How Embedded Finance will Transform the FinTech Landscape in 2024

Embedded finance, aka embedded banking, is transforming the financial services distribution model. E-commerce companies, Point-of-Sale systems, ride-sharing apps, food ordering apps, and other digital financial service providers consider it a revenue opportunity.

Is 2024 the Beginning of the Embedded Finance Era?

With over $7 trillion in revenue, embedded finance has generated a significant buzz in the FinTech market. Sadly, the financial services industry has not upgraded its core business model in years, and the COVID-19 pandemic has made the need even stronger than before.

While banks and insurance companies have spent exorbitant amounts of money digitizing their existing processes, it is high time that they invest fully in creating digital business models to recover the economic crisis.

Read more: The New Untapped Opportunities for FinTech Companies in the Coming Years

Embedded finance helps businesses overcome digital adoption barriers and offer outstanding financial services to customers. While embedded finance will benefit the economy globally, its potential implication for the FinTech industry is massive.

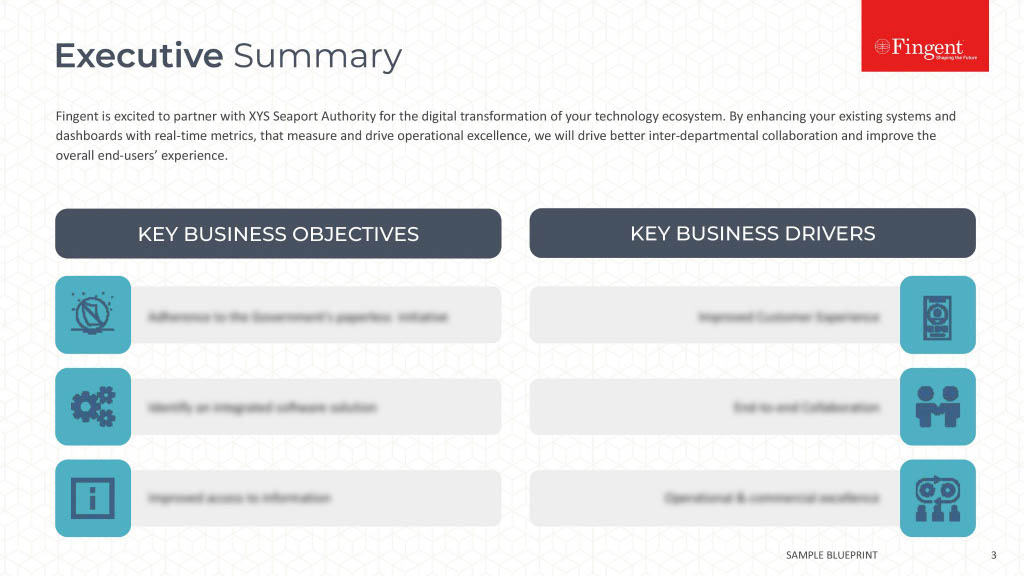

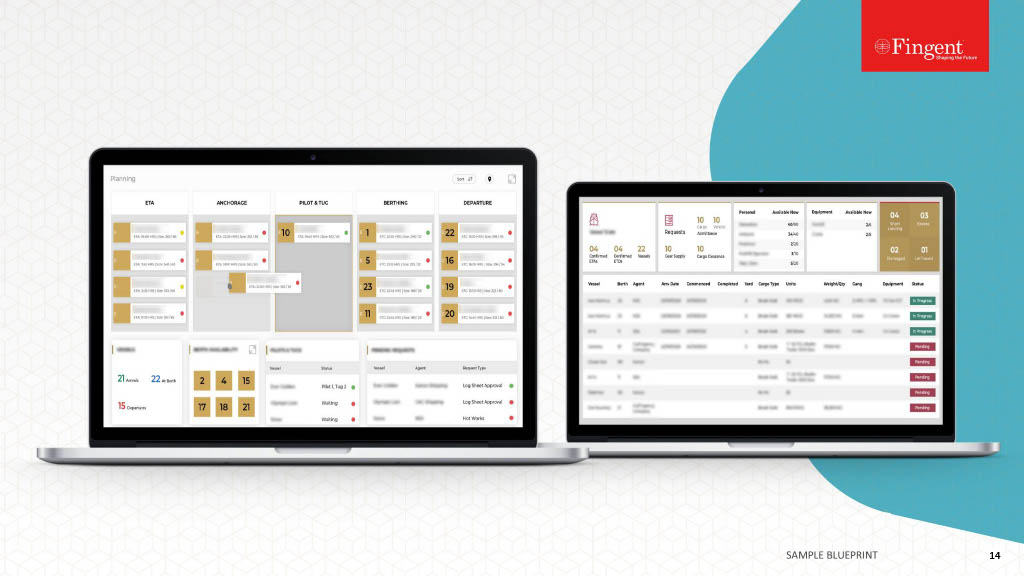

Fingent’s FinTech application development services continuously provide financial service and technology innovations, valued by global financial services institutions.

What is Embedded Finance?

Embedded finance is the amalgamation of a non-financial service provider with a finance service. It allows enterprises to create new revenue streams and reinvent the services they offer their customers. It is beneficial to both the enterprises as well as users. In most cases, it is easier to buy products from one single source instead of interacting with many other businesses over the day.

FinTech is already growing at a significant rate, and the pandemic has caused more people to use day trading platforms from lending sites to stocks.

As the world will start incorporating FinTech in their lives, embedded finance opportunities will increase in the future.

What are the opportunities for Embedded Finance?

The most significant advantage of embedded finance is that it streamlines financial processes. Previously, there was a gap between a consumer and the service provider or seller. So, the consumer would often approach a lender or a bank to bridge the gap. However, with embedded finance, the need for a third-party bank or lender is eliminated. Here are a few examples to understand how embedded finance can help you.

Read more: FinTech Innovation: What Is In Store?

1. To make payments

For some consumers, paying with cash for a purchase hurts, making them reconsider a purchase. Embedded systems help eliminate this pain. A consumer using a mobile app with an embedded payment program can tap a few buttons and make a purchase instead of digging into their wallets for cash – for example, a ride-sharing app like Uber. So, when you book your ride, you don’t have to pay the driver cash or pull out your debit or credit card at the end. Instead, you complete the transaction in the app after you reach your destination. You can also use the embedded system to order your favorite cold brew or lip-smacking snack from Starbucks. The mobile app allows users to order and pay for their best-loved delicacies. Starbucks’ online ordering system also rewards customers with redeemable points for every purchase.

2. Lending

Before embedded finance, a person had to apply for a bank loan or open a credit card if he/she needed to borrow money. However, with an embedded system, a person can apply for and secure a loan at the time of purchase.

Klarna and AfterPay are examples of embedded lending. These programs split an online purchase into smaller monthly payments. For instance, a payment of $100 can be divided into four installments with $25 each.

Read more: FinTech: Safeguarding customer interest in the post-pandemic world

3. Insurance

The need to consult an insurance agent or broker for purchasing an insurance policy is eliminated with embedded insurance programs. In the past, buying insurance was needed to buy a car or a house. Also, it was a completely separate part of the process. Some companies have now found ways to speed things up and increase their bottom line by embedding the action of applying for an insurance policy into making a necessary purchase.

For example, Tesla offers an insurance program that allows people to purchase an appropriate amount of coverage almost instantly. Additionally, the insurance available directly from Tesla costs less than a policy from a third-party insurance provider.

4. Investment

Most people feel investing is a complicated process and prefer to stay out of it. However, embedded banking programs help simplify the investing program.

For example, Acorns is a program that invests your spare change by rounding up purchases, thus making investing seamless and touch-free. It doesn’t require you to manually pay back the money since the app takes care of that. They adjust their portfolio according to the market, and so you don’t have to pay attention to the values of mutual funds or stocks.

How can enterprises use embedded finance or banking in their products or services?

Organizations can embed finance or banking in several ways. Even companies that are not in the FinTech industry are seeking ways to offer financial services. For instance, Shopify is offering lending services and bank accounts to companies. Organizations like Udaan and Grab have also started financial services like Udaan Credit and GrabPay.

In some cases, companies can act as connectors between financial services and non-financial businesses. For example, organizations can use a data transfer network by Plaid to offer financial products.

Another option for companies is that they can work with businesses that embed the required infrastructure into their products or services. With an increasing number of transactions and payment processing, the platform ecosystems can expand quickly, giving rise to the need for external financial services.

Read more: Technology in Finance: What to look out for in 2021?

How is embedded finance beneficial to companies?

1. A new revenue system

Most customers show displeasure when redirected to multiple applications or experience a failed transaction due to timeout. The best resolution to this issue is to have a single unified flow in the customer journey. Customers would stay loyal to a brand if they have an easy-to-use eCommerce website.

Companies can charge a small fee as a commission on such transactions. It helps companies to have a new revenue opportunity without investing in bringing in new customers.

2. Increased hit rate/footfall

Embedded finance products can boost footfall if they can provide an overall improved experience. Given the cut-throat competition, customer loyalty can decline when a better product is launched in the market. Consumers will not hesitate to switch their allegiance to a competitor as long as they get what they need.

Companies can expect an increase in hit rate and better scope of converting users to potential customers with embedded finance products. If the transactions are smooth, the conversion rate will improve.

3. Use existing resources

Organizations need not worry about the expenses and resources needed to acquire new customers or procure high-level infrastructure. By including a financial angle to create an embedded product, you can modify the current systems.

4. Improved customer experience

Embedded finance helps companies create a unified journey for their customers. Offering more services to the customers will eliminate their need to deal with a third-party vendor for completing their transactions. It will result in higher profits. The direct connection between the customer and the company will help improve the customer experience significantly.

Read more: Digital Transformation in Financial Services: All You Need to Know

How will embedded finance change the future of the FinTech landscape?

With the evolving nature of technologies, embedded finance will persist due to its customizable nature. It will give rise to new opportunities and reduce the gap between various industries and their interactions.

Companies must be open to collaborating to build a bigger market, survive, and stay ahead of the competition. Software solutions providers and technology companies like Fingent play a crucial role in boosting the financial services landscape. Contact us to know more about our FinTech software development services and solutions.

Stay up to date on what's new

Recommended Posts

04 Mar 2025 Financial Services

The Future of Payments: How Fintech is Redefining Transactions

Envision a reality where transactions occur in an instant, driven by advanced technology. Blockchain removes the middleman. Digital wallets replace bulky purses. Payments are now a tap or a swipe.……

25 Jun 2024 Financial Services B2B

Business Intelligence in Financial Services: Unlocking Data-Driven Success

Business Intelligence in Financial Services is proving to be a game changer. Business intelligence is a novel technology backed by AI. It is a combination of strategies and processes. Simply……

24 Mar 2023 Financial Services B2B

Reimagining the Financial Industry for a Digitized Society

Digital technologies are evolving at an unprecedented rate. Major innovations, such as artificial intelligence tools, machine learning software, cloud computing resources, and big data, have already reshaped the landscape of……

02 Jun 2022 B2B

Deliver Financial Services That Separate You From Your Competition

Your Financial Service business needs software solutions that fully consider all the individual features of your services. Why? The best financial advice must be provided in real-time and should be……

Featured Blogs

Stay up to date on

what's new