Category: Custom software

Is your software helping you grow—or holding you back? Off-the-shelf solutions may seem convenient. But they often fail to meet your business’s unique needs. This is where custom software development services come in. This solution aligns perfectly with your processes, objectives, and challenges.

Imagine software as unique as your business. It would let you streamline operations, delight customers, and automate complex tasks. The result? Enhanced productivity, expandable development, and an advantage that positions you in the lead.

How can tailored software reshape your business and secure your future? Let’s explore the possibilities.

Power Your Ideas with Tailored Technology We Help Customize Technology To Suit Your Business Needs

What is a Custom Software Solution?

A custom software solution meets an organization’s specific requirements. Unlike generic software, developers tailor custom solutions to an organization’s workflows and goals. They also consider scalability needs and are highly flexible.

Examples of Custom Software Solutions

Customer Relationship Management (CRM) Systems

Custom CRMs streamline processes by focusing on key metrics and workflows. Many businesses use custom HubSpot modules to link their CRM to e-commerce platforms, like Shopify. They also use them to track multi-channel customer interactions.

E-Commerce Platforms

Custom e-commerce solutions enhance user experiences. Amazon’s platform caters to its vast catalog. Brands are using features to engage their audience. These include personalized recommendations and subscription orders.

Healthcare Portals

Custom healthcare software, like Teladoc’s platform, meets unique needs. This encompasses safe data exchange, online consultations, and adherence to regulations.

Enterprise Resource Planning (ERP) Systems

Custom ERP solutions centralize operations. Siemens, for example, uses ERP software. It aims to optimize production schedules, automate purchasing, and streamline inventory management.

Financial Platforms

Custom financial tools like Xero integrate with banks. They offer immediate financial insights for small and medium-sized enterprises.

Inventory and Supply Chain Management Software

Zara’s custom inventory system adjusts stock in real time to trends. Walmart’s tailored supply chain software coordinates its vast global network.

Data Analytics Platforms

Netflix’s custom analytics tool personalizes recommendations based on user behavior. Goldman Sachs uses tailored platforms for investment insights and risk management.

Mobile Applications

Custom mobile apps like Uber’s integrate GPS, payment options, and driver ratings. Starbucks’ app enhances customer engagement with rewards, mobile ordering, and location-based services.

Why Choose Custom Software Development Services?

The global market for custom software development solutions will hit USD 179.90 bn by 2024. It will grow at a CAGR of 6.87% from 2024 to 2028, reaching USD 234.70 bn by 2028 (Statista). Thus, tailored software has become essential for companies aiming to remain competitive.

1. Tailored to Business Needs

The Gartner Digital Markets report says 90% of businesses believe technology is vital to meeting their goals. So why not put it to good use? Custom software development creates purpose-built solutions tailored to your unique processes and objectives. It boosts efficiency and value by focusing on key features and integrating them with existing tools, helping your business operate at its best.

2. Scalability

As businesses grow, their needs change. Custom software adapts to new demands, such as

- expanding product lines,

- entering new markets, and

- managing more data.

It allows for easy feature additions, improvements, and technology integrations. Scalable software ensures long-term value, supporting growth without costly overhauls.

3. Competitive Edge

Custom software development provides solutions that set your business apart. It enables unique features, automates tasks, improves customer interactions, and streamlines processes. Its flexibility lets you implement strategies that boost efficiency and innovation, helping you stay ahead of the competition.

4. Enhanced Security

Custom software is designed with robust security protocols tailored to your needs. It uses advanced measures to guard against cyber threats, including encryption, multi-layered authentication, and secure data storage. It is built with security in mind, safeguarding sensitive data and ensuring safe business operations.

Types of Custom Software Solutions

1. Web Applications

Web applications run in web browsers, allowing users to access them from any device with an internet connection. They are scalable, easy to update, and need no installations, reducing maintenance work. Custom web apps meet the needs of CRMs, project management tools, e-commerce sites, and customer portals. They deliver consistent, accessible services, boosting efficiency and digital presence.

2. Mobile Applications

Custom mobile apps help businesses engage customers and manage operations through mobile devices. Real-time tracking, secure payments, and alerts boost users’ experience and productivity. These apps streamline communication, connecting businesses, employees, and customers instantly. Available for iOS and Android, they ensure agility, engagement, and smooth operations on the go.

3. Enterprise Software

Enterprise software automates and streamlines core operations. Examples include ERP systems integrating finance, HR, sales, and supply chains. Custom enterprise solutions solve complex workflows and data issues. They boost productivity and enable real-time, data-driven decisions. They also align operations across the organization.

4. AI-Powered Applications

AI-powered custom software uses technologies like machine learning and automation. It analyzes large datasets to generate actionable insights. This helps businesses make data-driven decisions quickly.

AI tools automate tasks and use smart bots to improve customer service. They likewise offer customized experiences, such as personalized product suggestions.—Predictive analytics aids in anticipating trends, reducing risks, and spotting opportunities. AI in personalized apps boosts productivity, sparks creativity, and gives firms an edge.

Unlock a World of Opportunities with Custom Software Development

The Custom Software Development Process

Custom software development needs a structured, collaborative approach. This ensures the final product meets unique business needs.

1. Requirement Analysis

This phase sets the foundation for development. It requires collaboration between the client and team, who must identify business goals, define challenges, and outline features. We engage stakeholders and end-users to gather all needs, which forms a spec that directs the process.

2. Design

With clear requirements, the design stage focuses on intuitive UIs and effective UX. Wireframes, mockups, and prototypes visually depict the software, guaranteeing that simplicity, functionality, and accessibility meet business requirements.

3. Development

The coding stage involves developing the front-end (UI) and back-end (server, database, logic) using modern tools and frameworks. Modular development techniques, like API integrations, guarantee adaptability and scalability. Regular client feedback loops address evolving needs.

4. Testing

Testing ensures the software meets quality standards and functions seamlessly. Key testing methods include:

- Functional Testing: Verifies that features work correctly.

- Performance Testing: Assesses performance under load.

- Security Assessment: Identifies weaknesses and guarantees safety.

- User Acceptance Testing (UAT): The user checks that the software meets their requirements.

Bugs and issues are addressed quickly for a smooth user experience.

5. Deployment

Once tested and approved, the software is deployed and integrated with existing systems. Compatibility with infrastructure is ensured. Training sessions familiarize users with the new system. Problems and glitches are addressed quickly for a smooth user experience.

6. Maintenance

Continuous upkeep ensures that the software remains operational, safe, and current. Activities include:

- Fixing post-deployment bugs.

- Implementing updates for new needs or technologies.

- Enhancing security to address emerging threats.

- Providing user support for technical issues.

Key Technologies in Custom Software Development

Custom software development uses advanced tech to create scalable, efficient, and secure solutions. These are tailored to business needs.

1. Cloud Computing

Cloud services offer scalability, adaptability, and cost-effectiveness through pay-per-use models. They enable remote teamwork, ensure reliability, and provide disaster recovery.

2. Artificial Intelligence (AI)

AI improves software through automation, forecasting analytics, and customization. It improves decision-making, speeds up tasks, and powers chatbots and machine learning.

3. Blockchain

Blockchain guarantees data security and transparency through the encryption and decentralization of information. It enables secure records, and smart contracts, and builds trust in finance and supply chain.

4. Internet of Things (IoT)

IoT links devices for immediate data sharing and automation. It provides practical insights, streamlines operations, and improves customer experiences.

Choosing the Right Custom Software Development Partner

The achievement of your tailored software depends on choosing the right development partner to realize your vision promptly and cost-effectively.

1. Expertise in Your Industry

Experience matters. A partner must understand your industry’s challenges and regulations.

2. A Proven Portfolio

A strong portfolio reflects a partner’s capabilities and versatility.

3. Transparent Communication

Clear communication is critical for a successful partnership.

4. Ongoing Support and Maintenance

A reliable partner provides post-deployment services to keep the software optimized and secure.

Benefits of Investing in Custom Software

Investing in tailormade software provides many advantages that surpass the initial development expenses. Ready-made solutions may seem simpler. However, tailored software has lasting benefits and major perks.

1. Cost Efficiency

Though custom software may cost more than off-the-shelf solutions, it is a wise investment. Its long-term benefits outweigh the higher initial costs. Bespoke software removes ongoing licensing costs from ready-made solutions. These costs can accumulate over time, especially with extensive use.

After development, custom software is fully owned, which lowers ongoing expenses. It also enhances productivity by automating processes, optimizing operations, and reducing manual inefficiencies. These extended savings provide a greater ROI, rendering custom software a budget-friendly option.

2. Business Agility

Tailored software lets companies quickly respond to changing market demands, client needs, and new opportunities. Unlike pre-packaged solutions that may be inflexible, tailored software adapts to and with your business.

It lets you add features, pivot processes, or integrate new tech without delays or limits. This flexibility helps companies stay nimble, innovate, and stay competitive.

3. Integration

A major benefit of custom software is its smooth integration with current systems and tools. Many companies use CRMs and accounting apps to manage their operations. Tailored software enables seamless data transfer between these apps. It reduces manual entry and repetitive tasks. Custom software enables better decision-making. It does this by breaking down data silos and improving information accuracy. It also works well with legacy systems and modern cloud tools. This ensures your tech ecosystem runs efficiently as a whole.

Real-World Examples of Custom Software Success

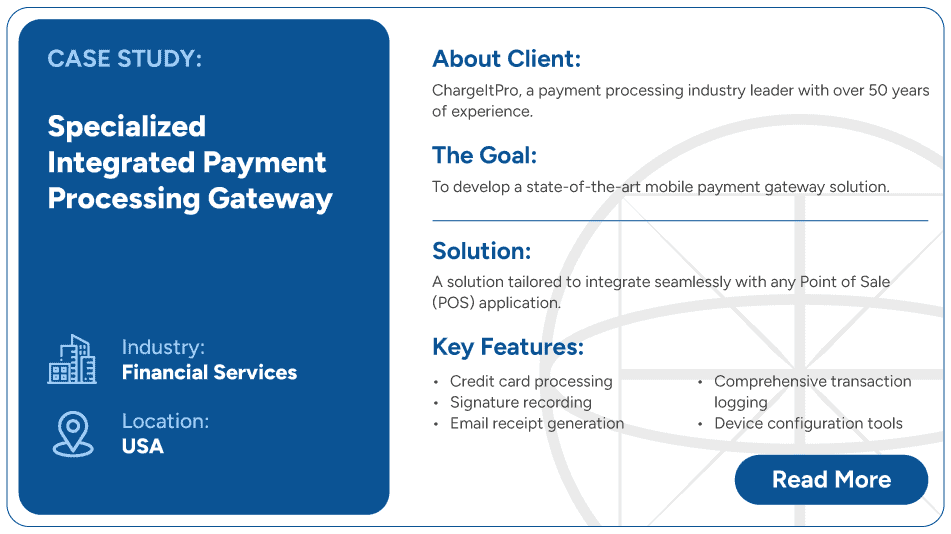

Private Jet Charter

Industry: Travel

Challenge: A private charter firm faced challenges in efficiently managing crew and planning flights, resulting in a rise of ‘empty legs.’ Dependency on off-the-shelf software hindered integrations, automation, and reduced flexibility

Solution: Fingent developed a tailored application enabling easy access to vital aircraft maintenance data, flight risk assessments, crew member IDs, and details, enabling efficient and stress-free flight planning. The application also integrates AI capabilities to monitor sales and automate pricing models.

Results: Accurate flight scheduling and planning, safe and secure travel experiences, centralized management, integrated solution.

Hydroponic Farming Company

Industry: Agriculture

Challenges: The company faced inefficiencies in farming due to manual data entry, inconsistent processes, and reliance on third-party tools. These issues hindered data tracking, resource management, and accurate sales forecasting, leading to delays and operational redundancies.

Solution: Fingent developed a custom web application for the client. Which has a central platform for data management. It tracks and calculates automatically. It also has real-time dashboards for planning and forecasting. This solution improved operational efficiency and enabled better resource allocation.

Results: Streamlined farming, less manual work, better schedules, and accurate sales forecasts. This boosted productivity and sustainability.

Choosing The Right Software Development Vendor: Your Go-to Checklist

Challenges in Custom Software Development and How to Overcome Them

Although bespoke software provides numerous advantages, the development phase can pose difficulties. Comprehending these obstacles and possessing tactics to manage them guarantees a more seamless experience.

1. High Initial Cost

A major obstacle in custom software development is the high initial cost of design, development, and testing. This may be daunting compared to ready-made solutions. They often seem cheaper at first.

Solution: Work with a development partner that offers flexible pricing models and ROI projections. Breaking down costs into phases, and providing clear estimates, can help. So can showing long-term benefits, like better efficiency and lower costs. Businesses will then see the value of their investment.

2. Longer Development Time

Custom software projects often take longer to develop. This is especially true for complex, tailored requirements. Delays can be challenging when businesses need quick solutions.

Solution: Adopting Agile methods lets us break the project into smaller phases. This delivers incremental updates and incorporates feedback. This keeps the process flexible and responsive to business needs. Clear communication between teams aligns them on goals and timelines. It minimizes setbacks and boosts efficiency.

3. Resistance to Change

New software can face resistance. This is especially true if employees are used to existing tools or systems. Some may feel uncertain about adopting new technology.

Solution: Engage stakeholders at the outset of the development process to cultivate a sense of ownership. Encourage team members to contribute their thoughts on essential features and functionalities. Thorough training and continuous assistance throughout the implementation stage guarantee a seamless shift. By training and involving employees, companies can reduce opposition and promote acceptance.

The Future of Custom Software Development

Emerging technologies are shaping the future of custom software. They boost automation, efficiency, and innovation.

AI: Combines predictive analytics, machine learning, and automation to improve decision-making and personalize user experiences.

Internet of Things (IoT): This technology collects data in real time and connects systems to boost innovation and optimize processes.

Blockchain: Boosts security and transparency via tamper-proof transactions. This is valuable in finance, healthcare, and logistics.

Cloud Computing: Makes software scalable, flexible, and accessible. It allows for remote deployment and better collaboration. By using these technologies early, businesses can unlock new efficiencies, stay ahead, and thrive in a digital-first world.

How Fingent Can Help

At Fingent, we provide tailored software solutions that help companies achieve their goals.

Fingent has delivered successful solutions ranging from ERP systems to mobile apps and AI platforms:

- Retail: We developed a real-time inventory system that optimizes supply chains.

- Logistics: We built scalable tools that enhanced supply chain efficiency.

Our case studies demonstrate how we help companies achieve their objectives with quality, practical, and creative solutions.

We work with you, from idea to execution, to solve your challenges. Our customized solutions meet your needs. Whether you want to optimize operations, improve customer experiences, or use new technologies, we can help. Learn how Fingent can transform your business and give you an edge. Together, let’s create the future of your business.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

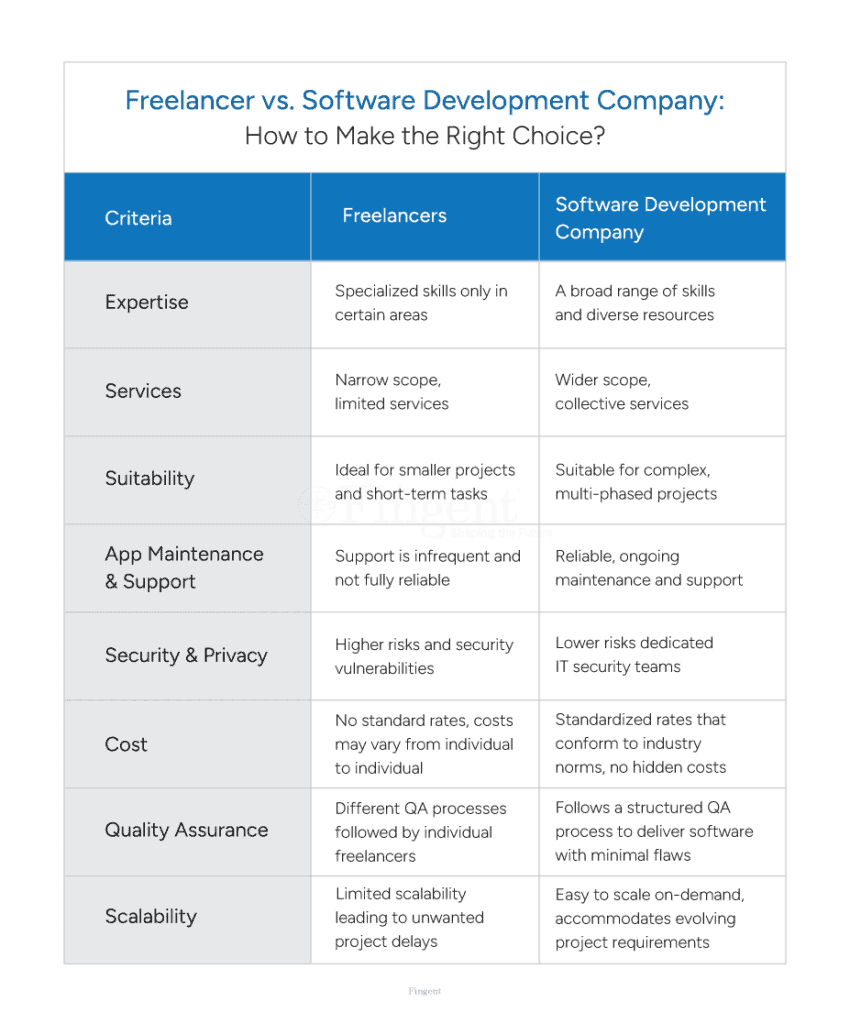

Businesses need modern technology to survive today’s ever-evolving market. The right enterprise software solution can help businesses thrive. However, not all businesses might have the necessary in-house skills to develop one, and let’s be honest, off-the-shelf software does not fit all needs. Thanks to custom software development vendors, enterprises can access technology experts on the go to build customized technology solutions that cater to their unique business needs.

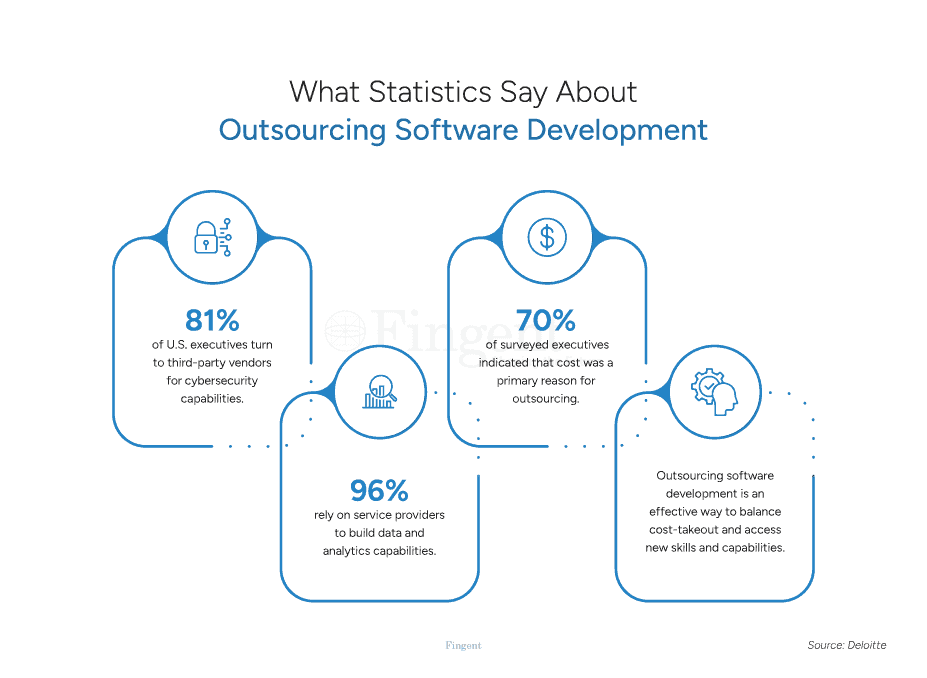

According to a survey by Deloitte, 79% of U.S. executives currently outsource software development. However, any business application is only as good as the developer who creates it. Choosing the right software development partner is a crucial responsibility.

If your business plans to hire an app development partner, here’s a quick checklist that can help. But before we get started, let’s look at why you need to choose the best software development vendor.

Have an Innovative Idea for Your Next Application?

Why Do Businesses Need Software Development Vendors?

Organizations rely on app development partners to:

- Bridge talent gaps and save in-house hiring costs

- Drive value by developing end-to-end solutions

- Access the best of technology, skills, and expertise

- Avoid development delays and cut operating costs

- Increase speed-to-market and enhance core competencies

- Mitigate the risks of running an in-house development project

You can easily unlock these advantages by choosing the right software development vendor. But what happens if you choose the wrong app development partner? Here are the risks!

Risks of Choosing a Wrong Software Development Vendor

Wrong software vendor selection can leave a lasting impact on your company.

- Poor-quality software rollouts can lead to massive sales losses. It can force your customers to go to competitors.

- Ill-fitted software solutions affect your day-to-day operations and increase your team’s workload.

- A bad match will never help you with add-ons and customizations you might need for the future.

- Botched software can cause frequent business disruptions. It can affect your customer experience, reputation, and brand.

- Faulty software can lower your team’s morale and engagement. Constant software glitches add to employee frustration and fatigue.

- A wrong vendor may not be able to meet your deadlines. They may also charge you more than expected. There is always an inherent risk of hidden costs.

- Communication breakdowns can create misunderstandings between the vendor and your stakeholders.

- Inadequate security measures opted by the vendor can put your business at risk. It can increase the chance of damaged, lost, or stolen data.

How can you avoid these risks? Ace software development vendor selection by using our checklist (below).

Why is Legacy Software Modernization Inevitable for Businesses?

Checklist: How to Choose the Right Software Development Vendor?

1. Define Your Needs and Goals

The first step to finding the right developer is identifying your goals. Why do companies seek to build customized software? Some of the common reasons are:

- Enhancing customer experience and satisfaction

- Improving workforce productivity and operational competency

- Tracking and managing staff responsibilities

- Automating specific tasks and repetitive functions

- Boosting reliability and security

A good discernment of your objectives and business needs will allow you to proceed to the next steps more efficiently.

2. Set up a Budget

Defining your goals should help you prepare a detailed budget. At this stage, it is important to determine the capital, expenditures, and forecasted return on investment (ROI).

Assess the factors that impact the cost of your software development project:

- Type of software you need and its level of complexity

- Custom software or off-the-shelf software

- UX/UI design considerations

- Backend infrastructure and dependencies

- Integrations with other applications you use

- Location of the app development partner

- Development time, resources employed

- Investments in new technologies

- Estimates/rates quoted by the software development vendor

Any business’s priority is to produce high-quality software. However, keeping the project within budget is vital for business success.

3. Research Potential Vendors

Research potential software development vendors. Assess the selected app development partners based on the following factors:

- Do they have experience working on the type of software you need?

- Have they worked in your industry or domain in the past?

- Do they handle the entire software development lifecycle? Do they provide post-launch application maintenance and support?

- Do they help train your staff on the new software?

- What are the services they offer?

- Does their rate fit your budget?

- What other value-added services do they provide software development? Developing an e-commerce application, maybe?

4. Shortlist Top Software Development Vendors

Choosing from hundreds of service providers can be overwhelming. Once you do the research and specify your requirements, you can start shortlisting the options you find appealing.

Here are a few ways to narrow down your list:

- Read through the company profiles, case studies, and client testimonials of potential vendors.

- Use any credible B2B rating platform to check out their ratings and reviews. Platforms like Clutch, GoodFirms, etc. list the top vetted software development partners.

- Filter vendors based on their minimum project costs, team size, average ratings, and location.

- Keep your list short so you can reach out to the selected firms quickly.

5. Talk to Each of the Selected Vendors

A direct conversation with the software development vendor gives you a fair idea of their services and expertise.

Before meeting a vendor, prepare a set of questions that will help you gauge their work:

- What technologies and programming languages are your team proficient in?

- What are the industries and domains that you primarily cater to?

- What project management tools do you use to manage your workflows?

- How do you ensure the quality of your software?

- What is your project engagement model?

- What software development methodology do you follow—Agile, Waterfall, RAD, Lean?

- How do you determine the costs of your work?

- Is my budget and expected timeline realistic for my project?

Above all, it’s crucial to identify if the potential vendor’s way of operating and objectives align with your requirements.

6. Narrow Down Your List Further

A direct conversation with each vendor should help you narrow your choices between two or three developers.

- Consult your leadership team. Weigh the pros and cons of each vendor based on your analysis.

- Shortlist your selection to one or two providers. Ensure they can understand your needs and match your company’s culture.

7. Data Security and Privacy Measures

Your business software needs to handle confidential company data. Is your software development partner capable of protecting your application from cyber threats?

- Before choosing a software development vendor, undertake an intellectual property due diligence inquiry.

- Find out how the vendor will be handling your data and assets.

- Review their integrated security and IP protection program.

- Determine the internal measures you should adopt to safeguard your enterprise’s IP.

- Identify which functions need to be managed in-house and what should be outsourced.

8. Compliance, Reliability, and Support

Along with analyzing the vendor’s cybersecurity offerings, you also need to verify:

- Does the vendor’s development and delivery practice/policies comply with the essential regulations?

- Have you done extensive background checks to ensure the integrity and reliability of the vendor?

- Did you do a proper technical and strategic vetting of the selected development vendor?

- Is the vendor equipped to address unexpected IT outages and disruptions?

- What are the risk management policies/processes followed by the software development vendor? Do they have a robust disaster recovery plan?

- Does their development process align with your organization’s sustainability goals?

- Does the vendor stick to responsible application design, development, and maintenance that can reduce the environmental impact?

Choosing the right software development partner requires careful planning. It’s indeed a very tricky job to pick out the right one from a huge list of potential vendors. The checklist aims to make the job simple for you.

Nearshore vs In-House Software Development: Know The Pros & Cons

Software Development Company vs. Freelancer: Which is Better?

What is the difference between a freelancer and a software development company?

- A freelancer is an individual who works independently on software development projects.

- A software development company is a professional organization that provides software development services.

How does working with a software development company help your business?

- A team of certified professionals well-versed in multiple areas

- Access to the latest technologies and specific domain expertise

- A reliable vendor-customer contract (agreement) to back you

- Round-the-clock support and IT help desk

- Transparent communications, no hidden surprises

- Standardized pricing with no additional costs

- Dedicated ongoing maintenance and support

Transform Your Business With the Right Software Development Vendor

The best software development vendor:

- Works with you throughout the entire development process

- Helps navigate the complexities of software creation and maintenance

- Makes incremental changes for continuous software enhancement

- Develops tailor-made solutions that align with your business goals

- Improves your business’s efficiency, productivity, and financial performance

Let Us Help You Ease Your Digital Transformation Journey

Why Choose Fingent as Your Software Development Partner?

Since 2003, Fingent has been a reliable and capable software development partner for leading global brands, including several Fortune 500 companies.

- An impeccable track record as a successful custom software vendor

- Experience in new and emerging technologies—AI, AR, VR, IoT, blockchain, and more

- Legacy application modernization, cloud migration

- Multi-platform development—web, mobile, cloud, and more

- Diverse offshore talent pool with experienced developers and tech professionals

- Tech certifications, partnerships, centers of excellence

Build scalable and robust applications by partnering with a professional custom software vendor. Contact us to get an extended consultation.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Wine and wisdom get better with age. But software doesn’t. That’s why experts say legacy software modernization is inevitable for modern businesses.

Picture this! Ten years ago, you might have owned a PC running Windows XP. But today, your new computer runs Windows 11. The latest OS makes your current PC more powerful and capable than the one you owned ten years ago. Likewise, your business is no longer the same as it used to be when you started it. Using legacy, underperforming software to manage your business can stall its growth. So, how can you make your business software robust and relevant? Thanks to legacy software modernization services for making your applications relevant and competitive.

This article explores why you need to invest in application modernization.

Don’t Allow Outdated Technology To Sloth Your Business Growth

Can Clinging To Outdated Technology Cost High For Your Business?

Yes! Holding on to outdated technology can cost your business more than it saves. These real-world examples prove the damaging effects of legacy software on businesses.

The Rise and Fall of Blackberry

The tale of Blackberry is a classic example that reveals the pitfalls of legacy software.

What was once a leader in the smartphone market lost ground to rival operating systems—iOS and Android. And the reason? Failure to innovate and reluctance to get rid of legacy system elements.

In 2011, Blackberry made a revenue of $20 billion. Fast forward to 2022, the figures dropped to $718 million. The same year, Blackberry decommissioned the infrastructure and services used by their legacy software and phone operating systems.

Myspace, The Lost Space

The story of Myspace is no different from that of Blackberry. Launched in 2003, Myspace was the first social network to reach a global audience in the pre-Facebook era.

Post-2007, Myspace started losing millions of users to its rising rival, Facebook. The most cited reasons behind Myspace’s failure are lack of usability and flexibility, low innovation, and slow load times.

Delta: Back-to-Back IT Outages

In August 2016, Delta Airlines suffered a loss of $150 million due to an outdated reservation system. Built in the 1960s, the system underwent a major crash caused by a power failure. The incident forced Delta to delay or ground most of its flights for at least six hours worldwide.

How can one forget the recent CrowdStrike outage that disrupted Delta’s operations worldwide? The incident affected Delta’s crew-tracking software, forcing them to cancel over 7,000 flights over five days. According to a CNBC report, the five-day outage cost the airline nearly $500 million.

How Does Legacy Software and Technology Impact Your Business?

Here are a few ways outdated applications affect your business’s performance and growth.

1. Lack of Interoperability

Legacy applications struggle to integrate and communicate with each other. Poor interoperability can hamper your progress. It can also slow down the adoption of more efficient processes.

2. Security Vulnerabilities

Outdated security measures and lack of updates can make legacy apps more susceptible to cyber threats.

3. Outdated Technology

Legacy applications often rely on outdated technology. Obsolete technology can make them incompatible with modern standards and best practices.

4. Limited Scalability

Scaling legacy applications to accommodate evolving demands can be challenging and expensive.

5. High Maintenance Costs

Legacy applications demand extensive resources and maintenance. This can result in escalating costs over time.

6. Inefficient Performance

Outdated software code and technology can mar the performance of legacy applications. This can hinder productivity, resulting in knowledge silos and slow response times.

7. Poor User Experience

Legacy applications fail to provide the Uber-like, personalized experience that today’s customers seek.

8. Operational Disruptions and Delays

Finding the right talent to track, maintain, and support legacy applications is arduous. This can lead to operational disruptions and delays in resolving critical issues.

Legacy Application Modernization: Excerpts From A CTO

How Can Businesses Solve the Risks of Legacy Software?

We’ve seen the risks legacy apps can expose your business to. That said, what’s the right approach to solve them?

Enter legacy software modernization—a process that allows you to upgrade or transform outdated, inefficient software systems into more contemporary, efficient, and adaptable solutions.

In a recent survey, RedHat highlights the primary benefits of application modernization. With legacy software modernization services, more than 50% of companies have achieved:

- Improved security (58%)

- Greater scalability (53%)

- Enhanced reliability (52%)

These findings show the potential value that application modernization can bring to companies.

Why Is Legacy Software Modernization the Way Ahead for Businesses?

Sticking to legacy technology will undermine your future projects and growth plans.

According to McKinsey, 70% of business transformation’s impact depends on technology. If the technology you use is old and obsolete, your entire IT budget will be spent maintaining legacy applications and infrastructure.

91% of customers consider ending relationships with companies that use obsolete software technologies.

The message is clear. Companies need to modernize if they want to remain competitive.

How Does Legacy Software Modernization Benefit Your Business?

In 2022, IDC predicted that most legacy applications would be updated by 2024. 65% of the applications will use cloud services to extend functionality or replace inefficient code.

Modernizing legacy apps will make them more secure, flexible, and scalable. Here are some of the top benefits of legacy app modernization:

1. Enhanced Customer Experience

Modernized applications offer new features, improved performance, and reliability. With a revamped UI and UX, modernization enhances customer experience and satisfaction.

2. Improved Employee Experience

Modernized applications boost employee productivity and collaboration. They help employees do their jobs faster while saving productivity. Features like automation and analytics allow employees to focus on more strategic initiatives. It helps reduce the risk of employee burnout and boost workplace morale.

3. Streamlined Data Management and Governance

Modernized applications improve data management and governance efficiency within your organization. It helps ensure the quality, consistency, security, and usability of your data.

4. Cost Reduction

Modernized applications drive operational efficiency, cut unnecessary maintenance costs, and boost employee productivity. All these lead to tremendous cost savings in the long run.

5. Increased Agility

Modernized applications allow businesses to be more agile and responsive to change. Contemporary applications help you adapt quickly to evolving market trends and needs. Restructuring and refactoring legacy software will make it more maintainable and adaptable.

6. Improved Cybersecurity and Compliance

Modernized applications incorporate the latest security standards and technologies. This will help safeguard your data against unwarranted access, cyber-attacks, and theft.

Ensuring compliance with industry standards is an integral component of application modernization. It helps avoid costly compliance issues. With app modernization, you can also reduce the risk of security breaches.

7. Hybrid IT—Best of Both Worlds

Modernization combines the preservation of critical components with functionality enhancement. Today, hybrid IT is a principal cloud strategy pursued by many companies. Hybrid IT brings to your table the best of both worlds. It blends the security and control of an on-premises environment with the flexibility and scalability of cloud services.

Enterprise Application Modernization Trends and Best Practices To Look Out For

Busting the Common Myths About Legacy Software Modernization

# Myth 1: Modernization Is Expensive

Studies reveal that successful modernization boosts annual revenue by 14% and can lower application maintenance and running costs by 30% to 50%.

You can prioritize your modernization strategy to control costs and complexity. For example, a smart application rewrite can be more effective than building a new application from scratch.

# Myth 2: Modernization Requires a Strong Internal IT Team

Hiring in-house staff with in-depth technical knowledge consumes your budget and time.

Engage with an external software vendor to handle your IT backlogs. An outsourcing partner can reduce your dependency on strong in-house IT teams. They provide you with the right mix of talent and technology to transform your legacy applications. Besides, you can save a lot on in-house hiring and maintenance.

# Myth 3: Modernization Will Disrupt My Business

Fear of operational disruptions forces many businesses to opt out of modernization.

Not all modernization scenarios need a platform switch. Usually, a wrapping approach is possible instead of a replacement strategy. Wrapping can be done in two ways:

- Adding a layer of API on top of the Service Oriented Architecture (SOA) in the legacy system. This will enable the legacy application with new capabilities. There is no need to install any special infrastructure.

- Another way is to connect an API directly with the back-end legacy system. It will give each system a separate wrapper. It avoids the need to integrate local service data with other services.

Today, custom software development vendors use RESTful APIs across many application modernization requirements. This way, newer functionalities can be enabled by migrating just the applications.

# Myth 4: If It’s Not Broke, Why Fix It?

Many businesses are complacent with the status quo. After all, why even touch something that works, right? Well, not exactly.

Risk can creep out from just about anywhere. Outdated security protocols, compatibility issues, evolving regulations—several aspects pose hidden costs or threats to your competitiveness.

Modernizing legacy applications is essential to cover your bases. Legacy software modernization is a critical hinge on which your business’s survival depends. It makes your business more resilient in the face of uncertainty.

# Myth 5: Modernization Involves Rigorous Planning and Complications

Building a modernization strategy requires a significant time investment. Modernizing without a priority can drive up costs and complexity.

Assessing the full scope of your organization’s needs upfront pays off in the long run. Take time to analyze the trade-offs between business and technology. Prioritize your needs and features. Find out what can enable a smooth modernization journey. Partner with a trusted custom software development company to execute your app modernization project.

How Can Companies Get Started With Legacy Software Modernization?

Here are four steps to begin your legacy application modernization journey:

1. Assess the Business Need to Modernize

Find out what is driving the need for modernization. Identify the opportunities that modernization will offer your business.

2. Choose Specific Modernization Efforts

Analyze the modernization efforts needed to meet your defined business goals. Map specific business outcomes and defined patterns of activity. Select a provider that can deliver the essential services.

3. Create a Modernization Roadmap

Identify the timeline for each phase of modernization. Ensure the journey in each phase adds incremental value while ensuring business continuity.

4. Make the Essential Changes to Adapt

Make necessary changes to your data structure and governance policies. Adapt your culture, skillset, and organizational requirements to benefit from the new workflows and resources.

Strategize Your Legacy Software Modernization Journey With Experts

How Can Fingent Help You With Legacy Software Modernization?

Right consulting support can make a real difference in legacy application modernization services. How does modernizing legacy apps with Fingent help you?

We help customize and integrate the best hybrid solution for your circumstances. Our team brings in:

- Deep cloud expertise

- Relevant skill sets for app modernization

- Logical integration of multiple business applications

- Excellence in the latest technologies

- Strategic vision and support

- Industry and domain expertise

- Customization to suit your specific needs

Gain fast solutions and low-cost implementation with our legacy software modernization services. Address your key constraints and modernize your application portfolios with Fingent. Contact us to know more.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

After AI tools like ChatGPT, Artificial Intelligence (AI) copilots are now particularly gaining traction due to their fascinating abilities. From creating instant emails, to taking the load of complex workflows, AI Copilots are assisting businesses to do more within less time. How can modern businesses leverage these rising capabilities of AI to boost success? This blog explains it all. Find out what AI Copilots are, how they benefit businesses and customers, and why it’s the future!

What are AI Copilots?

AI Copilots are advanced AI systems that collaborate with human operators to enhance decision-making and task execution. They leverage machine learning and data analytics to provide real-time insights and support. Custom AI copilots can unwaveringly improve operational efficiency and drive success across various industries. The goal is to augment human capabilities rather than replace them!

Drive Business Excellence with Artificial Intelligence

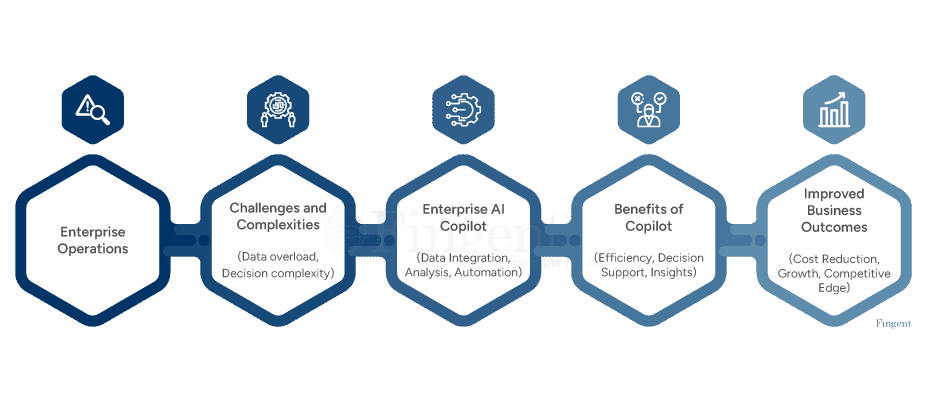

What is an Enterprise AI Copilot?

Enterprise AI Copilots are fine-tuned to build interconnectivity between your enterprise machines and systems. Many organizations are increasingly challenged by navigating and managing data across diverse systems. Enterprise AI Copilots integrate all systems under a single conversational interface, improving data efficiency and work productivity while keeping the entire organization connected. Enterprise AI Copilots augment human expertise and facilitate a collaborative approach to problem-solving and task execution in the ever-evolving landscape of modern enterprises.

How Does Custom AI Copilot Value Your Business and Customers?

The importance of specific benefits of Custom AI copilots can vary based on the nature of the business and its objectives. However, certain benefits are generally considered crucial for maximizing the impact of AI copilots across diverse industries. Here are five key benefits that are often deemed most important:

1. Enhanced Decision-Making

The ability of AI copilots to provide real-time insights and support for informed decision-making is foundational. This benefit ensures businesses can navigate complexities precisely and make strategic choices aligned with their goals.

2. Operational Efficiency

Streamlining workflows, automating routine tasks, and enhancing operational efficiency are fundamental to achieving overall productivity gains and cost reductions. This benefit allows businesses to operate more smoothly and allocate resources effectively.

3. Personalized Customer Experiences

Tailoring experiences based on customer data is crucial in today’s customer-centric business landscape. AI copilots contribute to personalized customer experiences and help foster customer satisfaction, loyalty, and long-term relationships.

4. Industry-Specific Applications

Customized solutions for different industries ensure that AI copilots can address sector-specific challenges effectively. This benefit is particularly important as it allows businesses to optimize operations according to the unique demands of their respective industries.

5. Exploration of New Opportunities

The ability of AI copilots to guide businesses into new markets and opportunities is vital for sustained growth and innovation. This benefit ensures that businesses remain adaptable and capitalize on emerging trends and possibilities.

Read More: AI in Business Development: Key Areas of Applications and Top Use Cases

Custom AI Copilots Soaring Across Industries: Real-World Use Cases

Custom AI copilots are crucial in simplifying business processes, tackling industry challenges, and fostering efficiency and innovation. Here are specific instances showcasing their impact:

1. Precision Medicine and Diagnosis Assistance

AI copilots collaborate with healthcare professionals, contributing to precision medicine and providing valuable insights for accurate diagnoses, ultimately enhancing patient care.

Example: Streamlining Data Entry and Processing

- AI copilots streamline data entry tasks, reducing errors and speeding up processing times.

- They enhance data accuracy and allow human resources to focus on strategic tasks.

2. Intelligent Investing and Fraud Detection for Finance Sectors

AI copilots revolutionize the financial sector by offering intelligent investment strategies, risk assessments, and robust fraud detection, ensuring a secure and optimized financial flight.

Example: Fraud Detection in the Financial Sector

- AI copilots use advanced algorithms to detect anomalies in financial transactions.

- They contribute to real-time fraud prevention, safeguarding financial institutions and clients.

3. Optimizing Production and Quality Assurance in Manufacturing

Custom AI copilots optimize production schedules, maintain quality control, and ensure precision, increasing efficiency and reducing errors.

Example: Quality Control in Manufacturing

- AI copilots analyze product images and data to identify defects in real-time.

- They improve quality control processes, minimizing defective product output.

4. Personalized Customer Journey in Retail

AI copilots reshape the retail landscape by analyzing customer behavior, optimizing inventory, and creating personalized shopping experiences, ultimately elevating customer satisfaction and loyalty.

Example: Optimizing Inventory Management

- AI copilots forecast demand, helping businesses maintain optimal inventory levels.

- They prevent stockouts and overstock situations, reducing costs and improving efficiency.

Implement AI To Your Existing Ecosystem Without Any Business Disruptions

Custom AI Copilot Tips & Best Practices

Adhering to these best practices helps businesses streamline the custom AI copilot selection process, ensuring a successful and future-proof integration aligned with their objectives.

- Define Goals Clearly: Understand your business needs and choose an AI copilot aligned with specific goals for purposeful integration.

- Prioritize Data Security: Choose AI copilots with robust security features and implement encryption for safeguarding sensitive information.

- Embrace Continuous Learning: Opt for AI copilots that exhibit continuous learning capabilities, ensuring adaptability to dynamic business environments.

- Foster Collaboration: Select AI copilots emphasizing collaboration and facilitating harmonious interaction with human teams for effective decision-making.

- Industry-Specific Expertise: Consider AI copilots with industry-specific expertise to address unique challenges and optimize processes effectively.

- Edge Computing Agility: Consider AI copilots exploring edge computing for real-time insights, ensuring adaptability in the evolving digital landscape.

- Emotional Intelligence Integration: Consider AI copilots with emotional intelligence integration for enhanced collaboration, future-proofing your investment.

- Scalability and Flexibility: Opt for AI copilots offering scalability and flexibility to adapt to changing business needs and scale.

- Transparency and Accountability: Prioritize transparency in AI operations, ensuring accountability and ethical practices.

- Diversity and Fairness Check: Implement measures to mitigate biases in AI copilots, prioritizing diversity and fairness for equal outcomes.

- User-Friendly Interfaces: Choose AI copilots with user-friendly interfaces to facilitate seamless integration into workflows and user adoption.

Empower Your Business With Custom AI Copilot: Fingent’s Expertise

At Fingent, we understand the transformative power of AI and are dedicated to helping businesses leverage their full potential. Here’s how we can elevate your organization:

- Precision-Crafted for Your Needs: Benefit from AI solutions customized to align seamlessly with your business objectives, ensuring optimal functionality and impact.

- Navigating the AI Landscape: Rely on our seasoned AI experts to guide you through the complexities of AI adoption, providing strategic insights and tailored recommendations.

- Ensuring Smooth Implementation: Our team specializes in seamlessly integrating AI solutions into your existing workflows, minimizing disruption, and maximizing efficiency.

Take the First Step Towards a Smarter Future

Custom AI Copilots are built to cater to your specific business needs. Unlike generic AI copilots, Custom AI Copilots can be incorporated within your existing systems and processes to redefine business potential and capabilities. Our experts at Fingent can help you discover opportunities with AI, build custom AI copilots, and seamlessly integrate them to power your business operations with AI efficiency.

Connect with our experts today and rediscover your business with innovations beyond digital transformation.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Retail is one of the most data-reliant industries globally. Inventory databases, customer details, POS systems, websites, social media data, and so much more provide rich data. However, to drive success, all this data must be converted into a dynamic, revenue-generating, and business-transforming asset. That’s where Retail Business Intelligence steps in!

Business Intelligence (BI) is especially prominent in customer service and inventory management. BI helps you organize, analyze, and contextualize business data in retail. It also offers performance measures and company trends, which help business owners make informed decisions. That is pure gold in today’s business environment.

Learn how Business Intelligence can transform your retail business in this 3-minute read!

Power Your Retail Operations With Intelligent Technologies.

What is Retail Business Intelligence?

Business intelligence is a type of AI that specializes in business functions. It helps users organize and manage businesses in a more efficient manner. In the retail industry, BI takes the big stage. Its superpower is the ability to automate almost any task. Retail BI has revolutionized the standard of business operations and customer satisfaction. These solutions can optimize assortments, sales trends, marketing campaigns, and more.

Currently, retail stores are also implementing BI and advanced algorithms. After all, a satisfied customer is the best business strategy. The BI solution can analyze demographic data, social media behavior, and purchase patterns. Using this information can enhance the customer experience. This creates a unique and personalized service, paving the way to customer retention and loyalty.

What are the Top Benefits of Using Retail Business Intelligence?

The worldwide BI and business analytics software market will reach nearly 17.6 billion dollars in 2024. There is a good reason for that. Business Intelligence powers business operations with valuable customer insights, optimized inventory management, and boosts marketing strategies. Listed below are the prime advantages of retail business intelligence:

1. Improves Business Operations

Optimization of business operations is the primary benefit of business intelligence in retail. It keeps a consistent record of everything happening within the company. This ensures that there are no errors due to an oversight of details or information. This is best seen in its ability to optimize the company’s inventory.

Retailers can use data analytics to process sales data on product demand. This allows them to make appropriate forecasts and predict upcoming trends. Furthermore, optimizing inventory management also involves preventing overstocking. This reduces inventory costs and enhances order management.

2. A Better Understanding of Customer Behavior

Machine learning learns from previous data to make accurate predictions. ML, as a subpart of business intelligence, enables retailers to study their customers. It collects information about the customers’ shopping habits and social media patterns. This data is vital to enhancing CX (Customer Experience) and optimizing marketing initiatives. Retailers can also use data analytics to create services that meet customer expectations. Analytics can help marketers draft customer progress maps, further providing insights about how to connect with the customer.

Let’s take a look at – How does Walmart use business intelligence?

Walmart being the industry giant, derives data from varied sources. The organization uses BI to analyze customer data derived from online transactions, in-store purchases, events, and more to drive intelligent insights. These intelligent insights reflect customer behavior, shopping patterns, and upcoming and fading trends. Such rich data can help determine the correlation between customers and various products, giving them more power to decide the shelf life of each product. Now they can effectively manage inventory, improve customer experience, and boost brand value, all while driving more revenue.

3. Helps Optimize Inventory Management

Inventory management includes storehouse activities related to product handling. Retailers face a variety of issues in this department. The issues range from tracking to overstocking. Investing in data analytics can help retailers deal with inventory management. These systems can maintain optimal stock levels and decrease inventory costs.

BI allows retailers to categorize their merchandise based on selective inventory control (SIC), which is also called ABC analysis. Here, BI analytics shows retailers the products that generate the most revenue. It segregates the inventory into three levels: A, B, and C. Level A is the most valuable, and level C is the least valuable.

4. Improved Merchandising

Business intelligence analytics can also recognize underperforming items. Using this information, retailers can optimize their product stock, which encourages them to find creative ways to promote these products. They can also opt to bring in new trending items and phase out stagnated inventory. BI can also categorize customers based on their sales patterns, which enables retailers to target promotions and pricing strategies.

5. Helps Optimize Store Floor Plans

Shopping can be a daunting process on its own. With the added hassle of unorganized floor plans, it becomes a nightmare. An ideal floor plan should help shoppers find products. It should also market new trending items to promote products. BI software can help business owners design a smooth floor plan. BI analytics works through various data sets and recommends insights. This determines if the selected floor plan has enough product types displayed etc. A good floor plan will make the customer’s shopping experience effortless.

Drive Industry Success with Intelligent Data Now!

6. Target Marketing

Marketing has recently become intensively data-driven. This is due to so many social media tools and marketing platforms. To stand out from all the competition, businesses need to have a strategy in place. They should have access to useful insights into consumers’ purchase patterns.

With BI analytics, companies can gain impactful insights into their customers’ preferences. These insights further enable them to make smart marketing campaigns. This also promotes the right merchandise on the appropriate platforms. This way, retailers can use business intelligence insights to make their company strategies more effective.

Here’s a perfect case study. How does Amazon use business intelligence to improve customer experience?

Amazon uses business intelligence to segment customers based on demographics, purchase preferences, and browsing history. This helps them better understand their customers’ purchase patterns, choices, and trends, which powers their marketing strategies. Each of their marketing campaigns is, thus, personalized to target the segmented groups, in turn boosting customer trust, personalization, brand value, and sales.

7. Boosts Efficiency in the Supply Chain

Efficiency is the most important base in the retail sector. Like cogs in a machine, every business department needs to work in sync. This is the only way to meet optimal efficiency in supply chain management.

Real-time business intelligence provides top-notch tracking capabilities for supply chain operations. This allows retailers to recognize congestion and enhance logistics. Retailers can streamline supply chain processes and cut costs by running deep analyses. They can optimize inventory management, production procedures, and transportation data. All this is possible through the implementation of Power BI.

How to Transform your Retail Operations with Business Intelligence?

From improving operations and marketing to enhancing supply chain efficiency, retailers are using Business Intelligence in many innovative ways. They are also using BI to analyze market trends, track competition, and create targeted advertising campaigns, ensuring a competitive edge in the market. Here are some ways in which the retail industry uses Retail Business Intelligence.

1. Analyzing Venue Performance

Staying in touch with the floor is important. Retail BI analysis enables store owners to track floor functions. They can track foot traffic and use it to make many decisions. Metrics such as opening hours and site selection based on foot traffic are very useful.

Case in point: Lowe’s uses predictive analytics to deliver services to individual zip codes. This way, the right store gets the right type and amount of product.

BI stretches until rent negotiations. It gives insights into a center’s visitation. This includes data such as foot traffic and cross-shopping. A shopping center operator can use this technology to justify a rent increase.

2. Identifying Broader Market Trends

Foot traffic is also used to assess the local demand for products.

Case in point: Retail BI can analyze the regional markets to analyze the potential for new launches. A manager could use BI to analyze the relative performance of previous stores. They can then choose the right location for a new store.

3. Keeping Tabs on the Competition

The world of retail is very competitive. Keep an eye on your competitor and their performance. Compare your progress to theirs to help forecast future growth. Conduct a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis if needed. It will reveal areas that need improvement. This will also help with budgeting and improve productivity.

4. Quantifying Cannibalization Risks

Location intelligence helps retailers reveal the physical reach of each store. These enable the store owners to decide where to set up the new store and where to reduce the store fleet.

Case in point: It can be used to optimize store performance by relocating it. Data analysis can show you the competition around you. It can also provide insights on better demographic fits for your establishment. In one case, relocation significantly improved business for a retail chain.

5. Creating Targeted Campaigns

Retaining customers and attracting new customers is the lifeblood of retail. BI helps by assessing customer information and providing insights for advertising campaigns. Foot traffic analytics applied to demographic datasets can also provide advertising insights. Businesses can use this power to create more bottleneck stores.

Case in point: Starbucks uses retail business intelligence software to promote products. The company lures customers into the stores with targeted advertisements. They have found a way to keep the existing customers loyal. They attract new customers simultaneously.

Power Your Enterprise With Fact-base Decision Intelligence

How can Fingent Help Drive More Success in Retail with BI?

Using cutting-edge technology, Fingent ensures the best outcomes for your retail business. These technologies include machine learning, data analytics, and predictive analytics. Experts at Fingent can create a solution that will help your business make intelligent and well-informed decisions.

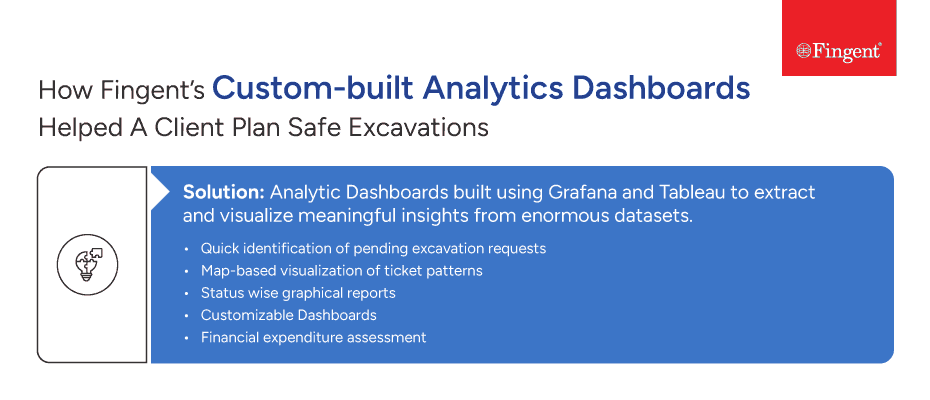

Here’s an example of how Fingent developed a top-notch solution for one of the leading retail enterprises. The solution tracks a customer’s digital journey across many milestones and delivers augmented experience insights. We have also created solutions for clients that can convert data sets into visual representations and automate data input procedures. Take a look at the complete case study.

Business Intelligence is revolutionizing the retail industry. Not embracing it will keep you behind! Give us a call, and let’s discuss how to make your retail business intelligent!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

AI in Business is a present reality! It’s a building revolution that is all-encompassing and is redefining business operations. You have only two options. Either ride on the crest of this wave or get submerged if not prepared!

How can you become AI-ready? In this blog, we aim to clarify pertinent questions a business leader may have to achieve this goal successfully.

Why Do Business Leaders See AI as a Game-Changer?

A survey of around 2,000 executives, CFOs, and CEOs across 9 countries showed that “61 percent believe AI is a game changer for their industry, with the figure rising to 82 percent in the tech sector and 51 percent among automakers.”

They have a good reason for this, too. AI can bring phenomenal improvements in virtually every sphere of business. Automating tasks, improving forecasting, supporting intelligent decision-making, tightening compliance and security – AI does all this and more.

The future of business is intelligence. And those who prepare for the AI revolution today will lead the way tomorrow. Preparing for an AI revolution is much like training for a championship team. Even the best players can’t win without rigorous training, good planning, and top-tier equipment. Likewise, to stay ahead in the competitive market businesses need AI preparation. This will help you to harness cutting-edge tools, refine your strategies, and build a skilled team.

This could result in more intelligent business tactics and improved customer interactions. As leaders, you are undoubtedly enthusiastic about the potential cost savings. More importantly, consider how it can offer personalized services on a grander scale.

Don’t Stay Behind! Unlock Business Growth, Efficiency & Innovation With AI.

How Do I Know If My Company Is Ready for AI Adoption?

Adopting AI in business is transformative. It entails careful consideration and strategic planning. Here are some critical questions to help you assess your company’s readiness for AI adoption:

1. Is There a Genuine Need for Your Business to Have an AI Solution?

Arrange for a thorough analysis of your business processes. Does your business depend on large amounts of data? Are there many tasks that can be automated? Have there been security leaks or a risk of losing valuable business if there were? This analysis will help pinpoint areas where AI can provide tangible benefits and solve existing challenges.

2. Where Can Automation Take the Load Off?

AI’s most impactful applications include automation. Identify regular, repetitive activities in your company. Automating such tasks can enhance effectiveness and minimize the risk of human mistakes. This will enable your team to focus on innovation and more valued activities.

3. Are Your Employees and Stakeholders Ready to Adopt AI?

Successful AI implementation requires teamwork among your employees and stakeholders. Conduct a survey to assess the team’s willingness to adopt AI. Then, guide and support your team in understanding AI’s capabilities through training and resources. Engage stakeholders right from the planning phase. This action will guarantee that concerns are addressed and that you have their backing.

4. Do Your Customers Understand How You Use AI?

Ensure that your customers understand how AI is being used to enhance their experience. Help them experience the benefits. Building trust through transparency will foster customer acceptance of AI-driven innovations. Also, provides customers with options to interact with human representatives. This will help maintain a balance between automation and the personal touch.

5. Do You Have AI Expertise, Experience, and Talent?

Successfully integrating AI is not simple. It takes a combination of knowledge, skill, and expertise. Check if you have it. If you spot any deficiencies in AI knowledge and skills, think about hiring AI experts or teaming up with outside specialists. Create a strong AI team.

How to Prepare Your Company for AI Adoption?

Preparing your company for an AI in business strategy is crucial if you want it to succeed. Done right, it can bring unprecedented efficiencies and competitive advantages. If done wrong, the risks could cost you quite a pretty penny. So before you dive in headfirst, let’s talk about those annoying risks.

1. Analyze the Risks

- Ethical and Legal Risks: If you don’t want AI to cause unnecessary stress, follow ethical guidelines and legal standards. Identify and remove biases from your AI models.

- Security Risks: Cyber-attackers love AI systems. Analyze and beef up your cybersecurity to protect your precious data.

- Operational Risks: What can you do when you face workflow disruption? Plan ahead! Planning well in advance to address disruptions can keep things running smoothly.

- Financial Risks: True, AI isn’t cheap. Apportion funds to cover all those costs and then some.

- Workforce Impact: AI can change the nature of jobs. Prepare your workforce for these changes. Reskill, upskill, and repeat.

2. Calculate the Pros and Cons

As with everything, there are pros and cons to the application of AI in business. It’s better to be conversant with all its strengths and weaknesses. Here is how you can understand AI’s value versus potential drawbacks.

Pros:

- Increased Efficiency: Like a robot butler, AI applications in business take care of all the boring, repetitive tasks, allowing your employees to focus on strategic activities.

- Improved Decision-Making: Like a wise old sage, AI’s data analysis can dispense deeper insights for better decisions.

- Cost Savings: AI cuts operational costs and hikes profitability.

- Enhanced Customer Experience: AI in business personalizes interactions and turns customer service into a 5-star experience.

- Innovation Opportunities: AI innovation leads to a goldmine of new product ideas and market strategies.

Cons:

- Initial Investment: AI implementation can be costly at the beginning.

- Integration Challenges: Integrating AI with IT infrastructure can be complex and time-consuming.

- Skills Gap: If your organization lacks AI expertise, you will have to invest in training or hiring new talent.

- Dependence on Data Quality: AI relies on high-quality data. What goes in is what comes out. Poor data leads to inaccurate results.

- Ethical Concerns: AI raises ethical questions. Data privacy and bias in decision-making are the two main concerns.

3. Centralize Your Company Data

Data is the source of energy for AI systems. Effectively adopting AI depends on centralizing, organizing, and ensuring data accessibility. Here are some ways you can achieve that:

- Data Integration: Merge data from different sources into a centralized platform to ensure detailed AI analysis.

- Data Quality Management: Establish governance practices to guarantee data accuracy, completeness, and consistency. Also, regularly clean and update data.

- Data Security: This could include encryption, access controls, and regular audits.

- Scalable Data Infrastructure: If your data infrastructure is unable to handle large volumes, consider investing in cloud storage.

- Data Accessibility: Do your stakeholders have the required access to data? If not, implement user-friendly tools. This will facilitate easy data access and analysis.

4. Prepare a Roadmap for Future Scalability

A strategic roadmap is necessary for leading AI adoption and ensuring future scalability.

- Define Clear Objectives: Set distinct goals for AI initiatives. Then, align them with business strategy and address specific pain points.

- Pilot Projects: Start with small pilot projects to test AI feasibility and impact. Collect insights, fine-tune your approaches, and build confidence.

- Continuous Improvement: Regularly evaluate and enhance AI strategies and solutions. You can do this by using performance data and feedback.

- Stakeholder Engagement: Engage key stakeholders throughout the AI adoption process. Inform them about progress, challenges, and successes to ensure support.

- Resource Allocation: Ensure necessary resources. Budget for ongoing costs like maintenance, training, and upgrades.

- Training and Development: Invest in training programs to build AI expertise. Encourage continuous learning to stay updated with AI trends and technologies.

A Leader’s Blueprint For AI Success

How Can Fingent Help Me Streamline AI Adoption?

The application of AI in business is transformative but complex. At Fingent, we streamline this process seamlessly. We develop tailored AI strategies aligned with your business goals, conduct a thorough risk assessment and mitigation for ethical, legal, operational, financial, and cybersecurity risks, and ensure centralized data management and integration with scalable cloud solutions. Our custom artificial intelligence (AI) solutions integrate smoothly into your IT infrastructure, starting with pilot projects for validation.

Contact Fingent now to start your AI expedition!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Business Intelligence in Financial Services is proving to be a game changer.

Business intelligence is a novel technology backed by AI. It is a combination of strategies and processes. Simply put, BI collects, cleans, formats, and analyzes data.

No big deal? Think again!

In a world that is ruled by data, this is a superpower.

Business intelligence is, in fact, a CFO’s best friend. It enables users to perform a wide range of activities with great ease. Since their advent, BI solutions have played a key role in banking and finance services. Business Intelligence in Financial Services offers priceless tools for risk assessment and cost management plans. They also provide detailed customer insights – a 360-degree view of the customer, which is priceless. So, in our current era, where data is everything, BI has become a valuable asset that offers support in decision-making.

Let’s discuss this in detail. First, let’s talk about the elusive 360.

Elevate Your Customer’s Digital Banking Experiences

The Need for a 360-View of Customers and Buyers in the Store

This technology is growing in popularity. It has become a well-favored tool among companies worldwide. A recent report predicts growth in the global business market. The predicted price for business intelligence and analytics software applications is $18 billion by 2026.

The concept of a 360-degree view is vital for businesses to function while predicting customer needs. This paves the path for meaningful insights and allows for more personalized interaction. The benefits of this method are listed below.

1. Superior Customer Understanding: The 360-degree view allows business owners to predict customers’ needs, allowing for more personalized interactions and rapport-building.

2. Personalized Marketing: Businesses can understand the customer’s preferences through the customer journey map. This map enables businesses to unravel customers’ thinking and curate marketing strategies, ensuring higher engagement and conversion rates.

3. Improved Customer Service: A 360-view means that the service representatives can access a customer’s entire history. Based on the client’s past behavior patterns, this method provides customizations. This personalization is evident in their interactions with you. In turn, it boosts customer satisfaction.

4. Operational Efficiency: With 360-degree view data collection, businesses can streamline their processes, making operations smoother and more efficient. The 360-degree customer view is a method that has revolutionized customer-service provider interactions. These conversations give clients a unified view of the customer’s journey. They also enable collaboration between different departments.

Why Do You Need a BI Strategy for Your Financial Business?

Technology is rapidly growing, and the amount of data generated in today’s business world is enormous. We create around 2.5 quintillion bytes of data every day!

Legacy financial processes have started failing. They don’t have the right tools to handle this much data. An efficient business intelligence strategy would be your knight in shining armor. It enables you to measure and evaluate performance. You can also identify competitive advantages and make informed, data-driven decisions. Other reasons why you should install this technology into your financial services include:

1. Better Decision Making

Business Intelligence implements Predictive Analysis to enrich the decision-making process. This derivative of AI can learn encoded data, recognize recurring patterns, and make accurate predictions. This greater visibility into potential outcomes based on past performances is the best tool for a business. Companies with an efficient BI strategy can gain insights on their customer behavior. This arms them with the ability to anticipate trends in the market and adjust business operations accordingly. Subsequently, the company’s risk of losses due to market shifts also drops.

Additionally, Business Intelligence improves communication between departments within the company. Employees can share meaningful insights from various datasets, removing the need to rely on anecdotal evidence. Working together towards a shared goal will boost efficiency and increase profits.

2. Increased Operational Efficiency

With a strong BI strategy, companies can streamline internal processes. They can also analyze employee behavior and performance to uncover hidden talent. Data analytics, a subset of BI, can shed light on how to optimize efficiencies within the organization. Companies with BI systems generally switch from manual, time-consuming labor to automated systems, which makes them more agile and frees up resources.

3. Solid Risk Management

Predictive Analytics and Machine Learning are potent tools for a business owner. These systems can also assess risks while predicting future trends. With these risk insights, companies can avoid making certain investments and commitments. This will help companies reduce losses that could hurt their bottom line if left unchecked.

4. Boosts Customer Retention

Financial business intelligence equips you with the most current information on customers. Banking and finance institutions can keep their marketing and sales teams armed. With BI’s help, your teams can recognize the organization’s most loyal and profitable clients. This information is gold as teams can concentrate their efforts on retaining these customers. They can also gain insight into the kind of customer that they can attract to their business,

5. Offers Competitive Edge

Due to its long list of perks, the BI strategy has the power to give you a strong competitive edge in the market. It also helps you streamline the best BI solution vendor for your financial business. These services are also integrated with superior features.

6. Reducing Costs

Cost-effectiveness is a quality check for the business intelligence strategy you use. Using predictive analytics and other BI tools, budgeting becomes more precise. Resource allocation is thus streamlined, and opportunities for cost reduction are identified; an efficient BI strategy will oversee training offerings and associated costs as well. This will help you budget and reduce unforeseen spending.