Category: Digital Transformation

Work isn’t linear anymore, and that changes everything! It brings Multi-Agent Systems into context like never before.

Think about it. A customer order triggers procurement. Procurement works its effect on suppliers. Logistics is way beyond delivery, affecting cash flow, customer experience, and brand trust. One decision rarely stays isolated, and by the time humans coordinate all of it, the moment has passed.

That’s exactly why Multi-Agent Systems (MAS) matter now.

Traditional automation follows scripts. AI tools often focus on single tasks or predictions. But modern enterprises need something more dynamic: Systems that can think locally, act independently, and still work toward a shared business outcome.

Like a team of specialists, each one knows its role. Each one makes decisions in real time, and none of them needs to wait for constant managerial approval.

When supply chains start acting up, customers don’t always stay put. Pricing becomes a moving target. MAS stops feeling futuristic; it starts feeling necessary.

What Are Multi-Agent Systems (MAS)?

In practice, MAS takes huge, complex business problems and chops them up into smaller decisions made independently but directed toward the same objective. Instead of a single AI trying to do everything, you have multiple agents sharing the load. Different roles but the same goal.

Before getting into benefits or use cases, there’s value in pausing here. MAS doesn’t make decisions the way traditional automation or standalone AI tools do.

At its core, a Multi-Agent System is just a set of software agents that act on their own, talk to each other, and react to their environment to reach a goal. If this still sounds abstruse, don’t worry. Let’s decompose it:

- One team watches demand signals

- Another monitors inventory

- A third negotiates supplier options

- A fourth handles customer commitments

Now imagine all of them working simultaneously, sharing context, resolving conflicts, and optimizing outcomes—without waiting for meetings or email chains.

That’s MAS!

Step Into The World of Multi-Agent Systems. Let Us Help You Navigate Smoothly with the Best Practices & Roadmaps.

The Key Components of a Multi-Agent System

The effectiveness of Multi-Agent Systems depends less on intelligence and more on structure. Clear roles, controlled interactions, and shared context determine whether agents reduce complexity or multiply it.

1. Agents (The Decision Makers)

Agents are independent software entities. Each agent:

- Has a specific role or responsibility

- Can perceive its environment

- Makes decisions based on rules, data, or learning models

- Acts without direct human intervention

In business terms, think autonomous digital employees with clearly defined KPIs.

2. Environment (The Business Reality)

It spans ERP and CRM. Also, it reacts to markets and customers, and stays within budgets, SLAs, and regulations. Nothing stays static. Agents have to adapt as it changes.

3. Communication & Coordination Mechanisms

Here’s where things get interesting. Agents don’t work in silos. They share context. They negotiate priorities. And they coordinate actions so one good decision doesn’t accidentally create three bad ones somewhere else.

This is what prevents “local optimization” from hurting the bigger picture.

4. Decision Logic & Policies

Each agent operates within:

- Business rules

- Governance policies

- Risk thresholds

- Ethical and compliance boundaries

This is where leadership intent is embedded into the system.

5. Learning & Adaptation

Advanced MAS can learn from outcomes. What worked. What failed. What cost more than expected? Over time, the system doesn’t just execute decisions—it improves them.

What Are the Benefits of Multi-Agent Systems?

The real value of Multi-Agent Systems isn’t raw intelligence. It’s how quickly decisions move, how well systems recover, and how easily they scale. In practice, what they deliver to firms is the ability to run decisions in parallel without constant human coordination.

The value becomes particularly very explicit under extreme conditions on the system—essentially when there are spikes in demand or disruption that require decisions faster than humans can coordinate.

This isn’t a tooling issue. It’s a decision bottleneck. This is where Multi-Agent Systems quietly shine.

1. Faster, Parallel Decision-Making

Traditional automation waits its turn. Multi-Agent Systems agents think, decide, and act simultaneously. Result? Bottlenecks disappear. Response time shrinks.

2. Better Resilience in Uncertain Environments

Markets change, suppliers fail. Customers behave unpredictably. With Multi-Agent Systems, decisions don’t collapse when one component fails. Other agents adapt, reroute, or compensate. Think shock absorbers, not brittle pipelines.

3. Scalability Without Linear Headcount Growth

As operations grow, coordination costs explode. More meetings. More approvals. More delays. Multi-Agent Systems scale decision-making without scaling people. That’s operational leverage.

4. Local Intelligence, Global Alignment

Each agent optimizes its own domain—pricing, inventory, logistics, compliance—while staying aligned to shared business goals. No tunnel vision. No chaos.

5. Continuous Optimization

With learning-enabled agents, systems don’t just execute decisions. They learn from what happens and improve as they go, which static automation simply can’t do.

Multi-Agent Systems in Practice: Real-World Enterprise Use Cases

You don’t have to look far to find Multi-Agent Systems in action. They’re already at work in supply chains, pricing engines, IT operations, and risk management today. These systems don’t just analyze data; they act on it in real time. The best way to understand Multi-Agent Systems is to see how they operate in production environments today.

1. Enterprise-Scale Supply Chain

Agents don’t react late. They continuously monitor demand and supplier reliability. This they do even during pricing shifts and logistics constraints. When disruption hits, they adjust orders and explore alternatives, no escalation emails required.

2. Dynamic Pricing & Revenue Management

One agent tracks market signals, another monitors competitor pricing. A third enforces margin rules. Together, they adjust prices in real time without sacrificing margins.

3. Customer Experience Arrangement

Agents handle personalization, support prioritization, churn prediction, and retention offers, coordinating actions across channels instead of reacting in isolation.

4. IT Operations & Incident Management

In IT operations, monitoring agents can help detect anomalies, whereas diagnosis agents isolate root causes, and remediation agents execute fixes. Human teams step in only when needed.

5. Fraud Detection and Risk Administration

Multiple agents can simultaneously analyze the transaction, behavioral pattern, and contextual risk. This flags issues not only faster but more accurately compared to rule-based systems.

Challenges and Considerations of Multi-Agent Systems

Multi-Agent Systems introduce autonomy, and without discipline, that autonomy quickly becomes risk. If not controlled properly, complexity will build up rather than be reduced. This is the part that matters before pilots turn into production at scale.

1. Architectural Complexity

Designing agent roles, interaction rules, and escalation paths takes serious thought. Poor design leads to noise, not intelligence.

2. Governance & Control

Autonomy without guardrails is a risk.

Enterprises must define:

- Decision boundaries

- Approval thresholds

- Auditability and explainability

Without governance, MAS can drift from business intent.

3. Security & Trust

Agents interact across systems and sometimes with external partners. That expands the attack surface. Strong identity, access control, and monitoring aren’t optional.

4. Cost & ROI Clarity

This isn’t the cheapest path upfront. The value comes later, through scale, speed, and resilience. Smart enterprises start small. Then expand.

Multi-Agent Systems in AI Explained and Why Businesses Should Care

Frequently Asked Questions (FAQ)

When executives assess multi-agent systems, the questions are usually predictable. These are sensible questions, and clear answers matter.

1. What are multi-agent systems in AI?

Multi-agent systems in AI are built around the idea that more than one intelligent agent, working together and reacting to change, often makes better decisions than one acting alone.

2. How do multi-agent systems work?

Each agent watches what’s changing, shares context with others, decides its next move, and acts without losing sight of the broader business objectives.

3. What is multi-agent system architecture?

A multi-agent system architecture outlines data flows, communication protocols, governance guidelines, agent roles, and enterprise system integration.

Why Multi-Agent Systems Are Foundational to Agentic AI?

Agentic AI isn’t about a single super-intelligent system. It’s about many intelligent agents working together responsibly. That’s why Multi-Agent Systems sit at the foundation of agentic AI. They bring structure to autonomy and discipline to intelligence.

Enterprises that succeed don’t start big. Start with one domain, define clear boundaries. Then measure outcomes and expand gradually. The goal isn’t replacing human judgment, but it’s amplifying it.

How Can Fingent Help Enterprises Start Small and Scale Safely?

Designing Multi-Agent Systems is as much a business decision as a technical one. Fingent helps enterprises architect, build, and govern Multi-Agent Systems that align with real outcomes—not experiments.

Connect with our experts today and discover ways you can leverage the latest technologies for your business. Talk to us now!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Increased customer expectations and rapid digital change – ring a bell? Work has become increasingly complex for business professionals. There’s more competition, and you need smarter, faster, and connected systems urgently. In this environment, using only generic tools can create roadblocks instead of support. This is why you need to take the route of custom software development.

Through tailored solutions, you now have the ability to cater to your particular requirements. Custom software development streamlines complicated tasks, slashing the cost of running operations and boosting output. It also designs experiences for customers and employees. Bespoke software development is the only way for businesses to survive today. With AI, the benefits are more powerful than ever. Come have a look at this power combo and see the benefits of custom software development for your business.

Why Businesses Must Invest in Custom Software Today

Off-the-shelf solutions work only when your needs are basic. But no successful business is truly “basic.” Each has its own complexities. This could include a unique customer journey, a complex approval process, needs for sensitive data, or regulatory controls. This is where custom software development becomes invaluable.

Custom tools are made just for your business goals, processes, and future plans. They’re different from packaged software, which is more general in the way it functions. Custom software grows with you and is very easy to integrate into your workflows. If you want your business to evolve, custom software is the way to go.

Drive Business Excellence With Custom-Built Software Solutions

7 Clear Signs Your Business Needs Custom Software

Here are the signs that your organization may need custom software because generic tools no longer fit:

1. Manual processes are slowing down growth

If teams are relying on spreadsheets, emails, or handwritten records, their growth will be limited. Manual work causes delays, errors, and decreases productivity, which is true when you’re a part of a fast-paced industry. Custom solutions automate workflows. This reduces human error. Your team gets to focus on what they do best. Scalability is one of the crucial benefits of custom software development. You know you need it if you are growing.

2. Your current tools cannot address unique business challenges

Every business has at least one process that no off-the-shelf tool can fully support. Your approval cycle might be complex. Maybe your customer onboarding journey is unique. You could also have special compliance needs. When generic platforms become restrictive, slow, or require endless workarounds, that’s your cue. With custom software development, your system adjusts to your business, not the other way around.

3. Operational costs are increasing year after year

The cost of commercializing, subscription renewals, and integrations that require a lot of work can accumulate. Relying on numerous individual tools can also put a drain on finances. Organizations sometimes have to buy a lot more features than they need. Proprietary solutions, on the other hand, may have a higher up-front cost, but significantly reduce costs over time. You are free from recurring licensing, additional add-ons, and platforms that your teams don’t fully use. Eventually, bespoke software is the more cost-effective and scalable route to take.

4. Contradictory data and low data visibility

Data is gold and should enable decision-making. Oftentimes, it becomes an impediment. What will you do with data that is spread out everywhere? Multiple CRM platforms, ERPs, Excel sheets, WhatsApp chats, legacy systems – where do you begin to look? This is bad data governance. In turn, it results in bad insights, siloed reports and more. The outcome? Sluggish decision-making. Custom software provides real-time analytics and enables automation. Custom software development boosts business performance, and this is one of its biggest benefits today.

5. Your software cannot scale with your business

Scalability is a big issue if your current tools:

- crash during busy times

- slow down as more users join

- need costly upgrades

- can’t handle new business models or departments

Custom solutions are built to grow with your business. They adjust to your needs. Whether you open new locations, add product lines, or onboard more users, they maintain strong performance.

6. Integration limitations are affecting productivity

Most businesses use a mix of applications — CRM, HRMS, accounting tools, ERPs, marketing platforms, and more. But when they don’t communicate with each other, efficiency drops. Poor integration leads to:

- double data entry

- inconsistent information

- miscommunication

- delayed operations

Custom software development makes it easy to let all your tech systems work together. That includes APIs, legacy systems, third-party platforms, and new tools. This produces a smooth flow of work that increases productivity and visibility.

7. You’re struggling to keep up with industry compliance or security standards

Now, for industries such as healthcare, BFSI, government, logistics, HR, real estate, etc., strict guidelines are to be maintained. Readymade software solutions rarely comply with or cater to all the regulations pertaining to industry, and they lack advanced security features. With custom software development, you can include:

- role-based permissions

- secure authentication

- audit trails

- encryption

- compliance configurations

- automated reporting

You can lower risk, improve your data privacy, and increase trust from customers and regulators.

Wait No More! Stay Ahead of The Competitive Curve with Custom Software Development

Your Most Common Custom Software Questions Answered

The benefits of custom software development are evolutionary to say the least. But it’s natural to have questions before you implement it.

1. How do I know if my business needs custom software?

Most businesses begin with off-the-shelf tools. But soon, these tools can limit growth. You’ll need custom software development if daily operations are slow.

This is how you know your existing tool set is underperforming:

- When repetitive work begins to take up too much of your staff’s time.

- If you constantly find yourself jumping from system to system.

- If your people are inventing workarounds

- Key tasks are being performed in Excel

- You rely on manual data entries that are dotted with errors

This shows that your off-the-shelf software isn’t working to your benefit. When it becomes a roadblock, you need to tap into the benefits of custom software development.

2. How does custom software improve efficiency and scalability?

Custom software fits your business perfectly. It removes issues caused by irrelevant features, confusing interfaces, or broken workflows. The system fits well with your internal processes. So, employees finish tasks faster and make fewer mistakes. As your business grows, custom software grows with you. You can easily add new features, support more users, introduce automation, or connect with new systems. Custom solutions grow at your pace. Unlike packaged tools, they don’t pressure you to upgrade to costly enterprise plans. Custom software development is very flexible. This flexibility makes it powerful for long-term efficiency and scalability.

3. Can custom software help reduce operational costs?

Absolutely. A major advantage of bespoke software development is the savings in cost in the long run. With process automation and optimization, your team can spend less time on repetitive work. This means fewer labour hours.

Custom software cuts out the need for many third-party tools. It also removes ongoing subscription fees. Plus, fewer manual errors mean reduced losses, faster service delivery, and better customer satisfaction. These enhancements accumulate into a leaner, more cost-effective operation over time. Although it may be a more expensive upfront cost, a custom solution can offer a far superior long-term ROI than off-the-shelf software.

4. How does poor data management affect business performance?

Simple truth: poor data organization slows down your business processes. How? Think about how your team is affected. They are now invested in gathering and verifying data from various documents and spreadsheets. Does this help in productivity? Of course not. They could have been spending this valuable time playing to their strengths – skills that they were hired for.

This is where custom software can benefit you. It is designed to help you automate. Collecting and analyzing data is done automatically. And it’s accessible to your team whenever they need it. Real-time dashboards and automated reporting are an immense help in making decisions – faster and more efficiently. This not only helps you but also your team to be more confident in what their role is, and this leads to greater business intelligence.

5. Why is integration so important in business software?

Modern businesses have many digital tools that are available for use, such as:

- CRM

- ERP

- HRMS

- Accounting software

- Marketing platforms

When these tools are not talking to one another, the information gets siloed. Teams are wasting time manually re-keying information, and productivity decreases. Integration makes each system function as a cohesive unit, like one integrated ecosystem. Tailor-made software allows a seamless flow of data across departments. This creates a unified experience for operations. It eliminates redundancy, errors, and accelerates the workflows. In simple words: better integration = better business performance.

6. What are the benefits of on-demand development teams?

Having an on-demand team can help you source talented developers quickly. This avoids long hiring cycles. Fingent offers vetted experts who can join your team right away. This helps speed up development and eases workload stress. You keep full control of the project. That’s nothing but a boon for you — flexible, expertise, predictable costs. This model is perfect when you have a short-term project or want to expand your tech team. It reduces the time required to make a delivery and maintains the momentum of development.

7. How do offshore software development centers speed up delivery?

Offshore development centers (ODCs) serve as your extended arms outside your home country. They help you grow fast. You get access to global talent, smooth processes, and 24/7 development. Because teams in different time zones can work while your local team rests, projects progress significantly faster. Fingent’s ODC model offers dedicated teams, advanced tools, and tested workflows. These elements speed up releases without sacrificing quality. An ODC is great for businesses seeking steady output. Expense reduction and accelerated time-to-market – that’s a win-win.

8. What industries most benefit from custom software development?

Almost all industries benefit from custom software development. This is particularly true for those who have unique processes or are subject to heavy compliance. Healthcare utilizes custom software for managing patients, medical records, and exchanging data in a secure manner. Finance depends on tailor-made solutions for reporting, risk management, and compliance. Retail and e-commerce have access to custom solutions for creating personalized customer experiences, automating inventory and product management, and integrating with email marketing platforms and sales channels. Customized software solutions are needed in manufacturing, logistics, real estate, education, hospitality and public administration. The software helps increase productivity, reduce errors, and improve customer service. If an industry calls for accuracy and process control, custom software is essential.

9. How can a tech partner help build future-ready custom solutions?

A reliable tech partner doesn’t just build software; they help you plan for the future. Companies like Fingent have knowledge of various industries and how they work. AI, automation, cloud, analytics, and IoT – they have the know-all on it.

They know industry trends. They help you create solutions that stay relevant as your business changes. With Global Capability Centers, Fingent provides continuous support, scalability, and innovation. Their teams use AI tools to cut build time, boost code quality, and make smarter apps. A good tech partner makes sure your software works well today. It should also be adaptable, secure, and ready for future challenges.

How Can Fingent Help?

Fingent’s Global Capability Center model offers businesses dedicated teams, scalable infrastructure, and continuous delivery. It also focuses on innovation-driven engineering. GCCs support:

- large-scale transformation

- multi-year digital roadmaps

- enterprise-grade solutions

- faster execution with reduced costs

This model is ideal for businesses looking for long-term digital capability building.

Fingent uses AI in all parts of software development. This includes requirement gathering, testing, and deployment.

AI accelerators help improve:

- project timelines

- code accuracy

- automation capabilities

- predictive analytics

- overall software intelligence

That way, you can be sure that all the solutions are smart, and future-ready.

Fingent offers flexible teams or a fully managed offshore center. We provide top talent in various technologies. Clients gain speed, flexibility, and budget benefit. We know the industry well. This helps us create solutions that meet real business needs and compliance rules. It doesn’t matter if you’re in healthcare, BFSI, education, logistics, or retail.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Are you stuck in AI pilot purgatory?

Many businesses get a great start on AI. They have promising AI pilots. Then, they are stuck in a particularly painful purgatory, never able to breathe real life into their projects. This means they often fail to deliver measurable value.

In this article, we’ll discuss why scaling AI is important. We’ll look at how you could get trapped in AI pilot purgatory. Then, we’ll provide a practical guide for companies to move from testing to actual use through a strong AI for enterprise.

Drive Maximum Business Impact With AI. Our Experts Can Help You Adopt AI with Clear,Stress-free, Quick-Win Strategies.

Why AI Scaling Matters

Launching a single AI model is easy. The real challenge is using it in various departments or locations. It also needs to meet client needs.

For companies, AI for enterprise is not a passing fad. It is an operating strategy that helps your enterprise make better decisions, cuts down on costs, and increases your competitiveness in the market. In its proper deployment, AI in the enterprise transforms all functions. It mechanizes routine tasks, foresees customer behavior, and discovers new sources of revenue.

But few AI initiatives ever get into production. In fact, Gartner estimates that over 40% of AI projects will be discarded by 2027. Most of these projects end up discarded because they can’t deliver ROI or retain stakeholder confidence.

When you get a project underway as soon as you can, it saves you effort, money, and time. Yet why is scalability so important?

- Enterprises need to move from experimentation to impact, fast. Pilots test feasibility, and scaling proves the value of the project. AI insights help businesses make smarter marketing and logistics choices. This intelligence spreads across the organization.

- Scaled AI systems learn continuously, which improves performance outcomes over time rather than staying as a one-off experiment. This provides ROI sustainability.

That’s why AI scaling from pilot to production separates visionary firms from those just experimenting with innovation.

Understanding the AI Pilot Purgatory Challenge

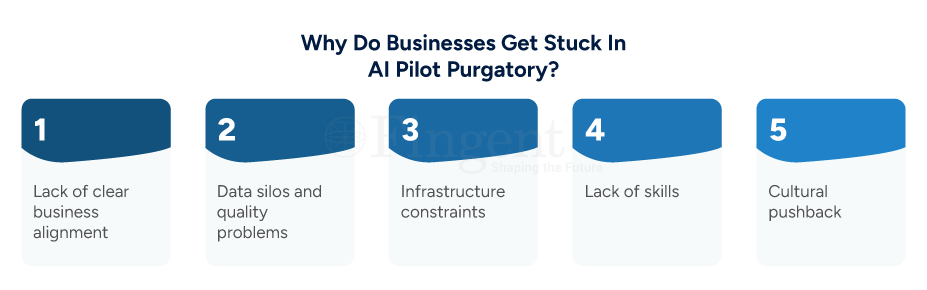

Many organizations are eager to begin new initiatives. Pilot projects are a great choice because they show potential. But somewhere between understanding the concept and production, the excitement fades. We call this stage the AI Pilot Purgatory, a place where great ideas stall. So, what keeps enterprises stuck here?

- Lack of clear business alignment: Many pilots show off new tech but fail to prove their value. Without measurable business outcomes, a pilot struggles to secure leadership support.

- Data silos and quality problems: AI hungers for good data. If data is disparate across departments, it can end up being inconsistent. This will hinder scaling.

- Infrastructure constraints: AI needs top-notch cloud infrastructure, data pipelines, and MLOps platforms to scale, but most companies ignore that.

- Lack of skills: To scale, data scientists won’t be enough. You require a team consisting of engineers, domain specialists, and a manager. They will keep an eye on the progress.

- Cultural pushback: Employees will push back against AI because they don’t believe in its decision, or they are afraid of being completely automated.

Eventually resulting in adoption barriers. To help your pilot escape purgatory, you need a complete enterprise AI strategy. This strategy should blend technology, governance, and cultural readiness.

Strategizing a Blueprint from Pilot to Production for AI Success

When you transition from pilot to production, the process isn’t done overnight. It is a structured journey that follows a blueprint. Here’s a blueprint to help your business scale AI from pilot to production.

1. Start with Business Value, Not Technology

Before coding for your project, determine high-impact business challenges that can be addressed with the help of AI. You can inquire:

- What are the most important processes in my company that can use automation? Are there any areas that can implement prediction to ease workflows?

- How should the project’s success be measured (KPIs, ROI, or time saved)?

This makes your AI for enterprise investment business-focused, not an experimental lab.

2. Build a Scalable Data Foundation

When your data is ready, AI success starts there. Construct central data lakes and maintain clean, labeled, and easily available data for departments. Invest in data governance frameworks such that data is of good quality and compliant.

3. Plan Scalability in Advance

Use reusable and modular blocks in building AI models on a strong foundation. Enforce MLOps practices that help integration, version control, and auto-deployment. This makes your AI a repeatable and scalable system rather than a one-time project.

4. Establish a Cross-Functional AI Taskforce

Scaling AI is an enterprise project, not an IT one. It involves more than one entity to make it work. So, you can bring in business leaders, data scientists, engineers, and compliance teams. Join forces towards a single purpose.

5. Use Ethical and Secure AI Practices

Enterprises need to focus on fairness and data privacy. To safeguard important data, establish an AI ethics board that looks carefully into policies that protect information. You can show accountability and regulatory compliance with XAI models.

6. Measure and Learn

Every successful enterprise AI strategy has ongoing feedback loops. Continuously track model performance, user adoption, and business results. Subsequently, retrain and improve models to keep pace with changing business objectives.

Strategize a Successful AI Journey for Your Enterprise. Assess AI Readiness, Spot Opportunities, and Integrate AI into Your Workflows.

Real-World Examples: Industry-Wise AI Scaling

Let’s explore how different industries are scaling AI in the enterprise effectively.

1. Banking and Financial Services

Banks lead with AI for enterprise when they use predictive analytics to detect fraud. They also use it to assess credit risk and personalize customer experiences.

Example: JPMorgan Chase’s COiN platform checks legal documents in seconds. This cuts down on spending for manual work and lowers operational costs.

Value: They experience all-round risk management and wiser decision-making.

2. Retail

AI for enterprise enables retailers to build buying experiences that are unique to their customers. It also streamlines supply chains.

Example: AI is employed by Walmart to predict customers’ demand. If their demand is altered, they modify stocks in real time.

Value: They get reduced wastage of products and improved customer service

3. Healthcare

Healthcare organizations gain from using AI in the enterprise. It helps with the before–diagnostics and predictive care. It also makes a notable difference to patient engagement.

Example: Diagnostic systems powered by deep learning can help analyze patient data and medical imaging in real time. The AI solution can be integrated with Electronic Health Records (EHRs) and lab databases. It also keeps HIPAA compliance and ethical transparency with enterprise AI strategy frameworks.

Value: Improved diagnostic accuracy, faster report turnaround time, and enhanced collaboration between clinicians and AI systems.

4. Manufacturing

AI in the enterprise changes manufacturing. It helps with predictive maintenance and quality control.

Example: Top players are using AI sensors that monitor machinery and prevent any breakdown.

Value: With this, they saved money, cut downtime, and achieved improved product consistency.

5. Nonprofits and the Public Sector

Non-profit organizations have greatly benefited from scaling AI implementations in enterprises for their workflows. It helps them to enhance engagement with donors and optimizes the way resources are utilized.

Example: UNICEF employs AI-driven data analytics to understand which regions require emergency aid.

Value: AI helped enhance their response time and effectively use their resources.

Common FAQs

Q. What is enterprise AI, and how is it different from general AI?

A. Enterprise AI is the use of artificial intelligence within large business settings. Enterprise AI is different from general AI. While general AI is used for consumer, as opposed to business, purposes and research, enterprise AI is designed to reinvent core business processes. Decision-making, prediction, automation, and customer interaction are just a few of them. It is about structured frameworks, governance models, and scalable infrastructure designed to enable the enterprise environment. Consider it as AI designed to deliver performance, compliance, and influence at scale.

Q. What is the timeline to deploy AI in a firm?

A.The timeline for implementing AI in the enterprise within a business relies on three key considerations: scope of business, data maturity, and complexity. A pilot would take 3–6 months, and a scaled deployment would take 12 to 24 months. Data-driven organizations with an adaptable culture can reduce the adoption time. Scaling is needed to plan extensively. That involves using AI to enhance processes and employee retraining. It can also establish MLOps for continuous improvement.

Q. Can small or medium enterprises scale AI successfully?

A. Yes! A size 500 fortune is not necessary to do business using AI for an enterprise. When an AI application is cloud-based, it allows SMEs to apply scalable analytics and automation. Begin small. Begin with one that has a high impact, such as sales forecasting or customer support automation. Pilot first, then roll it out incrementally. Strategic use of AI for enterprise has nothing to do with size but with clarity, intent, and action.

Q. How secure are enterprise AI implementations?

A. Enterprise AI rollouts put security at the top of the agenda. All serious AI systems abide by data protection legislation, like GDPR, and follow industry best practices. Security best practices include:

- Encryption of data in motion and rest

- Role-based access control implementation

- Conducting regular model audits

- Explainable AI (XAI) brings a whole new level of transparency

When done right, yes, enterprise AI can be secure. As secure as the systems it runs on. In fact, it can be even more secure because of its built-in anomaly detection and predictive monitoring.

How Can Fingent Help

At Fingent, we help businesses with their enterprise AI strategy. We guide them from ideas to full-scale implementation. We focus on finding real business value. We build data-driven roadmaps and facilitate responsible adoption across the enterprise. We help organizations:

- Move from pilot to production confidently

- Implement scalable and secure AI structures

- Make all transactions transparent and compliant

- Return quantifiable ROI with intelligent automation and analytics

Start your AI journey or move past pilot purgatory with Fingent. We can help you speed up transformation using AI for enterprise solutions that really work.

Think, Transform, and Evolve with AI

Scaling AI is not just about technology — it’s about transforming the way enterprises think, work, and evolve. Companies can avoid pilot purgatory by embracing an AI-based strategy that is robust and more powerful. Scalable infrastructure and an innovative culture are required. This can unlock the full potential of AI. The companies that succeed today will be leaders tomorrow.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

AI Adoption in enterprises is a no-brainer. Shouldn’t everyone be on it by now? You would think so. Businesses that have adopted it successfully are acing it. Predictive analytics, smart automation, and informed decision-making are a breeze for them.

For a few, however, AI adoption in enterprises is still patchy. Most companies have success in proof-of-concepts but fail to replicate them. In recent years, more businesses have seen the need to discard AI projects before production.

That’s why this blog talks about the most significant challenges in AI adoption, and how businesses can overcome them. Read on!

Discover How Your Business Can Harness AI For Maximum Impact

Why Enterprises Struggle with AI Adoption?

More than three-quarters (78%) of businesses apply AI in one or more business processes. While CEOs all concur that AI is the future, many find that scaling beyond pilots is challenging. Difficulty in cross-department collaboration, skills gap, unclear ROI, and security issues are some reasons.

Here is an overview of the main reasons why companies are having trouble applying AI:

- Data Complexity and Silos : AI models depend on data quality. Yet, 72% of enterprises admit their AI applications are developed in silos without cross-department collaboration. This fragmentation reduces accuracy and scalability.

- Talent and Skills Gap: AI adoption demands data scientists, ML engineers, and domain experts. But 70% of senior leaders say their workforce isn’t ready to leverage AI effectively.

- High Costs and Unclear ROI: Enterprises hesitate when infrastructure, integration, and hiring costs overshadow immediate returns. In fact, only 17% of companies attribute 5% or more of their EBIT to AI initiatives.

- Organizational Resistance to Change: Employee resistance is a major issue. 45% of CEOs say their employees are resistant or even openly hostile to AI.

- Security, Privacy, and Issues with Compliance: AI consumes sensitive data. Due to this, abiding by laws like GDPR becomes difficult. Lacking effective governance, companies are worried about reputation damage and penalties.

A Look into the Risks and Blockers of Scaling AI Across Organizations

Even when pilots succeed, enterprises face barriers in scaling AI across the organization. The key factor is the lack of understanding of the way AI models operate. Model drifts that reduce accuracy, integration challenges, and cost overruns are some reasons that could impede scaling. Let’s look at some key risks and blockers of AI adoption in enterprises:

1. Shadow AI and Rogue Projects

Departments start “shadow AI” projects with little IT governance. Local success translates to enterprise-wide failure, forming silos, duplication, and the danger of non-compliance.

2. Model Drift and Maintenance Burden

AI models are degrading over time with changing market trends and user behavior. Enterprises don’t know the price of ongoing monitoring and retraining. This results in “model drift,” which reduces accuracy and reliability. Poorly trained models may amplify biases, risking reputational and legal challenges.

3. Lack of Interoperability Standards

With more AI platforms emerging, firms battle interoperability. They are often hampered by integration challenges in scaling AI owing to variable data formats and incompatible systems.

4. The Hidden Costs of Scaling Infrastructure

Scaling AI doesn’t take just algorithms. There’s more behind the curtain. Cloud storage, GPU computing power, and security controls cost money. Most firms underestimate these hidden expenses, leading to cost overruns.

5. Cultural Misalignment Between Business and IT

Successful AI demands cross-functional alignment. IT is worried about security and compliance, and business units are always in a rush. The clash of cultures gets in the way of execution and keeps enterprise-wide scaling at bay.

Tips To Overcome These Challenges

AI adoption challenges in enterprises are common. But that does not mean that they aren’t impossible to overcome. Here are some tips to speed up AI adoption in enterprises:

- Establish Crystal Clear Business Goals: AI must address business priorities, not simply adopt technology for the sake of it. Leaders need to determine high-impact opportunities. Fraud detection, customer service automation, and demand forecasting are priorities.

- Invest in Data Readiness : High-quality, integrated data is key. Enterprises require good governance and integrated data in real-time. Organized data habits are far more likely to derive ROI from AI.

- Organize Cross-Functional Teams :AI is best with IT, business, regulatory, and domain subject matter experts in collaboration. It enables scalability and reduces ethical risk.

- Upskill and Reskill Talent: Cultural readiness is needed for AI deployment. Only 14% of organizations had a completely synchronized workforce, technology, and growth strategy—the “AI pacesetters”. Learning investments prevent more transition problems.

- Pilot Small, Scale Fast: Pilot projects must produce quantifiable ROI before large-scale adoption. This instills organizational confidence and reduces financial risk.

- Emphasize AI Governance and Ethics: Open models, bias testing, and compliance frameworks establish employee and customer trust.

- Collaborate with Seasoned Providers: Companies that lack in-house expertise bring value by partnering with seasoned AI providers like Fingent, which are focused on filling skill gaps, managing integration, and scaling responsibly.

Popular FAQs Related to AI Adoption in Enterprises

Q1: What are the main barriers to AI adoption in enterprises?

The primary inhibitors of AI adoption in enterprises are siloed data. The absence of competent talent, vague ROI, cultural opposition, and governance are a few other factors that pose challenges in AI adoption.

Q2: Why do AI pilots work but get stuck on scaling?

This happens because scaling needs robust data systems, governance, and alignment at departmental levels. Without them, pilots do not work in production.

Q3: How can businesses overcome AI adoption challenges?

AI adoption challenges in enterprises can be overcome if you first set clear business objectives. Once that is done, invest in upskilling employees and partnering up with seasoned AI providers like Fingent.

Q4: Is AI adoption in enterprises worth the risks?

Yes! Best-practice adopting firms are more likely to see positive returns and ROI. But firms with no AI strategy witness business success only 37% of the time. Whereas firms with at least one AI implementation project succeed 80% of the time.

Q5: Which are the industries that benefit most from AI adoption?

Tech seems to come immediately to mind. But the past few years have seen other industries jostle for space on the top list of adopters. The pharmaceutical industry has discovered what AI can do for clinical trials. Chatbots and virtual assistants have revolutionized banking and retail. Predictive maintenance has smoothed out many a problem for the manufacturing industry.

Strategize a Smooth AI Transition. We Can Help You Effortlessly Integrate AI into Your Existing Systems

How Can Fingent Help?

At Fingent, we deal with the intricacies of AI implementation in business organizations on a regular basis. Our capabilities are:

-

- Scalable AI solution planning based on business objectives.

- Effective data governance models.

- Glitch-free integration with legacy systems.

- Ethical and transparent AI model building.

- Cultural transformation through adoption and upskilling initiatives.

Whether your business is just starting pilots or fighting to scale, Fingent can assist in optimizing ROI and mitigating risks. Learn more about our AI services here.

Knock Those Barriers With Us

AI adoption barriers in business still keep organizations from realizing potential. The silver lining? With the right strategy and partnerships, businesses can blow past the challenges and drive a successful AI adoption journey.

The future of AI adoption in enterprises is not algorithms; it’s about trust, collaboration, and a vision for the longer term. Those who act today will reign supreme tomorrow. Give us a call and let’s knock these barriers down and lead your business to making a success of AI.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Walk into any modern factory today, and you will notice something different. No noisy jungle of machines. No conveyor belts. No caution tape. It is alive—with sensors, data dashboards, and smart devices all working in perfect harmony. So what’s really happening? It is digital transformation in manufacturing! And what’s powering it beneath all the blinking lights and high-tech gear? Not just automation. Not just AI.

But something more fundamental and flexible: custom software for manufacturers.

Would you like to know how custom software development impacts the manufacturing industry? This is a great question to ask—and it is one that deserves a deeper dive than just “it improves efficiency.”

This is because in a world where milliseconds matter and errors can cost millions, manufacturers are trading in cookie-cutter tech for customized digital tools that fit like they were built in-house. This blog discusses the why and how.

Why Off-the-Shelf Tools Are Not Built for Today’s Manufacturing

Off-the-shelf software might work fine for smaller businesses or simpler workflows. Does it work when you are trying to juggle multiple vendors, unpredictable supply chains, compliance headaches, and razor-thin margins?

Not really, that is when the cracks start showing.

One Size Doesn’t Fit Anyone

Generic tools are like buying sneakers in “one universal size.” Great in theory—useless in practice.

Your workflows are unique. Whether you are assembling high-precision auto components or crafting handmade soap, your challenges are different. Your systems should reflect you, not the average of everyone else.

Your Old Systems Don’t Want a New Stranger

Many manufacturers still rely on older, legacy systems. These may be clunky, but they work. Introducing a plug-and-play app that can’t “speak” their language? That creates silos and communication breakdowns.

What you need is manufacturing process optimization software that knows how to bridge the old and new, without breaking everything in the process.

You Need to Grow Fast—Not Wait for Updates

Markets shift. Product lines change. New regulations show up uninvited. Standard software just does not pivot fast enough. You are left with a system that ages faster than it improves.

On the other hand, custom solutions grow with you. Want to add a new plant? No problem. You need to integrate with a supplier in another country? Done.

Question worth asking: Why stick with software that asks you to adapt, when you can build one that adapts to you?

Control Should Be Yours—Not the Vendor’s

Let’s be real: when you’re using commercial software, the vendor decides when you get updates, what features are prioritized, and how fast bugs are fixed.

But with custom ERP for manufacturers, you’re in control. You steer the roadmap. You set the priorities.

Power Your Manufacturing With Modern Approaches Turn To Custom Software Development and Deploy The New-age Technologies

Custom Software: The Real Backbone of Modern Manufacturing

How Custom Software Development Impacts the Manufacturing? It becomes your edge. Your secret weapon. Your advantage.

Real-Time Production Visibility

Imagine seeing, in real time, every machine’s status, every order’s progress, and every bottleneck in your system—before it slows you down.

Successful digital work management (DWM) systems deliver value by increasing the efficiency of internal and external maintenance labor, reducing planned downtime through shutdown and outage optimization, and providing the opportunity to upskill the maintenance workforce. Taken together, these levers can lead to cost reductions of 15 to 30 percent.

That’s not a pipe dream. That is what happens when you invest in smart manufacturing solutions tailored to your workflow.

And the best part? You are not reacting anymore. You’re anticipating. Which means faster decisions and fewer errors. Think of it like upgrading from a map to GPS—you’re no longer guessing where the traffic is.

Predictive Maintenance: Don’t Just React—Prevent

Downtime is the silent killer of productivity. One broken machine can throw your perfect plan off track.

Across a wide range of sectors, it is not uncommon to see 30 to 50 percent reductions in machine downtime, 10 to 30 percent increases in throughput, 15 to 30 percent improvements in labor productivity, and 85 percent more accurate forecasting.

With manufacturing process optimization software, predictive maintenance becomes standard. Smart sensors detect patterns, algorithms flag anomalies, and you get alerts before a breakdown happens.

That’s the power of custom software. It doesn’t just report problems. It prevents them.

Data That Means Something

It is really not about how much data you collect. It is about how quickly and clearly you can act on it.

Custom systems help you visualize the right KPIs at the right time—no fluff, no clutter. That means managers, machine operators, and execs all work from the same truth, in real time.

Integrated Supply Chain Management

Manufacturing does not stop at the factory floor. Obtaining goods, logistics, and inventory play a huge part. With custom ERP for manufacturers, every part of your operation—from vendor management to delivery schedules—can be unified in one place.

That means no more double data entry or emailing spreadsheets back and forth.

Remote Monitoring & IoT Integration

With smart sensors, wearables, and IoT devices becoming the norm, manufacturers need systems that can gather, analyze, and respond to data from hundreds of sources. Custom solutions can be designed to connect to all your devices and give you complete remote control.

Whether you’re on the factory floor or across the globe, you’ll stay in the know.

Benefits of Custom Software in Manufacturing

We have seen how custom tools work. Now let’s talk about why they are worth every penny.

1. Higher Operational Efficiency

Automated processes, data accuracy, and real-time updates mean fewer delays, less rework, and smarter use of resources.

2. Cost Savings in the Long Run

Yes, there is an upfront investment. But custom software reduces errors, minimizes downtime, and boosts productivity—saving you more over time than you’d spend fixing issues with generic tools.

3. Competitive Edge

When you are running lean, responding fast, and making data-backed decisions, you naturally outperform the competition. That’s what digital transformation in manufacturing is all about—staying ahead of the curve.

4. Customer Satisfaction

Faster delivery times, better quality control, accurate tracking, and clear communication? That’s what your customers love. Custom software makes it possible.

The Hidden Wins: What Most People Miss About Custom Software

Everyone talks about efficiency and automation. Sure, those are important. But here is the gold that is every so often unnoticed:

1. Retain the Intelligence in Your Organization

Your top engineers and operators know the quirks of every process. But what happens when these stalwarts leave or retire?

With custom ERP for manufacturers, their insights become part of the system. Their problem-solving logic becomes code. Their workflow gets preserved—not lost.

2. Improve Team Morale and Adaptability

Let’s face it: people resist clunky software. But when tools are designed around how they already work, adoption goes up. Frustration goes down. Teams enjoy using the tools they’re provided.

Thought to reflect on: Are your tools helping your people work smarter—or just adding digital friction?

3. Differentiate Yourself from Competitors

Your competition might have access to the same machines, the same suppliers, maybe even the same customers. But what they do not have is your custom-built software system that reflects your way of doing things.

That is your edge. That is what turns good into great.

Case Study Spotlight: A Real-World Win

Let’s look at a real example.

One of Fingent’s clients—Lakeside Cabins—wanted to streamline their processes and deliver faster with more accuracy. They also wanted to modernize their approaches and offer unique experiences for their customers.

Fingent helped the client deploy 3D Configurators that enabled them to involve their customers through their web portal in designing the cabins at each stage of production. The customers felt more included and valued, plus the manufacturing outcomes were more error-free and sustainable.

That’s smart manufacturing solutions in action.

3D Web Configurator For Cabin Design

How Should Manufacturers Handle Custom Software?

If you are considering taking the leap, here are some initial steps you can begin with:

Audit your current systems.

What’s working? What’s not? Talk to your team. Gather feedback.

Identify your biggest pain points.

Focus on the challenges that are costing you time or your precious resources.

Start small but think big.

You don’t need a full-blown overhaul overnight. Begin with one system or process and scale up.

Choose the right partner.

Custom software is only as good as the team building it. Partner with a firm that has manufacturing experience and a consultative approach.

Why Fingent?

At Fingent, we don’t just write code. We solve problems.

Having years of experience in digital transformation in manufacturing, we comprehend the distinct challenges of the industry. Our team collaborates closely with clients to create customized tools that produce significant effects—from the factory floor to the executive suite.

We combine the strength of manufacturing process optimization tools, tailored ERP for producers, and adaptable, intelligent manufacturing solutions to develop systems that not only function—they perform miracles. From streamlining operations to modernizing legacy infrastructure, we ensure every solution is future-ready, not just functional.

And we do not believe in copy-paste tech. We trust in tailor-made excellence—software that feels as if it was designed specifically for you.

Whether you’re delving into automation, dealing with obsolete processes, or set to streamline your entire production pipeline, our team is prepared to dive in and start building.

Final Take: Don’t Buy the Future—Build It

Digital transformation in manufacturing is not just about modernizing. It’s about redefining how you compete.

Custom software is no longer a luxury. It’s the blueprint for the next generation of manufacturers. It’s about rethinking everything—from supply chain to shop floor—in a way that fits your DNA.

So here’s the question:

Are you still trying to retrofit your factory to someone else’s software—or are you ready to build tools that are made for you, by you, and grow with you?

Want to transform your operations with tailor-made tools? Then don’t follow the crowd—lead it. Let Fingent be your partner in progress. Let’s build something powerful together.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

All businesses are built on data. But the question is: Is your business truly driven by data? Or are you merely gathering data without a strategy? An effective Data Engineering strategy might be the key to standing out in the market instead of lagging behind.

Let us help you find out.

Data Engineering: The Backbone of Modern Business Intelligence

In a data-driven age, where information is currency, the businesses that harness data are the only ones staying competitive. Raw data can be a terrifying nightmare because it can be messy and disorganized. Above all, you will find it nearly impossible to uncover valuable insights. That’s why you need Data Engineering.

Drive Business Excellence with Intelligent Data

Harness Data Engineering for Boosted Operational Success

What is Data Engineering?

Simply put, Data Engineering is all about creating, building, and maintaining systems. It enables you to collect, store, analyze, and separate relevant data. In other words, it refines raw data into a more digestible form. This allows you to now harness its power to its full potential. Without this crucial step, businesses are left drowning in a sea of digital clutter. They miss out on valuable opportunities for growth and innovation.

If you want to unlock the true potential of your data assets and stay ahead of the competition – let data engineering pave the way for success.

Why Is Data Engineering a Big Deal?

The significance of Data Engineering solutions has escalated with the exponential growth of data. Every email, customer interaction, and IoT sensor signal contributes to the data wave companies need to handle. A report from Market Data Forecast indicates that the worldwide big data and data engineering services market is anticipated to grow to around $325 billion by 2033, increasing from $75.55 billion in 2024.

Without Data Engineering solutions, companies are overwhelmed by information and unable to derive value from it. With data engineering, they achieve clarity, efficiency, and a competitive edge.

Here’s what it accomplishes:

- Arranges and tidies data so that companies can effectively utilize it.

- Streamlines data processes, minimizing manual work and mistakes.

- Combines various sources for a comprehensive business perspective.

- Enhances storage and processing, reducing expenses and increasing efficiency.

- Ensures security & compliance because no one wants a data breach headline.

Now that we get the “why,” let’s break down the “how.”

Key Components of Data Engineering

Building Data Engineering solutions isn’t just about dumping everything into a cloud server and hoping for the best. It requires a solid foundation:

- Data Ingestion – Start with this first step: collect data from multiple sources such as APIs, databases, IoT devices, and social media.

- Data Storage – Your business will need a reliable home for your data – be it a traditional data warehouse (structured) or a data lake (unstructured).

- Data Processing – This is the stage where your raw data is cleaned, altered, and organized. Consider ETL (Extract, Transform, Load) pipelines that set up data for analysis.

- Data Orchestration – Automation solutions ensure the data processes operate smoothly while minimizing human errors.

- Data Governance & Security – GDPR and CCPA require uptight data security.

- Real-Time Analytics—Companies must stream data processing to make decisions quickly and on the go.

Data Engineering vs. Data Science: What’s the Difference?

They may seem very similar, but they are very different. Let’s simplify this for you. Data Science is like being a detective. One that digs into data to uncover patterns, trends, and insights. On the other hand, data engineering is like setting up a world-class crime lab that assists the detective in getting to the right clues. So, while one finds relevant data, the other makes sure the data is easily available and usable.

Without Data Engineering, data scientists lose almost 80% of their time because they have to clean and organize data instead of actually analyzing it. However, they can focus on extracting value and driving business impact with it.

Top Tools & Technologies in Data Engineering Solutions

The tech stack for Data Engineering solutions is constantly evolving, but here are the must-haves:

Data Storage & Management

- Amazon Redshift / Google BigQuery – Scalable cloud data warehouses.

- Apache Hadoop / Apache Spark – For massive distributed data processing.

- Snowflake – A high-performance, cloud-native data platform.

ETL & Data Pipeline Tools

- Apache Airflow – Automates and manages workflows.

- AWS Glue / DBT (Data Build Tool) – Streamlines ETL processes.

- Talend / Informatica – No-code ETL platforms for enterprises.

Streaming & Real-Time Processing

- Apache Kafka – Handles real-time data streaming like a pro.

- Google Dataflow – Processes real-time and batch data seamlessly.

- Flink – High-performance, scalable data streaming.

Data Governance & Security

- Apache Ranger – Manages security policies across data lakes.

- Collibra – Enterprise data governance at scale.

- Okta – Identity management and access control.

The Future of Data Engineering

The world of Data Engineering is only getting bigger. Here’s what’s next:

- AI-powered automation – ML-driven pipelines that self-optimize.

- Serverless data engineering – No infrastructure management, just pure efficiency.

- Data Mesh – Decentralized data ownership for more agile businesses.

- Edge Data Processing – Processing data closer to the source (IoT, mobile devices, etc.).

Real-World Examples of Data Engineering in Action

To demonstrate the impactful capabilities of Data Engineering, take a look at these success stories from Fingent’s collection:

-

Improved Decision-Making in Retail

Premium Retail Services (PRS) managed field marketing services for Samsung’s US market. Their representatives collect over a million data points monthly from over 12 retail segments. However, their reporting systems were outdated, and relying on PowerPoint and Excel led to delays and inefficiencies.

Solution: Fingent took the bull by the horns, so to speak, by developing a customized data analytics and visualization platform.

Result: This solution transformed complex datasets into intuitive visuals. It also automated data input and streamlined field data management. This enhanced their performance reviews and improved decision-making.

-

More Reliable Financial Forecasts

Quantlogic, a research firm, processed over 200,000 data touchpoints across 12 verticals in real-time in the financial sector. Its goal was to refine predictive algorithms for better investment planning.

Solution: Fingent implemented an advanced predictive analytics platform.

Result: This platform improved data quality and predictive accuracy. Thus, enabling Quantlogic to make more reliable financial forecasts.

-

Data Analytics to Determine Hospital Performance

The National Health Service (NHS) England struggled to evaluate hospital performance. This was due to their incongruent data sources and complex metrics.

Solution: Fingent deployed a comprehensive data visualization solution. This solution offered interactive graphs that linked across multiple disciplines. This system provided detailed analyses of key performance indicators.

Result: Now, NHS England can make informed decisions to enhance patient care and enjoy operational efficiency.

AI Tools for Data Analysis: Your Co-Captain to Business Success

A Look into The Future of Data Engineering

The field of Data Engineering is swiftly evolving. Here’s what businesses can anticipate:

- AI-Powered Automation: This will eliminate the need to monitor data pipelines manually. Machine learning algorithms will automate data pipelines and self-optimize whenever necessary.

- Serverless Data Engineering: When you shift towards serverless architectures, your business will be able to focus on data processing instead of battling to be the tech support. The benefit? Grater scalability and cost efficiency!

- Data Mesh Architecture: This approach enables you to own data. Each of your departments would be like a mini startup—independent, flexible, and accountable.

- Edge Data Processing: With this, you can process data right where it began. IoT devices and mobile applications will see reduced latency while enabling real-time analytics.

How Fingent Can Help

We understand that navigating the complexities of Data Engineering is not as easy as it seems. Yes, it requires expertise and a forward-thinking approach. At Fingent, our experts specialize in crafting tailored Data Engineering solutions. And we ensure the solutions we provide always align with your business objectives. Let’s take us through our services:

- Custom Software Development: We will build scalable and robust applications that meet your specific data needs.

- Digital Transformation Consulting: We will be there to guide your journey to data-centric architectures.

- Cloud Strategy Consulting: We are equipped to design and implement flexible and scalable cloud-based data solutions.

Contact us today to discuss Data Engineering solutions.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

An Offshore Development Center (ODC) is your personal innovation factory full of top talent working tirelessly to bring next-generation solutions to market. Unlike an outsourced team, an offshore software development center is your enterprise. The right ODC is just what you need to supercharge your business like never before, be it AI wizards, cloud experts, or a full-scale development team. Let’s look at Offshore Software Development benefits, trends, and more. But before that, let’s examine why ODCs are gaining traction.

Why Are ODCs Hot Right Now?

Simple. The old-school approach of hiring in-house teams for everything is starting to crack under pressure. Talent shortages, skyrocketing salaries, and hiring cycles that take longer than a monsoon season – these are real headaches. Instead, businesses are tapping into global talent pools, snapping up highly skilled developers who can hit the ground running. And having an offshore team isn’t just about cost – it’s a strategic advantage. Offshore software development benefits are uncountable! Need to get into a new market? Your offshore team might already speak the language and understand the local consumer mindset.

Power Your Software Development Efforts With Specialized Expertise Build Your Offshore Team with Fingent!

What Are The Benefits of Offshore Software Development Services?

So, is an offshore software development center just a fancy way to say “outsourcing”? Not quite. While cost savings are a big draw, the offshore software development benefits run deeper. Here’s why companies are making the shift:

- Access to Global Talent – In this “working remotely” world, confining yourself to local talent is a limiting factor. A dedicated offshore development center gives you access to a much broader global talent pool, and you can find specialized skill sets that are either not available locally or have become very scarce. India, for instance, has a significant boom in the population of software developers. India is also projected to surpass the US in the number of software developers by 2027.

- Scalability & Flexibility – Imagine gearing up for a major project and realizing you need double the developers—yesterday. With ODCs, scaling up (or down) is as easy as flipping a switch. No months-long hiring process, no stress.

- Faster Time-to-Market – With ODCs operating across multiple time zones, you can have a ‘follow-the-sun’ development cycle. This iterative model speeds up project timelines, allowing you to deploy and patch faster. The ability to operate 24/7 is a strategic advantage. Especially among industries in which time-to-market is of paramount importance. For example, an offshore team can work on different platforms at the same time. This allows you to ship products faster.

- Cost Efficiency – Let’s talk numbers: A developer in the U.S might cost upwards of $120K per year, while an equally skilled developer in India or Eastern Europe costs a fraction of that. Now multiply those savings across an entire team. Offshore software development can lead to substantial cost savings. Reports indicate that such services can be up to 50% more cost-effective compared to in-house teams.

- Focus on Core Business – You don’t want your top execs wasting time on recruitment and IT issues. A dedicated offshore development center lets you double down on strategy, sales, and customer experience while your development team takes care of the tech.

Blog : How to Build and Lead a High-Performing Offshore Software Development Team

Offshore Software Development Trends in 2025

The ODC landscape is shifting fast, and companies that stay ahead of the curve will reap the rewards. What’s coming next? Let’s break it down:

- AI is Taking Over (In a Good Way) – AI isn’t just a buzzword anymore; it’s a necessity. From chatbots to predictive analytics, businesses are relying on ODCs to build AI-driven solutions. Why? Because AI talent is hard to find, and offshore teams are loaded with machine learning wizards ready to dive in.

- AR/VR is No Longer Just for Gamers – The metaverse isn’t just a sci-fi concept anymore. Companies in retail, healthcare, and education are betting big on AR/VR, and they’re using ODCs to build these immersive experiences. Want to try on clothes virtually or attend a meeting as a hologram? ODCs are making it happen.

- Growing outsourcing industry – A report from Grand View Research indicates that the worldwide software outsourcing market is expected to attain $937.67 billion by 2027, with an annual growth rate of 7.7%. Major tech companies are utilizing offshore talent. They are acquiring developers from nations like India and Poland, where skilled tech professionals can be employed at 40-60% reduced costs relative to local rates.

- Cross-Platform is the New Norm – Nobody wants to build three separate apps for web, iOS, and Android. The future is all about cross-platform development, and ODCs are leading the charge with frameworks like Flutter and React Native, delivering seamless experiences across devices.

- Multi-Country ODCs for Risk Management—Businesses are spreading their development teams across multiple locations to hedge against risks like political instability, economic downturns, or even natural disasters. A diversified ODC strategy means no single event can shut everything down.

- Cybersecurity-First Development – With data breaches costing companies an average of $4.45 million per incident, security is no longer an afterthought. ODCs have been integrating cybersecurity measures into software since day one because an unsecured app is a disaster waiting to happen.

- Integration of Cloud and IoT – IDC forecasts that global investment in IoT will hit $1.1 trillion by 2026, and it’s almost certain that edge computing will emerge as an essential resource alongside the rise of 5G networks. Conversely, offshore teams are swiftly embracing cloud-native technologies as organizations such as Capgemini enhance development speeds via a mix of AI and cloud-based collaborative tools.

- Specialized Micro-Teams – The era of bloated dev teams is fading. Businesses are now forming streamlined, highly specialized teams to address intricate issues effectively. These groups concentrate on innovative fields such as blockchain, IoT, and financial technology solutions.

Collaborate With Top Tech Talents to Build Smart Solutions

Addressing Challenges in Offshore Software Development (And How to Overcome Them Like a Pro)

Let’s be real—no business model is without its quirks, and offshore development center (ODCs) are no exception. But here’s the good news: Every challenge has a solution, and companies anticipating and tackling these head-ons can unlock massive competitive advantages. So, what are the major hurdles? And how do you clear them? Let’s break it down.

1. Miscommunication – No More “Lost in Translation” Moments

Misunderstandings can occur when working with a team halfway across the world. However, using the right approaches can turn communication roadblocks into communication highways.

How to Fix It:

- Agile Standups: Daily or weekly syncs (even short ones) keep everyone on the same page.

- Clear Documentation: Proper documentation, whether on a Notion board, Confluence, or Google Docs, can reduce misunderstandings.

- Strong Onboarding: From day one, train offshore teams on company culture, brand guidelines, and project expectations.

- Tools Matter: Leverage Slack, Zoom, Jira, or whatever works best to streamline communication.

The Payoff? Fewer “I thought you meant this” moments. Instead, you will enjoy more seamless collaboration and a team that operates like a well-oiled machine—beyond boundaries.

2. Time Zone Differences

Image your in-house team clocking out for the day. And instead of progress grinding to a halt, your offshore team picks up right where they left off. This is the advantage of the “follow-the-sun” model. But without proper coordination, it can turn into a game of email ping-pong with delays at every step.

How to Fix It:

- Overlap Working Hours: Even a 2-4 hour overlap for real-time collaboration makes a big difference.

- Hand-off Culture: End-of-day updates ensure the next team starts work with full context.

- Asynchronous Communication: Not everything needs a meeting. To keep projects moving, use Loom videos, detailed Slack threads, and structured reports.

The Payoff? Instead of time zones being a hurdle, they become an accelerator—letting your business operate round-the-clock without burning out any single team.

3. Data Security Concerns – Locking It Down Like Fort Knox

Handing over sensitive data to an offshore team can feel risky. Security isn’t an afterthought—it’s a must-have.

How to Fix It:

- Strict NDAs & Access Controls: Limit data access to only what’s necessary—no open floodgates.

- ISO & GDPR Compliance: Ensure your offshore team follows international security standards.

- Secure Infrastructure: VPNs, firewalls, encrypted databases—your offshore team should be as secure as your in-house one.

- Regular Security Audits: Set up periodic checks to ensure compliance and identify vulnerabilities before they become disasters.

The Payoff? Peace of mind. Your data stays protected, compliance risks stay low, and your customers (and legal team) stay happy.

4. Cultural Differences – Turning Diversity Into a Strength

In fact, a global team means different working styles, holidays and expectations! Mismanaged, it can lead to clashes and inefficiencies. However, if we embrace it, it can drive innovation like no other.

How to Fix It:

- Cultural Sensitivity Training: A bit of awareness can significantly enhance mutual respect.

- Adaptable Work Hours: Acknowledge significant holidays among teams to prevent unforeseen changes.

- Embrace Diversity: A group that gains insights from varied viewpoints creates superior products.

The Payoff? A team that excels in teamwork and innovation rather than dealing with confusion.

Challenges need not become showstoppers! The best companies don’t sidestep challenges. They solve them! Once you have the right approaches, a dedicated offshore development center can boost your business. Because it can provide you with the best talent, round-the-clock efficiency, and massive cost savings — without the headaches. the benefits of offshore development center are numerous!

So, is an ODC the future of your company? Only if you’re ready to scale smarter, move faster, and build better.

Nearshore Software Development: A Quick Guide!

What Are the Leading Models for Offshore Development Centers?

Thinking about setting up an ODC? You’ve got options. Here are the top models businesses are using:

- Dedicated ODC Model – A long-term setup where your offshore team works exclusively for you, almost like an extension of your in-house staff.

- Project-Based ODC Model – Perfect for short-term projects requiring an expert offshore team to handle a specific task.

- Build-Operate-Transfer (BOT) Model: A service provider builds and manages the ODC, which is then handed over to you once it’s operational.

- Managed ODC Model – The service provider takes care of everything – hiring, infrastructure, payroll, etc.– so you can focus on business, not logistics.

Why Partner with Fingent to Build an ODC Team?

When it comes to offshore development, choosing the right partner is paramount. That’s where Fingent steps in. Fingent’s offshore development services help businesses establish secure, scalable, and tailor-made digital solutions that fit their needs. If you are serious about leveraging offshore software development benefits, Fingent ensures a seamless journey. We provide everything high-end and top-tier, whether AI specialists, AR/VR developers, or cybersecurity teams.

Connect with us today and explore our offshore software development services more.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

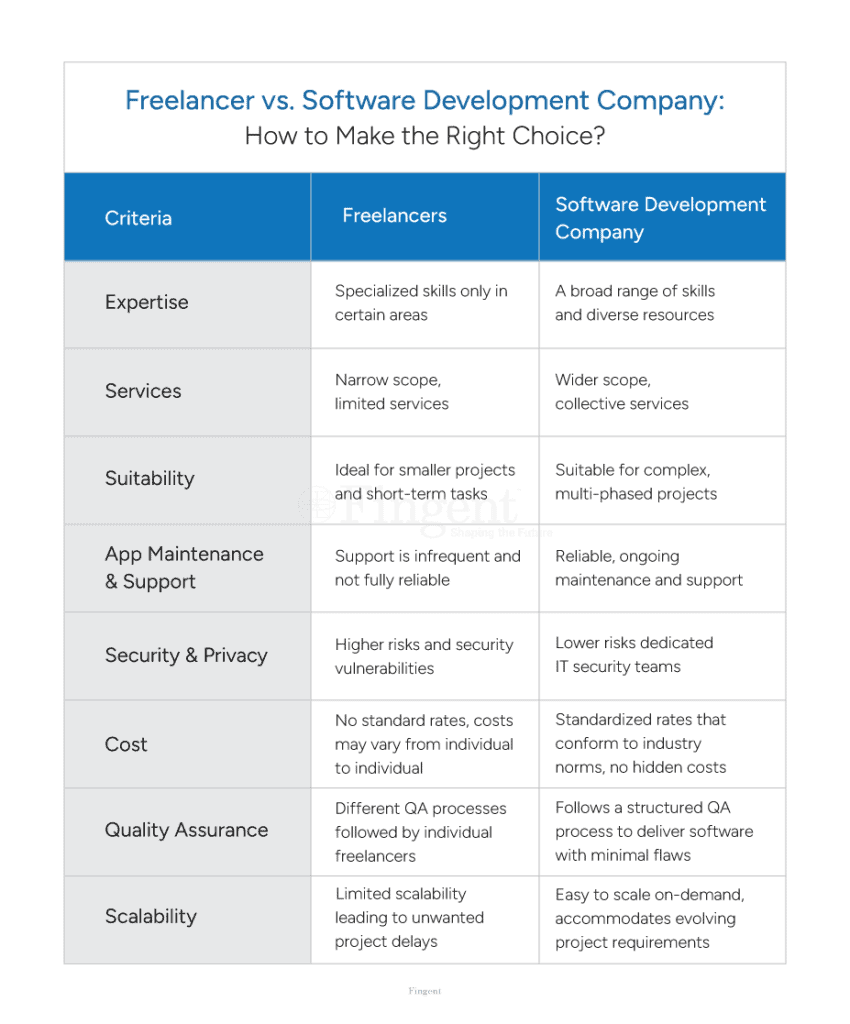

Businesses need modern technology to survive today’s ever-evolving market. The right enterprise software solution can help businesses thrive. However, not all businesses might have the necessary in-house skills to develop one, and let’s be honest, off-the-shelf software does not fit all needs. Thanks to custom software development vendors, enterprises can access technology experts on the go to build customized technology solutions that cater to their unique business needs.

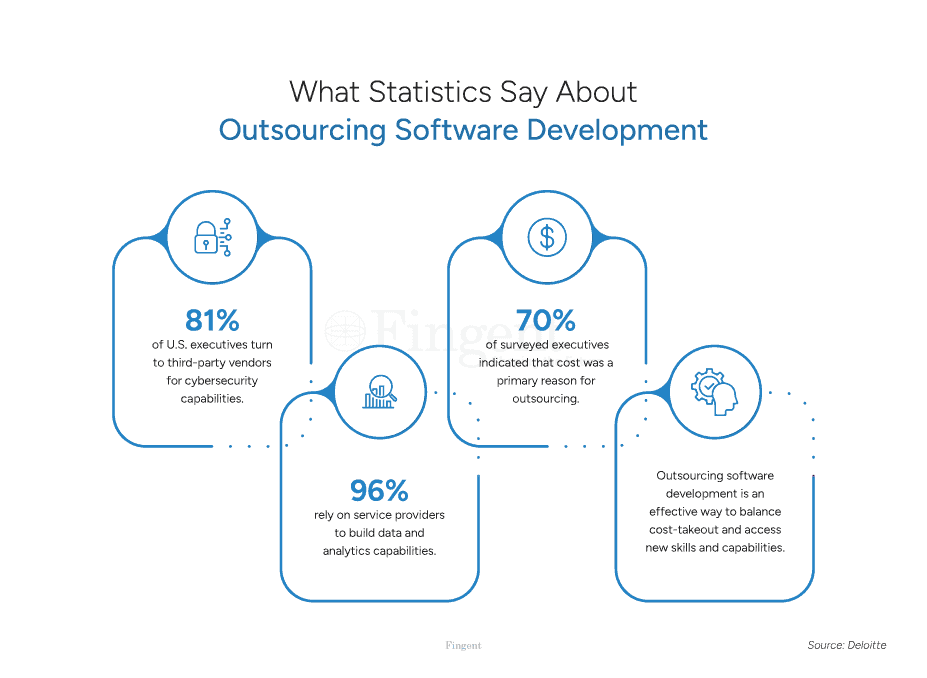

According to a survey by Deloitte, 79% of U.S. executives currently outsource software development. However, any business application is only as good as the developer who creates it. Choosing the right software development partner is a crucial responsibility.

If your business plans to hire an app development partner, here’s a quick checklist that can help. But before we get started, let’s look at why you need to choose the best software development vendor.