AI-Powered

AI Credit Scoring and Risk Assessment

Reducing Default Risk With Fair and Accurate Assessments

AI-based credit scoring improves lending accuracy by up to 85%.

Challenges of Traditional Credit Scoring Models

Inability to account for dynamic rules and unstructured credit data

Longer processing times and delays in credit evaluation

Manual risk assessment methods hike up operational costs

Missing data can potentially lead to inaccurate assessments

Subjective analysis triggers bias and discrimination in credit scoring

Inaccurate and unfair credit risk predictions due to limited data sources

Improve your lending decisions and credit evaluations with AI.

The Solution:

AI-Based Credit Scoring and Risk Evaluation

Machine learning to detect patterns that indicate creditworthiness or risk

Predictive analytics to forecast the likelihood of credit risk or delinquency

Automation of repetitive and rule-based tasks in credit appraisal process

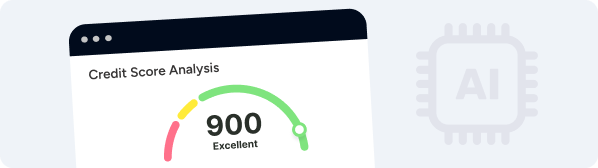

How AI-Based Credit Scoring Works

The Impact of AI-Powered Credit Scoring

AI Credit Decisioning Improves Lending Efficiency

decisioning

approval rates

Benefits of AI Credit Scoring and Risk Appraisal

Instant and accurate credit decisions with minimal manual intervention

Uncover complex risk patterns overlooked by traditional evaluation methods

Detect early signs of credit risks to reduce the likelihood of false positives

Automate large volumes of incoming credit applications with consistent accuracy

Cut the time-to-decision from days to minutes by automating loan approvals

Discover the right AI solution for your business case.

How Can Fingent Help You With AI Credit Decisioning and Risk Assessment

Custom AI solutions for banking, finance, and insurance providers

Development of automated, AI-powered credit evaluation solutions

Open APIs for integrating AI with existing loan processing systems

Implementation of virtual assistants and AI agents to help borrowers

AI and ML model development and training to optimize credit scoring

Legacy credit underwriting system modernization and AI integration services

Key Takeaways