7 Key Areas for Financial Institutions to Increase Profitability

In 2014, we saw the banking and financial services industry in the midst of a compliance crisis. Therefore, Most banking institutions pursued a shift in focus from defensive compliance remediation to revenue growth and cost reduction. Some banks had to settle some of their mortgage-related cases, the fines for which were quite huge. Further, the banks sought to increase operational efficiency and thereby enhance their financial performance. For this, they simplified their operations and went on to even cut down on their branch network. According to a research conducted by Deloitte, the industry closed down 1614 branches over 12 months ending in June 2014, which was the biggest downturn in over 2 decades.

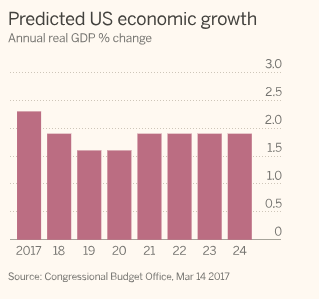

Now, the US economy is in a much better form compared to 2014. However, statics show a slight slow down in 2019-20, which is again forecasted to have a steady growth in the coming years.

The financial services sector has entered a new phase with a stronger focus on increasing profitability. In this post-crisis phase of improvement, banks and financial institutions are likely to focus on 7 areas in order to enhance growth and profitability. These are:

1. Achieving balance sheet efficiencies

Banks will have to revamp their deposits and assets mixes this year, so that they are in conformity with compliance regulations and at the same time do not compromise on increasing profitability. In order to retain deposits, banks will have to boost their customer relationship programs and increase cross-selling efforts. New rules regarding the Liquidity Coverage Ratio (LCR) and the Supplementary Leverage Ratio (SLR) which were finalized in 2015, will have to be complied with in this regard. Find more on Basel III Leverage Ratio Rules in this video.

All financial institutions having more than $250 billion in total consolidated assets or more than $10 billion in on-balance sheet foreign exposure are required to have a 100% LCR. In the case of assets, investments will have to be made keeping in mind the new rules of the Net Stable funding ratio.

2. Driving Mergers and Acquisitions

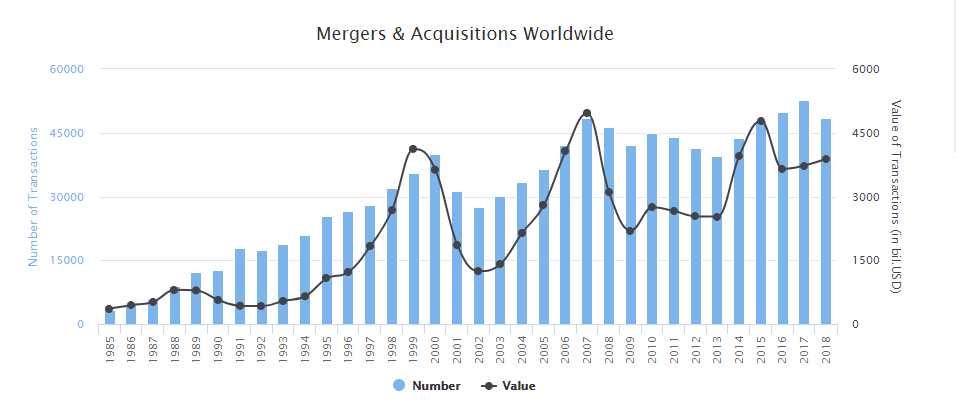

Since 2000, more than 790’000 transactions have been announced worldwide with a known value of over 57 trillion USD. In 2018, the number of deals has decreased by 8% to about 49’000 transactions, while their value has increased by 4% to 3.8 trillion USD.

3. Pursuing growth

Since 2014, there have been many obstacles to growth like low demand for loan, especially mortgages. The competition has also been quite heavy especially for fee-based services like wealth management. This year, there will a stronger focus on growth. Banks will have to invest in customer analytics as well as digital technology in order to develop better cross-selling strategies and also generate more interest of the customers. But, underwriting standards should be complied with strictly. With regard to competitive advantage, establishing partnerships with non-banking technology firms could be beneficial.

4. Transforming payments

Banks have replaced their traditional cards with the EMV standard of chip and PIN cards. A Statista survey carried out in June 2018 revealed that 83 percent of Americans between 30 and 49 years owned a credit card. The total credit card debt in the United States amounted to approximately 0.83 trillion U.S. dollars in the second quarter of 2018. With the introduction of Apple Pay, contactless payments are also becoming quite popular. And as contactless payments become more accepted, banks will have to look for ways to distinguish their way of delivering customer experience.

Fun Facts: In April 2018, the four major U.S. credit card issuers — Visa, Mastercard, American Express, and Discover — decided that they’ll no longer require signatures as a verification method for purchases. Retailers may still require signatures to verify cardholder identities, however, but only if they choose to do so. This will help streamline the checkout process without compromising card security — signatures aren’t a very good security measure, and cashiers never check them anyway.

5. Strengthening compliance management

In 2014, as mentioned before, banks and financial institutions had resorted to dealing with compliance pressure by strengthening internal control and resolving existing legal and regulatory issues. Further, as the compliance regulations have been bolstered, banks need to integrate compliance and risk management fully into the culture of the banks rather than concentrating on specific processes. It should be enforced in the performance management systems as well, through employee training. New regulations like heightened risk governance expectations and the enhanced prudential supervision rule specifically require the banks to improve their risk capabilities.

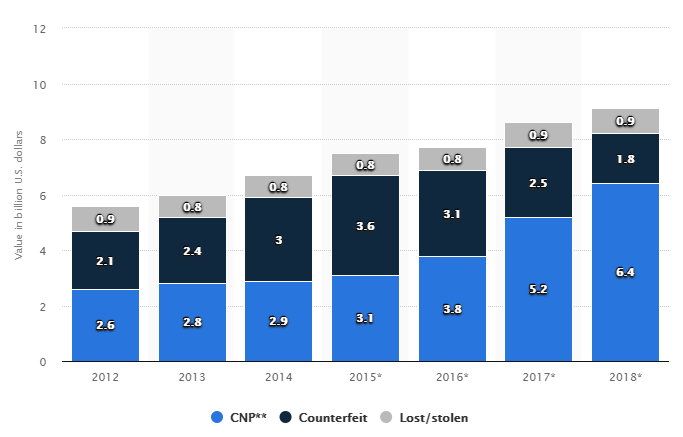

According to Statista reports, payment card losses due to counterfeit amounted to three billion U.S. Dollars in 2014 which declined to 1.8 billion U.S. Dollars in 2018.

6. Managing data and analytics

Since 2014, the efficiency of the data management processes followed in most of the banks had been found to be just about average. From a recent survey conducted by the Risk Management Association and Automated Financial Systems Inc., it was found that only 40% out of the 37 global financial institutions surveyed, felt the quality of their data to be above average or excellent. Banks now need to move toward a central Regulatory Management Office (RMO) in order to monitor the data management processes. Besides that, the Chief Data Officers should also extend their responsibilities and help in collaborating with new business lines and functional groups, which will help in value creation.

7. Enhancing cybersecurity

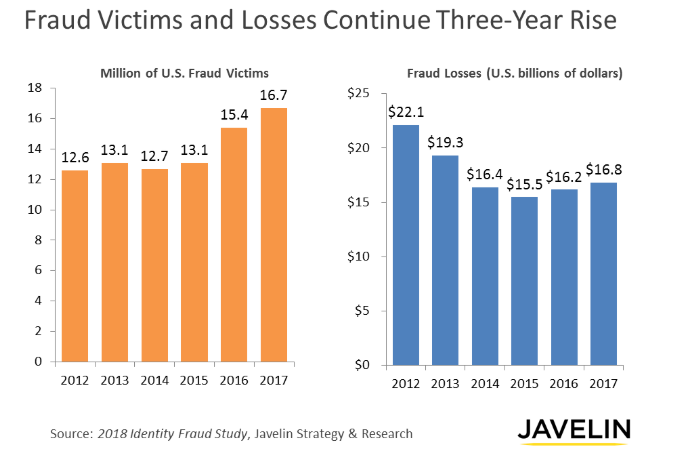

In 2014, there was a huge rise in the number and severity of cyber attacks. The 2018 Identity Fraud Study revealed that the number of identity fraud victims increased by eight percent (rising to 16.7 million U.S. consumers) in 2017, a record high since Javelin Strategy & Research began tracking identity fraud in 2003. The study found that despite industry efforts to prevent identity fraud, fraudsters successfully adapted to net 1.3 million more victims in 2017, with the amount stolen rising to $16.8 billion.

To improve cybersecurity efforts, banks are likely to add advanced features to their existing systems. New methods like Wargaming, attracting specialized talent etc. will prove to be quite helpful. Enhancing the existing intelligence systems to detect new threats or attacks on a regular basis could also be very helpful.

As the economy improves, banks need to invest more into technology for most of their concerns whether it is compliance or customer relations or cybersecurity. Improving data analytical capabilities will ensure that the ultimate goal of growth and profitability is achieved. Moreover, with ethics and risk management embedded into the organizational culture, it further assures improved profitability.

Fingent works with a number of financial institutions to help them be ahead in the market. Along with advanced technology practices, Fingent helps financial institutions implement industry proven practices to help their clients overcome challenges for growth.

Stay up to date on what's new

Recommended Posts

25 Jun 2024 Financial Services B2B

Business Intelligence in Financial Services: Unlocking Data-Driven Success

Business Intelligence in Financial Services is proving to be a game changer. Business intelligence is a novel technology backed by AI. It is a combination of strategies and processes. Simply……

02 Jun 2022 B2B

Deliver Financial Services That Separate You From Your Competition

Your Financial Service business needs software solutions that fully consider all the individual features of your services. Why? The best financial advice must be provided in real-time and should be……

03 Dec 2021 Financial Services

Is AI The Future Of Banking?

The pandemic is now the biggest and most critical challenge of traditional banking. Some of these challenges are revenue pressure, data security, customer service management, data collection and analysis, risk……

11 Aug 2021 Financial Services

7 Ways Business Intelligence In Finance Can Empower CFOs Today

Business Intelligence in Finance becomes the most trusted aide of the modern CFO. Here's how BI helps finance teams to leverage insights and drive the business forward. Business Intelligence In……

Featured Blogs

Stay up to date on

what's new