Category: Banking

Business Intelligence in Financial Services is proving to be a game changer.

Business intelligence is a novel technology backed by AI. It is a combination of strategies and processes. Simply put, BI collects, cleans, formats, and analyzes data.

No big deal? Think again!

In a world that is ruled by data, this is a superpower.

Business intelligence is, in fact, a CFO’s best friend. It enables users to perform a wide range of activities with great ease. Since their advent, BI solutions have played a key role in banking and finance services. Business Intelligence in Financial Services offers priceless tools for risk assessment and cost management plans. They also provide detailed customer insights – a 360-degree view of the customer, which is priceless. So, in our current era, where data is everything, BI has become a valuable asset that offers support in decision-making.

Let’s discuss this in detail. First, let’s talk about the elusive 360.

Elevate Your Customer’s Digital Banking Experiences

The Need for a 360-View of Customers and Buyers in the Store

This technology is growing in popularity. It has become a well-favored tool among companies worldwide. A recent report predicts growth in the global business market. The predicted price for business intelligence and analytics software applications is $18 billion by 2026.

The concept of a 360-degree view is vital for businesses to function while predicting customer needs. This paves the path for meaningful insights and allows for more personalized interaction. The benefits of this method are listed below.

1. Superior Customer Understanding: The 360-degree view allows business owners to predict customers’ needs, allowing for more personalized interactions and rapport-building.

2. Personalized Marketing: Businesses can understand the customer’s preferences through the customer journey map. This map enables businesses to unravel customers’ thinking and curate marketing strategies, ensuring higher engagement and conversion rates.

3. Improved Customer Service: A 360-view means that the service representatives can access a customer’s entire history. Based on the client’s past behavior patterns, this method provides customizations. This personalization is evident in their interactions with you. In turn, it boosts customer satisfaction.

4. Operational Efficiency: With 360-degree view data collection, businesses can streamline their processes, making operations smoother and more efficient. The 360-degree customer view is a method that has revolutionized customer-service provider interactions. These conversations give clients a unified view of the customer’s journey. They also enable collaboration between different departments.

Why Do You Need a BI Strategy for Your Financial Business?

Technology is rapidly growing, and the amount of data generated in today’s business world is enormous. We create around 2.5 quintillion bytes of data every day!

Legacy financial processes have started failing. They don’t have the right tools to handle this much data. An efficient business intelligence strategy would be your knight in shining armor. It enables you to measure and evaluate performance. You can also identify competitive advantages and make informed, data-driven decisions. Other reasons why you should install this technology into your financial services include:

1. Better Decision Making

Business Intelligence implements Predictive Analysis to enrich the decision-making process. This derivative of AI can learn encoded data, recognize recurring patterns, and make accurate predictions. This greater visibility into potential outcomes based on past performances is the best tool for a business. Companies with an efficient BI strategy can gain insights on their customer behavior. This arms them with the ability to anticipate trends in the market and adjust business operations accordingly. Subsequently, the company’s risk of losses due to market shifts also drops.

Additionally, Business Intelligence improves communication between departments within the company. Employees can share meaningful insights from various datasets, removing the need to rely on anecdotal evidence. Working together towards a shared goal will boost efficiency and increase profits.

2. Increased Operational Efficiency

With a strong BI strategy, companies can streamline internal processes. They can also analyze employee behavior and performance to uncover hidden talent. Data analytics, a subset of BI, can shed light on how to optimize efficiencies within the organization. Companies with BI systems generally switch from manual, time-consuming labor to automated systems, which makes them more agile and frees up resources.

3. Solid Risk Management

Predictive Analytics and Machine Learning are potent tools for a business owner. These systems can also assess risks while predicting future trends. With these risk insights, companies can avoid making certain investments and commitments. This will help companies reduce losses that could hurt their bottom line if left unchecked.

4. Boosts Customer Retention

Financial business intelligence equips you with the most current information on customers. Banking and finance institutions can keep their marketing and sales teams armed. With BI’s help, your teams can recognize the organization’s most loyal and profitable clients. This information is gold as teams can concentrate their efforts on retaining these customers. They can also gain insight into the kind of customer that they can attract to their business,

5. Offers Competitive Edge

Due to its long list of perks, the BI strategy has the power to give you a strong competitive edge in the market. It also helps you streamline the best BI solution vendor for your financial business. These services are also integrated with superior features.

6. Reducing Costs

Cost-effectiveness is a quality check for the business intelligence strategy you use. Using predictive analytics and other BI tools, budgeting becomes more precise. Resource allocation is thus streamlined, and opportunities for cost reduction are identified; an efficient BI strategy will oversee training offerings and associated costs as well. This will help you budget and reduce unforeseen spending.

How Is AI Transforming Financial Services: Use Case and Applications

How Can You Build a Successful BI Strategy for Your Financial Services Business?

A solid BI strategy can improve customer retention, optimize costs, and provide competitive advantages. It is vital for your plans and business goals to align with your Business Intelligence strategy to make it a success. Here are the key steps involved in building an efficient BI strategy:

1. Assess and Define Your BI Ecosystem

Gather all the information you need before embarking on this journey. A sound data plan is vital for your implementation. It should include identifying data sources and visualizing a strategy. Gather relevance from your data sources (clients, projects, sales, marketing, finance, etc.) You can organize them by department, function, or business impact to streamline the process. Visualizing a strategy will encompass discussing the company’s vision with stakeholders. Create an alluring presentation for them with the help of a designer. In your presentation, be sure to highlight the reasons and benefits of a BI strategy.

2. Budgeting

Your immediate next step is to develop an accurate budget. Without planning, the BI strategy implementation process can be expensive and can cause financial strain for the company. Developing a strategy beforehand will prepare you for any unforeseen expenditure.

3. Assemble Your BI Team

Select a group of proficient employees to work as your BI implementation team. Include company stakeholders in the team to keep them in the loop. Your team should include an HR employee, a scheduling officer, one from the union, and a legal assistant. This will be your army, as it were, so ensure you make the right choices.

4. Choose Your BI Platform

Your business goals are bound to change. Aim to install BI software that provides self-service templates and easy usability for beginners. This step is very important because it will define how your company is affected during and after implementation. Take your time, explore various platforms, and carefully make your pick.

5. Select Your BI Software Partner

This is a delicate journey. Be bold and decisive when you reach this step. Remember that the partner you choose will guide you throughout. Compare different partners to rate their different features. Lastly, combine this with previous reports and review them. Conducting demos is the most effective method for this step.

6. Plan User Training

Imagine if, after all the effort put into implementation, no employee is equipped to handle the aftermath. A true disaster! This is why planning early user training is so important. Once you have decided on a service provider, it’s time to plan your training program. Sometimes, service providers provide video training and live classes. This helps users set up and get familiar with the software. Training will help employees stay updated on insights and learn the best features.

7. Refine Your Data

This is the last stage of preparation to build a successful BI strategy. Refine your data structures and remove waste. The cleanest data possible will yield the best productivity results. The quality of data you enter into Power BI will affect the quality of insights you get, so it’s crucial not to underestimate this step.

How Does Business Intelligence Benefit Financial Services?

A solid BI strategy can improve customer retention, optimize costs, and provide competitive advantages. Here are some top benefits of implementing BI into your financial service strategy:

- Real-time insights: Financial BI can spontaneously access any financial data recorded, allowing for quicker and more informed decision-making.

- Improved reporting: Writing reports is a tedious job that can be automated with financial BI. This frees up employees to take part in analysis and interpretation.

- Cost savings and revenue growth: Financial BI can help businesses recognize areas of incompetence, cut costs, and discover new revenue streams.

- Increased efficiency: Financial BI can automate and streamline financial processes, reducing manual work and avoiding the risk of human error.

- Transparency and collaboration: With financial BI, communication between other departments and finance is reinforced.

How Can Fingent Help in Bringing Business Intelligence to Your Financial Service?

Fingent is known for using cutting-edge technology to ensure the best outcomes for clients. These technologies include machine learning, natural language processing, and more. These can be fashioned into valuable Business Intelligence tools customized for your business.

We can help your financial organization stay ahead of the competition. The software designed for you will ensure that your organization remains resilient regardless of any form of disruptive circumstance. Experts at Fingent empower businesses to maintain momentum with new developments. They also measure the effect of changes on customer requirements. Our custom software development experts at Fingent can help you understand everything you need to know about business intelligence.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

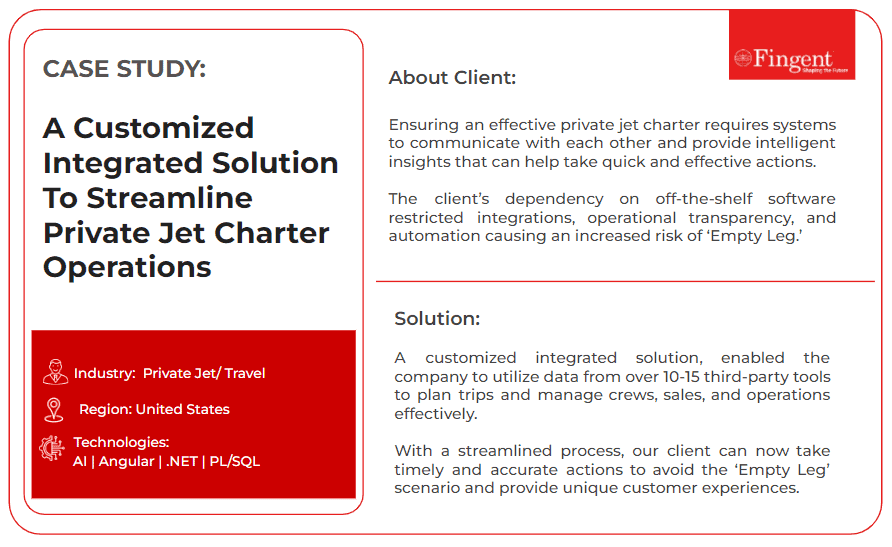

“Aviation is the branch of engineering that is least forgiving of mistakes.” – Freeman Dyson, British-American theoretical physicist and mathematician.

The truth in that statement is sobering indeed. The precision and skill needed to perfect a safe flight plan involves an army of brilliant minds. The process flows onto the nitty gritty of running the day-to-day tasks of the industry as well. That is where AI comes in.

“Artificial intelligence is not a substitute for human intelligence; it is a tool to amplify human creativity and ingenuity.” – Fei-Fei Li, co-director of the Stanford Institute for Human-Centered Artificial Intelligence.

Let us look into how AI is transforming the Aviation industry.

An Introduction to Aviation and Artificial Intelligence

The aviation industry includes nearly every facet of air travel as well as the operations that support it. By extension, this covers the entire airline sector, as well as the production of aircraft, research firms, military aviation, and much more. Aviation management includes a wide range of tasks like managing airport safety and security, air traffic control, airport operations, aircraft maintenance, and airline operations. The ideal pricing strategy for an airline will always vary depending on its unique business objectives, route network, and market competition. The use of strategic communications to market an aviation or aerospace company to decision-makers is known as aviation and aerospace marketing.

Where AI meets Aviation:

Artificial intelligence has revolutionized modern aviation, especially in connection with the modern airport. Recent reports by Radix state that “the artificial intelligence (AI) market, currently valued at $328.34 billion, is anticipated to expand by at least 120% annually”.

AI is already improving the efficiency and convenience of air travel by automating mundane procedures in airports. In the future, artificial intelligence (AI) in aviation will primarily focus on digital transformation projects to enhance customer experience, speed up procedures, lower costs, and explore many more benefits of such cutting-edge technologies. According to research, approximately 38% of airports plan to use AI for tailored marketing in the near future.

Read Case Study: How Fingent’s Customized Integrated Solution helped a Private Jet company streamline their operations.

Specific Areas AI Can Indent An Aviation Company

Artificial intelligence (AI) has already enabled autopilot technology to go from basic instruments for maintaining aircraft altitude to completely autonomous flight control systems that can operate gate-to-gate without requiring human intervention.

Furthermore, it can also be used by airlines and other operators for ground operations, flight planning, and fleet optimization. AI tools can help engineers designing airplanes create and certify goods more quickly and easily before they are even put on the market. Pricing strategy and marketing modules are two of the most critical areas that AI is impacting.

Pricing Strategies

Airlines are transforming passenger engagement and revenue optimization by utilizing Artificial Intelligence (AI) to harness the possibilities of personalization and dynamic pricing. We’ll explore three of these key artificial intelligence-driven tactics.

1. Dynamic Pricing For Tickets: Conventional pricing models frequently find it difficult to adjust in real time to changes in the market. However, this is where AI excels.

- Customer Division: AI divides travelers into categories according to their willingness to pay and purchase patterns. Different consumer segments might have their pricing methods customized to ensure that the price is appealing to them.

- Competitor Observation: Artificial Intelligence (AI) solutions enable airlines to promptly respond to shifts in the competitive landscape by monitoring the pricing and strategies of their rivals.

- Supplementary Services: AI maximizes the cost of both tickets and add-ons like checked baggage, in-flight Wi-Fi, and seat preference. Airlines can optimize their ancillary revenue by determining pricing that appeals to travelers.

2. Personalization Pricing Modules: Airlines are now able to customize services, offers, and experiences to each passenger’s specific interests and behaviors thanks to machine learning algorithms. This degree of personalization is available from the reservation procedure all the way through the in-flight encounter, leading to a flawless travel experience.

- Customer Segmentation and Profiling: To generate thorough client profiles, AI algorithms can examine a wide range of data sources, such as previous booking histories, travel trends, and even social media activity.

- Customized Deals and Services: Airlines can create customized offers once they have unique profiles in place. These customized deals increase passenger satisfaction and foster client loyalty.

3. Real-Time Demand Analysis: Real-time analysis and demand fostering generally fall under dynamic pricing, but they are also similar to personalized models.

- Analyzing Data in Real Time: AI systems monitor the market, demand patterns, and pricing strategies of rivals in real time to modify ticket prices. This guarantees airlines’ continued competitiveness and revenue maximization.

- Demand Forecasting: Artificial Intelligence is able to forecast changes in demand for particular flights and schedules. Then, airlines can modify their pricing to maximize income during busy periods or fill unfilled seats.

Marketing Model

AI is capable of analyzing enormous volumes of data to spot possible safety hazards, forecast equipment malfunctions, and support preventative maintenance, all of which increase overall aviation safety. As per reports, AI in aviation was estimated to be worth USD 686.4 million in 2022, and between 2023 and 2032, it is expected to grow at a compound annual growth rate of more than 20%. In order to manage air traffic and optimize flight routes, airlines and aviation corporations look for AI software solutions. Two key ways that AI influences marketing struggles in the aviation industry are:

1. Targeted advertising: Many neighboring industries utilize AI to optimize their advertising procedures and make them more attractive to the right audience. With passenger services like chatbots and tailored suggestions, AI can bring in more customers and revenue to airlines while simultaneously boosting customer satisfaction levels.

2. Monitor emails: The majority of requests for private flights are made via email, which means that operators must perform the tiresome chore of reviewing emails once an hour. With the help of AI, team members can react to travel requests more quickly and arrange flight schedules more easily by sifting through emails and selecting those that best fit what the business has to offer.

The Future Of AI In Aviation

By now, it must be evident how useful AI is to the Aviation industry. Furthermore, according to research, it is predicted to grow at a 37% annual rate of growth between 2023 and 2030, reaching US$ 12.1 billion by the end of 2031. Some emerging trends and advancements to look out for are:

Autonomous Aircraft: By decreasing human error, boosting productivity, and possibly even enhancing environmental sustainability, the development of autonomous aircraft might completely transform air travel.

- Data security: As AI systems are used more frequently, there is a greater need than ever for strong cyber security defenses against online threats.

- Workers Adaptation: As AI technologies are integrated, the aviation sector will need to upskill its workers and create new positions that reflect the shifting job market.

- UAVs (unmanned aerial vehicles): These drones with AI algorithms installed can effectively scan large areas, giving security operations useful data.

- Predictive maintenance: AI systems that can precisely forecast the need for maintenance by evaluating data from sensors integrated into aircraft components by reducing downtime and enhancing overall safety; this proactive strategy assists airlines and maintenance teams in identifying any problems before they become more serious.

- Customer assistance: Customers may soon be able to utilize AI-powered devices like Amazon Alexa, which can be connected to an airline’s mobile app. After that, Alexa may be used to respond to queries, deal with typical issues, track flight statuses using their numbers, manage check-in requests, and find out if amenities like Wi-Fi are available while flying.

- Passenger identification Kiosks: It is anticipated that AI will be used soon to provide self-service flight check-in. Consumers will utilize this technology in facial recognition kiosks. It is anticipated to enhance customer satisfaction and enable quicker check-ins and client flow at the airport.

How Can Fingent Help Aviation Companies Explore Capabilities with AI Better?

Here at Fingent, we believe using emerging technology can help industries reimagine processes and find possibilities in impossible challenges. We enable organizations to look beyond digitalization and create innovations that change lives by providing them with easy-to-use and quickly implemented software solutions.

Fingent combines the full force of its expertise in many facets of technology to bring you a solution that will fit your needs. This includes the power of augmented, virtual, and mixed realty, data analytics, network, and infrastructure security, and more.

We use an agile process to create dependable, high-quality, reasonably priced solutions that have an impact. In addition to our well-known post-installation care, we provide excellent customer service and knowledgeable support from the beginning to the end of the implementation. Give us a call, and lets create a custom solution that will help your aviation business reach new heights.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How the insurance industry delivers service has evolved significantly in the last decade.

Regardless of what form of insurance sales or policy management your organization is engaged in, you can attest that face-to-face interactions are no longer routine and are, in fact, an oddity.

As the insurance industry’s new normal, more and more interactions between customers, industry experts, other organizations, and adjustments claims occur digitally. Though phone-based communications will continue to be a part of the customer service process for the foreseeable future, customers, care providers, other insurers, and virtually anyone else with whom an insurance company interacts have come to expect a largely digitized experience.

For any organization to thrive in the insurance industry of tomorrow, it must take steps to evolve its processes today. That means creating a cohesive modernization strategy and investing in leading-edge technology solutions.

Read more: Answering the Burning Questions of Business Leaders on Digital Transformation!

Top Challenges Facing the Insurance Industry

To understand what a modernized strategy looks like in the insurance industry, it’s vital to examine some of the top challenges businesses will face in the coming years.

1. Staffing Shortages

Historically, the insurance sector has contended with turnover rates somewhere in the range of 8-9%, according to Insurance Business America, but that span climbed to 12-15% by September 2022.

That additional turnover significantly impacts business continuity and diminishes the customer experience. It can also negatively influence insurers’ ability to replace members of leadership that are retiring or stepping away from the industry.

2. Skyrocketing Costs

Inflation and numerous other factors have contributed to rising costs of everything from healthcare to vehicles higher than ever before. Naturally, some of these cost increases are passed onto insurers and their customers, so insurance companies must find ways to absorb some of these expenses while mitigating rate increases for their clients.

Insurers should also explore ways to reduce their operating costs to keep coverage prices lower. Otherwise, businesses may find it challenging to retain customer accounts, particularly in sectors like automotive insurance, where consumers can freely shop around and change policies in six-month intervals.

3. Antiquated Legacy Systems

Some legacy systems hinder the ability of many businesses to embrace digital transformation. These aging platforms can make it challenging to comply with relevant regulatory requirements and increase an organization’s overall operating costs.

The longer that insurance companies cling to antiquated systems, the harder it will be for them to streamline traditionally tedious practices, such as claim management. Therefore, insurance companies must replace these inefficient, disjointed platforms with modern, unified alternatives.

The Role of Digital Transformation in Solving These Challenges

Digital transformation can bring modern technologies to any business process to improve its operation. Fast-growing digital transformation technologies include machine learning, artificial intelligence (like ChatGPT), customer relationship management platforms, and intelligent document processing software.

Digital transformation holds the key to solving the insurance industry’s most significant problems, and it appears that many in the industry realize this, as recent projections estimate that insurance technology spending will increase by 25% between 2022 and 2026 in the US and UK.

A cohesive digital transformation strategy will lay out a roadmap for replacing aging technologies with modern alternatives, and once these technologies have been replaced, the cost savings are almost immediate.

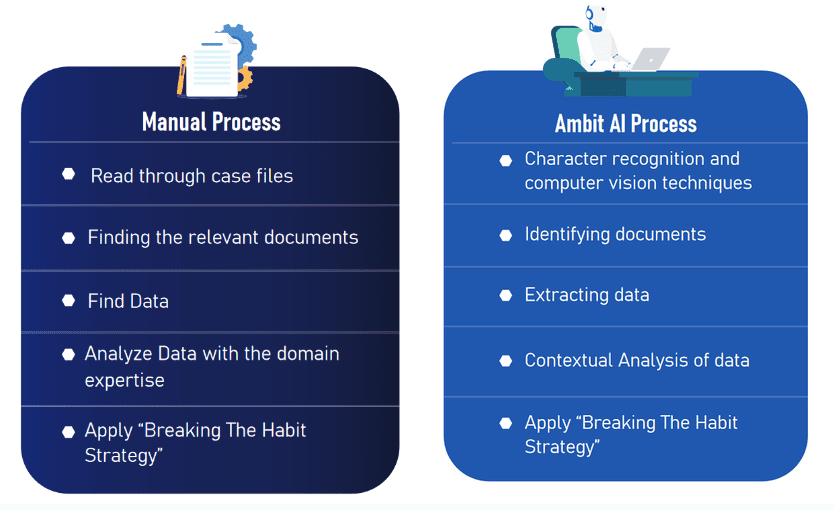

In one example of how a digital transformation strategy led to practical innovation, Fingent joined forces with the California law firm of Sapra & Navarra, LLP to develop Ambit, an AI and ML program that simplifies and enhances the management of workers’ compensation claims. Claims may include hundreds of pages consisting of a variety of letters, affidavits, forms, and other documents from claimants, doctors, lawyers, investigators, employers, and witnesses, among others. Utilizing both artificial intelligence and machine learning, the Ambit system streamlines the claims management process, reducing claim costs, and helps break the old practices of:

- Taking too long to assess claims

- Treating similar claims inconsistently

- Not equipping claim adjusters with modern tools

Instead, Ambit improves the efficiency of all parties — insurance carriers, self-insured companies, lawyers, and claim adjusters — while reducing costs for insurers by 57%.

The Ambit solution was designed to:

- Easily ingest the many documents in the claims process

- Quickly identify missing, processed & corrupted pages

- Review structured and unstructured documents automatically

- Identify areas of concern

- Suggest potential legal defenses

- Automate calculations and reminders for important legal deadlines

- Generate case summaries, with action plans

These automation capabilities not only make life easier for claims managers but enable organizational leaders to offset productivity issues created by ongoing labor shortages by reducing onboarding time for new hires. These capabilities result in more uniform handling of the claims while speeding their resolution and lowering their overall costs.

In general, automation technologies, such as those implemented during a digital transformation initiative, will also decrease operating costs, enabling insurance companies to increase their profitability and offer their customers more competitive premiums.

Read more: How AI Drives Digital Transformation In The Insurance Industry

The Essential Components of Digital Transformation

The technology trend in insurance is clearly moving from the strictly paper-based methods of the past to the digital. Beyond static websites to mobile apps. Beyond email to text and chat. Beyond processes driven by people to more and more intelligent automation that speeds up and uniformly handles all kinds of processes from marketing, and operations, to customer service.

Every organization’s digital transformation roadmap should be as unique as the business itself, but every digital transformation strategy must include a few core elements:

- Clear objectives

- An integrated plan

- A leadership-driven approach

- Investments in the right technology

When creating your organization’s digital transformation strategy, you should start by defining your “why.” In other words, you must identify the reasons you are undertaking this initiative in the first place.

From there, work with a digital transformation partner who can help you create an integrated plan that includes everyone from executive members to line-level employees.

Digital transformation efforts — even small ones — require the active support of top management. Change is the hardest thing to achieve in the organization and without the sponsorship of the corporate leaders, the effort is unlikely to succeed.

Finally, you will need to replace outdated, inefficient technology with modern, robust solutions. When appropriate,

partner with a custom software development firm that can provide you with a purpose-built solution you need for your business. They are equipped with the personnel and experience to generate a solution in the minimum timeframe and without the need to increase in-house headcounts.

If your organization has been exploring ways to improve the customer service experience, increase productivity, improve profitability, and streamline its operations, it is more than ready to embrace digital transformation.

Successfully facilitating digital transformation requires a cohesive strategy, some cutting-edge technologies, a commitment to doing things better, and the right development approach.

Read more: Digital Twin Improving Predictability and Risk Management in Insurance!

How Fingent Can Accelerate Your Process

Naturally, the cornerstone of any digital transformation initiative is technology choices. These may be an off-the-shelf system for standard processes, the integration of existing systems or, your transformation may demand a custom solution that can accommodate your business needs unlike systems available to anyone else.

At Fingent, we specialize in creating resilient custom software solutions that are able to change and adapt according to your requirements. We work with insurance industry clients to help them streamline mission-critical business processes, and – as in all our projects – we accomplish this by providing dynamic, unique software that incorporates the most appropriate technology, such as the latest in machine learning and artificial intelligence technologies.

Connect with Fingent today to accelerate your digital transformation with the help of an experienced software development partner.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Here’s another feather on our hat!

Fingent ranks amongst the “The Best Software Development Companies In Education – 2022” listed by the leading consumer education website, Online Degree!

This year’s focus is a huge testament to the work done by Fingent to address the most critical development issues that educators and students are currently facing in online and distance learning applications. Fingent’s digital products, learning systems, and custom software solutions for education are more intuitive and user-friendly and help drive better results with technology for educational institutions across the globe.

“With technology in the game, enabling people to quickly grasp concepts is not tough anymore, provided the right technology is implemented correctly. That’s where Fingent comes in! We make technology simple to access so that it can be leveraged to perform and provide the best!”

– Dileep Jacob, Senior Vice President – Global Operations, Fingent.

OnlineDegree.com is an educational platform founded by edtech startup veterans and academics in higher education. The site has appeared in hundreds of media outlets and publications for its work to educate working adults, academic professors, and administrators on various ways to improve the affordability and accessibility of higher education.

Ranking amongst the Best Software Development Companies in Education for 2022 is a big honor for Fingent and a step forward to many more innovations in the field of education. We believe in enabling industries to step into the future with smarter methodologies, renewed visions, and improved capabilities derived from the right technologies. Connect with us today, and learn how Fingent can help drive innovations and take your educational organization to new heights.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

The pandemic is now the biggest and most critical challenge of traditional banking. Some of these challenges are revenue pressure, data security, customer service management, data collection and analysis, risk management, and so on. These are the warning lights and alarm bells that call for caution over emerging risks. AI (Artificial Intelligence) has gained recognition as an effective solution.

AI is empowering the banking industry to provide individualized frictionless customer experiences. It is driving customer loyalty and profitability by automating banking processes.

In this article, we will discuss how AI can resolve banking challenges. We will also discuss some of the common challenges banks might encounter in implementing AI and how a tech partner can help deploy AI better.

How AI Can Resolve Banking Challenges?

AI is the new electricity – Andrew Ng.

Modern technology such as AI can be tailored to the specific needs of the banking sector. The digital age is opening up new opportunities. According to a Business Insider research report, banks are expected to save an estimated $447 billion by 2023 with the help of AI applications. Given that, here is how AI can resolve some challenges.

Read more: Digital Transformation in Financial Services: All You Need to Know

1. AI-enabled conversational interfaces

Chatbots are one of the most popular cases of applying AI in banking. Bots are programmed to communicate with thousands of customers with minimum expense. Insider Intelligence estimates that the adoption of chatbots could save the banking sector $11 billion annually by 2023.

Mobile banking has become the most popular and chatbot services attract users’ attention and create a unique brand identity. AI functionality in mobile apps is helping banks generate more revenue than when customers visit their branches. Banking organizations that leverage AI improve their quality of services and remain competitive despite the crisis.

2. AI-enabled data collection and analysis

Banks generate an enormous amount of data every day. Collecting and recording this data is an overwhelming task for employees. Besides, all this work may be a wasted effort if there is no proper plan to use this data. Hence banks need to determine the relationship between the collected data. That is another major challenge.

AI-based apps improve the user experience by collecting and analyzing data. The collected data then can be used to grant loans or fraud detection.

3. AI-enabled Risk management

Providing loans is a challenging task for bankers. Extension of credit to a fraudster can get the bank into difficulties. Or a borrowers’ economic downturn can adversely affect the bank. 2020 statistics show that credit card delinquencies in the US alone rose by 1.4% in a duration of six months.

AI-enabled systems can appraise a customer’s credit history more accurately. Additionally, AI-powered mobile banking apps track financial transactions and analyze user data to help banks anticipate the risks associated with the extension of credit.

4. AI-powered data security

Credit card fraud is on the rise. It is the most common type of personal data theft. AI-powered systems can analyze customer behavior, location, and financial habits. So, if it detects any unusual activity, it triggers a security mechanism immediately.

Read more: Artificial Intelligence and Machine Learning: The Cyber Security Heroes Of FinTech

When all these challenges are successfully tackled, how does the AI-powered bank look like? Read on to find out.

How Does The AI-First Bank Look Like?

AI-bank rises to meet customers’ expectations and remain competitive. The AI-powered bank will offer intelligent and personalized propositions and experiences as it understands customers’ past behavior. It can span across multiple devices providing a consistent experience to its customers.

What Are The Common Challenges Banks Might Face In Implementing AI?

Implementing AI technology in banking is not always easy. You need to ensure you have the right team and expertise. You will also need access to data, resources to invest in the project, and parties that are willing to adopt the new technology.

- Access to data: It is one of the biggest challenges to implementing AI. Additionally, banks might face challenges with training data. It becomes hard to update or improve the AI models if the team does not have the necessary information to use and learn from.

- Localization: Localization is critical to the banking sector as they often need to design models with multiple markets that they serve. Localization can help you properly customize the customer experience. Your data partner can support you with localization as they have skilled linguists to develop aspects such as style guides and voice persona.

- Security and compliance: It is quite challenging to keep all the data confidential and secure. The right data partner can offer a variety of security options. They have security standards to ensure your customers’ data is securely handled. Look for data partners who have strong data protection with certifications and regulations. They will be able to provide secure annotation. They will also provide onsite service options, private cloud deployment, on-premise deployment, and so on.

- Trust, transparency, and explainability: AI models can only be successful if they can be understood and trusted by customers as they will want to be sure that their personal information is handled and stored securely. Talk to your partner and ask them to explain the model to you. Or you can always go back to the training data that was used to develop the model and extract some explainability.

- Data pipelines: Connecting data pipeline components to use siloed data is not as easy as it seems. To do this effectively, banking institutions must ensure their data is collected and structured correctly. They must also ensure that this information enables ML models to predict according to the business goals. Look for a partner with extensive security offering as their expertise will enable your banking service company to be successful and scale.

Read more: The New Untapped Opportunities for FinTech Companies in the Coming Years

How A Tech Partner Like Fingent Help Deploy AI Better?

Implementing AI into banking is a serious responsibility. It takes in-depth knowledge, an enormous amount of time, and dedication to accuracy. That is what Fingent has. We do not just follow the trends. Instead, we focus on how AI can add value to your particular banking needs.

Fingent top custom software development company, can bring transparency and explainability of AI automated decision making to your banking processes. We can provide an easy-to-use interface through APIs delivered either on-premise, in the cloud, or as a SaaS offering.

By embedding AI and ML into our products, we can accelerate the release of explainable business models that will underpin new AI use cases. These can help create a seamless customer journey and automate manual processes with self-learning capabilities. We are confident that we can help you deploy AI better. Give us a call and let’s get talking.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Smart Contracts to Streamline KYC: A Big Leap in FinTech

The advent of online transactions has brought in improved convenience, speed, and cost advantages across various aspects of our lives. KYC processes, online shopping, insurance premium payments, internet banking, and a host of financial functions have witnessed a drastic transformation with the adoption of FinTech solutions.

Read more: Technology in Finance: What to look out for in 2021?

However, these digital advancements have also taught us that a person’s online identity is not always what it appears to be. Identity theft, phishing schemes, and money laundering are just a few examples of digital scams that have wreaked havoc in the finance sector. Shockingly, a report by PwC stated that “in 2020, the average US organization experienced six incidents of fraud in the last 24 months and customer fraud ranks first among them.” The total loss suffered by the US companies from the frauds is close to $6.5B (over the past two years).

As many of us know, the KYC (know-your-customer) process was designed to eliminate the risk of customer fraud. Various companies use KYC to verify their customers’ credentials with the ultimate aim to confirm that they are not fraudulent or engaged in any criminal activity. However, KYC is a labor-intensive, repetitive process that is prone to human error. This blog explains how smart contracts for KYC can solve problems related to customer fraud and identity theft. Before that, let’s consider what smart contracts are and how they work.

What are smart contracts?

Most industries are eagerly adopting blockchain technology for smart contracts. According to Statista, “in 2021, global spending on blockchain solutions is projected to reach 6.6 billion dollars and is expected to reach 19 billion US dollars by 2024.”

Investopedia defines a smart contract as a self-executing contract that entails an agreement between the buyer and the seller. A smart contract encodes the agreement/ transaction between two parties and exists across a distributed, decentralized blockchain network. Smart contracts eliminate the need for an external party or an intermediary to enforce the contract as defined. The decentralized blockchain network controls the execution of trusted transactions and agreements. All the transactions are trackable, irreversible, and impossible to manipulate because of the immutable audit trails created by blockchain.

In simple words, smart contracts are programs that run based on predetermined conditions. Participants engaged in a smart contract are sure about the outcome. The unique digital structure of a smart contract makes it super secure and resilient to any kind of data modification. What problems do smart contracts solve, though? Here are a few examples of real-world problems solved by smart contracts.

Read more: Leveraging Blockchain Technology to Transform Supply Chain Industry

How does a smart contract work?

A smart contract is a blockchain application. Just as a standard legal contract, a smart contract outlines the terms and conditions between two organizations. It works on a condition-based principle, that is: ‘if-when-then.’ Smart contracts allow you to define as many conditions or terms as you would require. Moreover, a smart contract enables both parties to interact in real-time, saving enormous time and resources. Additionally, it allows for anonymity, if needed.

How smart contracts assist banks and financial institutions to solve KYC-related problems?

1. Identity theft

Clients’ identity includes data on where they live, their passport number, driving license, security number, and so on. These data points are stored in centralized databases. If a criminal gets hold of one of these documents, they can exploit certain security flaws and steal your client’s identity. Cybercriminals can use your customer’s identity to gain some financial advantage or steal money. There have been occasions when a criminal successfully stole a deceased person’s identity to commit crimes.

Smart contracts on blockchain offer a novel solution that may include a comprehensive electronic signature service. It allows access to a private key and a public key. While a public key provides access to your public records, it offers concrete security as no one has access to change or edit your data. However, a private key allows you to give access to those required. This simple method helps prevent and restrict identity theft. Best-in-class data encryption technology ensures the highest levels of safety standards.

Read more: How Blockchain Enables the Insurance Industry to Tackle Data Challenges

2. Distributed user data collection

Smart contracts enable finance companies to uncomplicate the process of identity verification. It can make data available on a decentralized network. For example, claiming, verifying, and processing insurance has always been a labor-intensive task that frustrates your customers. Smart contracts offer a single source of truth, drastically reducing friction in the business process.

Here is how smart contracts simplify the process:

- Make data reconciliation easy

- Improve accuracy

- Minimize time spent in uncovering information

- Enhance improvements in speed and accuracy

- Improve customer experience

3. Automation and standardization of operations

Client data is collected daily. Name, address, and social security number are required for almost all transactions. Considering the recent progress achieved on KYC policy standardization, it is now possible to use smart contracts to control operations and execute agreements or transactions.

You can streamline the procedure across the industry by coding and standardizing the KYC workflow. It will minimize manual oversight and increase the effectiveness of the KYC system. It even allows you to implement multilingual solutions with the help of translation tools and smart contracts. Since smart contracts remove the need for a manual process for each document, decisions can be made quicker.

4. Comprehensive authentication process

It is crucial to verify the identity of individuals for data protection compliance and the prevention of fraud. A cryptographic verification solution is vital here. On the other hand, industries face another major challenge – allowing users to conduct online banking through apps. The glitch is that if a person loses her smart device, she exposes herself and the bank to a greater security risk.

Fortunately, the blockchain’s decentralized model almost eliminates the security risk by not allowing any edits on the data accessed by the thief or the fraudster. Once a smart contract on blockchain is formed, it remains immutable.

5. Communication and transparency

The smart contract will allow you to monitor everything from account openings to day-to-day transactions actively. Since the terms and conditions are pre-defined, it is recorded immediately, and remittance is raised automatically. This process avoids laborious approval workflows.

Since it allows for trust data to be stored on the KYC smart contract platform, banks or financial service providers can eliminate the secondary validation processes and cross-checking. Apart from this, when mistakes occur, they are quickly identified, reported, and solved. While transparency has to be dictated by the parties involved in traditional contracts, smart contracts always remain transparent. Such openness makes tracing transactions less cumbersome and could be traced right from the point of origin. Additionally, it automatically creates fully accessible history.

Read more: How AI and Machine Learning are Driving Cyber Security in FinTech?

6. Heightened security

KYC banking processes can go on for weeks, highly increasing the maintenance of regulatory compliance as the industry struggles to dodge financial fraudsters and terrorists. Fortunately, a shared ledger will help adjust and monitor the KYC process for all those involved. This would allow all parties to view any changes or updates made to the clients’ data. Such direct access would save on the time-intensive process of identifying suspicious activity and reporting it.

Read more: The New Untapped Opportunities for FinTech Companies in the Coming Years

Get smart with smart contracts!

As you can see, Smart Contracts are so much more than just an intelligent way of handling contracts. They are going to become the only way, and it’s time you get ahead of the competition by leveraging this technology. Contact Fingent, a top custom software development company, for all your software needs.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Embedded finance, aka embedded banking, is transforming the financial services distribution model. E-commerce companies, Point-of-Sale systems, ride-sharing apps, food ordering apps, and other digital financial service providers consider it a revenue opportunity.

Is 2024 the Beginning of the Embedded Finance Era?

With over $7 trillion in revenue, embedded finance has generated a significant buzz in the FinTech market. Sadly, the financial services industry has not upgraded its core business model in years, and the COVID-19 pandemic has made the need even stronger than before.

While banks and insurance companies have spent exorbitant amounts of money digitizing their existing processes, it is high time that they invest fully in creating digital business models to recover the economic crisis.

Read more: The New Untapped Opportunities for FinTech Companies in the Coming Years

Embedded finance helps businesses overcome digital adoption barriers and offer outstanding financial services to customers. While embedded finance will benefit the economy globally, its potential implication for the FinTech industry is massive.

Fingent’s FinTech application development services continuously provide financial service and technology innovations, valued by global financial services institutions.

What is Embedded Finance?

Embedded finance is the amalgamation of a non-financial service provider with a finance service. It allows enterprises to create new revenue streams and reinvent the services they offer their customers. It is beneficial to both the enterprises as well as users. In most cases, it is easier to buy products from one single source instead of interacting with many other businesses over the day.

FinTech is already growing at a significant rate, and the pandemic has caused more people to use day trading platforms from lending sites to stocks.

As the world will start incorporating FinTech in their lives, embedded finance opportunities will increase in the future.

What are the opportunities for Embedded Finance?

The most significant advantage of embedded finance is that it streamlines financial processes. Previously, there was a gap between a consumer and the service provider or seller. So, the consumer would often approach a lender or a bank to bridge the gap. However, with embedded finance, the need for a third-party bank or lender is eliminated. Here are a few examples to understand how embedded finance can help you.

Read more: FinTech Innovation: What Is In Store?

1. To make payments

For some consumers, paying with cash for a purchase hurts, making them reconsider a purchase. Embedded systems help eliminate this pain. A consumer using a mobile app with an embedded payment program can tap a few buttons and make a purchase instead of digging into their wallets for cash – for example, a ride-sharing app like Uber. So, when you book your ride, you don’t have to pay the driver cash or pull out your debit or credit card at the end. Instead, you complete the transaction in the app after you reach your destination. You can also use the embedded system to order your favorite cold brew or lip-smacking snack from Starbucks. The mobile app allows users to order and pay for their best-loved delicacies. Starbucks’ online ordering system also rewards customers with redeemable points for every purchase.

2. Lending

Before embedded finance, a person had to apply for a bank loan or open a credit card if he/she needed to borrow money. However, with an embedded system, a person can apply for and secure a loan at the time of purchase.

Klarna and AfterPay are examples of embedded lending. These programs split an online purchase into smaller monthly payments. For instance, a payment of $100 can be divided into four installments with $25 each.

Read more: FinTech: Safeguarding customer interest in the post-pandemic world

3. Insurance

The need to consult an insurance agent or broker for purchasing an insurance policy is eliminated with embedded insurance programs. In the past, buying insurance was needed to buy a car or a house. Also, it was a completely separate part of the process. Some companies have now found ways to speed things up and increase their bottom line by embedding the action of applying for an insurance policy into making a necessary purchase.

For example, Tesla offers an insurance program that allows people to purchase an appropriate amount of coverage almost instantly. Additionally, the insurance available directly from Tesla costs less than a policy from a third-party insurance provider.

4. Investment

Most people feel investing is a complicated process and prefer to stay out of it. However, embedded banking programs help simplify the investing program.

For example, Acorns is a program that invests your spare change by rounding up purchases, thus making investing seamless and touch-free. It doesn’t require you to manually pay back the money since the app takes care of that. They adjust their portfolio according to the market, and so you don’t have to pay attention to the values of mutual funds or stocks.

How can enterprises use embedded finance or banking in their products or services?

Organizations can embed finance or banking in several ways. Even companies that are not in the FinTech industry are seeking ways to offer financial services. For instance, Shopify is offering lending services and bank accounts to companies. Organizations like Udaan and Grab have also started financial services like Udaan Credit and GrabPay.

In some cases, companies can act as connectors between financial services and non-financial businesses. For example, organizations can use a data transfer network by Plaid to offer financial products.

Another option for companies is that they can work with businesses that embed the required infrastructure into their products or services. With an increasing number of transactions and payment processing, the platform ecosystems can expand quickly, giving rise to the need for external financial services.

Read more: Technology in Finance: What to look out for in 2021?

How is embedded finance beneficial to companies?

1. A new revenue system

Most customers show displeasure when redirected to multiple applications or experience a failed transaction due to timeout. The best resolution to this issue is to have a single unified flow in the customer journey. Customers would stay loyal to a brand if they have an easy-to-use eCommerce website.

Companies can charge a small fee as a commission on such transactions. It helps companies to have a new revenue opportunity without investing in bringing in new customers.

2. Increased hit rate/footfall

Embedded finance products can boost footfall if they can provide an overall improved experience. Given the cut-throat competition, customer loyalty can decline when a better product is launched in the market. Consumers will not hesitate to switch their allegiance to a competitor as long as they get what they need.

Companies can expect an increase in hit rate and better scope of converting users to potential customers with embedded finance products. If the transactions are smooth, the conversion rate will improve.

3. Use existing resources

Organizations need not worry about the expenses and resources needed to acquire new customers or procure high-level infrastructure. By including a financial angle to create an embedded product, you can modify the current systems.

4. Improved customer experience

Embedded finance helps companies create a unified journey for their customers. Offering more services to the customers will eliminate their need to deal with a third-party vendor for completing their transactions. It will result in higher profits. The direct connection between the customer and the company will help improve the customer experience significantly.

Read more: Digital Transformation in Financial Services: All You Need to Know

How will embedded finance change the future of the FinTech landscape?

With the evolving nature of technologies, embedded finance will persist due to its customizable nature. It will give rise to new opportunities and reduce the gap between various industries and their interactions.

Companies must be open to collaborating to build a bigger market, survive, and stay ahead of the competition. Software solutions providers and technology companies like Fingent play a crucial role in boosting the financial services landscape. Contact us to know more about our FinTech software development services and solutions.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Technology in Finance: An Overview of the 2025 Landscape

Technology in finance, along with evolving consumer behavior and regulations, are transforming the financial services industry. The COVID-19 pandemic is accelerating the industry’s focus on digital offerings. Government payment schemes, emergency loans, and personal finance management are the need of the hour.

With several bank branches shut and long waiting hours for phone assistance, financial institutions are forced to invest in better IT infrastructure, relevant automation, and technology in finance to deal with the growing consumer demands.

Read more: The impact and significance of digital transformation in financial services.

A study of financial institutions (FIs) by ISMG and OneSpan in North America revealed that providing customers with a top-notch experience is their main priority. 49% of the respondents feel that legacy and manual ID verification are the biggest obstacles to digital opening for FIs, while 35% found that knowledge-based authentication tools were obstacles to onboarding.

Some general FinTech statistics worth knowing are:

- By 2022, the global financial sector is expected to be worth USD 26.5 trillion with a CAGR of 6%.

- 49% of banks and 60% of credit unions in the US believe that FinTech partnerships are worth it.

- Digital payment is one of the most significant FinTech products and holds about 25% of the FinTech market.

That said, many banking and financial institutions are adopting the latest technologies such as artificial intelligence, blockchain, etc., into their operations to benefit their customers, stay competitive, and improve business growth.

Read more: FinTech: Safeguarding customer interest in the post-pandemic world

Here are the top five technologies that transform the financial services industry currently.

1. Artificial Intelligence

The most crucial advantage of Artificial Intelligence in the finance industry is cost savings, which is anticipated to be worth $447 billion by 2023.

AI systems are a game-changer for the finance industry as they can examine vast amounts of data and find patterns and trends that people may miss, and even predict future trends. AI technology makes it possible to automate processes and manage tasks such as comprehending new rules and regulations or generating personalized financial reports for individuals. For example, IBM’s Watson is capable of understanding complex regulations, including reporting of markets’ requirements in the Financial Instruments Directive and the Home Mortgage Disclosure Act.

Chatbots in banking are helping automate simple tasks such as opening a new account or transferring money between accounts and are proving to be a great money-saving tool.

Many financial institutions such as Bank of America and JP Morgan Chase use AI to streamline customer service. Additionally, AI facilitates mobile banking that allows 24/7 access to customers to conduct banking operations. AI is also helping financial institutions boost security and detect and prevent fraud.

2. Blockchain

Blockchain is a promising technology that will impact financial systems significantly. Blockchain technology is inspiring to create several P2P (peer to peer) online financing platforms that help monetary interactions happen in a more decentralized way. Blockchain technology can improve existing systems and processes and create cryptocurrencies.

Five typical applications of blockchain include:

- Make cross-border transaction processes faster, more accurate, and less expensive

- Banks can leverage trade finance to create smart contracts between participants, increasing transparency and efficiency

- Clearing and settlement procedures

- Protect against fraud and speed up the verification process with blockchain-enabled IDs

- Credit-reporting

3. RegTech

RegTech is a regulatory technology that uses cloud computing technology through SaaS (software-as-a-service) to help businesses comply with regulations efficiently and lower costs.

The various areas of RegTech intervention are:

- Data management

- Reframing regulations and implementing new governances

- Real-time reporting

- Data- analytics and decision

- Fraud and risk management

Non-compliance with mandatory government rules leads to fines and crisis. So most FIs want to do everything in their power to avoid non-compliance.

The need for RegTech solutions is growing as FIs grapple to stay compliant with new and existing regulations. RegTech solutions will create a layer that companies will rely upon significantly. Its high accuracy, single dashboard, data analytics, alerts, and insights will help companies optimize resources allocated to compliance and achieve better results.

4. Machine learning

Similar to AI, machine learning helps create a marketing campaign around the consumer. It enables you to understand what kind of services will attract your target market. For example, how people find a financial website, what page they clicked, and what services they need.

Machine learning algorithms and their capability for sentiment analysis will impact trading significantly in the future. It involves using enormous volumes of unstructured data such as photos, video transcriptions, social media posts, presentations, webpages, blogs, articles, and business documents to understand the market sentiment.

Sentiment analysis will transform the future financial markets, and many believe that machine learning will be central to developments.

5. Big Data

According to the IDC Semiannual Big Data and Analytics Spending Guide, currently, banking is one of the top investors in big data and business analytics solutions. Credit card transactions, ATM withdrawals, credit scores, etc., generate massive amounts of data. Deriving actionable insights from this data is crucial to optimize financial processes and make effective business decisions. It will increase the competency of financial institutions in the future.

Big data can help FIs learn more about customers and make business decisions in real-time. Big data analysis allows FIs to identify market trends and streamline internal processes and reduce risks.

Read more: FinTech Innovation: What Is In Store?

The Future of FinTech Adoption

82% of traditional financial organizations plan to collaborate with FinTech companies in the next five years as they fear losing out. 88% of established FIs believe that they may lose to standalone FinTech companies in the next five years if they fail to adopt FinTech innovation.

Financial companies will have to work towards providing a seamless digital experience for their consumers. To avoid the risk of losing out in the market, many FinTech startups, incumbent financial institutions, and technology companies are entering into new partnerships.

Read more: The New Untapped Opportunities for FinTech Companies in the Coming Years

Technology in finance is no different than other disruptive technologies across various industries. It would be wise for even small businesses to consider FinTech as an investment for the future. Fingent has developed end-to-end disruptive technologies and innovative FinTech solutions that will help your business thrive and stay relevant. Contact us for more details.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

The inevitable role of FinTech in improving your financial systems and outcomes

The COVID-19 outbreak has affected every aspect of the economy including financial technology or FinTech. Postponed events and conferences mark missed opportunities for FinTech companies, which could have been a great time to build relationships and focus on new businesses. As investors and customers retreat to more cautious positions, FinTech companies may find fundraising a challenge. Those who seek consumer investments are hit harder. Consumers may be reluctant to invest during such volatile times. Even those consumers who are relatively insulated from economic fallout may choose to invest in safer options for the present. FinTech innovations can improve the efficiency of the financial system and financial outcomes for their customers. This article will discuss how FinTech can safeguard customers’ interest in the post-pandemic world.

What is FinTech?

FinTech is a combination of Finance and Technology. It is used to describe new technology that can improve and automate the use and delivery of financial services. It also enables people to live upgraded lives through innovation. FinTech includes many sectors such as fundraising, education, retail banking, and more. It plays a major role in the development and usage of cryptocurrencies. FinTech also covers various day-to-day financial activities including money transfers, check deposits, and investment management.

Read more: FinTech Innovation: What Is In Store?

Why protect customer interest?

Customers are the primary source of growth, so they must be handled with the respect they deserve. Any product or service which is customer-centric offers the potential to attract and retain customers. Since FinTech provides advantages of speed and convenience, customers are looking at FinTech as a viable alternative. People want streamlined services with applications that are easy to adapt to. Hence, FinTech companies are outlining measures to make their services less complex and more transparent. They are focusing on creating better digital processes that their customers can personalize easily.

Customers’ convenience and requirements are paramount for FinTech start-ups. To that end, they are designing products and solutions to ensure customer satisfaction. Delivering a top-notch customer experience is the goal of FinTech companies globally.

Measures to protect customer interest

Here are some cutting-edge technologies that are protecting customer interest now and into the future:

1. IT foundation for better customer experience

FinTech startups are usually smaller in size and have a technological edge. They have a fresh canvas, allowing them to migrate easily from legacy technologies. The younger digital-first audience is attracted to their services. Larger FinTech enterprises must adopt a new IT foundation with modern technologies. Currently, FinTech customers prefer startups over established brands because they can reap the rewards in the form of better digital experiences. Though startups have a technological advantage, they must continue to focus on their capital reserves to make it through these unprecedented times.

2. Digital communication tools

The FinTech sector is based on understanding the needs of their customers. It is crucial for these companies to strategize the manner in which service providers communicate with their customers. This gets customers locked onto their services with relative ease. Communication through online media or through the content on your site can draw in new leads and build customer trust. When customer interest is protected, they will most likely return to you. In turn, they will recommend the service to their relatives and friends. These parameters are crucial if you want to keep your business afloat.

3. Embrace digital transformation

While your staff may be susceptible to coronavirus, technologies like ML and AI are immune. The financial services system must address customers’ demands swiftly and efficiently. Smart devices and the integration of artificial intelligence are a great way to achieve this. Virtual assistants and chatbots can deliver a customized experience to your customers. They perform all the activities that are usually done by customer service personnel and other executives. However, these digital solutions are faster and reflect sophistication. Digital transformation provides holistic 24/7 monitoring and automated remediation.

Read more: Artificial Intelligence In Investment Management: What To Expect

4. Digital banking

Previously, a customer’s confidence in a financial company depended mostly on physical infrastructure. However, COVID has changed that momentously! The new generation banking system is going all-digital to reach mobile-first customers. Digital-only banks do not need sophisticated infrastructure or higher human resource management. Digital banks are able to deliver cost-effective, robust services that match the high standards set by traditional banks.

5. P2P Transactions

P2P digital payment is quickly gaining popularity. Customers are adopting such technologies for daily use. P2P eliminates the middle layer and drastically reduces transaction costs. Digital transactions help FinTech enterprises expand their footprints and customer base.

6. Security and privacy

FinTech is an industry where the risk of financial crime is high. It is vital for FinTech companies to think over customer security while designing their consumer experience. Apparent security measures make customers feel comfortable. Customers expect rigid security from FinTech solutions along with reliability and FinTech is practicing stringent security measures to beat the competition. They are making visible efforts to handle customer data with care. To gain the attention of your customers you can make your privacy policies visible enough on your website or app. Remember, it can reflect on the confidence a company has in its security measures.

Read more: Artificial Intelligence and Machine Learning: The Cyber Security Heroes Of FinTech

Changing for the better

It may be difficult to predict how the payments landscape will emerge in the next few years and what will be the long-term impacts on the FinTech industry. Nevertheless, it is likely to witness a transformation that can dwarf what has been achieved thus far. At such times, it is important to gain the confidence of your customers to retain them and enjoy their loyalty.

Thus far, FinTech has only been in the shadows as it were, but now it has found a home in the innovation economy globally. Millennials are more reliant on their smart devices to accomplish their daily tasks. They want the world and its conveniences at their fingertips anywhere and anytime. Given that, perhaps the future might see more interesting innovations in customer experience.

Let’s look at some opportunities for FinTech in the future:

- Companies with remote workforces are better positioned to thrive during and after this difficult period.

- FinTech gives an impetus for greater adoption of contactless money transactions.

- FinTech companies are well-positioned to find new ways to incorporate better digital solutions.

In order to capitalize on all these opportunities, you will need a technology partner to help guide you through the latest innovations. Give us a call and let’s discuss how Fingent top custom software development company, can help you guide your business and customers to success in the post-pandemic world…

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Transforming Businesses with RPA- Leading Use Cases in HR and Banking

Various organizations use RPA tools to automate simple to complex tasks and perform them with minimal or no human intervention.

From an IT perspective, you tend to bucket all RPA uses cases into data integration or testing. However, from a business perspective, you need to find out how to get a better time to value and how to overcome obstacles that hinder the business value. Then you can determine use cases that fit into this characterization.

For example, you want to roll out a change in your business process, and need integration into another system. You can do that in two ways:

- either through APIs and get into the IT changed management routine,

- or by using RPA to drive interfaces without an API and get the change rolled out in weeks instead of months.

So, time to value is the calculation that businesses need to do, and check whether the change is worth it.

Read more: What Makes a Business Process Apt for Automation

Suppose you have to perform tasks that are very repetitive in nature – like filling in excel forms, web forms, things like visual basic or word with data which you already have access to, or which you need to aggregate from various systems. Here you can have an RPA bot to pull that data or even push out that data to multiple systems. You won’t have to rekey that information manually. You can always use an RPA bot to do that in an automated fashion. In both these cases, you can write integrations or you can have a system do it for you.

RPA gives you a way to configure that behavior rather than write a code for it. In other words, RPA use cases need to be data-intensive, rule-driven, and repetitive. The drivers almost always tend to be time to value, time to market, and so on.

Now that you’ve understood where to use RPA in your business, let’s have a look at some of the use cases.

RPA Use Cases in HR

According to UiPath, 40% of your HR professionals’ time can be reclaimed using RPA. Robotic Process Automation can be combined with your existing HR systems like SAP or Workday that allows you to create digital process automation with ease. Here are the two key HR areas where automation leads to transformation.

1. Payroll:

Payroll operations consist of a large number of repetitive, rule-based tasks with activities like data collection, calculations, and scheduling tasks. Payroll workers have to collect data from various departments or units in different formats. The next step is data validation and entering that information into other applications. All these tasks are prone to error.

These activities can be automated using RPA technology since all the data that payroll staff deals with is structured. RPA can make payroll more organized without using expensive software.

The benefits of RPA in payroll are improved accuracy, lower costs due to reduced manual labor and data security. Since the number of menial, time-consuming tasks performed by employees is reduced, they can focus on tasks with higher strategic value.

2. Onboarding and offboarding:

Every time you get a new employee, the candidate’s details have to be uploaded to all systems that you use. They may need a Windows account, access to your time reporting tool, email addresses, IT equipment, and so on. If someone from the HR team manually enters all this data they would be stuck in mundane tasks. Instead, you can have a script doing these repetitive tasks. With RPA, you can automate the entire onboarding procedure since the process is the same for every new employee.

Employee exits too, have to be managed consistently. Manual processing makes these tasks error-prone and may raise auditory concerns. If RPA is implemented in this case, the bot analyzes the incident to find out which tasks need to be executed. It notifies the IT team to terminate access and recover the equipment, terminates the employee from the HCM, revokes system access, generates exit documents, and processes final payments.

Read more: Jaw-dropping Facts about Robotic Process Automation

RPA Use Cases in Banking

A slow economy and rising customer expectations have caused banks to look for cost optimization methods. The back-end processing activities in the banking sector consist of tasks that are rule-driven, repetitive, labor-intensive, and high in volume. RPA technology can help to automate these processes, thus eliminating the need for human intervention. Here are the two major banking functions that can be automated for improved results.

1. Loan application processing:

The processing of loan applications is a tedious process. For document verification, employees need to manually verify different documents and associated information and then organize all data into a single file. Very often, employees get stuck in this task and spend too much time on it. RPA employed in this procedure can automate the whole process by opening different web portals and validating the information. The bot then initiates an email to the employee for a final decision. Thus, the bot helps to save valuable time and improves the time to client response.

2. Account opening:

The account opening process is cumbersome, time-consuming, and prone to errors. RPA can help speed up this process and make it more accurate. Bots draw out information from forms and enter it into separate host applications. Thus RPA eliminates errors and improves the quality of data in the system.

Read more: How Robotic Process Automation Simplifies Business Operations