Provides critical insights of past, present and future data in real-time environments.

The globe is yet to witness over 50 billion connected devices by the time period of 2020-2030 and over 7 billion customers using the web worldwide.

For an immersive experience on how to transform your IoT-enabled industry or business with the Digital Twin technology, call us right away. We will help you gather brilliant strategies on fostering innovation with specific digital twin models!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How Machine Learning Systems Detect And Prevent Frauds Without Affecting Your Customers

There is nothing more fearful than imbalanced data, especially when dealing with various payment channels like credit and debit cards in banks and other financial organizations. With the wide increase of different payment mediums, businesses are finding it difficult to authenticate transactions. But Machine Learning has been a viable solution to detect fraudsters.

Machine Learning can be referred to as the ability of machines to learn data with the help of human intelligence as well. According to the latest report by Gartner, by 2022, more than nearly half the data and analytics services/ tasks will be done by machines.

Related Reading: Read on to learn how machine learning can help boost customer experience.

Machine Learning In Making Real-Time Decisions To Prevent Fraud Activities

If a business is able to predict which transactions can lead to fraudster attacks, then the business can considerably lower costs and make critical decisions. While sending sensitive data to a third-party, it is important that the data is not misused for fraudulent activities. This can be done as follows:

-

Using Machine Learning Models

Consider a score produced from a number of algorithms that is a combination of all possible features. This set of algorithms can be termed as a machine learning model. This machine learning model constantly queries these algorithms in order to produce an accurate score that can be used to predict frauds.

Machine learning models can be compared to data analysts who run numerous queries on large volumes of data and try finding out the best from the derived outcomes. Machine Learning makes the whole process fast and accurate.

-

Fraud Scores For Fraud Detection

There always exists large amounts of data. Machines are trained using these data sets that are pre-labeled as frauds. These labels are based on earlier records of confirmed fraudulent activities.

The machines are then trained using this labeled set of data. These data sets are now called as training sets. By a named label, the machine is taught to determine if a new transaction or a particular customer is likely to be a fraudster based on a score of 0 to 100, being the probability.

This score enhances the ability of a business to ensure a considerable reduction in frauds by providing accurate predictions.

Related Reading: Check on to this Infographic to learn more about Machine Learning.

Can Machine Learning Actually Predict And Prevent Fraudsters?

Designing as well as being able to apply algorithms that are on the basis of data sets from the past, enables to analyze frequent patterns in these data sets. These patterns in data via the algorithm are taught to machines and these machines considerably reduce human effort.

These algorithms help businesses boost predictive analysis. Predictive analysis is important for data reduction by using statistical modeling techniques that help in predicting future business outcomes on the basis of past data patterns. In fact, among many businesses, 75 percent of them find growth to be their main source of value, whereas 60 percent of some others believe that it is nothing else but predictive analytics that is the key to deriving value!

Machine learning algorithms are not only used in predictive analytics, but also in image recognition, detecting spam, and so on. Machine Learning can be trained by a 3 phase system.

1. Train

2. Test

3. Predict

So to be able to predict an occurrence of fraud in large volumes of data sets and transactions, cognitive technologies of computing are applied to raw and unprocessed data.

Machine Learning thus facilitates, prediction and prevention of fraudsters for the following key factors:

- Scalability: Larger the data sets, increased is the effectiveness of machine learning algorithms. Initially, the machine learns which transaction/data sets are fraudulent and which ones are safe, the machines are well able to predict such cases in future transactions.

- Readiness: Manual tasks are time-consuming. These are not preferred by clients. Hence, machine learning strategies are used to acquire faster results. Machine learning algorithms process a large number of data sets in real-time to customers. Machine Learning frequently and periodically analyzes and processes new data sets. Advanced models like neural networks have provisions for autonomous updations in real-time.

- Productivity: The need to perform redundant tasks reduces productivity. The continuous repetitive task of data analysis is performed by Machine Learning algorithms and prompts for human intervention only when required.

Related Reading: Check out how machine learning is revolutionizing software development.

Machine Learning Methods – Using White Boxes And Ongoing Monitoring To Detect Fraudsters

What does a machine learning system do? The methods adopted and the various approaches used for this are termed Whiteboxes, as there is no definite method or model to analyze the score obtained. Similarly, regular and ongoing monitoring is critical for a machine learning system to identify the trends and data statistics on a regular basis.

How Fraudsters Are Detected And Prevented By Using Machine Learning

Data sets are initially collected and partitioned. The machine learning model is taught the sets in order to predict data fraud. The following are the steps in which Machine Learning implements and performs fraud detection:

- Data Partitioning: The data is segmented into working in three different phases such as training the machine, testing for data sets and finally, cross-checking of the prediction results.

- Obtaining Results of Historical Data: To obtain such data sets, training sets have to be first provided to the machine that includes input values associated with its corresponding output values. This helps in predicting and detecting frauds.

- Predicting Anomalies, If Any: Based on the input and output data, predictions are determined by analyzing the anomalies or fraud cases in the data sets. For this, building models are used. This can be done by many techniques such as using Decision Trees, Logistic Regression, Neural Networks, and Random Forests, etc.

- Out of the techniques, Neural Networks are quick in processing results by analyzing data sets and helps in making decisions in real-time. It does so by observing regular patterns of frauds in earlier cases of data sets given to it for learning.

In a nutshell, Machine Learning is proving to be the right technology in detecting and preventing fraudsters from malicious activities. If banks start using machine learning systems, it could analyze unstructured data and prevent customer’s accounts from fraudulent activities. To know more about how you can empower machine learning and other technology trends to secure data, get in touch with our IT experts today!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Artificial Intelligence (AI), the next big thing in the technology space, is all set to unleash big scale disruptions. The potential impact is more profound in the financial sector, which lives and breathes data.

Artificial Intelligence (AI) powered “smart” machines do not just crunch data. It indulges in self-learning to solve cognitive tasks, until now the forte of the human brain. A traditional analytical engine or software robot requires someone to feed in clear set of rules set in advance. AI-endowed self-learning machines create the rules and frame the logic by itself, as it crunches through millions and millions of rows of historic data, identifying. It learns to perform the required task based on the decisions humans have made previously. AI powered algorithms also learn from mistakes, meaning the predictive analytics in spews becomes more and more accurate with every recorded transaction.

In the financial sector, such AI-powered systems delve into many years of banking, insurance, mortgages and financial trading history, apply deep learning principles, and self-construct algorithms to automate routine tasks, unlocks insights, improve decisions, mitigate risk, and prevent frauds. AI’s natural language processing system can read through regulations, reassembling words into a set of computer-understandable rules.

The CBInsights Conference on the Future of Fintech predicts a rapid pace of disruption in the financial sector, requiring incumbent stakeholders to adapt or risk being submerged in the coming tidal wave of predictive analytics. Apart from conventional tools, Artificial Intelligence-inspired technologies such as blockchains, insurance tech, robo-advising, and other latest cutting-edge innovative tools promise to take analytics to a whole new level.

The following are the potential applications of Artificial Intelligence, which would take over financial services in the near future:

- Improved efficiency through greater automation and better insights

- New models for several traditional functions, especially in stock analysis and wealth management advisory services

- Customization and personalization of financial products, leveraging the services of analytics-driven recommendation engines;

- Improved cyber-security monitoring and responsive systems, and automated fraud detection

Improved Efficiency

AI and robotics powered automated solutions are on the verge of subverting the traditional business models of banks and other financial institutions.

AI-based algorithms automate much of the routine tasks that require extensive workforce now, leading to considerable savings on overheads, accelerated processes, and overall improved efficiency. Being lean and mean is the mantra for success in today’s highly competitive environment, and AI will help financial institutions discover new meaning to lean and mean.

AI-based technology simplifies and automates a host of routine tasks related to money management processes, such as identity authentication, know-your-customer checks, sanctions list monitoring, billing fraud oversight, anti-money laundering monitoring, risk control processes, and more.

AI facilitates several tasks, such as bot messaging, document discovery and more which require extensive manual work now.

Such efficiency improvement interventions have the potential to offer huge ROI for the financial service industry. Banks adopting ROI already report about 40% increase in productivity.

New Trading Models

AI powered predictive analysis has the potential to create entirely new business models in equity, forex and other trades.

Algorithms are already in widespread use to manage risk and exposure. With AI getting better, the scope of intervention will change from refining existing models to becoming the bedrock of newer innovative models. AI-powered algorithms offer brokers and investors access to charts and trends at a much more sophisticated level than before, enabling them to chase short-lived opportunities cutting across venues, asset classes, and geographies. Trading algorithms assess the best liquidity providers during execution. The possibilities are endless.

Thomson Reuters predict algorithmic trading systems to handle 75% of the global trade volumes in the near future. Almost all hedge fund in the world already have a huge data-science team, and deploy sophisticated filters to screen investment ideas.

Tightening regulation mandating extensive record keeping and tracking of all trades, and the need for increased speed in correlating multiple variables, to keep pace with a fast paced and highly competitive environment plays into the eventual dominance of AI.

Deep Personalization and Customization

One of the innovative possibilities with AI in the financial sector is in the realm of marketing. Already, marketers are analyzing behavioral data captured from online activities in a big way, to customize and personalize offerings based on spending habits, social-demographic trends, location, and other preferences.

With AI capable of understanding human language and emotion, marketers of financial products and services would soon take personalization to a whole new level. For instance, AI-powered marketing database could suggest language that elicits certain emotional responses to advertising and email subject lines, and trigger cultural sensitivities to certain words and timing of campaigns. Biggies such as Citi and AmEx already use such tools to good effect, to fine tune their social media and marketing engagement.

Security and Fraud Prevention

Cyber-attacks have brought down many high-profile financial institutions, and continue to be a nightmare for the industry stakeholders. AI promises a fresh breath of hope.

For instance,

- AI based analytic engine capture multivariate time series patterns, to predict anomalies.

- AI based predictive analytics make explicit customer behavior, to flag potential fraud or breach in real-time

- AI can easily correlate and link multivariate transaction data, facilitating easy recovery of layers of bank documentation and data to meet regulatory policies, and establish a money trail to bust financial frauds.

- Sophisticated machine learning and algorithm that monitor market movements in real time allow regulators to prevent major accidental market movements.

Regulations influencing financial markets, such as the European Union Markets in Financial Instruments Directive II (MiFID II) push for greater automation of trades, further boost the prospects of AI in the niche.

Experts estimate AI to surpass human intelligence by 2040. However, the financial services sector need not wait that long for predictive analysis to take over and relegate human brains to a role of supporting AI functions. It nevertheless takes great skill in developing actionable apps and products that leverage AI to unlock the many possibilities on offer. Your best bet is to partner with us and leverage our highly talented and experienced skill set for the task. We are in the thick of AI inspired things, having access to the latest technology and developments, and offer you the unique value proposition of technical competency with a considerable track record in every industry to understand your specific needs and develop highly customized products.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Some marketing campaigns are hilarious and others heartbreaking, whatever they are, they are interruptive for sure- because it makes you stop by and notice! To justify the statement, you may think digital marketing campaigns should always be the most attractive and catchy. But that is not often the case. For instance, the banking and finance industry is one of those industries in which you cannot really make use of a lot of creativity and colorful marketing campaigns. Whether it is a social media campaign or any other kind of digital marketing technique, you need to put in a lot of thought, while also keeping in mind the various regulations governing the financial industry. So, how exactly can you go about digital marketing for this industry?

Here are some tips:

- Talking to customers about more than just banking – Whether it is through the social media or through any other digital marketing channels like e-mails or websites, it is important to keep your customers engaged. It is true that talking to customers about events and activities in the banking industry can be rather less exciting and it might be difficult to keep the customers engaged. Hence, you need to make an effort to think beyond the financial perspective of what you can do for your customers and get them talking about what they might be interested in or what they can relate to. For example, you could ask questions through your facebook page to get to know your customers’ opinions on general matters of interest like events that happened in their city etc.

- Adding a little color – When using social platforms for marketing, make sure that you talk in their language. Connect with them and communicate with them like they do. If you make your communication formal, on any social platform, it will turn out to be an extension of your website and people will lose interest. Hence, you can share pictures or videos of events in banks or of new services provided, and engage with customers in a meaningful way. For example, Wells Fargo has posted pictures of the last signs switching over through a social media channel when they transitioned the last of their Wachovia branches over, instead of sharing a press release about the same.

- Organizing contests – Contests have always proved to be one of the most effective ways to engage with customers. You can have contests on any digital marketing channel, although it might be most effective on a social networking channel. Contests, again help you connect with and keep regular contact with your customers. For example, HSBC Students had promoted their scholarship contest through social networking channels and it triggered an overwhelming response within their community.

- Highlighting success stories – What could be more effective for promotion than a genuine third party endorsement. Rather than having self promotional ads, you can have some of your existing customers share online, their experiences with your bank. You can identify some of your customers whom you’ve had the longest relationship with, or some with a unique story etc. and share them through your digital marketing channel. If you share these stories in a creative and fun way, you can have your customers interacting and engaging in no time.

These are some things you can do while carrying out your digital marketing campaigns. In order to increase the effectiveness it can be accompanied by other regular marketing campaigns as well like partnering with colleges or universities etc. Marketing for banks and financial institutions, even though is a tough job, if done properly and thoughtfully, can generate best results.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

In 2014, we saw the banking and financial services industry in the midst of a compliance crisis. Therefore, Most banking institutions pursued a shift in focus from defensive compliance remediation to revenue growth and cost reduction. Some banks had to settle some of their mortgage-related cases, the fines for which were quite huge. Further, the banks sought to increase operational efficiency and thereby enhance their financial performance. For this, they simplified their operations and went on to even cut down on their branch network. According to a research conducted by Deloitte, the industry closed down 1614 branches over 12 months ending in June 2014, which was the biggest downturn in over 2 decades.

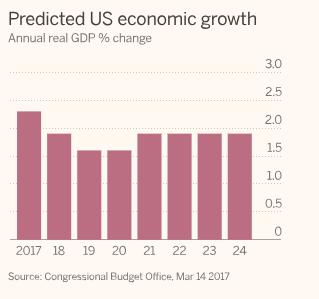

Now, the US economy is in a much better form compared to 2014. However, statics show a slight slow down in 2019-20, which is again forecasted to have a steady growth in the coming years.

The financial services sector has entered a new phase with a stronger focus on increasing profitability. In this post-crisis phase of improvement, banks and financial institutions are likely to focus on 7 areas in order to enhance growth and profitability. These are:

1. Achieving balance sheet efficiencies

Banks will have to revamp their deposits and assets mixes this year, so that they are in conformity with compliance regulations and at the same time do not compromise on increasing profitability. In order to retain deposits, banks will have to boost their customer relationship programs and increase cross-selling efforts. New rules regarding the Liquidity Coverage Ratio (LCR) and the Supplementary Leverage Ratio (SLR) which were finalized in 2015, will have to be complied with in this regard. Find more on Basel III Leverage Ratio Rules in this video.

All financial institutions having more than $250 billion in total consolidated assets or more than $10 billion in on-balance sheet foreign exposure are required to have a 100% LCR. In the case of assets, investments will have to be made keeping in mind the new rules of the Net Stable funding ratio.

2. Driving Mergers and Acquisitions

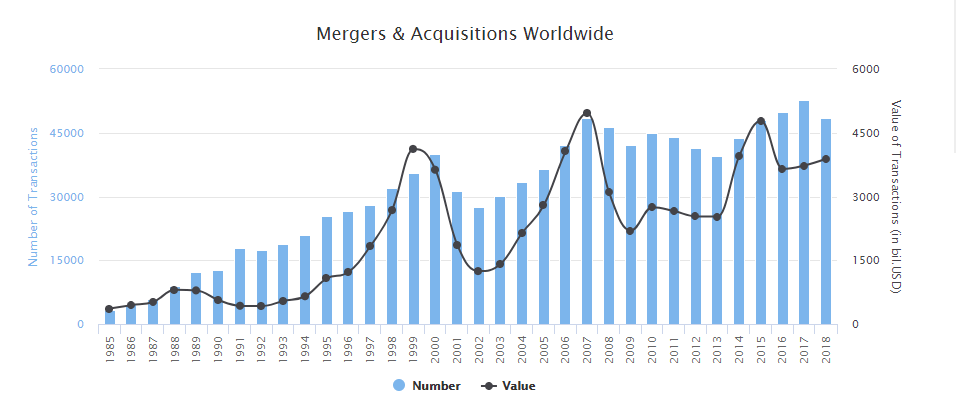

Since 2000, more than 790’000 transactions have been announced worldwide with a known value of over 57 trillion USD. In 2018, the number of deals has decreased by 8% to about 49’000 transactions, while their value has increased by 4% to 3.8 trillion USD.  Although 2016 witnessed a dropdown, Mergers and acquisitions (M&A) are likely to continue growing in 2019, the main driving factors being efficient and strong balance sheets, challenges to the growth of revenue, limitations to achieving cost efficiencies etc. Banks, however will have to focus more on adhering to the compliance regulations concerning M&A, especially in cases where the amount exceeds $10 million or $50 million, wherein the scrutiny will be stricter.

Although 2016 witnessed a dropdown, Mergers and acquisitions (M&A) are likely to continue growing in 2019, the main driving factors being efficient and strong balance sheets, challenges to the growth of revenue, limitations to achieving cost efficiencies etc. Banks, however will have to focus more on adhering to the compliance regulations concerning M&A, especially in cases where the amount exceeds $10 million or $50 million, wherein the scrutiny will be stricter.

3. Pursuing growth

Since 2014, there have been many obstacles to growth like low demand for loan, especially mortgages. The competition has also been quite heavy especially for fee-based services like wealth management. This year, there will a stronger focus on growth. Banks will have to invest in customer analytics as well as digital technology in order to develop better cross-selling strategies and also generate more interest of the customers. But, underwriting standards should be complied with strictly. With regard to competitive advantage, establishing partnerships with non-banking technology firms could be beneficial.

4. Transforming payments

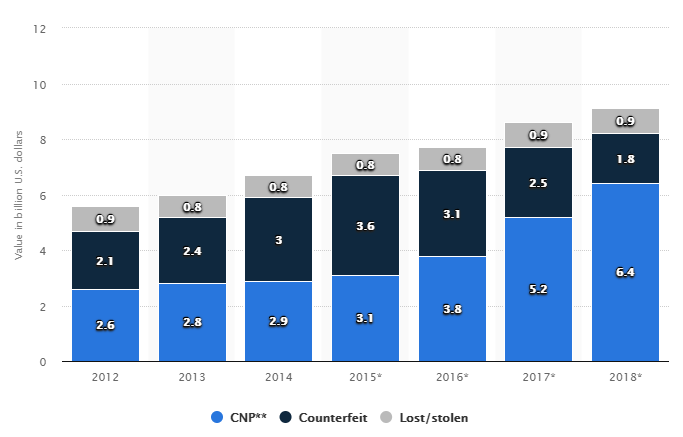

Banks have replaced their traditional cards with the EMV standard of chip and PIN cards. A Statista survey carried out in June 2018 revealed that 83 percent of Americans between 30 and 49 years owned a credit card. The total credit card debt in the United States amounted to approximately 0.83 trillion U.S. dollars in the second quarter of 2018. With the introduction of Apple Pay, contactless payments are also becoming quite popular. And as contactless payments become more accepted, banks will have to look for ways to distinguish their way of delivering customer experience.

Fun Facts: In April 2018, the four major U.S. credit card issuers — Visa, Mastercard, American Express, and Discover — decided that they’ll no longer require signatures as a verification method for purchases. Retailers may still require signatures to verify cardholder identities, however, but only if they choose to do so. This will help streamline the checkout process without compromising card security — signatures aren’t a very good security measure, and cashiers never check them anyway.

5. Strengthening compliance management

In 2014, as mentioned before, banks and financial institutions had resorted to dealing with compliance pressure by strengthening internal control and resolving existing legal and regulatory issues. Further, as the compliance regulations have been bolstered, banks need to integrate compliance and risk management fully into the culture of the banks rather than concentrating on specific processes. It should be enforced in the performance management systems as well, through employee training. New regulations like heightened risk governance expectations and the enhanced prudential supervision rule specifically require the banks to improve their risk capabilities.

According to Statista reports, payment card losses due to counterfeit amounted to three billion U.S. Dollars in 2014 which declined to 1.8 billion U.S. Dollars in 2018.

6. Managing data and analytics

Since 2014, the efficiency of the data management processes followed in most of the banks had been found to be just about average. From a recent survey conducted by the Risk Management Association and Automated Financial Systems Inc., it was found that only 40% out of the 37 global financial institutions surveyed, felt the quality of their data to be above average or excellent. Banks now need to move toward a central Regulatory Management Office (RMO) in order to monitor the data management processes. Besides that, the Chief Data Officers should also extend their responsibilities and help in collaborating with new business lines and functional groups, which will help in value creation.

7. Enhancing cybersecurity

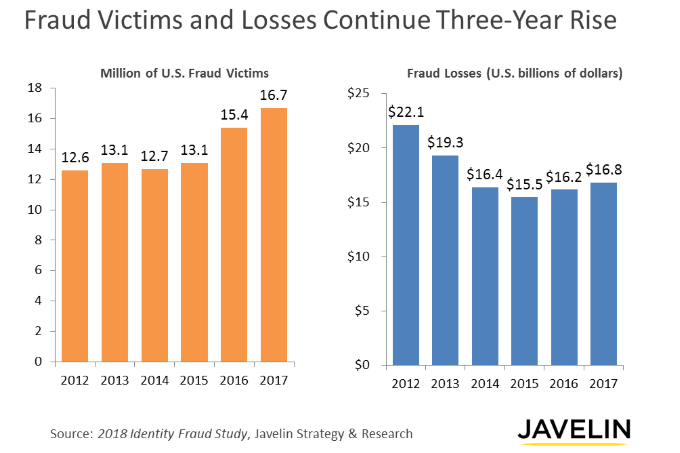

In 2014, there was a huge rise in the number and severity of cyber attacks. The 2018 Identity Fraud Study revealed that the number of identity fraud victims increased by eight percent (rising to 16.7 million U.S. consumers) in 2017, a record high since Javelin Strategy & Research began tracking identity fraud in 2003. The study found that despite industry efforts to prevent identity fraud, fraudsters successfully adapted to net 1.3 million more victims in 2017, with the amount stolen rising to $16.8 billion.

To improve cybersecurity efforts, banks are likely to add advanced features to their existing systems. New methods like Wargaming, attracting specialized talent etc. will prove to be quite helpful. Enhancing the existing intelligence systems to detect new threats or attacks on a regular basis could also be very helpful.

As the economy improves, banks need to invest more into technology for most of their concerns whether it is compliance or customer relations or cybersecurity. Improving data analytical capabilities will ensure that the ultimate goal of growth and profitability is achieved. Moreover, with ethics and risk management embedded into the organizational culture, it further assures improved profitability.

Fingent works with a number of financial institutions to help them be ahead in the market. Along with advanced technology practices, Fingent helps financial institutions implement industry proven practices to help their clients overcome challenges for growth.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new