Tag: SAP

Right ERP software helps CFOs contribute to organizational decisions more logically.

Selecting the Right ERP Solution: Crucial Points a CFO should Keep in Mind

The CFO is one of the most significant decision-makers in an enterprise today. CFO is the protector of your business’s financial records and has an ultimate say while making financial decisions for the company. However, in this digital age, the role of a CFO is evolving. A CFO takes a more holistic approach in the current scenario and guides the organization towards success by leveraging digital intelligence. CFOs must be equipped to keep their company afloat during an unexpected crisis such as the pandemic, identify new investment opportunities and help the business prosper in the face of intense competition. A tall order but not impossible.

To achieve this, CFOs must look at their existing systems to upgrade or replace those slowing down the organization. CFOs are responsible for ensuring that any new technology they adopt has what it takes to turn the business into an effective market disruptor.

This article covers a CFO’s top 5 considerations when choosing an ERP solution.

Read more: How Organizations can Gain a Competitive Edge by Implementing Digital Core ERP

1. Obtain hands-on knowledge on the process

CFOs might find it tempting to leave the ERP process knowledge to technical teams, but this could mean that they miss out on learning the crucial aspects of the ERP that will affect the organizational costs. Technology assists CFOs in controlling accounting and tax standards and in engaging with the business to drive value jointly.

Read more: SAP S/4HANA: Transforming The CFO into a Business Value Creator and Role Model

Technical jargon can be overwhelming for CFOs. But they need to clarify their questions with their ERP service provider.

To get you started, here are some important software concepts related to ERP implementation.

- Installation: Know what is required of your current server.

- Customization: Make sure the ERP software suits your organization’s specific requirements. Compared to other ERP systems, SAP requires minimum customization. It has many customizable solutions that are suitable for all types of businesses.

- Configuration: Ensure your software is in harmony with your workflow. Thankfully, SAP is suitable for any size organization.

Apart from this, confirm the ERP is hosted on the cloud because it is easier to handle and more secure to manage. Those who have migrated to cloud-hosted ERPs reap the benefits during the pandemic, where remote working is the only option to ensure business continuity. Making sure the solution is rewritten for the cloud will help CFOs keep up with any future changes.

2. Invest in a service provider with vision and efficiency

Your ERP solution’s longevity is determined by your service provider’s efficiency and capability. Do not hesitate to clarify certain aspects of your service provider and the services they have to offer you. Find out if their financial situation makes it a viable option for a long-term contract.

You also need to identify if your service provider can give you access to all the information you need for years to come. Additionally, consider if your vendor is relevant to the current market scenario and can stay relevant in the future. To that end, it may be helpful to enquire about their research and development plans to ensure they will provide you with high-end products now and in the future.

Read more: Why Choose Fingent as Your Odoo ERP Partner

3. What are the aspects of integration?

ERP is one of the multiple systems that determine your organization’s performance. To achieve optimum results, you will have to enquire about integration with other aspects such as EPM, SCM, HCM, and CX, to make way for a smoother workflow. How? When you have various platforms working together harmoniously, you can avoid data inconsistency between two systems.

Read more: 5 Reasons to Integrate Your E-commerce Application with Odoo ERP

To avoid cumbersome processes after ERP implementation, you must consider if the vendor you are planning to hire can provide you the best support required. Talk to them to ensure that all the different platforms function as one unit. The most relevant integration for a CFO is integrating ERP with EPM (Enterprise Performance Management). Picking the right vendor will help you with such critical integrations.

4. Choose the right ERP

ERP that fits one company does not match the other because each company has its own unique needs. Whether a business is small, medium, or large, a CFO must be aware of the need for financial planning tools. Hence, as a CFO, you must confirm your ERP caters to the size of your business. Additionally, your current ERP must be scalable to accommodate employees from various departments. In other words, you will need a scalable ERP system for your entire operation to work smoothly.

Read more: 5 Tips For Getting The Best Out Of Your ERP System

5. Identify the needs of all departments to ensure teamwork

The ultimate aim of a CFO is to ensure that the ERP they select is delivering excellent results. Hence, it is crucial to have all your employees on board and understand the ERP system.

To achieve that, you need to identify the needs of each department in your organization and make sure that ERP meets all those needs. This allows for an enhanced workflow among all employees. Include your organization’s CIO and other leaders during the planning and implementation of ERP software. They can spread a positive outlook toward the new system among the rest of the employees.

Read more: How Fingent Helps CFOs Gain New Insights and Reliably Enable Key Decisions

Are you ready to steer your business to success?

Understandably, implementing ERP will take time and effort. Besides, as a CFO, you will have to identify the potential and tangibly justify the cost of ERP. However, choosing the right vendor can make implementation hassle-free and result-oriented.

It is no surprise that successful implementation and deployment of ERP hinges on the right partnership with the right vendor.

As an Official Ready Partner for Odoo and SAP Silver partner, Fingent is the right provider to assess and understand your unique business requirements and help you become a cloud-powered enterprise. We offer dramatically shorter implementation timeframes. Our ERP allows for rapid configuration, customization, and deployment, significantly reducing the implementation cost. We provide both cloud and on-premises ERP solutions. So, do you feel ready to steer your business to success? Give us a call!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

The COVID-19 pandemic has hit retailers hard. Overnight, malls, boutiques, and shops teeming with customers were evacuated. As the days dragged by and shutters remained close, many retailers had to let go of employees and even shut their shops permanently. We will see how, but this blog aims to show that this does not need to be the case for your retail business. You can still stay afloat, beat the competition, and rise to success with a little help from SAP!

Changing market conditions show no mercy on retailers

With the pandemic raising its ugly head, 2020 seemed to paint a dismal picture for the future of retail. Major retailers have been canceling orders and delaying payments to their suppliers. This forced some brands to store their seasonal articles or move them into distribution centers or outlets. For some retailers, the coronavirus pandemic increased the risk of bankruptcy due to store closures, while others barely made it through.

For example, Rubana Huq, the president of BGMEA (Bangladesh Garment Manufacturers and Exporters Association), told the press that 3.18 billion orders were suspended. This had an impact on more than half of the 4 million garment workers in Bangladesh.

At the other end, brick-and-mortar presence is seeing a shift to the online commerce environment, which picked up at an exponential pace. E-commerce proved to be a pivotal moment for retailers, making it necessary for them to invest in digital capabilities. A critical aspect of staying competitive in such unprecedented times is the growth of technology and its importance in operational success.

Read more: How Fingent Helps CFOs Gain New Insights and Reliably Enable Key Decisions

Read on to find out how SAP plays a crucial role in turning things around for the retail industry.

SAP enables a differential strategy in the competitive market

More and more companies are recognizing the advantages of implementing SAP solutions. In the current recessionary and competitive market, delaying digital transition may prove a costly misstep that retail businesses will find hard to retrieve. Solutions offered by SAP can help retailers control various aspects of their business and identify trends in customer behavior and capitalize on opportunities at the right time.

With ever-changing customer behavior, SAP equips retailers to become customer-centric. It can help retailers analyze buying behavior by providing much-needed consumer insights. These insights will help them offer more personalized and delightful buying choices that attract customers and retain them.

Here is how SAP equips retailers:

- Provides real-time behavioral information, both online and in-store

- Reduces cycle time

- Helps retailers identify newer ways to find leads and build loyalty

- Streamlines operational process

Also, SAP solutions can help retailers offer a real-time personalized buying experience as it influences buyers’ behavior at the point of purchase. To create such a customized offering, retailers will need insight into buyers’ purchase history, profile, and shopping behavior. That’s where SAP solutions come to your rescue. SAP can provide retailers with all the information required to help them stay competitive.

SAP solutions help deal marketing and merchandise challenges

The retail industry can be volatile, especially during times like these. Retailers who manage seasonal merchandise might find it challenging to maintain multiple products and keep track of all that product data. Any incorrect data can prove costly for the organization. Such inaccurate data can also lead to a mismatch of data across all sales channels, presenting inconsistent product pricing and customers’ eventual loss.

Thankfully, SAP is the backbone for merchandise management, nullifying all these challenges. It comes with a simplified data model that offers end-to-end support for all retail functions. This concept works across the product lifecycle, from master data creation to stock management. It allows retailers to create and maintain the data effortlessly while ensuring pricing consistency across all the channels. These features can increase the organizations’ revenue, minimize data errors, enhance time to market, facilitate a better customer experience, and increase conversions.

Here is an example of how SAP solution helps:

Fewer markdowns: Retailers such as consumer electronics and fashion deal with seasonal goods. To stay competitive, retailers must ensure that these products are available in good time. SAP solutions offer more efficient season management and optimized ordering.

SAP solutions can help manage challenges in the supply chain

Inaccurate data can create challenges in planning, leading to longer response times and increasing the risk of losing the consumer to competitors. Fortunately, SAP solutions come with a single platform for all warehouse and transportation management. Features such as real-time analytics and advanced shipping capabilities can eliminate inventory challenges and enable live inventory management.

Thus, the supply chain process becomes agile and leads to higher revenue. It can also reduce the operating cost of the warehouse. By simplifying and automating processes, SAP can redefine retail and bring value to any retail business.

Read more: How SAP Helps Realize Voice-enabled Warehouse Operations

Following examples prove SAP helps with supply chain:

1. Fewer stock-outs

Supply chains are typically complex and need high levels of agility. SAP solution enables retailers to track procurement journeys automatically that helps reduce revenue loss due to the late arrival of seasonal goods.

2. Lower inventory costs

SAP can harmonize stock information and keep it up to date. At any given point, a retailer can intervene centrally and place a repeat order when necessary. This reduces inventory carrying costs and enables better inventory management which increases revenue.

3. Create seamless customer experiences

Retailers realize the significance of adopting sensor technology to create seamless and highly personalized business processes across all channels. SAP simplifies logistics and digital channel processes from order to payment, both in-store and online.

Key solutions from SAP for retailers

Here are some key solutions that SAP has made available, which can help your retail business:

1. SAP S/4HANA Retail solution for merchandise management

With the SAP S/4HANA retail solution for merchandise management, you can perform necessary checks on inventory, offers, availability across stores, and more in a single, unified view. It is instrumental in engaging your customers with cross-channel interactions.

Read more: SAP S/4HANA: Redefining End-To-End Solution

2. SAP Commerce Cloud

Through the SAP Commerce Cloud, retailers gain the ability to “launch new digital experiences with headless e-commerce capabilities.” SAP Commerce Cloud empowers your retail business with Web apps, chatbots, messengers, and other capabilities to enhance your customers’ digital experience, engagement, and conversions.

Read more: Why is SAP Commerce Cloud A Complete Digital Business Solution

3. SAP Ariba Strategic Sourcing

The SAP Ariba Strategic Sourcing Suite is “a single, closed-loop, source-to-contract solution bundle for managing sourcing and suppliers across all spend categories.” It helps retailers efficiently manage their direct materials sourcing without going through laborious and faulty manual processes.

Read more: SAP Ariba & SAP IBP Integration to enhance supply chain visibility in manufacturing

4. SAP Extended Warehouse Management

The SAP Extended Warehouse Management system is a brilliant solution to managing high-volume warehouse operations. It gives you complete visibility of your supply chain logistics, warehouse operations, and distribution process, giving you seamless control and maximizing the use of your resources.

5. SAP Business One for Retail

SAP Business One for Retail is a comprehensive digital solution that enables retailers to manage all their retail operations, including Point of Sale (POS) insights. It helps retailers with better inventory control, a streamlined ordering process, and seamless multi-channel e-commerce.

Read more: SAP Business One vs. SAP Business ByDesign: Helping Businesses Pick the Best

Empower your retail business with SAP

An industry capable of adapting to new and evolving trends will rapidly recover from the pandemic’s effect. SAP solutions can help retailers examine those trends in great detail. SAP is a powerful tool that allows you to gather all the essential data needed to improve your business. Powered by insights gathered with the help of SAP solutions, retailers can redefine loyalty programs and stay competitive in the current market space.

Fingent offers custom implementation and migration services to SAP and can help you move quickly and make the best use of this technology NOW when you need it the most. Leveraging SAP solutions with a Silver Partner of SAP will give your retail business an added advantage. Drop us a message, and let’s get you started.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

SAP Intelligent Robotic Process Automation accelerates your move towards Intelligent Enterprise. Redirect your resources to high-value functions with SAP IRPA.

Supercharge your business with SAP Intelligent RPA!

Is it a good time to look toward the future while the world is in the thick of the COVID-19 crisis?

Yes, it is!

Irrevocably, the pandemic has impacted business priorities in far-reaching ways. This global crisis has pushed businesses to pivot on a dime as they respond to changing factors such as customer needs, market, and new priorities. Even companies that were slow to adopt automation have begun leveraging powerhouse processes like Intelligent Robotic Process Automation (IRPA).

Read more: How Automation Ensures Businesses Stay Afloat During COVID-19 Crisis

Organizations are now using Intelligent RPA to provide faster service to customers, revamp operations for distributing work, and reduce costs during this economic turmoil. Most enterprises are embarking on their automation journey with SAP IRPA. This piece shortlists seven reasons how global IRPA from SAP can enhance business performance and productivity.

What is SAP IRPA?

The SAP IRPA suite is an end-to-end cloud solution of automation tools. The work on IRPA technology began in early 2018. Within two years, SAP managed to become a relevant global RPA player. SAP IRPA provides better integration into the SAP application stack. It uses intelligent bots to automate repetitive manual processes. What makes SAP Intelligent RPA is that it helps businesses stay relevant by providing insights that empower them to make the right decisions.

Read more: SAP Focused Industry Templates & Automation Solutions

7 ways SAP IRPA can enhance the performance and productivity of your business

1. Easy integration with SAP applications

Usually, employees will have to spend a lot of time moving from one application to another. This is where intelligent bots come in and address one of the biggest pain-points of employees. It allows them to execute processes over multiple systems, multiple software, and multiple cloud solutions. This way, employees enjoy the ease of data transfer while still accessing numerous applications quickly. Such easy integration improves speed and efficiency while reducing costs.

Read more: Top 3 UI Offerings from SAP: Fiori, Screen Personas, and Lumira

2. Purchase order follow-up

It is the responsibility of the company to follow-up on a purchase order. This may mean that the business will have to follow-up on numerous occasions, right from the issuance of the purchase order to receipt of goods. However, this does not mean that the process keeps changing with each purchase order. A single SAP report is not capable of addressing all these follow-ups. A user will have to rely on various reports.

SAP IRPA implementation enables a user to quickly generate daily reports on all open purchase orders. By implementing the SAP IRPA tool, a business could make its follow-up system much more efficient. It allows business users to pay attention only to a few cases while the rest could be handled by the SAP IRPA tool.

3. Supplier evaluation

Keeping track of suppliers’ information helps the purchasing department negotiate the best rates. It can also help ensure the timely delivery of material and services. A supplier evaluation could include parameters such as price and delivery of the materials or services, goods receipt, invoice verification, quality, and price changes.

The reports must be run to get the relevant data. Implementing SAP IRPA can help business users export the data to multiple Excel sheets, and run compares to create one report that can then be published weekly. This way, a business will have error-free, real-time data that helps them with the supplier selection process.

4. Workflow monitoring

In every business, transactions happen daily, and workflow failures are common. However, at a crucial time, workflow failures can affect crucial business processes. It would require a workflow support team to run data fixes and restart the workflow.

With SAP IRPA, you can quickly identify the issue and fix it. This process does not require a support ticket, and you can do it regularly. It takes the load off the workflow consultants as they need to be involved only for issues that require code changing.

5. Cost optimization

SAP IRPA can create cost savings by enabling 24/7/365 execution at a fraction of human equivalents’ cost. Using robotic technology proves to be cost-effective and helps businesses cut down operational costs.

The likelihood of human error is higher in routine manual tasks. SAP IRPA can help improve that while saving costs by eliminating the need to repeat a job. This translates into reducing costs incurred by human-error.

6. Maximize business process performance

Bots can learn patterns without explicit training. This capability helps in identifying structured and unstructured data and takes necessary actions automatically. These self-learning bots maximize business process performance.

SAP IRPA can deliver bots that provide human-like interactions with customers. By automating repetitive business processes that need human intervention, digital assistants improve user productivity and efficiency.

Read more: How Robotic Process Automation Is Revolutionizing Industries?

7. Interface monitoring

While interfaces help in numerous transactions, they also encounter many failures. Sadly, most users are unaware of an interface failure unless they identify a failed business transaction. This may force a business to depend on support teams to identify and fix the problem to ensure that the business transaction can be completed on time.

However, identifying the problem is a tedious and complicated task that takes a considerable amount of time. Typically, an organization starts monitoring its interface only when a business user realizes that his/her business transaction failed.

A better approach would be to implement SAP IRPA to program interface monitoring that can be done daily. This allows the support team to focus on solving issues before a support ticket is raised.

Why is it essential to choose SAP IRPA now?

Before COVID-19, RPA has played a vital role in delivering digital transformation, driving-up productivity, improving work capacity, and augmenting overall worker satisfaction. During the COVID-19 crisis, RPA enabled businesses to take urgent action to reduce the pandemic’s negative impacts. This allowed companies to turn resources around to ensure business continuity. Moving forward, SAP IRPA will facilitate business continuity and future growth of organizations as they emerge from the current economic downturn.

Read more: How SAP Supports Effective Business Continuity Planning

If you haven’t yet enabled SAP IRPA powerhouse, it’s high time you did! Give us a call and let us help you get on-board ASAP.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Digital core ERP can help bring about innovations across the value chain. Companies have to get ready to compete by leveraging the digital core or be left behind.

Take your business to the next level using digital core ERP!

Organizations commonly use Enterprise Resource Planning or ERP software to streamline their back-office functions, logistics, customer service operations, and inventory management. However, it is not agile enough to match the ever-changing requirements of a digital customer.

To establish agility within the foundation of ERP, providers worldwide are repositioning themselves to adapt to the new shift of digital core. Digital core ERPs such as SAP S/4HANA can help companies to stay relevant in today’s digital economy. Odoo ERP and SAP are two of the leading core ERP vendors that help automate back-office functions and accelerate your journey to the intelligent enterprise.

Read more: Unlock the Potential of Intelligent Enterprise with SAP Leonardo

What is meant by digital core?

Simply put, the digital core includes technology platforms and applications that enable organizations to transform into digital businesses and meet the changing customer needs. Digital core ERP allows companies to overcome complexity in enterprise and resource management and drive business innovation.

It includes emerging technologies such as IoT, AI, machine learning, and advanced analytics that require businesses to adopt flexible, scalable, and cloud-based platforms. Digital core prepares data for machine learning systems, text to speech, neural networks, decision making, and other advanced applications and creates algorithms for business and IT.

The digital core will allow organizations to improve their existing business processes or develop new business models using digital transformation initiatives.

This new integrated system allows business leaders to predict, simulate, plan, and predict future business outcomes in the digital economy.

Read more: SAP S/4HANA: Transforming The CFO into a Business Value Creator and Role Model

Why is digital core significant for your business?

Businesses that fail to address the changing enterprise and consumer demands due to their rigid core systems face the risk of losing the competition to their more agile counterparts.

To prevent losing business and reputation, enterprises must leverage digital core in the right way and integrate it seamlessly with their internal and external partners. In other words, enterprises must look beyond digitizing peripheral processes and align their core to meet the changing demands. It will not just eliminate manual steps and deliver agility but also provide a seamless user experience.

Examples of digital core

Finance

Finance professionals can leverage the digital core to obtain a single source of truth for finance. Finance departments have to handle reconciliations between internal and external reporting and multiple sources of truth stored in different ledgers. While traditional applications can help optimize and control functions, they cannot create a single source of truth, resulting in data accumulation by reconciling ledgers and valuations. With the digital core, businesses can eliminate reconciliation and execute seamless closing from unified data models. It also improves the allocation and closure of processes by ten times. The digital core’s main advantage is that it helps simulate financials in real-time with many ‘what-if’ possibilities.

Read more: How Fingent Helps CFOs Gain New Insights and Reliably Enable Key Decisions

Automotive manufacturing

The digital core can provide a digital experience along the automotive manufacturing value chain. The digital core can power a connected car to offer a personalized driving experience to drivers, including services like parking and fuelling options based on real-time information. The connected vehicle captures data that can be used for predictive analysis to gain insights into driver behavior and preferences. The digital core also helps enhance manufacturing by moving from batch orders to real-time manufacturing resource planning to meet the growing demand.

What are the benefits of the digital core?

Digital core allows enterprises to integrate business process and transactional data from back-office ERP systems with a large amount of data (structured and unstructured) from different sources. Advanced analytics can be embedded in the digital core data to produce new insights, such as proposing further actions and predicting outcomes. Interestingly, many of these processes can operate automatically in near real-time.

How to prepare for digital core transformation?

Firstly, it is essential to have an all-inclusive digital strategy along with effective executive leadership. Additionally, enterprises can focus on three critical tasks:

- Restructuring the organization

- Transforming the organization’s culture

- Re-platforming their technologies

As digital core transformation will have an impact on both the core and the peripheral assets as well as technologies, the new strategy must allow them to:

1. Push tailor-made solutions

Companies that use SAP products can move to SAP HANA products such as SAP S/4HANA and opt for the right cloud-based products to allow better agility during deployment.

2. Establish strong collaboration with partners

Collaboration with partners will help you achieve faster time-to-market for innovations. Also, you can leverage partner innovations along with data integration to deliver value to your customers continually.

3. Enhance the business

Use business process management tools to optimize your business processes and meet customer expectations. Technologies like cognitive analytics allow businesses to identify strategies that lower their value.

Advanced skill sets and enterprise-wide scale are required for digital core transformation, which may be challenging for most businesses. Therefore, it becomes imperative that you find an experienced and trusted partner who can support your digital core journey.

Here are a few tips for choosing the right implementation partner:

- Evaluate their investments

- Understand their willingness to collaborate

- Gauge their implementation expertise

- Look for SAP or Odoo ERP partners

- Gauge their desire to embrace new products and platforms

Read more: 5 Salient Features of Odoo that Make it a Reliable ERP for Enterprises

Why choose Fingent as your digital core ERP implementation partner?

Fingent offers ERP implementation and consulting services to businesses worldwide. We are an Official Partner of Odoo. Our Odoo ERP implementation and customization projects are tailored for easy adaptability. Fingent is also an SAP Silver Partner. With our expertise in cloud computing and custom ERP development and implementation, we can support you through this critical time and help stabilize your business operations and strategize for the future. Get in touch with our expert to discuss your requirements.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Fiori vs. Screen Personas vs. Lumira: Which SAP UI platform best-fits your requirements?

User experience defines customer experience today. User expectations vary with individuals, previous experiences with software, or devices. People tend to leave a mobile app or a web application if they find it slow, inefficient, and difficult to use. Amazon’s open and highly navigable UI has made it a leader in e-commerce, with 29% of baby boomers and 21% of Generation X ranking its UX as the best a web or mobile app can offer. This example of Amazon tells us how vital UI is to create and deliver an unparalleled user experience.

Being a leader in enterprise applications, systems, and products, SAP has always developed user interfaces that its customers appreciate. Over these years, SAP has come up with replacements to its traditional SAP GUI, designed on platforms like NetWeaver. As the UI technologies mature, the tools used for design and development transform. This piece analyzes three of the most popular SAP UI offerings and their benefits: Fiori, Screen Personas, and Lumira.

Read more: How Fingent Enables e-Invoicing for SAP Users to Stay Compliant with GST India Regulations

1. SAP Fiori

Built on the latest design principles, Fiori is one of the most contemporary and enhanced user experience offerings. Fiori applications are device-independent, easy to use, and easily configurable across tablets, desktops, and smartphones. It simplifies workflow approvals, information lookups, and self-service tasks and brings excellent user experience to enterprise applications.

SAP Fiori enables multiple device applications through which a user can start a process on her laptop or desktop and continue it on a smartphone or tablet. For unmatched application response and query-execution time, SAP Fiori can be combined with SAP HANA. It’s easy to set up Fiori and configure a transaction application in systems that run on ECC 6 or EHP 7+ versions. Fiori aligns with SAP’s future UI/UX strategies by offering a modern and delightful user experience.

Benefits of Fiori

- In addition to increased productivity, research reveals that Fiori delivers a 64% reduction in time needed to complete a task than SAP GUI.

- Fiori is simple and easy to learn, so it has a better adoption rate and cuts training time.

- Fiori offers more intuitive workflows that feature business logic instead of SAP logic. So employees tend to get less frustrated.

- Users without SAP expertise find Fiori easier to use.

- Unlike the mouse-keyboard structure of SAP GUI, field technicians and employees can use Fiori-based applications on different device types.

- Developers find less need to build their tools on SAP HANA.

Read more: What is Business Process Expertise in SAP and Why You Need it

2. Screen Personas

Screen Personas is a UI framework or a tool that enables modifications to the existing SAP GUI by allowing you to add or remove fields your users don’t need, collect data automatically using the scripting engine and bring scattered data to a single screen using the editor. Screen Personas is ideal for automating and streamlining business processes and simplifies transactions to create the Fiori user experience across all the devices. This UI offering is included in the standard SAP ERP license.

One of the significant drawbacks of Screen Personas is that it remains limited to the current transaction screens. While it is possible to combine transactions or load extra information via Bapi’s, there could compromise the performance. We can use Screen Personas on different devices, so it becomes necessary to build a separate ‘flavor’ for each screen size, which means extra development time is needed. Further, there are offline options for Screen Personas.

Benefits of Screen Personas

- It reduces the number of clicks by simplifying SAP GUI transactions, simplifies user interfaces, and improves user productivity and data quality.

- Allows users to access data and fill-out data on their mobile devices, making working on the go a breeze. Screen Personas has improved the work experience on the go and in dynamic work environments like the factory floor.

- Screen Personas can be leveraged to bring SAP Fiori experience to transactions and SAP S/4 HANA.

- Reduces the cost involved in training the employees.

- Boosts your company’s image and branding.

3. Lumira

Also known as a visual intelligence tool, SAP Lumira helps create stories and visualize them on a dataset. You can enter the data in Lumira as data sets and then apply filters, calculated columns, and hierarchies to build documents on Lumira. To visualize the data effectively, you can choose different charts such as pie charts, bar charts, etc. The tool is simple and has a user-friendly interface that allows you to create captivating visualizations and analyze data without scripting.

Benefits of Lumira

- From fact-based solutions to complex business questions, Lumira improves decision-making by avoiding list tables and fixed format reports.

- Integrates wide-scale insights that include minute details, which helps maximize business knowledge.

- Increases self-service data usage without burdening the IT department

- Visualize vast quantities of data in real-time using SAP HANA and deploy the same to mobile devices.

SAP Lumira Standard Edition is a paid version and SAP Lumira Personal Edition is available for free download.

UI focused on design thinking

SAP technologies are focused on design thinking and define methodologies to address business challenges. Design thinking provides creative ideas and solutions to resolve complex use cases.

Intelligent technologies from SAP, such as Leonardo, IRPA, Edge Services, IoT, etc., are designed to be integrated with any of your existing SAP ERP systems like ECC or S/4HANA. For instance, you can use IoT services to create Fiori apps in the SAP Cloud Platform. When integrated into your business processes, you will not know there is machine learning involved as an end-user, and you won’t see any apparent changes. However, you will experience automatic decision-making or recommendations.

Read more: Unlock the Potential of Intelligent Enterprise with SAP Leonardo

There is no denying that SAP technologies and tools are evolving to offer an enriching user experience. Its unique UI offerings like Fiori, Screen Personas, and Lumira are designed to address customer priorities, UI expectations, and investment. Are you looking to create a successful UI strategy for your organization? Fingent helps you make the best of SAP’s UI platforms. Contact our expert today and discuss your requirements.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

SAP helps increase warehouse management productivity with voice picking!

Voice technology has been there for a while and is here to stay. Its increasing adoption among warehouse distribution centers has led to increased accuracy, improved productivity, and training time reduction. Supply chain executives report attaining a 50% decrease in picking errors and a typical ROI in less than one year with voice integration.

In retail warehouses, complex facilities such as inventory control are vital, with several picks to be performed every hour. The warehouse employees should be an efficient and accurate while ‘picking’ as wrong picking can lead to incorrect deliveries and affect customer satisfaction.

To improve staff accuracy and speed of pick, warehouses can consider “Voice Picking” technology. Voice picking is an extension of the Warehouse Management System (enhanced by additional software and hardware) that allows transferring instructions to the warehouse operators using earphones and microphones. Voice Picking uses a wearable computer that includes a headset and microphone so that the order pickers can be instructed on what items to pick from where and later confirm their actions verbally into the Warehouse Management System (WMS).

Read more: How Robotics in Logistics Helps Improve Supply Chain Efficiency

Benefits of Voice-picking

A voice-picking system creates a hands-free, heads-up workflow. Unlike the traditional warehouse order picking, where you need to stop to read, scan, or punch keys, the voice-picking system allows users to listen and speak efficiently. Some of its benefits include:

- Productivity improvement

- Reduction in errors by 25% or more

- Decrease in accidents as operators rely on eyes and hands-free technology and hence are more aware of the surroundings

- Cuts training time

How is voice-enabled warehouse operation helping during the COVID-19 pandemic?

In the last few months, warehousing and logistics have been hit hard. While there was enormous pressure on the warehouse to execute deliveries quickly due to increasing customer expectations, COVID-19 has caused further disruption.

Logistic companies have had to evaluate options and make changes across transportation modes, considering delays, interruptions, and price changes.

According to a survey from August to September 2020, about 32,200 jobs were added to the warehouse and storage sector. Thanks to voice and device technology! Voice integration helped address the labor shortage and equipped new workers. Here are a few benefits of voice-enabled warehouse management.

1. Efficient onboarding

New workers can pick up their barcode scanner or mobile device and begin their work with minimal onboarding time. Latest device upgrades offer improved designs and user-friendly interfaces. Whether a Windows 10, iOS, or Android device, workers can choose the device they like. This flexibility helps simplify the training and onboarding process of new workers, optimizing workforce management, and making it a more efficient experience.

New workers can get started quickly without the need for lengthy training processes. With voice-enabled applications, you can reduce the training time from several hours to just a few minutes.

2. Increased productivity

Voice capabilities are helping workers to keep pace with the high volume of orders. It helps them cope with the increased pressure to meet soaring demands, reduce training time, and use the hand-held devices of their comfort.

3. Higher accuracy

With hands-free wearables and voice picking, workers don’t need to stop frequently to check their devices. It will reduce errors and allow pickers to complete more orders within the same timeframe with improved speed and accuracy.

4. Improved safety

The coronavirus has made “contactless” mandatory. Voice picking can eliminate many physical touchpoints that can lead to virus exposure. Minimizing surface contact is one of the best ways to protect warehouse workers.

Read more: Contactless services: The new retail norm

How does SAP help voice-picking?

SAP’s open architecture supports several voice integration methods that help users achieve immense productivity and accuracy. If your business is running on SAP’s Extended Warehouse Management (EWM) solution or Warehouse Management (WM), voice can be easily integrated. It results in the seamless integration of ERP with your warehouse management solutions and voice. Ultimately, the accuracy, productivity, comfort, and safety of all your warehouse processes will improve. It helps distribution centers deliver on time, achieve deadlines, and scale.

Read more: SAP Preconfigured Solutions Boost Efficiency Among Industries

Today, voice integrated into SAP has become an essential tool for many businesses. SAP’s voice picking provides superior ergonomics, eliminates distractions, and allows users to focus on the task. The voice technology is specifically designed to provide voice recognition in noisy environments. The noise cancellation ability helps lower warehouse background noise, such as truck horns, pallet drops, and conveyor system mechanism.

Additionally, the technology helps overcome language barriers as most systems come in more than 40 languages allowing users to interact with SAP most naturally and effectively.

Voice with SAP can quickly scale with your business both when your business grows and when you need to accomplish seasonal peaks. With SAP’s explicit instructions, you can add new employees’ onboarding time and capacity without any complex changes to the given infrastructure.

Download Our Case Study: How Fingent automated integration between SAP SuccessFactors and SAP S/4HANA

To conclude

As the economy battles to overcome uncertainty, using safe, cost-effective solutions, embracing advanced technologies like voice-enabled applications are imperative to sustain. Additionally, with COVID-19 showing no signs of ending soon and the world shifting to contactless shopping, embracing voice-enabled applications makes sense from an economic and physical safety standpoint.

No other technology has impacted the logistics and shipping industry like voice in the recent past. Extend your logistics and fulfillment processes by making voice technology a vital ingredient of your company’s IT strategy. Contact us now to get started.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

SAP Analytics Cloud: 7 proven ways it can help your business

From manufacturing to marketing, businesses worldwide face unforeseen challenges as they continue to meet the impact of the COVID-19 pandemic. Many organizations are accelerating digital transformation, establishing variable cost structures, and implementing agile operations to emerge from the pandemic stronger.

While most companies believe that the pandemic will negatively impact their business, some businesses feel that the consequences will be short-term. Although most firms have been affected by the pandemic, a survey shows that two-thirds of micro firms are severely affected by the crisis than 42% of the large companies.

Amidst this uncertainty, companies must consider how the pandemic’s continuation or return in different regions will impact their recovery strategies. Businesses must face this uncertainty by reassessing assumptions, re-evaluating scenarios, and strengthening their ability to respond.

Read more: 11 Practices Followed by Leaders to Build Resilience and Ensure Rapid Business Recovery

Simply put, now is the time for businesses to focus on supporting critical areas of their business that will help them stay relevant in the new environment and plan new strategies for what’s next.

Critical areas for businesses to focus presently

- Workforce

- Finances

- Operations and supply chain

- Strategy and branding

- Tax, trade, and regulatory

- Crisis management and response

What can businesses do?

- Leverage their crisis management team to focus on efforts in the wake of the crisis.

- Shift your focus on bringing back employees to work, assess your company’s response efforts to date, and evaluate areas for real-time course corrections.

- Use the insights the crisis has provided to help chalk out better strategies and capitalize on the opportunity for transformation.

SAP Analytics Cloud has changed the way businesses plan their strategies. It is a robust, agile analytics platform that helps firms arrive at faster and improved business decisions. Moreover, it delivers insights that can be used for enhanced decision-making and optimize resources across all processes.

Read more: How SAP Supports Effective Business Continuity Planning

Combining our functional and industry expertise with SAP Analytics Cloud, Fingent delivers analytics solutions that drive your competitive advantage, reduce costs, and increase revenue.

What is SAP Analytics Cloud?

SAP Analytics Cloud or SAC is one of the best SaaS solutions that combines all the functionalities such as planning, predictive, business intelligence, and more in one user interface. It helps save time and effort while making improved decisions.

SAP Analytics Cloud comes in two modes: Private and Public. As the name suggests, the Private edition hosts only one customer while the Public edition offers multi-tenancy. Also, cost-wise, the public edition is less expensive than the private edition.

Also read: Fingent offers e-Invoicing integration for SAP ERP users in India – Stay compliant with GST India e-Invoicing

Top 7 business challenges solved by SAP Analytics Cloud

1. Planning and consolidating financial strategy in one solution

SAP Analytics Cloud puts together- planning, predictive, Business Intelligence, and augmented analytics competencies into a simple cloud environment that allows you to consolidate your finances, expenses, and revenues at a single source across your whole organization.

2. Discovering useful insights

SAP Analytics Cloud joins hands with machine learning and augmented analytics to help convert insights that deliver value across your business.

Augmented Analytics allows you to explore your data automatically, discover cycles and trends, and identify possible ways to effectively chalk-out your expenses and cost plans. These intelligent insights can be turned into an actionable plan using a personal sandbox environment that helps visualize your performance metrics and simulate potential budget outcomes.

3. Aligning plans across your business

There’s no denying that financial and operational planning is a must when working with multiple teams and stakeholders. SAP Analytics Cloud helps you make smart decisions. It comprises several collaborative enterprise planning tools that allow you to link and align your expense and cost plans across departments such as HR, sales, finance, marketing, IT, and supply chain in real-time. These benefits eliminate the need for sending out unnecessary emails enclosed with irrelevant plans and avoid collaborating without context.

SAP Analytics Cloud allows you to create and assign tasks with the calendar, communicate with your team in real-time with the discussion panel, and collaborate directly on your plans with the data point commenting tool.

4. Improving planning cycles with predictive analysis

Gone are the days of the tedious manual building of your expense forecasts. SAP Analytics Cloud includes exceptional machine learning and predictive analysis technology that can help you build accurate expenses and cost plans much faster.

You can use the predictive features to automate baseline expense planning forecasts based on previous data. You can then monitor plan attainment with real-time, up-to-date predictive forecasts. Its accuracy indicators enable data analysts (without any technical knowledge) to trust the data-driven predictions before including them into their planning process directly.

5. Enhancing strategic business decisions

With SAP Analytics Cloud machine learning technology, you can convert insight into action within seconds. Automated technology helps you avoid agenda-driven and biased decision-making as it provides you with insights that drive your business.

- Search to Insight – Natural language query generates visualizations to answer your questions instantly. Machine learning technology provides you with important trends quickly.

- Smart Insights – Machine learning technology helps you save time and focus more on high-value activities by allowing you to understand the significant contributors of data points without the need to pivot your data manually.

- Smart Discovery – This allows you to identify key influencers and relationships in your data to help you understand how business factors influence performance. Also, it can detect anomalies and help you take corrective measures. With machine learning projection, anyone can simulate the impact of strategic business decisions.

Case study: Automated Integration between SAP SuccessFactors-Employee Central and SAP S/4HANA – Find how Fingent helped the customer gain real-time insights for improved decision-making

6. Data modeling

SAP Analytics Cloud helps you plan and build the right model where your data is stored efficiently. With this end-to-end solution, you can immediately take action and start planning. The data modeling feature allows you to prepare your data for analysis. “Models” and “Stories” are the two key components of SAP Analytics Cloud’s BI function. Models allow you to enhance your data by cleansing, wrangling, establishing hierarchies, defining rules and conditions, and adding formulas. Stories give life to your data by letting you visualize your information through charts and graphs, which will help you gain valuable business insights.

7. End-to-end industry dashboards

SAP Analytics Cloud offers business content packages tailored to individual analytic scenarios. Each package entails aesthetically built dashboards, stories, and data models carefully designed for specific lines of business and end-to-end business scenarios. Also known as Analytics Content Network, this business content library offers tried and tested best practices for leveraging your available data and accelerating your go-live. The content network is customized to work with existing SAP data sources such as SAP S/4HANA or SAP C/4HANA.

Read more: SAP Focused Industry Templates & Automation Solutions

Today, businesses need to forecast changes ahead of time. SAP Analytics Cloud helps to anticipate and plan for the impact of the crisis on business. How a business responds to challenging situations determines its strength and potential to recover.

Fingent is an SAP Silver Partner. With our expertise in cloud computing and SAP services, we can support you through this critical time and help stabilize your business operations and strategize for the future. Get in touch with our expert to discuss your requirements.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How SAP S/4HANA Helps CFOs to Overcome The Slump and Steer Business Forward!

Unpredictable times such as these call for an “anytime, anywhere” finance function, and CFOs are expected to take the lead in accelerating strategic growth across the enterprise. Therefore, suddenly the CFOs found their organizations in a firefighting mode: gauging risks, preserving cash, and rapidly revising all financial plans and forecasting for the next month, quarter, and year. At this point, most CFOs found technology to be a key driver for improving transparency and efficiency. SAP S/4HANA is ‘the’ technology that supports the evolution of the finance function today and into the future.

However, this journey is not easy. Companies must develop a business case for SAP S/4HANA that will support their strategic vision. By leveraging the right finance technology innovations and partnering with a trusted SAP solutions provider, companies can maintain global regulatory compliance and engage in efficient finance processes.

Technology assists CFOs to control accounting and tax standards and engage with the business to jointly drive value. Having said that, technological trends that have been sitting in incubation mode have now emerged as real working models. This article discusses how SAP S/4HANA can leverage the CFO’s vision of becoming a value creation role model for the business.

Read more: How Fingent Helps CFOs Gain New Insights and Reliably Enable Key Decisions

Typical challenges for the CFO’s vision

Most often, a CFO’s agenda is held back by their organization’s complex technology landscape. This often renders efficient closing and reporting impossible within expected timelines. Such cumbersome systems hamper the management of working capital while making it difficult for finance departments to obtain reliable figures for profit and loss or forecasted budgets.

Perhaps you find yourself in this situation: At the end of the month, you find that you could not meet the deadline for the period closure. To make matters worse, mistakes made during the month must be rectified, data from different systems must be imported randomly into an Excel sheet. That is not all! All this information must be manipulated into a decent report. You take a breath that eventually it all worked well. However, the same thing happens the next month, and this pattern keeps repeating itself month after month. That stress peaks by the year-end. Amidst all this chaos, you are left with little time to proactively steer the company based on those figures. You may wonder, is all this financial data gathering purely an obligation just to satisfy auditors?

Companies can gain much profit by keeping admin up-to-date and proactively adjusting the business based on current financial data. That is the biggest advantage SAP S/4HANA provides. It gives the reins of business into your control.

Read more: How SAP S/4HANA transforms the end-to-end business process

Three focus areas where CFOs can gain more control with SAP S/4HANA

1. Control system landscape

As a CFO, you must deal with various financial systems and programs that contain your financial data. All financial data must be collected continuously and loaded into a reporting tool. Apart from this, data must also be entered into an Excel program. Such a fragmented landscape with a jumbled interface leads to errors, data duplication, and the probability of inconsistent data. This translates into enormous amounts of wasted money and time. Replacing this complex structure with an integrated system saves a lot of time and money. SAP S/4HANA provides CFOs a simplified landscape that leads to more control.

Read more about our Case Study: How Fingent successfully automated the integration between SAP SuccessFactors and SAP S/4HANA. Click here to download!

2. Control over processes

Fragmented processes lead to many errors and waste much time. However, once your system landscape is integrated, you will be able to optimize your processes. This will save time, which you can use to proactively manage the company with critical decision making based on your current financial data. This is where SAP S/4HANA finds value. It offers possibilities to automate and integrate processes. It allows you to add smart KPIs. This, in turn, helps you decide which areas need your attention and avoid those that are less important.

3. Control transactions

Entering data several times on different screens and in various steps leads to incomplete data. Most often, no valuable information can be retrieved from such a system. Nevertheless, S/4HANA can ensure that the transactions are carried out correctly. This will keep the data informative and up to date.

How S/4HANA can transform the landscape to help embrace a CFO’s vision

The challenges faced by CFOs and finance professionals today are complicated, but S/4HANA can simplify them. CFOs can seamlessly unify their information landscape to remove gaps and ease pain-points by leveraging the in-memory data and processing capabilities of SAP S/4HANA architecture, and cloud deployment scenarios.

Instead of grappling with disparate pieces, this approach enables CFOs and financial professionals to see a holistic real-time view that encompasses all operational data sets and analysis capabilities within a single unified architecture.

What is the impact of SAP S/4HANA on CFOs?

SAP S/4HANA improves access to information, and the ability to manipulate that information. Additionally, it can dramatically improve the real-time analytics performance. Thus, with the help of SAP S/4HANA, CFOs have more power to show the management board what they can achieve.

Empowered with SAP S/4HANA, CFOs know that they can respond impromptu to the management board’s questions. With that power, they can just tap for details and input from the live business. Usually, the management board fires off questions after the CFO delivers the company report. Such questions could be linked to newly acquired subsidiaries or similar activities. SAP S/4HANA gives CFOs instant access to all data and processes of the company. Thus, a CFO is now able to include outcomes of the newly acquired business. Also, SAP S/4HANA allows you to model the efficient integration of identical operations and product hierarchies. This allows CFOs to join key drivers in their simulation model with new business planning and get instant combined results. In turn, it will help board members to figure out the impact of global cash flows and financial position.

CFOs can pull real-time cash and liquidity data of all business systems. With the analytics in SAP S/4HANA, they can advise the board confidently if the venture would be profitable. Evidently, CFOs do more than just crunching figures. They give the board a preview of what the business could look like after a merger or with an investment. To that end, SAP S/4HANA enables CFOs and financial professionals to predict potential market growth in addition to current operations.

How can SAP S/4HANA help CFOs achieve their prime objectives in an agile manner?

1. Financial planning, data processing, and analysis

Proper financial planning is a strategic objective for organic business growth. However, proper financial planning depends on the availability of financial data for profitable growth. Financial planning must be aligned with the growth strategies of the organization. It must be analyzed to explore new products, channels, and markets. With an embedded BPC solution for planning, SAP S/4HANA provides agility, flexibility, and accuracy in the planning process. Since it is available in the enterprise core system, no time is wasted in data loads and data reconciliation. It makes previous years actuals available for making plans. Financial data can be churned easily to simulate various growth strategies and help the organization make informed decisions.

2. Support corporate growth

Businesses expect CFOs to support them in driving growth strategies, both organic and inorganic growth. Mergers, acquisitions, and decisions to expand business in various geographies play an important role in growth strategies. To that end, SAP S/4HANA provides real-time financial reporting that reduces the time-consuming reconciliation process. This results in a quick closing. Since it is supported by analytical dashboards with simulations, it can help CFOs make strategic decisions with accuracy and agility.

3. Gain a competitive advantage

CFOs want to keep an eye on regulatory changes and changing domestic and international economic conditions because it gives an opportunity to drive competitive advantage. They can do this with the support of SAP S/4HANA. Since it is an innovation platform it can help CFOs to reimagine and reinvent their processes. Thus, it can bring agility to their decision making.

SAP S/4HANA upholds agility and accuracy of financial information

An ongoing concern for CFOs is the lack of agility in getting financial reporting. Additionally, manual data reconciliation results in inaccurate data. However, SAP S/4HANA provides financial reports in real-time. Its universal journal feature brings in simplicity and flexibility. Since it allows you to store data in a single table, slicing and dicing the data is made easy. This makes reporting at multiple dimensions simple and real-time.

Most CFOs realize that managing evolving technology such as SAP S/4HANA is not just about streamlining operations. It is also essential for managing fraud detection, regulation, and compliance. Compliance requirements have become stringent globally. SAP S/4HANA provides a comprehensive solution for fraud and risk management.

Laser focus on your core competency

CFOs and finance professionals do not view themselves as bookkeepers. They are business outcome-focused leaders and business partners who are stewards of the company’s profit and resources. They are innovators and strategists. CFOs are those who can overcome economic uncertainty and use financial data for growth. Hence, they must be trusted advisors to the management board while overseeing the job of managing cost and profitability. In short, a CFO must be a multitasker! SAP S/4HANA provides the platform and tools for efficient multitasking. It supercharges a CFO’s vision of becoming a value creation role-model for the business.

As CFOs grapple with new disruptive business models, SAP S/4HANA Finance can help them in their decision-making process at a tactical and strategic level. Being an SAP Silver Partner, we are helping CFOs to gain new insights and reliably enable key decisions.

Talk to an expert to understand how we can enhance your organization’s ability to pivot quickly and adapt to dynamic business scenarios.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Fingent Helps Ensure Hassle-free Filing of B2B e-Invoices for SAP Users in India

e-Invoicing is fast becoming the norm rather than the exception across industries and is being deemed mandatory by many governments as well. The Government of India has announced that starting from 1st October 2020, e-Invoicing will be mandatory for enterprises with a turnover of ₹500 crores while they submit their B2B invoices to the IRP and GST portal.

Invoices that do not comply with the set requirements will be considered null and void. All registered businesses under the notified class of taxpayers with an aggregate turnover of ₹500 crores and above must get ready and take advantage of solutions that facilitate the automatic issuance and receipt of electronic invoicing.

In today’s fast-changing world, enterprises are under increasing pressure to adapt and perform. One way to deal with this challenge is to simplify processes for both buyers and suppliers. e-Invoicing is an excellent step in that direction. By making the transition from physical to digital invoicing, many companies are reaping the benefits of a more reliable, traceable, secure, and streamlined process. Fingent helps you accomplish the change in the simplest way.

This article covers how SAP provides an automated solution for your business and how easy it is to file e-Invoices through your SAP ERP system.

Without further ado, let us get into the details of e-Invoicing for B2B businesses.

What is the difference between a digital invoice and an e-Invoice?

Is there really a difference? Yes, there is! A digital invoice is either a Word or a PDF file of a paper invoice that is scanned. An e-Invoice on the other hand, is a data file that is transferred between computers. It contains structured data making it easier for a computer to comprehend and book automatically.

Why switch to e-Invoicing?

IRN has become mandatory on invoices and it is a requirement to avail the credit. False filing of credit with fake invoices has caused a considerable loss of revenue for the government. The e-Invoice system can provide a better taxpayer service resulting in an enormous reduction in evasion. e-Invoicing can also enhance the efficiency of tax administration by setting up enterprises on paper to generate invoices.

An e-Invoice helps you detect and avoid false claims made through fake invoices. It restricts tampering with invoice value and other details. It can also simplify GST reporting.

Here are some benefits of e-Invoicing:

- Convenient: Processing is digital and automated

- Fast: No waiting time for the paper to move from one desk to another

- Accurate: Minimized human error

- Cost-effective: Printing and postage cost is eliminated

Read more: Recession-proof Your Business with Digital Alternatives, Go Paperless!

What is involved in e-Invoicing?

Having seen the benefits of e-Invoicing, let us get into the nitty gritty of e-Invoicing. Electronic invoicing or e-Invoicing is a system that is used to generate and authenticate an electronic document containing transaction information between the seller and the buyer. It is automatically sent over the internet and can be easily integrated into a customer SAP ERP or third-party system.

The IRP (Invoice Registration Portal) gives an identification number to these e-Invoices. The IRN (Invoice Reference Number) generated by IRP will then be used to transfer all the information to the e-Way bill portal and the GST portal. This system reduces human efforts and a lot of paperwork. These e-Invoices are specially simplified with web apps while still allowing for SAP systems to process them easily.

The documents that are valid for e-Invoicing are invoices by a supplier, credit notes by a supplier, debit notes by a recipient. In the SAP system it is extremely easy to determine if the customer is eligible for e-Invoicing. Currently, the SAP solution is valid for B2B customers. If a customer has a registered GSTIN (goods and services tax identification number), the standard SAP solution determines if the customer is eligible for e-Invoicing or not.

How to generate an e-Invoice under GST?

Here is a look at the steps involved in generating e-Invoices:

- e-Invoices must be generated in the standard format prescribed by the GST network.

- After generating the e-Invoice, it will be updated on the IRP and sent through an asynchronous call.

- The IRP will then assign an IRN to the e-Invoice and digitally sign it.

- Then, IRP will generate a unique QR code that contains vital information on the invoice.

- Lastly, the e-Invoice is emailed to the recipient of the document.

The e-Invoice process and its advantages

The e-Invoice system aims to avoid data mismatch errors by addressing various challenges and enabling better data reconciliation. The generation process allows for interoperability, thus minimizing data entry error. It allows you to track the e-Invoices prepared by suppliers in real-time. As the relevant data of the invoices are auto populated when filing different returns, it makes the tax return filing process much simpler and easier.

How SAP rose to the occasion

With most aspects of the business being digitized, the government process is not far behind. This approach towards digitization by the government has generated a need for electronic tax compliance. The e-Invoice system with regulatory obligations has become mandatory for businesses in most countries, including India. In order to cater to the need for a country-specific legal requirement integration, SAP developed its own SAP document compliance solution for S/4 HANA systems and SAP ECC for India users.

Benefits of navigating e-Invoicing through SAP document compliance

- A Global platform: SAP e-documentation is a globally used platform to generate e-Invoices and real-time reporting.

- Live status update: It offers a live status update for each e-Invoice.

- Health check: By validating transaction data, it ensures an error-free payload to the IRN and NIC portal.

- Three solutions in one platform: It consists of e-Way bill, e-Invoice, and SAP digital compliance service of India.

SAP document compliance can offer businesses real-time generation of e-Invoices, auto-generate part-A of the e-Way bill while creating an e-Invoice, smoothen reconciliation between the e-Way bill and IRN and make cancellation of IRN possible.

How Fingent can help you stay compliant with GST India e-Invoicing

Being a Silver Partner of SAP, Fingent offers e-Invoicing integration for SAP ERP users in India. We provide:

- API integration to authenticate, generate, cancel, print, and track e-invoice as per the prescribed format

- Follow SAP billing transactions to generate e-invoices directly

- MIS Reporting, Reconciliation, Status, Alerts, and Dashboards

- Extensive configuration options and easy-to-manage customizations

- No conflict with any of the existing SAP functionalities

- SLA-driven support under AMC

- On-demand support to handle any statutory changes made by the Govt.

Read our case study: Automated Integration between SAP SuccessFactors-Employee Central and SAP S/4HANA– How Fingent helped the customer gain real-time insights for improved decision-making

The right implementation of e-Invoicing has the potential to transform the transactional landscape of the Indian commercial economy into a transparent digital system. It is an opportunity to create an automated e-trail and the SAP solution is designed to help you make this smoother and keep a tight control over legal requirements and compliances.

Future-proof your business by giving it the edge it needs with our customized SAP solutions, which will help you with your e-Invoicing as well as offer you a host of other competitive advantages. We at Fingent are experts at creating intelligent business solutions with SAP. Give us a call and let us get you started.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Empowering CFOs to Derive Crucial Insights and Implement Strategic Decisions with Confidence

The role of the CFO is no longer restricted to fulfilling traditional financial duties. With advances in technology, the CFO’s responsibilities are also growing as today’s CEOs and boards demand the finance function provide real-time, data-enabled decision support. The present-day CFOs and their teams serve as gatekeepers to critical data that is required to generate forecasts and support business leaders to make strategic decisions that have a lasting impact.

With that said, what are the challenging areas for CFOs where they can perform better with the integration of the right technology? We’ve tried to list out a few here.

Key Challenges Faced by CFOs

1. Insights

- Acquiring self-service analytical capabilities to garner strategic and operational insights for reliably enabling key decisions and enhancing visibility through the board-room to the shop floor.

- Addressing big data requirements is another challenge. Embedded data analytics that connects transaction executions with immediate insights and analyses is a must-have weapon in the CFO’s armor. With automatic matching capabilities, finance professionals can reduce the time taken to gather data.

- Predictive insights are essential to assess future outcomes. CFOs equipped with predictive analytics capabilities empower organizations through powerful budgeting, planning, and forecasting that will drive the business on the right path.

2. Ensure agility to respond, adapt and survive

- It’s always at the top of a CFO’s agenda to optimize risk management and establish a sustainable cost-effective control environment. A sustainable compliance program (compliance-first approach) can free up to 30% of the function’s capacity while keeping the risks low.

- Structure finance to make the most of tight budgets and provide financial support for corporate initiatives by ensuring discretionary expense management and operational costing optimization.

- Increasing adoption of “Shared Services model” (service delivery models under centralized and decentralized structures) for enterprise operations allows businesses to expand to several domains, customers, products, geographies, and channels. For CFOs, this translates to more challenges w.r.t. strategic pricing, customer and product profitability modeling, and profitable growth target setting. CFOs also need to cater to multiple businesses and stakeholders while supporting all the current and evolving business models.

- Embedded localization requirements to best-balance the risk and efficiency and implement best practices supporting operations across segments, industries, and geographies.

- Flexible deployment models allowing the optimal combination of cloud and on-premise solutions.

3. Optimize costs, digitize finance, and other functions

- CFO and other finance professionals are expected to offer more value-add solutions that provide strategic direction for the enterprise. Automation of repetitive, rule-based finance functions enables CFOs and financial professionals to focus more strategically.

- CFOs need to gain improved visibility across all cost components that allow them to take quick actions such as cutting unwanted costs and justifying new costs in a tangible way.

- Integrate and unify all corporate processes allowing for a higher level of standardization. This can only be achieved with an intelligent enterprise technology like SAP S/4HANA.

Why is SAP S/4 HANA ideal for CFOs?

Traditional ERP systems store data in many different tables. As a result, financial teams struggle with isolated and inconsistent information from many sources. They end up spending hours sifting through data and compiling reports manually. Despite this, they are unable to provide the desired financial insights. On the other hand, SAP S/4 HANA stores all financial information in a single Universal Journal. It is a powerful concept that eliminates redundancy and creates a single source of truth. This gives you easy access to accurate, timely, and qualitative information. Your business processes become transparent and reliable.

The broad portfolio of new technologies and innovations in SAP S/4 HANA Finance empowers CFOs with responsive decision-making tools. These tools give you instant insights into all the company’s data and systems. You can perform end-to-end analyses right from the boardroom to the shop floor.

Read more: How SAP S/4HANA transforms the end-to-end business process

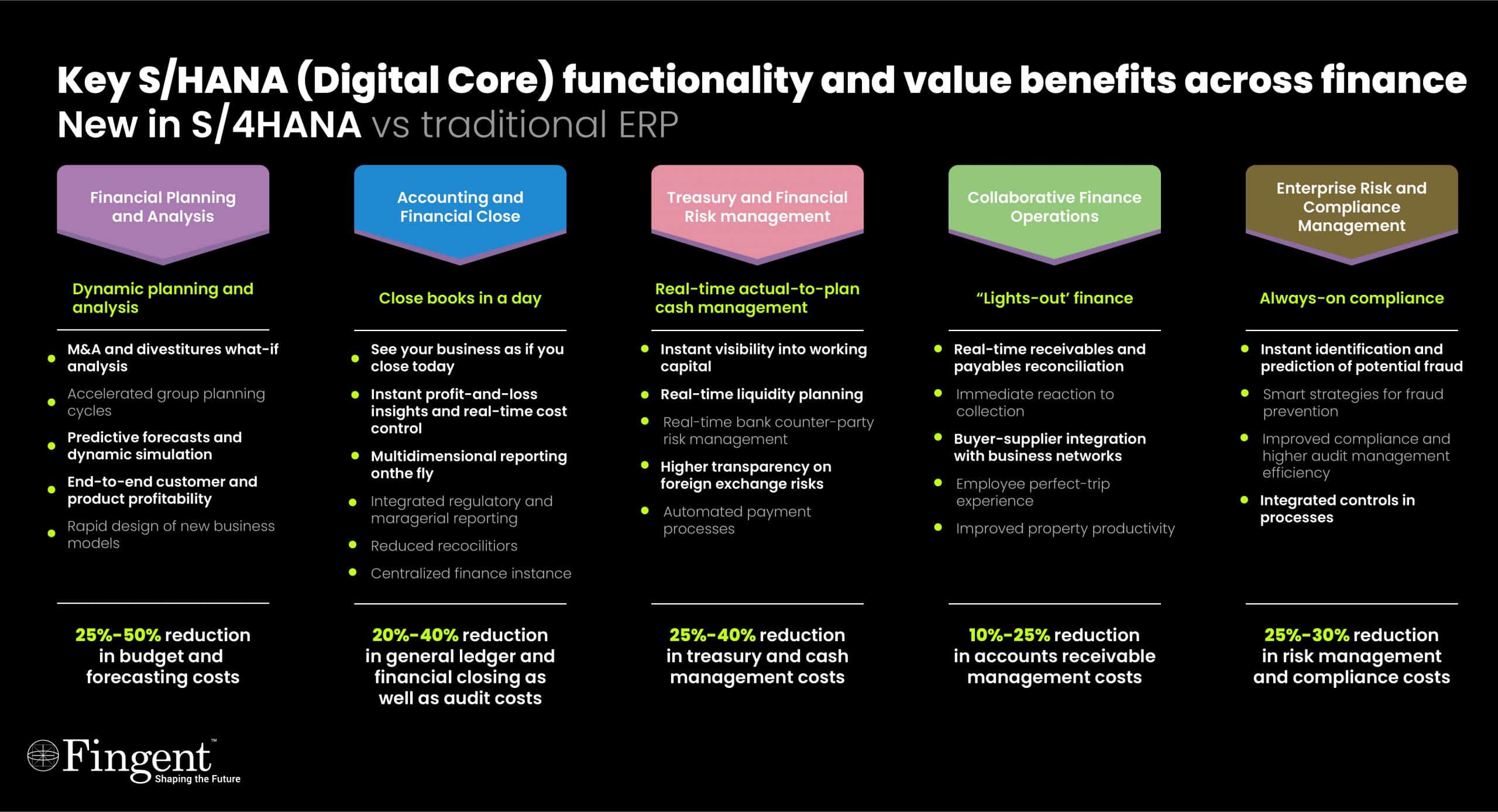

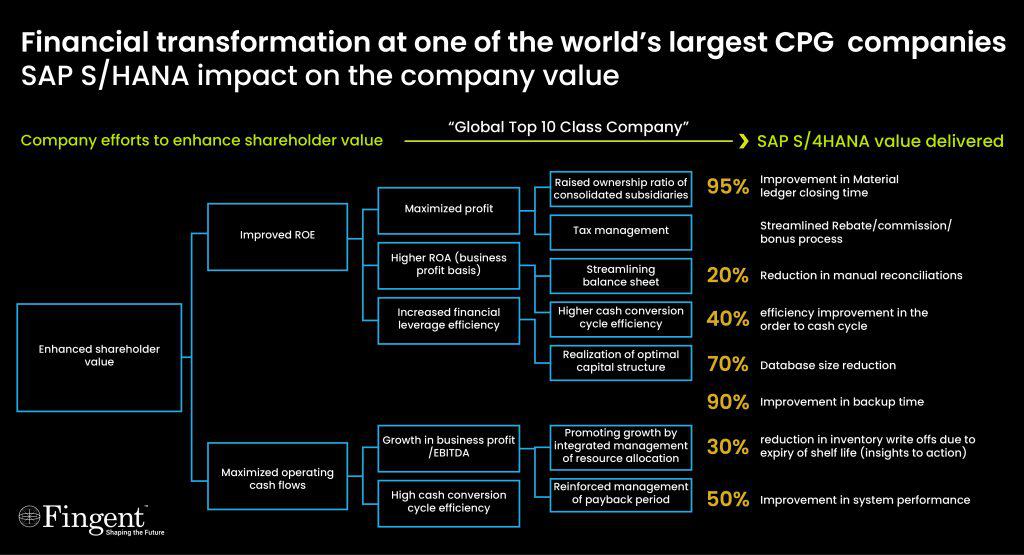

(Click to enlarge the image) Source: SAP

(Click to enlarge the image) Source: SAP

Embedded Analytics

Organizations using ERP systems have always found that while it’s easy to enter data into the system, getting interesting information from it is tedious. SAP S/4 HANA Finance enables direct reporting without the need for a data warehouse for specific analytic requirements. This is possible because of the Universal Journal. However, this alone does not deliver the right insights. This is where Embedded Analytics in S/4 HANA comes in.

Embedded Analytics allows not only the intuitive navigation through graphical views but also the close integration of analysis capabilities within the operational transactions. This makes it easy to act directly on the right information without having to switch between screens or systems. It has business planning, consolidation, and forecasting capabilities which can help you gain new insights from different perspectives.

The embedded analytics in S/4 HANA is also helpful to determine the best course of action when unprecedented disruptions occur. Thus, the role of the Office of Finance transforms from mere historical reporting to analyzing business performance.

Read our case study: Find out how Fingent automated integration between SAP SuccessFactors and SAP S/4HANA

Predictive Capabilities

Organizations need accurate financial insights to steer their business in the best path. In the past, decision-makers requested information through month-end reporting. That practice is long gone. Today, continuous delivery of relevant information is the minimum requirement. More insights are requested on what the future would bring. This is where Predictive Accounting can help.

For example, when a sales order is confirmed in the system, it is not recorded in accounting until you deliver the goods and send an invoice. With Predictive functionality based on the sales order, a predictive invoice is registered. When the actual invoice is sent out, the predictive posting is back-posted, reducing the predicted amounts. This predictive accounting logic can help you simulate financial postings based on the confirmed incoming sales orders. You end up getting an accurate and futuristic view on your margin.

Read more: How SAP Helps Manage Your Payroll During COVID-19 Crisis