AI-Powered

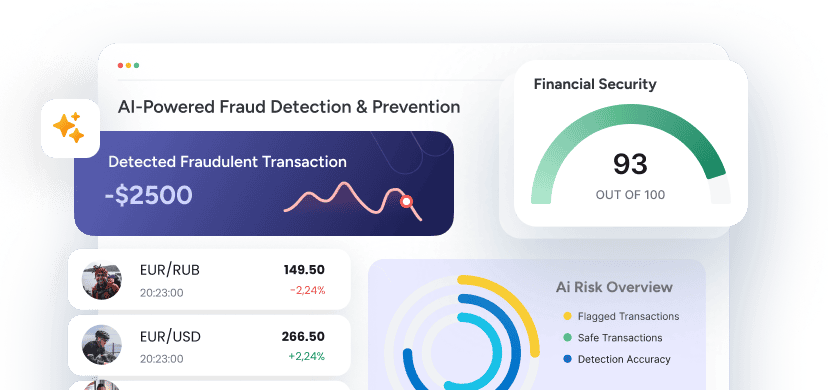

AI-Driven Fraud Detection and Prevention

Makes Financial Operations Safer and Reliable

AI fraud detection identifies 90% of all fraudulent transactions, twice as effectively as traditional methods.

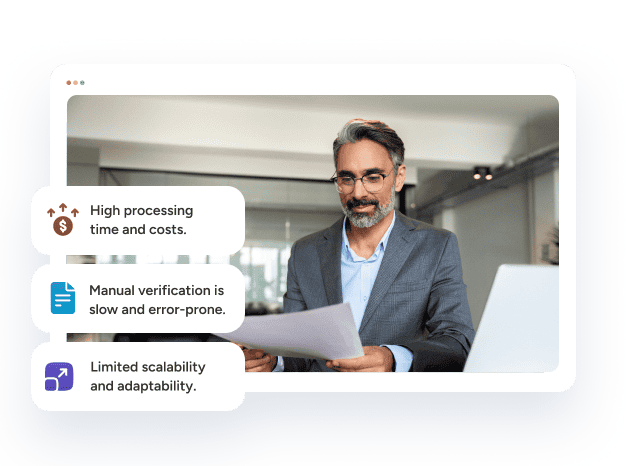

Challenges of Traditional Fraud Detection Methods

Traditional rule-based fraud detection systems are static and less adaptive to evolving fraud patterns

Rise of complex and sophisticated fraud schemes exploiting technology and vulnerabilities

Conventional fraud detection systems generate substantial false positives, requiring manual review

Manual reviews and post-transaction analysis can significantly delay the identification of fraudulent activities

Protect your financial operations with AI-powered solutions.

The Solution:

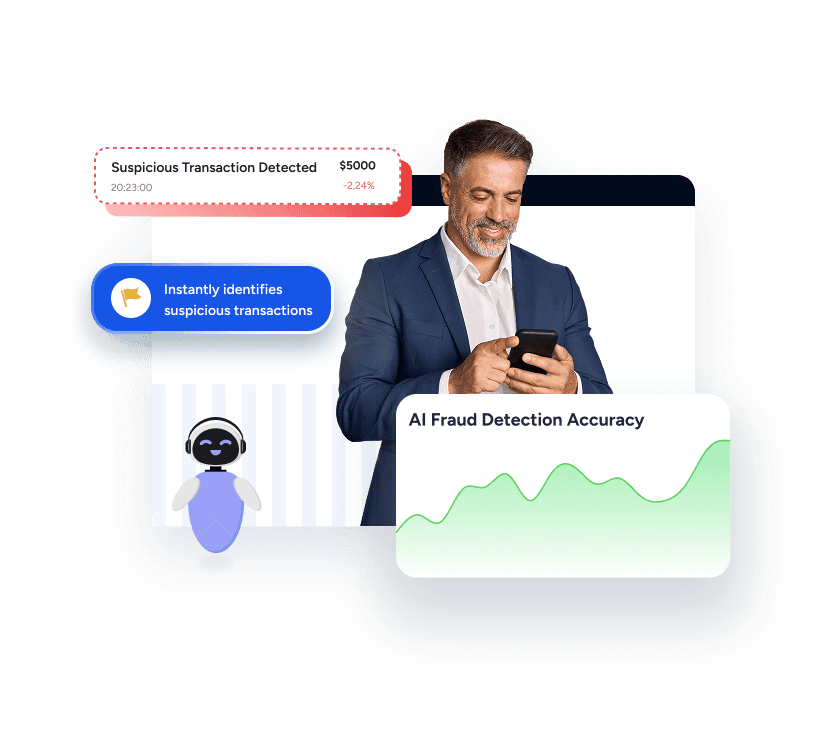

AI-Driven Fraud Detection and Prevention

The Impact of AI-Driven Fraud Detection and Prevention

Benefits of AI-Powered Fraud Detection and Prevention

Substantial reduction in false positives and increase in fraud detection accuracy

Instant identification of suspicious transactions helps reduce financial risks

Minimize monetary losses by identifying suspicious transactions instantly

Boosts your ability to maintain effectiveness against emerging threats

Ideal for large financial institutions handling massive volumes of data

Ability to detect hidden fraud patterns that humans might overlook

Upgrade to AI-powered financial security.

How Can Fingent Help With AI-Based Financial Fraud Detection and Prevention

Custom software solutions leveraging Gen AI, machine learning, and deep learning

Customized data analytics solutions to derive actionable insights and modeling of data

Creation of AI virtual assistants to enable personalized, real-time customer interactions

Advanced AI-based fraud detection that goes beyond traditional CAPTCHA and IP-based detection

Embed AI into your existing portfolio of applications with minimal disruptions and downtimes

Key Takeaways