Tag: AI

The Growing Application of AI in Insurance Leads to a Radical Transformation

- Introduction

- Why does the insurance industry require AI now?

- What are the benefits of AI in the insurance industry?

- Top 3 primary use cases for AI in the insurance industry

- Must-have AI technologies for the insurance industry

- Are you ready to ride on the wave of AI?

Introduction

Digital transformation is not a business decision, it is a survival strategy. The Insurance industry is slowly recognizing that this vital truth is applicable to them as well. As insurers face several strategic and operational challenges due to the COVID-19 pandemic, they are recognizing that technology is the only answer and solution. Armed with this knowledge, the insurance industry is undergoing a swift and tremendous transformation, driven by the burning need to improve customer experience.

Artificial Intelligence lies at the heart of these changes and is fundamental to success. AI tries to solve the age-old problems by integrating them with existing infrastructure or by replacing legacy systems. This article answers some of the pertinent questions that will assist industry leaders in making an informed decision.

Why does the insurance industry require AI now?

Unlike many other challenges that are usually contained to one geographic location, COVID-19 is impacting essentially every corner of the world. It gave the entire planet a crash course in connected living and has made massive changes. Small insurance companies are now struggling to survive the onslaught of new requests and most larger firms may need to downsize to make it through these stressful economic times. In this climate of uncertainty, AI will be one of the key factors that will help winners survive. Until recent times, the insurance industry has only used AI in minimal ways. But there are several processes that could be improved drastically using AI.

1. Marketing and sales:

AI technologies can be used to price insurance policies more relevantly and competitively. It can be used to recommend the most beneficial products to their customers. Insurers can customize the price of their products based on individual needs and lifestyles so that their customers are happy to pay only for the coverage they need. This heightens the appeal of insurance to a wider audience while attracting some newer customers.

2. Risk management:

Neural networks of AI can be used to red flag fraud patterns and minimize fraudulent claims. AI can also be used to improve actuarial models and risks that could lead to working out more profitable products.

3. Operations:

Chatbots can be developed to understand and answer the bulk of customer queries over chat, phone calls, and email. This is especially helpful during situations like the pandemic where customers and insurers are unable to meet with each other. This can free up significant resources and time for the insurers that can be used in more profitable activities.

Read our white paper: How can your business use AI to achieve higher profits now?

What are the benefits of AI in the insurance industry?

1. Efficient process:

Currently, we are witnessing the first wave of tangible opportunities. The automation provided by AI is offering insurers reduced costing along with more efficient processes. The work dividends form the first wave of benefits. Monotonous, low-level, hazardous, and long-drawn-out tasks are taken over by machines freeing humans to do the high-level and more productive tasks. It also ensures efficiency without the margin of human error.

2. Accurately measured and priced data:

The role of underwriters is changing as AI is set to re-engineer and amplify insurance underwriting. Powered by the disruptive growth of data, AI has the potential to help underwriters analyze vast amounts of information, locate red flags, and help them make more accurate decisions. While we are not expecting to eliminate human underwriters, working alongside AI systems will ensure that all risks are accurately measured and priced.

Read more: 6 Ways Artificial Intelligence Is Driving Decision Making

3. Claims processing made easy:

Claims processing has long been a pain-point for the insurance industry. Managing claims requires a significant manual effort right from document processing to flagging potential fraud. Restricted movement during the COID-19 pandemic makes this task especially difficult. AI can be used to automate document processing. It can scan complex forms quickly and accurately. The insurance company can cut its claims processing time from weeks to just a matter of minutes. AI can help ensure that rejection of any claim is based on solid reasons. This way, insurance companies can drive cost efficiencies by reducing the number of denials that prevent claimants from going for appeals which insurance companies may ultimately have to settle.

Top 3 primary use cases for AI in the insurance industry

The advent of AI represents a quantum leap in how insurance is bought and sold, and how customers are served. Also, it is creating opportunities for insurance companies to affix their leadership positions within the industry.

Here are five primary use cases. If beginners can use this approach to disrupt the old guard, established firms can stave off new competitors and differentiate themselves from conventional foes.

Use Case 1: Always-on customer service

Insurance companies are expected to meet the customer’s expectations themselves. Gone are the days when we companies used to delegate customer service to brokers or agents. Customers expect to reach their insurance providers through any channel-like website, email, mobile app, voice call, chat, social media, etc. It’s become mandatory for insurance providers to possess multi-channel capabilities to handle queries and attend service requests. This is where AI comes to the rescue enabling insurance firms to be on the job 24/7. Always-on, multi-channel service available through chatbots, and customized interactive tools will be your secret sauce to exemplary customer service.

Read more: How AI is Redefining the Future of Customer Service

Use Case 2: Automate processes that are difficult to automate

Insurance companies employ a large workforce to manually perform operational processes. Variations in products, state-specific rules, and lack of adoptions of standards across the value chain previously made it harder to automate the process. With AI, it is now possible to predict and continuously improve the process by leveraging ML thus automating the processes effectively. By combining RPA tools with cognitive technologies, insurance companies can automate processes such as customer service requests, endorsements, and claims-processing, and provide a faster turn-around time.

Use Case 3: Continually improve the value from data

Predictive models help insurance companies determine business-critical aspects such as the maximum possible loss, probability, and pricing. However, as the companies innovate products, reach out to newer customer segments, and address new risks, these predictive models quickly get outdated making it difficult to keep up with changes. AI makes it possible to provide a feedback loop for machines to learn and adapt to ever-changing insurance business needs.

Read more: How Blockchain Enables the Insurance Industry to Tackle Data Challenges

Must-have AI technologies for the insurance industry

AI has become the cornerstone of digital transformation for the insurance industry. Leveraging AI technologies can help insurance companies address various issues that they may encounter. These are some must-have AI technologies in the insurance industry:

1. Image analytics

Insurance companies must carry out inspections to validate their decisions based on actual facts. This helps them spot any existing or potential risks and support their customers in risk management. This can be very time-consuming. The use of AI focuses on the reduction of inspection time and increases the surveyor’s productivity. It can be applied in property and casualty insurance to analyze the images of cars at the accident scene, determine the parameters, and assess replacement costs.

Advanced image analytics enables quick analysis of photos to determine parameters crucial from the perspective of life insurance. These parameters enable insurers to decide whether medical underwriting is required or not and provide an instant quote and formulate policies.

2. Internet of Things

IoT allows insurance companies to cross-sell to existing customers. They could offer discounted insurance to existing customers. There are several IoT backed devices that can detect and alert a customer when there is an issue within their home or commercial property. Integrating IoT with AI, insurance companies can offer a far superior service and enhance the customer experience.

3. Machine Learning in underwriting

The automated process eliminates the tedious and error-prone job of dealing with unstructured documents and extracts information from them to make business decisions. AI, ML, and Deep Learning can help in extracting such information, aligning it to common vocabulary, and making that information accessible through virtual assistants or search engines. This way underwriting now becomes an automated process that lasts just a few seconds.

4. End to end automation

AI helps insurers automate complex processes, end to end. Using RPA, you can tackle simpler and repeatable tasks. For example, the claims assessment process can be automated to enable the assessor to receive evidence through more advanced AI-based techniques.

Insurance companies receive data from brokers in a variety of formats and require many people to convert the data to a standard format. AI can map this data accurately allowing insurers to reduce inefficiencies in their processes. It can also improve data quality by detecting gaps and addressing those gaps in the incoming data.

Read more: Scalable Benefits of RPA in Banking, Insurance, and Logistics

5. Machine Learning for price sophistication

Price optimization techniques with the help of ML and GLMs help insurance companies to understand their customers, allows them to balance capacity with demand, and drive better conversion rates.

6. Connected claims processing

Advanced algorithms can help insurance claims to be automated which allows insurers to attain high levels of accuracy and efficiency. Data-capture technologies can replace manual methods. Evaluation of the validity of a claim is also made much simpler.

Read more: 5 Steps to Gain Business Value with AI Adoption

Are you ready to ride on the wave of AI?

Rapid advances in AI will lead to disruptive changes in the insurance industry. The winners in AI-based insurance will be those who harness the power of new technologies. Most importantly those companies who do not view disruptive technologies as a threat to their current business will thrive in the insurance industry. Get started on making sure you are one of them! Contact us to adopt the power of AI into your insurance business.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Robotics in Logistics: Dawn of a New Era

Since the advent of e-commerce, getting goods to the customer’s door or stores from the factories or warehouses has become a mammoth task for logistics companies. Forecasts say that “worldwide warehousing and logistics robot unit shipments will increase to an estimated 620,000 units annually by 2021.” The solution for this herculean task of transporting goods far and wide thus becomes apparent: the dawn of robotics in logistics. The use of robotics in logistics offers far greater levels of uptime over manual labor, bolstering productivity in a vast array of professional environments.

Retail giants like Amazon and Walmart that have already deployed robots in their warehouses and fulfillment centers will only expand their deployments, especially in the wake of current situations. Leveraging robotics in logistics cuts around 70% of warehouse labor costs and helps businesses function day and night with minimal costs. Want to find out how? This post will help you understand the importance of utilizing warehouse robotics in the supply chain.

A Surge in Warehouse Robotics in Supply Chain

The first robot in the supply chain was capable of moving material about a dozen feet. For several years, robots were used only in industrial manufacturing because it was not safe for people to be around them. However, over the last few decades, innovative logistic robotic companies have worked hard to mesh AI and machine learning, better sensors and response capabilities, warehouse management software or logistics management software.

Recently, warehouse robotics in the supply chain has picked up pace exponentially. There has been huge funding and investment in the industry. For example, Alibaba invested $15 billion into robotic logistics infrastructure and Google invested $500 million into automated logistics for JD. It is also estimated that the global market for warehouse robotics in the supply chain is projected to reach a market value of $22.4 billion by the end of 2021.

Evidently, the dawn of robotic logistics is right here now!

Read More: How Robotic Process Automation Is Revolutionizing Industries?

What is Robotic Logistics?

The logistics industry is what is holding our modern world together. It includes a huge amount of different processes. Ordering, transportation, warehousing, picking, packing, delivery, inventory, and routing are just a few of those processes.

So, robotic logistics means the application of robotics to one or more of these processes. A few common robotic applications are robotic palletizing, robotic packaging, robotic picking commonly used in warehousing or any other logistics software solutions.

So, what kind of robots could be useful for your warehouse?

Warehouse Robotics in Supply Chain

1. Autonomous Mobile Robots (AMR)

AMRs use sophisticated sensor technology to deliver inventory all over the warehouse. They do not require a set track between locations. They can understand and interpret their environment through the use of maps, computers, and onboard sensors.

These warehouse robots are small and nimble with the ability to identify the information on each package and sort it with impeccable accuracy. They cut down on the redundant manual process which is prone to human error.

2. Aerial Drones

Aerial drones aid in optimizing warehouse inventory processes. They can quickly scan locations for automated inventory. They can scan inventory much faster than a human can and send an accurate count immediately to your warehouse inventory management software.

These drones do not need markers or lasers to guide them. They don’t take up valuable space in your warehouse. They can travel quickly and assist in hard-to-reach areas.

3. Automated Guided Vehicles

Automated guided vehicles and carts (AGVs and AGCs) transport inventory around your warehouse following a track laid in your warehouse. These warehouse robots are perfect for larger warehouses because it reduces the time spent by workers just moving from one area to the next.

4. Automated Storage and Retrieval System (AS and RS)

Automated Storage and Retrieval Systems are robot-aided systems that can place or retrieve loads from set storage locations. AS and RS differ depending on the system needed, the type of task, or the goods that they will be working with. They can be programmed to work as a craft that moves and works on a well-defined path or a crane that retrieves goods between aisles. There are also aisle climbing robots that retrieve customer orders.

These free up the time of workers who can then concentrate on more complicated processes such as packing and posting the goods.

Read more: What Are Cobots and How Can They Benefit Industries?

What is Driving the Need for Collaborative Robots in Logistics?

Although there has been a boom in logistic robotics, there are two specific factors that are driving the current need for collaborative robots in logistics.

- The growth of e-commerce: When products are directly shipped to customers, there is a huge variety of different packing requirements.

- The lack of available workforce: Shortage of skilled workers can affect logistics.

What are the Benefits of Adopting Robotic Logistics?

The logistics industry can see many tangible and clear benefits of adopting robotic logistics.

- By reducing human errors, robotic logistics can bring in significant profits and can also reduce warehouse costs.

- Robotics can allow for workforce adaptability.

- Robotic logistics improve safety for workers by taking over dangerous jobs such as getting items from high racks or storage spaces.

- Reduced human error and increased delivery speed brought about by robotic automation will increase customer satisfaction.

Read more: Open source robotics process automation

Enjoy the Freedom To Do More

Robots are being used rather extensively in logistics. Due to the complexity of supply chain processes robots will be increasingly used for dull, dirty, and dangerous tasks freeing your workers for more complex tasks. This means cost-effective, fast, and error-free operations. If you’re seeking to revolutionize your business with the incredible potential of robotics, Fingent, a top custom software development company, is here to assist you.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How Time Series Analysis Enables Businesses to Improve Their Decision Making

- Introduction

- Definition of Time Series

- The 5 Most Effective Time Series Methods for Business Development

- Time Series Regression

- Time Series Analysis in Python

- Time Series in Relation to R

- Time Series Data Analysis

- Deep Learning for Time Series

- Benefits of Using Deep Learning to Analyze Your Time Series

- Time Series is Valuable for Business Development

Introduction

Time series analysis is one of the most common data types encountered in daily life. Most companies use time series forecasting to help them develop business strategies. These methods have been used to monitor, clarify, and predict certain ‘cause and effect’ behaviours.

In a nutshell, time series analysis helps to understand how the past influences the future. Today, Artificial Intelligence (AI) and Big Data have redefined business forecasting methods. This article walks you through 5 specific time series methods.

Definition of Time Series

Time series is a sequence of time-based data points collected at specific intervals of a given phenomenon that undergoes changes over time. It is indexed according to time.

The four variations to time series are (1) Seasonal variations (2) Trend variations (3) Cyclical variations, and (4) Random variations.

Time Series Analysis is used to determine a good model that can be used to forecast business metrics such as stock market price, sales, turnover, and more. It allows management to understand timely patterns in data and analyze trends in business metrics. By tracking past data, the forecaster hopes to get a better than average view of the future. Time Series Analysis is a popular business forecasting method because it is inexpensive.

Read more: Why Time Series Forecasting Is A Crucial Part Of Machine Learning

The 5 Most Effective Time Series Methods for Business Development

1. Time Series Regression

Time series regression is a statistical method used for predicting a future response based on the previous response history known as autoregressive dynamic. Time series regression helps predictors understand and predict the behaviour of dynamic systems from observations of data or experimental data. Time series data is often used for the modeling and forecasting of biological, financial, and economic business systems.

Predicting, modeling, and characterization are the three goals achieved by regression analysis. Logically, the order to achieve these three goals depends on the prime objective. Sometimes modeling is to get a better prediction, and other times it is just to understand and explain what is going on. Most often, the iterative process is used in predicting and modeling. To enable better control, predictors may choose to model in order to get predictions. But iteration and other special approaches could also be used to control problems in businesses.

The process could be divided into three parts: planning, development, and maintenance.

Planning:

- Define the problem, select a response, and then suggest variables.

- Ordinary regression analysis is conditioned on errors present in the independent data set.

- Check if the problem is solvable.

- Find the correlation matrix, first regression runs, basic statistics, and correlation matrix.

- Establish a goal, prepare a budget, and make a schedule.

- Confirm the goals and the budget with the company.

Development:

- Collect and check the quality of the date. Plot and try those models and regression conditions.

- Consult experts.

- Find the best models.

Maintenance:

- Check if the parameters are stable.

- Check if the coefficients are reasonable, if any variables are missing, and if the equation is usable for prediction.

- Check the model periodically using statistical techniques.

2. Time Series Analysis in Python

The world of Python has a number of available representations of times, dates, deltas, and timespans. It is helpful to see how Pandas relate to other packages in Python. Pandas software library (written for Python) was developed largely for the financial sector, so it includes very specific tools for financial data to ensure business growth.

Read more: How Predictive Algorithms and AI Will Rule Financial Services

Understanding Date and Time Data:

- Time Stamps: Refers to particular moments in time.

- Time intervals and periods: Refers to a length of time between a particular beginning and its endpoint.

- Time deltas or durations: Refers to an exact length of time.

Native Python dates and times:

Python’s basic objects for working with dates and times are in the built-in module. Scientists could use these modules along with a third-party module, and perform a host of useful functionalities on dates and times quickly. Or, you could use the module to parse dates from a variety of string formats.

Best of Both Worlds: Dates and Times

Pandas provide a timestamp object that combines the ease-of-use of datetime and dateutil with vectorized interface and storage. From these objects, pandas can construct datetimeIndex that can be used to index data in dataframe.

Fundamental Pandas Data Structures to Work with Time Series Data:

The most fundamental of these objects are timetstamp and datatimeIndex objects.

- Time Stamps type: It is based on the more efficient numpy.datetime64 datatype.

- Time Periods type: It encodes a fixed-frequency interval based on numpy.datetime64.

- Time deltas type: It is based on numpy.timedelta64 with TimedeltaIndex as the associated index structure.

3. Time Series in Relation To R

R is a popular programming language and free software environment used by statisticians and data miners to develop data analysis. It is made up of a collection of libraries specifically designed for data science.

R offers one of the richest ecosystems to perform data analysis. Since there are 12,000 packages in the open-source repository, it is easy to find a library for any required analysis. Business managers will find that its rich library makes R the best choice for statistical analysis, particularly for specialized analytical work.

R provides fantastic features to communicate the findings with presentation or documentation tools that make it much easier to explain analysis to the team. It provides qualities and formal equations for time series models such as random walk, white noise, autoregression, and simple moving average. There are a variety of R functions for time series data that include simulating, modeling, and forecasting time series trends.

Since R is developed by academicians and scientists, it is designed to answer statistical problems. It is equipped to perform time series analysis. It is the best tool for business forecasting.

4. Time Series Data Analysis

Time series data analysis is performed by collecting data at different points in time. This is in contrast to the cross-sectional data that observes companies at a single point in time. Since data points are gathered at adjacent time periods, there could be a correlation between observations in Time Series Data Analysis.

Time series data can be found in:

- Economics: GDP, CPI, unemployment rates, and more.

- Social sciences: Population, birth rates, migration data, and political indicators.

- Epidemiology: Mosquito population, disease rates, and mortality rates.

- Medicine: Weight tracking, cholesterol measurements, heart rate monitoring, and BP tracking.

- Physical sciences: Monthly sunspot observations, global temperatures, pollution levels.

Seasonality

Seasonality is one of the main characteristics of time series data. It occurs when the time series exhibits predictable yet regular patterns at time intervals that are smaller than a year. The best example of a time series data with seasonality is retail sales that increase between September to December and decrease between January and February.

Structural breaks

Most often, time-series data shows a sudden change in behaviour at a certain point in time. Such sudden changes are referred to as structural breaks. They can cause instability in the parameters of a model, which in turn can diminish the reliability and validity of that model. Time series plots can help identify structural breaks in data.

5. Deep Learning for Time Series

Time series forecasting is especially challenging when working with long sequences, multi-step forecasts, noisy data, and multiple inputs and output variables.

Deep learning methods offer time-series forecasting capabilities such as temporal dependence, automatic learning, and automatic handling of temporal structures like seasonality and trends.

Read more: Machine Learning Vs Deep Learning: Statistical Models That Redefine Business

Benefits of Using Deep Learning to Analyze Your Time Series

- Easy-to-extract features: Deep neural networks minimize the need for data scaling procedures and stationary data and feature engineering processes which are required in time series forecasting. These neural networks of deep learning can learn on their own. With training, they can extract features on their own from the raw input data.

- Good at extracting patterns: Each neuron in Recurrent Neural Networks is capable to maintain information from the previous input using its internal memory. Hence, it is the best choice for the sequential data of Time Series.

- Easy to predict from training data: The Long short-term memory (LSTM) is very popular in time series. Data can be easily represented at different points in time using deep learning models like gradient boosting regressor, random forest, and time-delay neural networks.

Time Series is Valuable for Business Development

Time series forecasting helps businesses make informed business decisions because it can be based on historical data patterns. It can be used to forecast future conditions and events.

- Reliability: Time series forecasting is most reliable, especially when the data represents a broad time period such as large numbers of observations for longer time periods. Information can be extracted by measuring data at various intervals.

- Seasonal patterns: Data points variances measured can reveal seasonal fluctuation patterns that serve as the basis for forecasts. Such information is of particular importance to markets whose products fluctuate seasonally because it helps them plan for production and delivery requirements.

- Trend estimation: Time series method can also be used to identify trends because data tendencies from it can be useful to managers when measurements show a decrease or an increase in sales for a particular product.

- Growth: Time series method is useful to measure both endogenous and financial growth. Endogenous growth is the development from within an organization’s internal human capital that leads to economic growth. For example, the impact of policy variables can be evidenced through time series analysis.

Read more: An Introduction to Deep Reinforcement Learning and its Significance

We can help you get the best of Time Series Analysis to benefit your business. Reach out to us to understand more about our data analytics and machine learning capabilities and how it can help your business grow.

Run your service business from anywhere

ReachOut digitizes your service workflows in a centralized platform to help you manage scheduling, customers, invoicing, & more from your home or office.

Get StartedStay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Understanding the concept and significance of Deep Reinforcement Learning

The field of reinforcement learning has exploded in recent years with the success of supervised deep learning continuing to pile up. People are now using deep neural nets to learn how to use intelligent behavior in complex dynamic environments. Deep reinforcement learning is one of the most exciting fields in artificial intelligence where we combine the power of deep neural networks to comprehend the world with the ability to act on that understanding.

In deep learning, we take samples of data and supervise the way we compress and code the data representation in a manner that you can reason about. Deep reinforcement learning is when we take this power and apply it to a world where sequential decisions are to be made.

We use deep reinforcement learning to solve tasks where an agent or an intelligent system has to make a sequence of decisions that directly affect the world around the agent. While trial-and-error is the fundamental process by which reinforcement learning agents learn, they do use neural networks to represent the world.

Read more: Key Differences Between Machine Learning And Deep Learning Algorithms

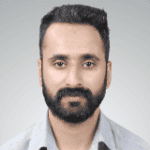

Types of learning

All types of machine learning– supervised learning, unsupervised learning, semi-supervised learning, and reinforcement learning are supervised by a loss function. Even in unsupervised learning, there is some kind of human intervention required to determine and provide inputs on what is good or bad. Only the cost of human labor required to obtain this supervision is low. Thus, the challenges and the exciting opportunities of reinforcement learning lie in how we get that supervision in the most efficient way possible.

In supervised learning, you take a bunch of data samples and use them to learn patterns to interpret similar samples in the future. However, in reinforcement learning, you teach an agent through experience. So the essential design step in reinforcement learning is to provide the environment in which the agent has to experience and gain rewards. In other words, a designer has to design not only the algorithm but also the environment where the agent is trying to solve a task.

The most difficult element in reinforcement learning is the reward – good vs bad. For example, when a baby learns to walk, success is the ability to walk across the room and failure is the inability to do so. Simple! Well, this is reinforcement learning in humans. How we learn from so few examples through trial-and-error is a mystery. It could be the hardware – 230 million years of bipedal movement data that is genetically encoded in us or it could be the ability to learn quickly through the few minutes or hours or years of observing other humans walking. So the idea is if there was no one around to observe, we would never be able to walk. Another possible explanation is the algorithm that our brain uses to learn which has not yet been understood.

The promise of deep learning is that it converts raw data into meaningful representations whereas the promise of deep reinforcement learning is that it builds an agent that uses this representation to achieve success in the environment.

Deep Q learning

Q-learning is a simple and powerful algorithm that helps an agent to take action without the need for a policy. Depending on the current state, it finds the best action on a trial-and-error basis. While this works for practical purposes, once the problem size starts increasing, maintaining a Q-value table becomes infeasible considering the amount of memory and time that would be required. This is where neural networks come in.

From a given input of action and state, a neural network approximates the Q-value function. Basically, you feed the initial state into the neural network to get the Q-value of all possible actions as the output. This neural network is called Deep Q-Network. However, DQN is not without challenges. The input and output undergo frequent changes in reinforcement learning with progress in exploration. The concepts of experience replay and target network help control these changes.

Read more: Top 10 Machine Learning Algorithms in 2020

Deep Reinforcement Learning Frameworks

Here are the three Deep Reinforcement Learning frameworks:

1. Tensorflow reinforcement learning

RL algorithms can be used to solve tasks where automation is required. However actual implementation is easier said than done. You can ease your pain by using TF-Agents, a flexible library for TensorFlow to build reinforcement learning models. TF-Agents makes it easy to use reinforced learning for TensorFlow. TF-Agents enables newbies to learn RL using Colabs, documentation, and examples as well as researchers who want to build new RL algorithms. TF-Agents is built on top of TensorFlow 2.0. It uses TF-Eagers to make development and debugging a lot easier, tf.keras to define networks and tf.function to make things faster. It is modular and extensible helping you to pick only those pieces that you need and extend them as required. It is also compatible with TensorFlow 1.14.

2. Keras reinforcement learning

Keras is a free, open-source, neural network Python library that implements modern deep reinforcement learning algorithms. Using Keras, you can easily assess and dabble with different algorithms as it works with OpenAI Gym out of the box. Keras offers APIs that are easy and consistent, thus reducing the cognitive load. These APIs can handle the building of models, defining of layers or implementation of multiple input and output models. Keras is fast to deploy, easy to learn, and supports multiple backends.

3. PyTorch Reinforcement learning

PyTorch is an open-source machine learning library for Python based on Torch and is used for applications such as natural language processing. It consists of a low-level API that focuses on array expressions. This framework is mostly used for academic research and deep learning applications that require optimized custom expressions. The PyTorch framework has a high processing speed with complex architecture.

All these frameworks have gained immense popularity and you can choose the one that suits your requirements.

While deep reinforcement learning holds immense potential for development in various fields, it is vital to focus on AI safety research as well. This is going to be fundamental in the coming years in order to tackle threats like autonomous weapons and mass surveillance. We should, therefore, ensure that there are no monopolies that can enforce their power with the malignant use of AI. So international laws need to keep up with the rapid progress in technology.

We have tried to brush across the basics of deep reinforcement learning and the top 3 frameworks that are in use currently. Want to know more about this amazing technology? Reach out to us at Fingent!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

What is Transfer Learning and how can it help you?

Have you ever tried teaching a baby to recognize objects?

That’s an example of Transfer Learning at work in its most elementary form. Babies as young as eight months old can transfer learning from images to objects. As we grow, we continue to use the same method to learn things. We continue to use the knowledge we gain from one domain to learn other things faster in another domain. This is the concept in Artificial Intelligence that has come to be known as Transfer Learning. This blog discusses transfer learning and its vital role in the future of AI.

What is Transfer Learning?

Transfer Learning is a method in which a model developed for a particular task is used as a building block to solve a different problem. It is a domain of AI, which uses machine learning algorithms to improve learning capacities in one domain through previous exposure to another domain.

Currently, Transfer Learning is gaining much popularity because it can train deep neural networks with lesser data. The goal of transfer learning is to build a model that can be applied to different, yet related problem areas.

It is interesting to note that the pre-trained AI models are called “teacher” models, and fine-tuned AI models are called “student” models. For example, we need not learn and remember that a bus has wheels on four ends. Why? Because we are capable of relating it to what we already know: that a vehicle generally has four wheels. On the other hand, a computer needs to develop such logic by learning all the attributes of a bus. That is the reason why a computer needs much more data than we do. This is where transfer learning comes into play. Transfer Learning aims to reduce the need to use huge amounts of data, by using data available from related domains.

It is important to note that Transfer Learning is different from Traditional Machine Learning. Traditional learning works in isolation, in the sense that it is based on specific tasks and datasets, and separate isolated models are trained through this. The knowledge gained is not retained or transferable to other models. Transfer Learning, on the other hand, ensures that this knowledge is retained and leveraged to train newer models to perform different yet related tasks.

Related Reading: Classifying Knowledge Representation In Artificial Intelligence

Transfer Learning Collaborates Perfectly With AI

Being a fast-evolving frontier of data science, transfer learning can be used by data scientists to tap into statistical knowledge that is gained from previous projects. Its benefits are manifold.

- Boosts productivity: Deep Learning and Machine Learning projects address solution domains for which huge amounts of data have already been collected, used and stored. The same work can be used by data scientists to develop and train fresh neural networks. This boosts productivity and accelerates the time required to gain insight into new modeling projects.

Transfer Learning also enhances productivity when there are close parallels between the source and target domains. For example, deep learning knowledge gained from training a computer to translate from English to Arabic can also be partially applicable to help it learn to translate from English to Hindi.

Related Reading: Why Time Series Forecasting Is A Crucial Part Of Machine Learning

- Risk Reduction: At times, underlying conditions of the phenomenon that has been modeled might change radically. That will render the previous training data set inapplicable. On such occasions, data scientists can use Transfer Learning to leverage useful subsets of that previous training data from related domains as they now build a fresh model.

Transfer Learning can be used to predict certain problems in domains that are susceptible to highly improbable events. For example, a stock-market crash might be useful to predict political catastrophes. This way, Transfer Learning can stand at the forefront of data science by gaining and applying fresh contextual knowledge through various forms of AI.

- Improves learning: Transfer Learning can use the knowledge gained from source models to improve learning in the target model. This improves baseline performance. It also saves time because it does not have to learn from scratch.

Transfer learning allows the use of small datasets to solve complex problems. If a new domain lacks sufficient labeled training data, transfer data can assist in leveraging relevant data from older modeling projects. Applications of deep learning generate enormous amounts of complex data. Managing such data manually would require a lot of human resources. Hence, Transfer Learning is critical for the success of IoT and deep learning applications.

https://www.fingent.com/insights/portfolio/achieve-higher-business-growth-profits-with-artificial-intelligence/

Transfer Learning for Future Innovation

As machine learning and deep learning continue to accelerate, transfer learning will accomplish things with improved efficiencies that were unimaginable in the past. Transfer learning will support deep neural networks in running businesses more efficiently.

In a tutorial called Nuts and bolts of building AI applications using Deep Learning, renowned professor and data scientist Andrew Ng predicted that “after supervised learning — Transfer Learning will be the next driver of ML commercial success.” We are seeing that happen right in front of our eyes. Explore this revolutionary tool with Fingent’s custom software development experts and see if this is something that could help your business.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How AI and Voice Search Will Impact Your Business

“It is common now for people to say ‘I love you’ to their smart speakers,” says Professor Trevor Cox, Acoustic engineer, Salford University.

The Professor wasn’t exactly talking about the love affair between robots and humans, but his statement definitely draws attention to the growing importance of voice search technology in our lives. AI-driven voice computing technology has drastically changed the way we interact with our smart devices and it is bound to have a further impact as we move into coming years.

In this blog, we will consider six key predictions for AI-Driven voice computing in 2024.

How Essential Is AI-Driven Voice Search For Businesses?

Voice search is becoming increasingly popular and is evolving day after day. It can support basic tasks at home, organize and manage work, and the clincher – it makes shopping so much easier. No doubt about it, AI-driven voice search and conversational AI are capturing the center stage.

Related Reading: Why you can and should give your app the ability to listen and speak

Voice-based shopping is expected to hit USD 40 billion in 2022. In other words, more and more consumers will be expecting to interact with brands on their own terms and would like to have fully personalized experiences. As the number of consumers opting for voice-based searches keeps increasing, businesses have no option than to go all-in with AI-driven voice search. With that in mind, let’s see where this is going to be leading businesses in future.

Six key predictions for AI-driven voice search and conversational AI in 2024

1. Voicing a human experience in conversational AI

Chatbots are excellent, but the only downside is that most of them lack human focus. They only provide information, which is great in itself, but not enough to provide the top-notch personalized experience that consumers are looking for. This calls for a paradigm shift in conversational design where the tone, emotion, and personality of humans are incorporated into bot technologies.

Statista reports that by 2020, 50% of all internet searches will be generated through voice search. Hence, developers are already working on a language that would be crisp, one that is typically used in the film industry. Such language could also be widely used on various channels such as websites and messaging platforms.

Related Reading: Capitalizing on AI Chatbots Will Redefine Your Business: Here’s How

2. Personalization

A noteworthy accomplishment in voice recognition software enhancing personalization is the recent developments in Alexa’s voice profiling capabilities. Personalization capabilities already in place for consumers are now being made available to skill developers as part of the Alexa Skills Kit. This will allow developers to improve customers’ overall experience by using their created voice profiles.

Such personalization can be based on gender, language, age and other aspects of the user. Voice assistants are building the capacity to cater even to the emotional state of users. Some developers are aiming to create virtual entities that could act as companions or councilors.

3. Security will be addressed

Hyper personalization will require that businesses acquire large amounts of data related to each individual customer. According to a Richrelevance study, 80% of consumers demand AI transparency. They have valid reasons to be concerned about their security. This brings the onus on developers to make voice computing more secure, especially for voice payments.

4. Natural conversations

Both Google and Amazon assistants had a wake word to initiate a new command. But recently it was revealed that both companies are considering reducing the frequency of the wake word such as “Alexa.” This would eliminate the need to say the wake word again and again. It would ensure that their consumers enjoy more natural, smooth and streamlined conversations.

5. Compatibility and integration

There are several tasks a consumer can accomplish while using voice assistants such as Amazon’s Alexa or Google’s Assistant. They can control lights, appliances, smart home devices, make calls, play games, get cooking tips, and more. What the consumer expects is the integration of their devices with the voice assistant. Coming years will see a greatly increased development of voice-enabled devices.

6. Voice push notifications

Push notification is the delivery of information to a computing device. These notifications can be read by the user even when the phone is locked. It is a unique way to increase user engagement. Now developers of Amazon’s Alexa and Google Assistant have integrated voice push notifications which allow its users to listen to their notifications if they prefer hearing over reading them.

What Does It Mean for Your Business In 2024?

AI-driven voice computing and conversational AI is going to change all aspects of where, when and how you engage and communicate with your consumers. In coming years, IDC estimates a double-digit growth in the smart home market. Wherever they are and whatever channel they are using, you will be required to hold seamless conversations with your customers across various channels.

“Early bird catches the worm.” Be the first in your industry to adopt and gain the benefits of voice search and conversational AI. Call us top custom software development company and find out how we can make this happen for you.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Understanding The Types Of AI Systems To Better Transform Your Business

In this digital era, industries are witnessing the ability of multifaceted artificially intelligent systems performing tasks that mimic intelligent human behavior or even beyond. Artificial Intelligence today, manage large chunks of data and perform redundant tasks, allowing the human workforce to focus on core tasks. This saves cost and time and improves productivity significantly.

According to Gartner, the number of industries adopting AI has grown over 270% in the last 4 years. Technology giant, Google pledges $25 million USD in a new AI challenge named ‘AI For Social Good’. Understanding Artificial Intelligence Types, is important to get a clear picture of its potential.

Related Reading: Check out how Artificial Intelligence is revolutionizing small businesses.

Types Of Artificial Intelligence Calculation: Two Main Kinds Of AI Categorization

AI makes systems imitate human capabilities. Though AI can be classified into different types, the 2 main categories are defined as Type-1 and Type-2 and are based on AI capabilities and functionalities. Let us walk through the major classifications of AI types.

Type 1: AI-Based On Capabilities

1. Weak or Artificial Narrow Intelligence (ANI)

Weak or Narrow AI is a type of AI which performs assigned tasks using intelligence. This is the most common form of AI available in today’s industries. The Narrow AI cannot function beyond what is assigned to the system. This is because it is trained to perform only a single specific task.

ANI represents all AI machines, created and deployed till date. All artificially intelligent systems that can perform a dedicated task autonomously by making use of human-like abilities, fall under this category. As the name suggests, these machines have a narrow range of responsibilities.

Apple’s Siri, for instance, is an example for Narrow AI. Siri is trained to perform a limited pre-defined set of functions. Some other examples include self-driving cars, image and speech recognition systems.

The category of complex artificially intelligent systems that make use of deep learning and machine learning, fall under the category of Artificial Narrow Intelligence systems. These machines are categorized under the ‘Reactive’ and ‘Limited Memory’ machines, which is discussed in detail going forward in this article.

Know more about the key difference between deep learning and machine learning.

This video is made using InVideo.io

2. Artificial General Intelligence (AGI)

General Artificial Intelligence is a type of AI which can perform any intellectual tasks as humans. AGI machines are intended to perceive, learn and function entirely like humans. Additionally, the objective of devising AGI systems is to build multiple competencies which can significantly bring down the time needed to train these machines.

In a nutshell, AGI systems are machines that can replicate human multi-function capabilities. Currently, researchers around the globe are trying to design and develop such AI. Since there is no example as of now, it is termed, General AI.

3. Artificial Super Intelligence (ASI)

Artificial Super Intelligent systems can be best described as the zenith of AI research. ASI is intended not only to replicate multi-faceted human intelligence, but also possess faster memory, data processing, and analytical abilities.

This is a hypothetical concept of AI where researchers are trying to develop machines that can surpass humans. This is an outcome of General AI.

Type 2: AI-Based On Functionalities

1. Reactive Machines

The reactive machines perceive the real world directly and react according to the environment. The intelligence of Reactive Machines focuses on perceiving the real-world directly and reacting to it. An example of reactive machines is Google’s AlphaGo. AlphaGo is also a computer program that plays the board game. It involves a more sophisticated analysis method than that of DeepBlue. AlphaGo uses neural networks for evaluating game strategies.

2. Limited Memory

Limited memory machines are those that can retain memory for a short span of time. These machines have the capabilities as that of purely reactive machines. Additionally, limited memory machines can learn from previous experiences to make decisions. For instance, self-driving cars are limited memory machines that can store data such as the distance of the car with nearby cars, their recent speed, speed limit, lane markings, traffic signals, etc.

The observations from previous experiences are preprogrammed to the self-driving car’s system. This data, but is transient. That is, it is stored only for a limited period of time. This is because it is not programmed to be a part of the self-driving car’s library of experience, compared to the experience of human drivers.

Nearly every artificially intelligent system today uses limited memory technology. For instance, machines that make use of deep learning is a prime application of limited memory. These machines are trained with huge volumes of data sets which are stored in their memory as a reference model. An example of this is the AI that recognizes images. Image recognition AI is trained using a multitude of pictures along with their labels, as data sets.

Artificial intelligent systems such as chatbots and virtual assistants are also examples of limited memory machines.

3. Theory Of Mind Machines

Theory of Mind can be defined as a simulation. To be crisp, when a person considers himself in another person’s shoes, his brain tends to run simulations of the other person’s mind. Theory of mind is critical for human cognition. Additionally, it is crucial for social interaction as well. A breakdown of the theory of mind concept, for instance, can be illustrated as a case of autism.

Instead of a pre-programmed engine, AI scientists are looking forward to developing a series of neural networks. This series will be used to develop the ‘Theory Of Mind’.

‘Theory Of Mind’ machines are aimed at figuring out someone else’s intentions or goals.

4. Self-Awareness Machines

Self-Awareness machines exist hypothetically today. As the name suggests, these machines are supposed to be self-aware, like of the human brain. The machines can be described as the ultimate objective of AI scientists.

The goal of developing self-awareness machines is to make these capable of having emotions and needs as of humans.

Related Reading: You may also like to read about building an Intelligent App Ecosystem with AI.

To learn more about AI capabilities and how it can benefit your organization, Contact Fingent, top custom software development company, right away to explore strategies for implementing AI in your business. Unlock the potential of AI and achieve positive outcomes for your organization.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Artificial Intelligence (AI) is considered to be one of the most significant disruptive technologies today. More and more businesses are already realizing its benefits. Gartner’s 2019 CIO survey revealed that the percentage of companies implementing AI increased by about 270 percent over the last four years, and 37 percent in 2018 alone.

Leveraging the power of AI to enhance your existing business applications isn’t nearly as complicated as you might think. You don’t need a billion-dollar budget to implement AI-powered applications. In fact, small and midsize businesses (SMBs) today are cutting costs and delivering great customer experiences with AI-powered applications—and they are competing with giant companies at scale.

Here’s a look at how you can enhance your existing business applications with AI:

Enhance CRM Apps with AI

Incorporating AI into your current Customer Relationship Management (CRM) system, for instance by using chatbot or automated live chat support, will allow your company’s helpdesk to provide better, faster and more dynamic responses. It will also help you reduce the man-hours needed to resolve queries and help you build better engagement and customer trust. And because the AI-powered CRM system provides predictive insights, you can automatically recommend similar products or services a customer may be interested in.

Related Reading: Unconventional Ways Artificial Intelligence Drives Business Value

Streamline Supply Chain with Machine Learning

Machine learning (ML) allows your system to discover patterns in the supply chain data using algorithms that automatically identify the factors that contribute to the success of your supply networks, while constantly learning in the process. ML algorithms and the applications running them can analyze large, varied data sets in no time, improving accuracy in forecasting supply and demand. If applied correctly within your SCM work tools, ML could revolutionize the agility and optimization of your supply chain planning.

AI-Powered Recruitment Apps

Artificial Intelligence is expected to replace 16 percent of Human Resource (HR) jobs within the next 10 years, according to Undercover Recruiter. Integrating AI into your existing recruitment processes or tools could help your company’s HR department find the right candidate or the best fit faster and easier, thereby saving you time and money. AI-powered video interview tools, for instance, can utilize biometric and psychometric analysis to evaluate your applicants’ tone of voice, micro-expressions, and body language.

Related Reading: AI To Solve Today’s Retail Profit Problems

Improving Cybersecurity System with AI

Given the data breaches and cyber-attacks that have hit headlines in recent years, integrating AI into your current security system is vital to protect consumer data, improve trust and deliver true business value. About 71 percent of companies in the US plan to spend more budget on AI and machine learning in their cybersecurity software this year.

AI not only improves your company’s existing detection and response capabilities but also allows new abilities in preventive defense. It enhances and streamlines your security operating model by reducing complex, laborious and time-consuming manual inspection and intervention processes. Because the AI-powered cybersecurity system can self-adjust and learn data over time, you can automatically detect and block cyber-attacks and fraud.

Enhancing Space Exploration with AI

Another area where the application of AI has great potential is exploring outer space. NASA has plans to look for life on other planets, such as Mars, in the very near future. In their Mars 2020 initiative, they will use AI to explore Mars in greater depth, which includes looking for alien lifeforms. Most of us are at least slightly familiar with or aware of NASA’s Opportunity rover, which wrapped up a 14-year Mars mission when it quietly went dark in February 2019. Opportunity, also known as “Oppy,” found evidence that Mars at some point was home to water — a huge discovery.

Going forward with Mars 2020, NASA’s Mars Exploration Program will continue its use of AI for space exploration. In ongoing efforts to evaluate whether Mars is (or was at some point) habitable for humans and other animals, the Mars 2020 rover is equipped with a drill it will use to collect samples of rock and soil. It will store these samples in special tubes that will be collected by a later NASA mission. Read more about the artificially-intelligent robotic arm that will make it all happen.

Related Reading: Industry experts weigh in on the adoption of AI and ML in software development

Taking Your Existing Business Applications to the Next Level with AI

New AI frameworks and tools make provisioning AI capabilities more feasible than ever before. Working with a development partner who has the data science and AI technology experience, creating or updating a business application with AI can be started rapidly, take less time to code, and the resulting application placed into service sooner. Nor would it be necessary to staff for these hard-to-find resources for the long term.

Related Video: Artificial Intelligence – How to navigate AI

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

6 Chatbot Security Practices You Need To Implement

According to a survey by Oracle, regarding the benefits of using chatbots for their consumer-facing products, which included responses from 800 decision-makers, including chief marketing officers, chief strategy officers, senior marketers, and senior sales executives from France, the Netherlands, South Africa, and the UK, it was found out that “80 percent of companies wanted to have some type of chatbots implemented by 2020!

It is also forecasted that 90% of bank-related interactions will be automated by 2022. Moreover, 80% of businesses will have chatbot automation implemented by 2020. Also, 47% of consumers would buy items from a chatbot when 28% of top-performing companies are already using AI for marketing! With chatbots turning into the trend, it is vital to implement chatbot security measures.

A Back Door Open To Hackers

Chatbots are nowadays mostly used in industries such as retail, banking, financial services, and travel that handles very crucial data such as credit/debit cards, SSN, bank accounts, and other Sensitive PII (Personally identifiable information).

The aggregation of such data is crucial for the chatbot to perform. Thus, it is required that chatbots are not vulnerable to be exploited by any hackers.

A recently released report from MIT Technology Review and Genesys showed that 90% of companies are already using AI strategies to increase revenue. The research also found that on average, between 25% and 50% of all customer queries can be solved through automated techniques. This has made it easier than before to handle complex tasks.

Related Reading: Read on to know more about the top AI trends of 2019.

The HTTPS Protocol For Security Of Chatbots

HTTPS protocol is the basic and default setting required for a good security system. The data that is being transferred over the HTTP via encrypted connections are secured by Transport Layer Security (TLS) or Secure Sockets Layer (SSL).

Related Reading: Check out how Fingent helped create an enhanced and engaging learning experience through chatbots.

Types of Security Issues

Security Issues fall into two main categories:

-

Threats

Threats are usually defined as different methods by which a system can be negotiated or compromised. Threats can include incidents such as Spoofing, Tampering, Repudiation, Information Disclosure, Denial of Service, Elevation of Privileges, and many other threats.

-

Vulnerabilities

Vulnerabilities are defined as methods that a system is compromised and cannot be identified and solved correctly and on time. A system becomes open to attack when it has poor coding, lax security, or because of human errors. The most effective way to solve the issues of a possible vulnerability is to implement SDL (Security Development Lifecycle) activities into the development and deployment methods.

As per the study by the Ponemon Institute, In 2017, the average total cost of a successful cyber-attack was over $5 million, or $301 per employee!

Here are 6 chatbot security issues that you need to consider right away:

1. Encryption

Data while transit can also be misused. There exist different protocols that provide encryption, while addressing these problems of misuse and tampering.

According to article 32 (a) of the General Data Protection Regulation (GDPR), “it is specifically required that companies take measures to de-identify and encrypt personal data. So, chatbots have access only to encrypted channels and communicate through those”.

For instance, Facebook Messenger introduced the new feature called “Secret Conversations” that enabled end-to-end encryption based on Signal Protocol.

2. Authentication and Authorization

Authentication is performed when the user needs to verify their identity. This is often used for bank chatbots.

Generated authentication tokens verify data that are requested through a chatbot. On completing the verification of the user’s identity, the Application produces a secure authentication token, along with the request.

Another step of security measures is an authentication timeout. The token generated is used for only a certain amount of time, after which the application has to process a new one.

Two-way verification is another process where the user is asked to authorize their email address or to receive a code via SMS. This is a crucial process which is necessary to verify that the user of that account is the real user that is using the chatbot.

3. Self-destructing Messages

When Sensitive PII (Personally identifiable information) is being transferred, the message with this data is deleted after a definite period of time.

Personally identifiable information (PII) is any data which can be used to identify a particular person. It includes records such as a person’s medical, educational, financial and employment information. Examples of data elements that can identify and locate an individual include their name, fingerprints or other biometric (including genetic) data, email address, telephone number or even their social security number.

This kind of security measure is crucial when working with banking and other financial chatbots.

4. Personal Scan

When working with personal data, it is necessary to take security precautions and measures.

Apple was the first company that added finger authentication to their iPhones. This technology is now being used widely to verify an individual’s identity. This is performed when initiating a transaction or when you want to access your bank account using a chatbot that a personal scan is required.

5. Data Storage

Chatbots are effective because they retrieve and store information from users.

For instance, if you have a chatbot that performs online payments, this can mean that your clients are providing their financial information to a chatbot.

The best solution in this situation is to store such information in a secure state for a required amount of time and to discard these data later on.

Some other concerns are the following:

- Biometric authentication: Iris scans and fingerprint scans are popular and robust.

- User ID: User IDs involve processing secure login credentials.

- Authentication Timeouts: A ‘ticking clock’ for correct authentication input. This prevents giving hackers an opportunity to guess more passwords.

- Other strategies could include 2FA, behavior analytics, and kudos to the ever-evolving AI trends.

6. Tackling Human Causes

The one and only other factor or cause that cannot be altered is the human factor. With commercial applications in specific, that chatbot security and end-user technique have to be resolved. This will ensure the chatbots from being vulnerable to threats.

Related Reading: Find how artificial intelligence can drive business value.

To know more about secure bot building, get in touch with our software development experts today!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Disclaimer: This is an opinion piece. The views expressed in this article are mine and does not represent my employer.

Smart, sentient machines! The latest (well, not really) hype! Look back a week or two, and think about the number of days you went without hearing about how AI is going to change your career, health, medicine, food, travel or whatever. Television, newspapers, and blogs remain constantly flooded with announcements about the imminent disruption <insert field here> that is going to witness due to using AI.

Let me show you some, ahem, examples.

We have here (in the order of increasing horror):

- AI-powered Air Conditioners

-

AI-powered Washing Machines

Source – Gizmodo

-

AI-powered Suitcases

Source – Indiegogo

-

AI-powered Phones

-

AI-powered Toilet

Source – The Verge

-

AI-powered Underwear!

Okay, I made that last one up. But for a second there, you guys did believe me, right? RIGHT?

That is the sad state of affairs. We are all techies here, and might think “wait, WHAT?”. But the vast majority of the not so technical audience out there sees AI as magic. They see it as something beyond their cognitive ability to process and accept any BS branded as “AI-powered” without questions. Thus, we have this article!

Source – Mashable

So what is the truth with AI? If you dig deep enough, or if you peel off enough layers(pun intended), what is happening?

Before we move on to taking the buzz off of buzzwords, let’s look at some core concepts.

Related Read: Top Artificial Intelligence Trends to Watch Out for In 2019

What is AI?

From wiki, Artificial intelligence is intelligence demonstrated by machines. It is the study of “intelligent agents”: any device that perceives its environment and takes actions that maximize its chance of successfully achieving its goals.

But Really, What Is Artificial Intelligence?

IM[not so H]O, AI is just a buzzword. Really, it is just meaningless jargon. Okay, maybe not meaningless, but it’s still jargon. Don’t believe me? Let me give you some examples:

- Computers playing checkers and beating the best human players was considered AI. Until it was not when it was accomplished around 1994 by Chinook, the checkers-playing computer program.

- Computers playing chess and beating the best human players was considered AI. Until it was not when it was accomplished around 1997 when IBM’s Deep Blue defeated the then world champion, Garry Kasparov.

- Cruise control was considered AI. Until it was not when it started being available in production cars in 1990+(partial) and 2010+(full speed range).

- Automatic parking was considered AI. Until it was not when it started being available in production cars somewhere around 2006.

- Human speech recognition was considered AI. Until it was not when it started being available as Google Assistant, Cortana, Siri, etc. Now we have a real-time speech translation!

I could go on, there are quite a few examples of this phenomenon, formally known as(yes, it is so well known that it has a name) the AI effect [wiki].

So a much better definition of AI was put forth by Douglas Hofstadter.

“AI is whatever hasn’t been done yet.”

– Douglas Hofstadter

Just Computation

“Every time we figure out a piece of it, it stops being magical; we say, ‘Oh, that’s just a computation’.”

– Rodney Brooks

So, if it’s all just computation, why was it not, well, “computed” earlier?

Yes, computation, or rather, the capacity for computation is the key. A lot of problems were characterized as AI because, at the time, algorithms for solving that were not known yet, or because the resources to compute those were not available yet.

-

Availability of Computation Power

Eg. Chess/other games, etc.

Moore’s law and the explosion in storage availability have played a major role in turning the tables. [It is important to note that the tables have not turned completely. Yet. There is so much more ground to cover.]

-

Availability of Unbiased Data

Eg. Natural language processing (NLP).

Okay, now you may be thinking “Enough data was not available for speech recognition? This guy is full of BS”, but hear me out. With the explosion of social networks, so much content is created and made freely available that finding huge swaths of unbiased(this is the key here) voice/video of natural speech is available, which in turn has helped the advances in NLP.

-

Availability of Infrastructure

I guess I don’t have to mention the improvement in internet speed that happened over the decade. This has accelerated content creation, real-time processing, etc.

So, What is All the Current Hype About?

The hype is not current. There has been huge interest around AI from the time it was first proposed around the 1950s. The sheer number of films about it tells us about how much.

But the current wave of hype and buzz surrounding AI comes from the recent advances made in, drumroll please, Machine Learning.

What is Machine Learning?

Machine learning is

- giving computers the ability to learn

- to find patterns in data

- from experience

- without explicit programming.

ML is essentially about classifying and predicting stuff.

The typical operation is something like:

- Take some data

- Learn patterns in the data

- When presented with new data, classify it for the best guess of what it probably is, based on the “learning” that happened in [2].

Related Read: Machine Learning- Deciphering the most Disruptive Innovation

Meh! So what is the big deal?

Once trained for one purpose, the same ML system can be reused(with additional training) to learn new concepts. This can be done without rewriting the code. Now that is a big deal.

Let’s look at a simple example: Classifying emails.

Traditional programming:

if the email contains "it's never a job, its always a career" then send to trash; if the email contains ... then ... if the email contains ... then ...

ML programs:

try to classify some emails; change self to reduce errors; repeat;

That was a two-minute primer on Machine Learning. So next time someone starts talking about Artificial I, I hope you feel the pang and say “Excuse me, I think you mean Machine Learning, not AI”.

Source – HubSpot

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new