Category: Business

SAP Analytics Cloud: 7 proven ways it can help your business

From manufacturing to marketing, businesses worldwide face unforeseen challenges as they continue to meet the impact of the COVID-19 pandemic. Many organizations are accelerating digital transformation, establishing variable cost structures, and implementing agile operations to emerge from the pandemic stronger.

While most companies believe that the pandemic will negatively impact their business, some businesses feel that the consequences will be short-term. Although most firms have been affected by the pandemic, a survey shows that two-thirds of micro firms are severely affected by the crisis than 42% of the large companies.

Amidst this uncertainty, companies must consider how the pandemic’s continuation or return in different regions will impact their recovery strategies. Businesses must face this uncertainty by reassessing assumptions, re-evaluating scenarios, and strengthening their ability to respond.

Read more: 11 Practices Followed by Leaders to Build Resilience and Ensure Rapid Business Recovery

Simply put, now is the time for businesses to focus on supporting critical areas of their business that will help them stay relevant in the new environment and plan new strategies for what’s next.

Critical areas for businesses to focus presently

- Workforce

- Finances

- Operations and supply chain

- Strategy and branding

- Tax, trade, and regulatory

- Crisis management and response

What can businesses do?

- Leverage their crisis management team to focus on efforts in the wake of the crisis.

- Shift your focus on bringing back employees to work, assess your company’s response efforts to date, and evaluate areas for real-time course corrections.

- Use the insights the crisis has provided to help chalk out better strategies and capitalize on the opportunity for transformation.

SAP Analytics Cloud has changed the way businesses plan their strategies. It is a robust, agile analytics platform that helps firms arrive at faster and improved business decisions. Moreover, it delivers insights that can be used for enhanced decision-making and optimize resources across all processes.

Read more: How SAP Supports Effective Business Continuity Planning

Combining our functional and industry expertise with SAP Analytics Cloud, Fingent top custom software development company, delivers analytics solutions that drive your competitive advantage, reduce costs, and increase revenue.

What is SAP Analytics Cloud?

SAP Analytics Cloud or SAC is one of the best SaaS solutions that combines all the functionalities such as planning, predictive, business intelligence, and more in one user interface. It helps save time and effort while making improved decisions.

SAP Analytics Cloud comes in two modes: Private and Public. As the name suggests, the Private edition hosts only one customer while the Public edition offers multi-tenancy. Also, cost-wise, the public edition is less expensive than the private edition.

Also read: Fingent offers e-Invoicing integration for SAP ERP users in India – Stay compliant with GST India e-Invoicing

Top 7 business challenges solved by SAP Analytics Cloud

1. Planning and consolidating financial strategy in one solution

SAP Analytics Cloud puts together- planning, predictive, Business Intelligence, and augmented analytics competencies into a simple cloud environment that allows you to consolidate your finances, expenses, and revenues at a single source across your whole organization.

2. Discovering useful insights

SAP Analytics Cloud joins hands with machine learning and augmented analytics to help convert insights that deliver value across your business.

Augmented Analytics allows you to explore your data automatically, discover cycles and trends, and identify possible ways to effectively chalk-out your expenses and cost plans. These intelligent insights can be turned into an actionable plan using a personal sandbox environment that helps visualize your performance metrics and simulate potential budget outcomes.

3. Aligning plans across your business

There’s no denying that financial and operational planning is a must when working with multiple teams and stakeholders. SAP Analytics Cloud helps you make smart decisions. It comprises several collaborative enterprise planning tools that allow you to link and align your expense and cost plans across departments such as HR, sales, finance, marketing, IT, and supply chain in real-time. These benefits eliminate the need for sending out unnecessary emails enclosed with irrelevant plans and avoid collaborating without context.

SAP Analytics Cloud allows you to create and assign tasks with the calendar, communicate with your team in real-time with the discussion panel, and collaborate directly on your plans with the data point commenting tool.

4. Improving planning cycles with predictive analysis

Gone are the days of the tedious manual building of your expense forecasts. SAP Analytics Cloud includes exceptional machine learning and predictive analysis technology that can help you build accurate expenses and cost plans much faster.

You can use the predictive features to automate baseline expense planning forecasts based on previous data. You can then monitor plan attainment with real-time, up-to-date predictive forecasts. Its accuracy indicators enable data analysts (without any technical knowledge) to trust the data-driven predictions before including them into their planning process directly.

5. Enhancing strategic business decisions

With SAP Analytics Cloud machine learning technology, you can convert insight into action within seconds. Automated technology helps you avoid agenda-driven and biased decision-making as it provides you with insights that drive your business.

- Search to Insight – Natural language query generates visualizations to answer your questions instantly. Machine learning technology provides you with important trends quickly.

- Smart Insights – Machine learning technology helps you save time and focus more on high-value activities by allowing you to understand the significant contributors of data points without the need to pivot your data manually.

- Smart Discovery – This allows you to identify key influencers and relationships in your data to help you understand how business factors influence performance. Also, it can detect anomalies and help you take corrective measures. With machine learning projection, anyone can simulate the impact of strategic business decisions.

Case study: Automated Integration between SAP SuccessFactors-Employee Central and SAP S/4HANA – Find how Fingent helped the customer gain real-time insights for improved decision-making

6. Data modeling

SAP Analytics Cloud helps you plan and build the right model where your data is stored efficiently. With this end-to-end solution, you can immediately take action and start planning. The data modeling feature allows you to prepare your data for analysis. “Models” and “Stories” are the two key components of SAP Analytics Cloud’s BI function. Models allow you to enhance your data by cleansing, wrangling, establishing hierarchies, defining rules and conditions, and adding formulas. Stories give life to your data by letting you visualize your information through charts and graphs, which will help you gain valuable business insights.

7. End-to-end industry dashboards

SAP Analytics Cloud offers business content packages tailored to individual analytic scenarios. Each package entails aesthetically built dashboards, stories, and data models carefully designed for specific lines of business and end-to-end business scenarios. Also known as Analytics Content Network, this business content library offers tried and tested best practices for leveraging your available data and accelerating your go-live. The content network is customized to work with existing SAP data sources such as SAP S/4HANA or SAP C/4HANA.

Read more: SAP Focused Industry Templates & Automation Solutions

Today, businesses need to forecast changes ahead of time. SAP Analytics Cloud helps to anticipate and plan for the impact of the crisis on business. How a business responds to challenging situations determines its strength and potential to recover.

Fingent is an SAP Silver Partner. With our expertise in cloud computing and SAP services, we can support you through this critical time and help stabilize your business operations and strategize for the future. Get in touch with our expert to discuss your requirements.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Odoo ERP Implementation for Sales and Revenue Optimization

Pandemic or no pandemic, businesses are facing intense competition in the market. To stay competitive, your organization must think strategically before every move. This is especially true when it comes to sales and marketing. Ask yourselves these questions: Are your projections based on assumptions rather than figures derived from an analytical perspective? Does it take an awfully long time to reconcile your finances at the end of the month? Are you struggling to keep up with a surge in order volumes, which leads to disgruntled and dissatisfied customers? Is your inventory a royal mess? If your answer is yes to any of these questions, then your business needs an ERP system! With its vast suite comprising over 40 business productivity applications, Odoo ERP provides a smoother and simpler way to run your business.

The range of business apps offered by Odoo is highly comprehensive, fully-integrated, easy to use, and supports numerous different industries. Fingent, utilizing its partnership with Odoo ensures their clients are leveraging one or more apps from Odoo to boost their business efficiencies.

This article will highlight the challenges you may be facing in sales and marketing, and help you see if Odoo ERP can be a solution.

Challenges in Marketing and Sales

Sales and Marketing play a vital role in your business, whether you are a B2B or a B2C company. Here are some challenges that could be an indicator that something is amiss and that you need to take action asap.

1. Different processes to handle different tasks

Is your company using different types of software to record, track, and process information? If so, it can result in inaccurate sales data. Not having the accurate and latest accounting information can have an impact on everything from market budgets to payrolls.

The good news is that the Odoo ERP software can integrate these systems so that all business functions stay connected to a single database. This will ensure you get accurate, real-time data when required. This can also free up your staff so they can concentrate on helping the business grow even faster.

2. Finance reconciliation is a laborious process

Perhaps your accounting team is spending hours cross-posting information, rekeying numbers, or reconciling data manually. Odoo ERP can make a big difference here. It can automate process transactions and generate audit trails and financial reports. This can greatly simplify period-end closings.

3. Reconciliation of data takes too long

Finding average sales margins or other metrics might be a daunting task for companies that have isolated systems or work on spreadsheets. Thankfully, the Odoo ERP solution can give a holistic view of your business operations so that your staff can get accurate information to accomplish their jobs more effectively.

Read more: 5 signs which imply that your business needs Odoo ERP

How Can Odoo ERP Assist Your Business Gain?

Odoo ERP provides more than 5000 modules. These can help you accomplish all your business tasks efficiently and successfully. Since it is an open-source ERP platform, it can fulfill all business requirements. Odoo is API-friendly. Hence, it is easy to implement and integrate with your other business applications and modules.

Odoo has a modular structure that allows for phased implementation. Implementing one module at a time helps your organization test the functionality of that module before implementing the rest. This saves a considerable amount of time and resources. Also, with Odoo development, you can avoid licensing costs. Understandably, this enables businesses to invest for future customizations.

Fingent’s new plugin facilitates the scheduling of Zoom meetings from Odoo!

Check out our Odoo Zoom integration module launched in Odoo Apps Store.

With Odoo you can:

- View complete details of sales order and sales management in real-time with the help of a single software application.

- Track the future profitability of your organization based on the analytics of current production and sales.

- Make quick and informed decisions with the help of sales reports. These reports help you forecast the product demand for the future.

- Decrease the time that takes to manage the sales process.

- Manage the entire sales order lifecycle with the help of post-sales activities.

- Minimize the delivery time.

Read more: 5 Salient Features of Odoo that Make it a Reliable ERP for Enterprises

In What Ways Can Odoo ERP Help?

Odoo ERP is a customizable platform. It enhances sales and marketing and thus drives growth. It can help in:

1. Managing Sales

Odoo makes it easy to manage and categorize sales orders into a well-structured and hierarchical system. It allows you to create fresh orders as well as review existing ones.

2. Point of Sale or PoS

Odoo can optimize the Point of Sale management that includes various processes like invoicing, cash registration, and inventory.

3. Customer Relationship Management

The customer relationship module (CRM) of Odoo helps you manage business activities, cash opportunities, solve bug-related issues, and focus on leads. With the help of this module, you can automate most activities like streamlining communication. It also allows you to prioritize your work.

4. Easy Warehouse Management

Odoo can support the management of multiple warehouses and stock locations. You can easily and quickly define inbound, outbound, and stock locations for each of those warehouses.

Read more: How your online store can benefit from Odoo ERP integration

5. Purchase Management

Odoo ERP makes it convenient to monitor the quotations from the suppliers. You can effortlessly convert those quotations into purchase orders.

6. Enhance Manufacturing Process

Odoo helps you to streamline the manufacturing process and its management. It can simplify the process of planning and speed up the process of manufacturing.

7. Generate More Leads

Odoo website builder provides a wide range of preferential options. Most importantly, it provides useful features for sales and marketing that include drag-and-drop and call-to-action buttons. Also, a client’s proposal for a project is directly stored into the Odoo sales app which can be retrieved anytime.

8. Project Management

Odoo ERP makes project management simple yet more efficient. You can track the status of the project in real-time. Additionally, it allows you to categorize the project into sub-tasks and assign it to different employees. No longer do you have to worry about missed deadlines because Odoo’s calendar helps you to keep a track of those stringent deadlines.

9. Automation

Tasks such as sales order and invoice generation of Odoo ERP system allows you to automate manual tasks with zero or minimal errors. Such automation lets your staff focus on more important aspects of business growth.

Read more: Top 5 Open-source ERP Systems for Medical Equipment Suppliers

The Bottom-line

Integrating systems and maintaining them with security updates could seem like a herculean task if your business is working on multiple orders. It can become a complicated and costly endeavor to maintain outdated versions of business software. Fortunately, Odoo is being updated continuously for higher performance and improved scalability. It allows you to match the market’s competitive scenario by implementing end-to-end ERP.

In more ways than one, the coronavirus pandemic has pushed us to live and perform without any excuses. We can perform well when we learn to live with technology. Odoo ERP can help your company make profits now and in the future. Fingent has hands-on expertise in the consulting, implementation, and customization of Odoo for clients globally. Give us a call and we will be happy to help you understand and implement this solution for your business.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

All That You Need to Know about Managed Services for IT!

IT requirements evolve continually as the technology undergoes rapid changes. This has led to increased security threats to data and downtimes which can disarm any business. Before you panic however, let’s begin by saying that many companies have been able to successfully handle these challenges. The solution – a good partnership with the right managed IT services provider.

Managed services for IT play an integral role in the modern business field as it is nearly impossible to venture into contemporary services without some form of IT support. Managed IT services can help you smoothen different processes on the cloud while managing security and finance challenges efficiently in a continuous manner. That isn’t all. This article will help you see why managed services for IT is important and how you can implement it to improve your business operations.

Read more: What Is IT Consulting? How Can It Revitalize Your Business?

What do you mean by Managed Services for IT?

Managed services for IT are services that are outsourced to an external IT service provider. That service provider is completely responsible for the day-to-day operations of your specialized applications and business equipment. This allows your in-house IT team to focus on more strategic IT programs and frees up your team to focus on your business’s core competencies.

What is the importance of Managed Services for IT?

Traditionally, IT-related maintenance was done only through the “break-fix” methodology. This meant that a business would call a maintenance expert only when something broke down. This would completely halt all business operations until the problem is fixed. The more your system stays down, the more will be your organization’s money drain. Unresolved IT issues such as security breaches that compromise your data could prove to be costlier than you think. Such data security breaches are devastating for your business.

Thankfully, as the name suggests, Managed services for IT allows smooth management of a business without disrupting the flow of business operations. On your behalf, your IT service provider will manage, monitor, and resolve the problems of your IT systems and functions. Such a partnership allows you to focus on your core business process without any hindrance caused by IT issues.

Read more: Software Development Outsourcing – Why software development outsourcing is a smart move now?

The most important advantages of Managed IT Services

1. Get the expertise you need

New technology might bring in new problems that your IT team may not have the knowledge or experience to solve. Then there is the issue of management. Fortunately, both these problems can be resolved by your managed service provider. A key advantage of the managed service model is that it allows you to either hire an entire team of IT professionals or choose specialists depending on the demands of each project.

2. Cost-effective

Managed services for IT lowers labor costs. Also, it can completely eliminate the cost of hiring and training new IT staff. The best upside is that you won’t ever have to worry about unexpected service costs. This means your organization can now shift from a capital expense model to an operating expense model.

3. Scale your system as needed

Your technology decides whether you need to scale up or down. Managed IT service providers can respond to such changes in real-time.

4. Downtime reduction and recovery

Managed services for IT provide backup solutions to protect critical information. In the event of a disaster, they can also provide avenues for service continuations. For smaller businesses, this can be a lifesaver.

How can you leverage Managed IT Services to improve your business?

Leveraging managed services for IT cannot be done in a one-size-fits-all way because most companies use different options to meet their overall goal. Though the services offered by each provider may vary, they can still be useful when handled properly. There are businesses that use three or more types of IT functions. If yours is one of those businesses these tips below will help you take the most advantage of managed services.

1. Choose your provider wisely

Each business has its own specific requirements. Identifying that requirement will make it easier to choose the right managed services provider. Often, most businesses need a minimum of three IT services (eg: cloud, IT consulting, and data and network security). But you will need to assess your business needs and come to the exact number. Once you have your requirements down, you can go about researching the credentials of the IT partner. Previous clients and case studies is the best place to start. The best way to find a capable managed service provider is through referrals, work colleagues, and reviews on online platforms.

2. Develop a business relationship

The best collaboration is when your managed IT services provider partners with your existing IT team in a seamless way. With that in mind, it is important to build a good working relationship with your provider. This will ensure that your skills complement each other, and resources are effectively used leading to better business outcomes. It will also give your team the opportunity to learn as much as possible from them.

3. Device a reliable data backup and recovery strategy

The most important objective of hiring managed services for IT is to protect data. Your data is under tremendous risk during a virus attack, machine error, unexpected hacking, or improper handling. During such instances, it is critical to have a good back-up strategy. Such a strategy will ensure that your business does not grind to a halt due to lost data. Fortunately, hiring good managed services for IT makes it easier for your company to develop a strategy that can protect existing data and retrieve lost data.

Read more: Digital Innovation – 10 Services Offered by Fingent to Prepare Your Business for the Future of Digital Innovation

What does the future hold for Managed IT Services?

According to Gartner, 56% of business leaders engage with service providers for long-term development and maintenance. This will result in 63% of global managed service providers gaining their revenue through digital business infrastructure operations by 2023. Managed services for IT have kept the business world running and will continue to do so in the future. Are you keeping pace with it?

Survive and thrive

In our current state of extraordinary upheaval brought by the COVID-19 pandemic, managed services for IT may be your company’s greatest hope for surviving and thriving during and after these unprecedented times. Partner with us and see for yourself! First though, take a look at our case studies and feel free to check our credentials. We want you to be sure we are the right fit for you.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Catch InfinCE on NewsWatch!

InfinCE, the flagship product of Fingent top software development company, will be featured on the award-winning television show NewsWatch on November 30th at 7 AM EST.

NewsWatch is a popular TV show that covers technology, consumer, travel, health, and entertainment news for a broader audience and airs nationwide on the AMC Network and ION Network.

Over the years, InfinCE has transformed into an all-in-one cloud built for the demands of modern businesses. Featuring a unified cloud, InfinCE packs in advanced collaboration and remote working tools to empower the global workforce to work and collaborate from anywhere. Business owners, on the other hand, can easily manage their IT assets and data from a single location via the centralized administration capabilities of InfinCE. Moreover, nascent entrepreneurs can quickly set up their entire IT from email to website and collaboration tools on branded IT infrastructure at an unbeatable price!

Don’t forget to tune in to NewsWatch on your preferred network. To know more on program schedules, visit the NewsWatch website.

Watch this short video to discover how InfinCE transforms enterprise collaboration with its next-gen cloud technology.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How SAP S/4HANA Helps CFOs to Overcome The Slump and Steer Business Forward!

Unpredictable times such as these call for an “anytime, anywhere” finance function, and CFOs are expected to take the lead in accelerating strategic growth across the enterprise. Therefore, suddenly the CFOs found their organizations in a firefighting mode: gauging risks, preserving cash, and rapidly revising all financial plans and forecasting for the next month, quarter, and year. At this point, most CFOs found technology to be a key driver for improving transparency and efficiency. SAP S/4HANA is ‘the’ technology that supports the evolution of the finance function today and into the future.

However, this journey is not easy. Companies must develop a business case for SAP S/4HANA that will support their strategic vision. By leveraging the right finance technology innovations and partnering with a trusted SAP solutions provider, companies can maintain global regulatory compliance and engage in efficient finance processes.

Technology assists CFOs to control accounting and tax standards and engage with the business to jointly drive value. Having said that, technological trends that have been sitting in incubation mode have now emerged as real working models. This article discusses how SAP S/4HANA can leverage the CFO’s vision of becoming a value creation role model for the business.

Read more: How Fingent Helps CFOs Gain New Insights and Reliably Enable Key Decisions

Typical challenges for the CFO’s vision

Most often, a CFO’s agenda is held back by their organization’s complex technology landscape. This often renders efficient closing and reporting impossible within expected timelines. Such cumbersome systems hamper the management of working capital while making it difficult for finance departments to obtain reliable figures for profit and loss or forecasted budgets.

Perhaps you find yourself in this situation: At the end of the month, you find that you could not meet the deadline for the period closure. To make matters worse, mistakes made during the month must be rectified, data from different systems must be imported randomly into an Excel sheet. That is not all! All this information must be manipulated into a decent report. You take a breath that eventually it all worked well. However, the same thing happens the next month, and this pattern keeps repeating itself month after month. That stress peaks by the year-end. Amidst all this chaos, you are left with little time to proactively steer the company based on those figures. You may wonder, is all this financial data gathering purely an obligation just to satisfy auditors?

Companies can gain much profit by keeping admin up-to-date and proactively adjusting the business based on current financial data. That is the biggest advantage SAP S/4HANA provides. It gives the reins of business into your control.

Read more: How SAP S/4HANA transforms the end-to-end business process

Three focus areas where CFOs can gain more control with SAP S/4HANA

1. Control system landscape

As a CFO, you must deal with various financial systems and programs that contain your financial data. All financial data must be collected continuously and loaded into a reporting tool. Apart from this, data must also be entered into an Excel program. Such a fragmented landscape with a jumbled interface leads to errors, data duplication, and the probability of inconsistent data. This translates into enormous amounts of wasted money and time. Replacing this complex structure with an integrated system saves a lot of time and money. SAP S/4HANA provides CFOs a simplified landscape that leads to more control.

Read more about our Case Study: How Fingent successfully automated the integration between SAP SuccessFactors and SAP S/4HANA. Click here to download!

2. Control over processes

Fragmented processes lead to many errors and waste much time. However, once your system landscape is integrated, you will be able to optimize your processes. This will save time, which you can use to proactively manage the company with critical decision making based on your current financial data. This is where SAP S/4HANA finds value. It offers possibilities to automate and integrate processes. It allows you to add smart KPIs. This, in turn, helps you decide which areas need your attention and avoid those that are less important.

3. Control transactions

Entering data several times on different screens and in various steps leads to incomplete data. Most often, no valuable information can be retrieved from such a system. Nevertheless, S/4HANA can ensure that the transactions are carried out correctly. This will keep the data informative and up to date.

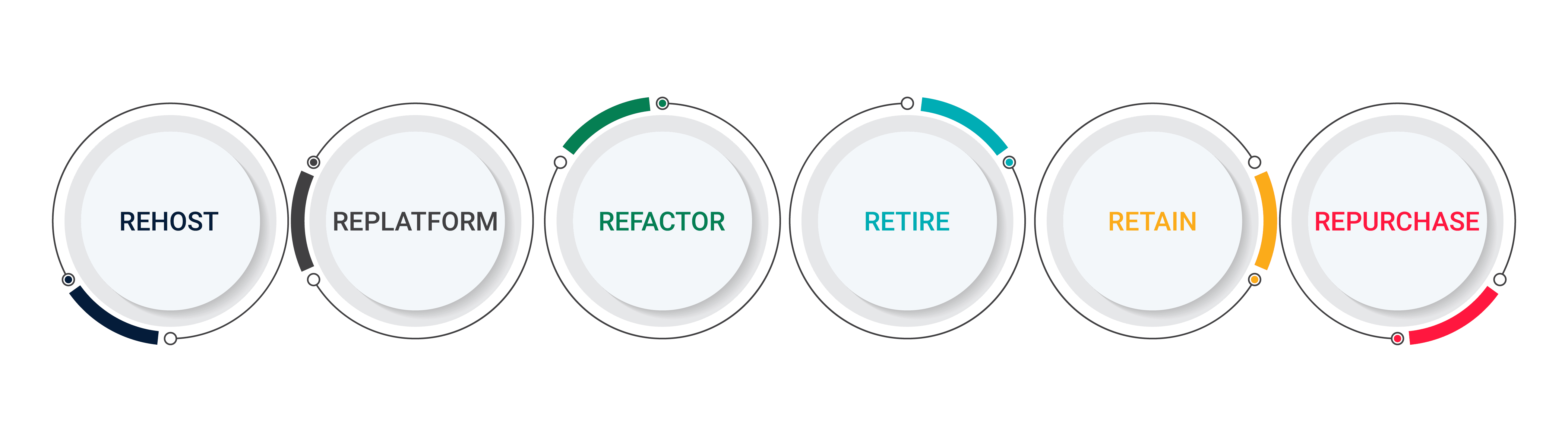

How S/4HANA can transform the landscape to help embrace a CFO’s vision

The challenges faced by CFOs and finance professionals today are complicated, but S/4HANA can simplify them. CFOs can seamlessly unify their information landscape to remove gaps and ease pain-points by leveraging the in-memory data and processing capabilities of SAP S/4HANA architecture, and cloud deployment scenarios.

Instead of grappling with disparate pieces, this approach enables CFOs and financial professionals to see a holistic real-time view that encompasses all operational data sets and analysis capabilities within a single unified architecture.

What is the impact of SAP S/4HANA on CFOs?

SAP S/4HANA improves access to information, and the ability to manipulate that information. Additionally, it can dramatically improve the real-time analytics performance. Thus, with the help of SAP S/4HANA, CFOs have more power to show the management board what they can achieve.

Empowered with SAP S/4HANA, CFOs know that they can respond impromptu to the management board’s questions. With that power, they can just tap for details and input from the live business. Usually, the management board fires off questions after the CFO delivers the company report. Such questions could be linked to newly acquired subsidiaries or similar activities. SAP S/4HANA gives CFOs instant access to all data and processes of the company. Thus, a CFO is now able to include outcomes of the newly acquired business. Also, SAP S/4HANA allows you to model the efficient integration of identical operations and product hierarchies. This allows CFOs to join key drivers in their simulation model with new business planning and get instant combined results. In turn, it will help board members to figure out the impact of global cash flows and financial position.

CFOs can pull real-time cash and liquidity data of all business systems. With the analytics in SAP S/4HANA, they can advise the board confidently if the venture would be profitable. Evidently, CFOs do more than just crunching figures. They give the board a preview of what the business could look like after a merger or with an investment. To that end, SAP S/4HANA enables CFOs and financial professionals to predict potential market growth in addition to current operations.

How can SAP S/4HANA help CFOs achieve their prime objectives in an agile manner?

1. Financial planning, data processing, and analysis

Proper financial planning is a strategic objective for organic business growth. However, proper financial planning depends on the availability of financial data for profitable growth. Financial planning must be aligned with the growth strategies of the organization. It must be analyzed to explore new products, channels, and markets. With an embedded BPC solution for planning, SAP S/4HANA provides agility, flexibility, and accuracy in the planning process. Since it is available in the enterprise core system, no time is wasted in data loads and data reconciliation. It makes previous years actuals available for making plans. Financial data can be churned easily to simulate various growth strategies and help the organization make informed decisions.

2. Support corporate growth

Businesses expect CFOs to support them in driving growth strategies, both organic and inorganic growth. Mergers, acquisitions, and decisions to expand business in various geographies play an important role in growth strategies. To that end, SAP S/4HANA provides real-time financial reporting that reduces the time-consuming reconciliation process. This results in a quick closing. Since it is supported by analytical dashboards with simulations, it can help CFOs make strategic decisions with accuracy and agility.

3. Gain a competitive advantage

CFOs want to keep an eye on regulatory changes and changing domestic and international economic conditions because it gives an opportunity to drive competitive advantage. They can do this with the support of SAP S/4HANA. Since it is an innovation platform it can help CFOs to reimagine and reinvent their processes. Thus, it can bring agility to their decision making.

SAP S/4HANA upholds agility and accuracy of financial information

An ongoing concern for CFOs is the lack of agility in getting financial reporting. Additionally, manual data reconciliation results in inaccurate data. However, SAP S/4HANA provides financial reports in real-time. Its universal journal feature brings in simplicity and flexibility. Since it allows you to store data in a single table, slicing and dicing the data is made easy. This makes reporting at multiple dimensions simple and real-time.

Most CFOs realize that managing evolving technology such as SAP S/4HANA is not just about streamlining operations. It is also essential for managing fraud detection, regulation, and compliance. Compliance requirements have become stringent globally. SAP S/4HANA provides a comprehensive solution for fraud and risk management.

Laser focus on your core competency

CFOs and finance professionals do not view themselves as bookkeepers. They are business outcome-focused leaders and business partners who are stewards of the company’s profit and resources. They are innovators and strategists. CFOs are those who can overcome economic uncertainty and use financial data for growth. Hence, they must be trusted advisors to the management board while overseeing the job of managing cost and profitability. In short, a CFO must be a multitasker! SAP S/4HANA provides the platform and tools for efficient multitasking. It supercharges a CFO’s vision of becoming a value creation role-model for the business.

As CFOs grapple with new disruptive business models, SAP S/4HANA Finance can help them in their decision-making process at a tactical and strategic level. Being an SAP Silver Partner, we are helping CFOs to gain new insights and reliably enable key decisions.

Talk to an expert to understand how we can enhance your organization’s ability to pivot quickly and adapt to dynamic business scenarios.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

In Conversation with Stephen Cummings, SVP, Infince

Infince represents the next phase of cloud for enterprises. Being a progressive approach to running IT, Infince democratized the cloud enabling businesses of all kind to leverage its possibilities. Unveiled at the 2018 Small Business Expo, Infince marks a shift in “untangling technology”, which simplified how businesses utilize the cloud for refining their processes and operations. Infince delivers a secure cloud model that encompass all the essential IT requirements of enterprises.

As a radically different enterprise cloud system, Infince really invoked my curiosity to know more about its simplified cloud model. Stephen Cummings, the Senior Vice President of Business Development at Fingent Corporation was earnest enough to spare a little time from his busy schedule and give me a firm background about Infince in accordance with the questions that I presented. He elaborated on the features and functionalities of Infince, which got me well informed of the capabilities of this platform.

Thank you, Stephen, for your time. Let us begin this short interview with a brief description of what Infince is about.

So, can you tell us a bit about Infince and who is it aimed at?

Up until now, cloud technology has been structured for use by, and marketed to, a technical audience of developers and IT professionals in large corporations. We developed Infince to both simplify how businesses get the software and related support and to dramatically lower their IT-related costs. By building upon the latest developments in cloud-based systems, and incorporating available open source software, we have been able to pull together the things a small business needs to have a secure, modern IT infrastructure – from a company website and mail server to full-featured enterprise software and desktop tools.

Infince is the new way for small businesses to run IT.

Business owners don’t have time to learn about digital tools or to manage them, and they don’t have money to waste. We give them high-value technology options that are intuitive and affordable. Our concierge support services are at hand whenever there is a technical question or concern.

What led you to develop a cloud platform like Infince?

Survey after survey showed that a large percentage of small businesses were not taking advantage of technology that would help them significantly improve their ability to serve their customers. In today’s internet-focused world, their lack of technology puts them at a serious disadvantage to their more nimble competitors. Many companies were discouraged from using existing open-source software, which, though free of cost, did require technical knowledge to get set up.

At the same time, we knew that new developments in cloud and communications technology were making it possible to deliver solutions for them in a completely new way. For open source specifically, we knew if we could automate the setup process, a further barrier to its use would be eliminated. What we were able to do is to make software set up a “one-click” process and to do the same for support services.

Business owners can not only get up and running easily and quickly, but they can do so without anxiety because they can easily use a “life-line” to have someone knowledgeable lend a hand.

Yes, technical complexity and jargon are preventing businesses from adopting the technology. In view of that, can you elaborate on the challenges that you came across while developing this platform?

To make a system both powerfully featured and easy to use meant we had to meet a number of design challenges. How could we make the setup fast and automatic, even for business owners who may not be very technical themselves? How can we make it easy -whether a business owner is technologically intrepid or not – to leverage the options that make sense for their business?

How can we make application software developed by many independent developers work well together? How can we accommodate a flexible and economical infrastructure that works for simple or complex applications, and for small or large companies?

How can we make the user have a friendly experience, for example with a “single-sign-on” capability across all applications? How can we give users an even more secure system than is typical?

With data privacy and security featured again in the news, how much protection does a business cloud platform like Infince offer to businesses?

We have given a lot of focus on data security as it allows people to build trust within the application and its information – which is one of the most important factors. Every customer’s data is hosted on a separate secure virtual server. Our secure servers and SSL built for applications ensure that there is no information that is being tracked or eavesdropped by any external entities.

How much relevance does cloud computing have in today’s business environment? And where does Infince fit in this environment?

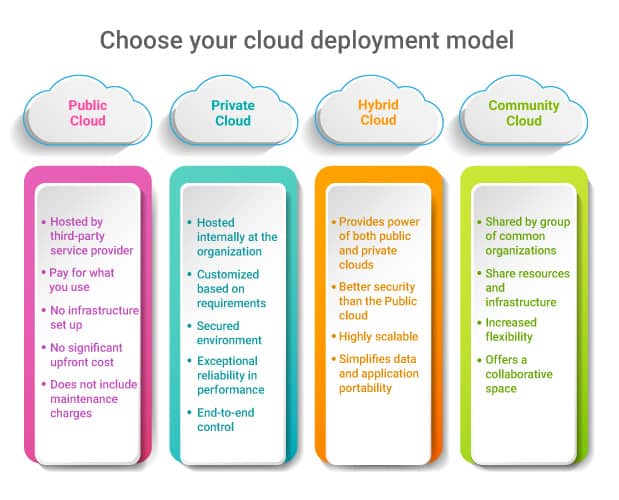

In today’s business environment, a business owner needs to have access to her data right when she needs it, irrespective of her location or geography and the device she is accessing it from. This is what cloud computing provides – an access to one’s business data at any time and anywhere you have an internet connection. Apart from this obvious benefit, cloud computing also improves scalability, business continuity, collaboration efficiency and reduces cost. So yes, cloud computing is going to be here for the foreseeable future.

Cloud computing is an umbrella term for different types of cloud services, that include SaaS, PaaS & IaaS. Infince can be considered as an IaaS service as we provide the servers, storage, and networking hardware, as well as the virtualization layer. On top of that, we also leverage SaaS to offer a plethora of tools and applications that will cover all the technology needs of an SMB. Infince is thus a unique combination of IaaS and SaaS to cater to all the IT needs of a small business.

Read more: Top Trends That Will Transform Cloud Computing in 2020 and Beyond!

Will Infince’s concept of cloud management for businesses lead to a better form of managing and optimizing business processes?

Infince is an IT solution for SMBs. A small or medium business owner needs technological solutions for a variety of business needs, but may not have an IT budget that is large enough to afford the top of the line enterprise software solutions. On the other hand, we have a lot of feature-rich Open Source software that are competitive alternatives to Enterprise Software.

The challenge here is that installing, customizing and setting up an Open Source software requires technology experts in the team. Off the shelf SaaS products will need the employees to access various products through multiple channels with multiple logins, with no single source for all of the business data.

Infince is a solution to this problem. We are constantly integrating good quality Open Source and third-party tools into our App Marketplace. With a few clicks, an Infince customer can add the desired App to his Infince Workplace.

The new software will automatically be integrated through Single Sign-On, becoming part of their IT system. This ease of plugging in business apps on demand makes Infince a powerful IT solution for SMBs.

What are the potential benefits that small and medium businesses can derive from using Infince?

In terms of setting up Small & Medium businesses, the ability to collaborate with their internal team and carrying out business activities has substantially improved and can be managed accurately using Infince — which no platform provides. Going further, different departments within a company can be micromanaged and this increases transparency by also allowing user restrictions across Infince.

Security is another key area that benefits our customers, as nowadays the emails, files that we share travel through various servers before reaching us, and there can be eavesdropping and privacy can be at stake. We provide servers that are managed by us to send emails and fresh dedicated email servers can also be bought at a very less cost.

How do you envision the future of Infince and what new improvements and upgrades will be implemented in this solution in the coming times?

Infince stands for “Infince Cloud for Enterprise” and that’s the vision driving us. By continuously integrating more and more applications in our App Marketplace and innovating our cloud solution, we aim to arm SMBs with the latest technology and tools. The business owners can concentrate on growing the business while we take care of their IT. Our work never stops!

Compared to other enterprise cloud platforms, what specific features have you included in Infince to make it a popular dependable platform?

Compared to other enterprise cloud platforms, we are providing one-of-a-kind platform wherein business can access numerous Open Source applications, with a Single-Sign-On option to effectively run their businesses. Apart from that, all the servers, hosting and basic support for Open Source applications are offered by us and an extremely affordable cost and is secured. Our features, costing, and level of services have been brutally transparent and there have not been any hidden costs involved which sets us apart from our potential competitors.

Does the extended storage options given at Infince come in specific tiers?

We prescribe a minimum of 2GB storage per user. Additional storage can be bought from a minimum of 10GB upwards. The real benefit for Infince customers is that they are in control of how the storage is allocated across the users. The business owner is free to do a differential allocation of the extended storage across users, as per individual requirements.

That indeed provided me with some in-depth information about Infince. In a way, the open accessible cloud model that you envision clearly does have much larger potential in the coming years. Deep down, I do believe in the same thing, which is that all businesses should be given the means to utilize technology to their advantage.

By creating a platform like Infince, Fingent Corp has indeed opened the doors of the cloud to businesses of all kind, so that they could remain technologically competitive and productive. Thank you, Stephen, for granting this interview and wishing the very best for all your ventures.

To learn how your enterprise can benefit from custom-built business applications, get in touch with our experts today!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

The impact and significance of digital transformation in financial services

Changing customer expectations, increasing regulatory complexity, stiff competition, and other factors are constantly pushing businesses for renovation and innovation. Also, the rising number of FinTech companies and solutions over the last few years have completely transformed the financial services landscape. Rather than just technology, digital transformation in financial services has now become an integral part of a successful business strategy. Digital transformation in the financial industry has improved employee and customer experience by helping meet regulatory deadlines and ensure cost-effective operations while remaining highly competitive.

If you consider how banking has transformed over the years, you will understand how digital transformation in banking and financial services has grown to benefit everyone with convenience. From simple branch offices to ATM and mobile apps, digital transformation has offered greater convenience, choice, and experience. Today, customers are gravitating more towards digital experiences and products.

What is the importance of digital transformation in the financial industry?

According to a recent report by Global Economic Prospects, the global economy will contract by over 5% in 2020 due to the COVID-19 pandemic.

However, the crisis has accelerated economic transformation, leading to an increase in the adoption of digital financial services.

Although the digital transformation was a development priority even before the COVID-19 crisis, it has now become indispensable for both short-term as well as long-term sustainable recovery efforts.

Here are four fundamental shifts that are forcing financial institutions to accelerate the rate of digital adoption.

1. Forced adoption of online and mobile channels

Social distancing and lockdowns are forcing people to stay indoors or go outdoors only to buy essential items. This has forced the rapid adoption of digital technology across the globe.

Deloitte reports that the United States, which has traditionally lagged in digital adoption is experiencing an all-time high in the number of check deposits and mobile logins. Interestingly, the major contributors to this growth are baby boomers and senior citizens who have been typically slower to adopt the digital channels.

For example, Goldman Sachs reported a 25% increase in the number of active users on the bank’s institutional platform. Also, the country has seen a spike in call center interactions as customers seek protection from the financial crisis caused by the pandemic.

2. Digital and contactless payments

The lockdown has witnessed a race among retailers to set up e-commerce capabilities to capture sales. With consumers shifting to online purchasing, there has been an acceleration towards digital and contact payments.

While MasterCard reported over 40% growth in contactless payment across the globe, Visa reported a staggering 150% increase in the U.S alone. Hygienic payment modes such as digital wallets, scanning QR codes, click/tap-to-pay, etc. have taken off well to encourage contactless payments during the pandemic.

Read more: FinTech: Safeguarding customer interest in the post-pandemic world

3. Virtualization of the workforce and ways of working

Previously, financial institutions hardly imagined their workforce working remotely. But, the COVID-19 pandemic has forced financial services companies to build a remote work model.

Wells Fargo and Bank of America have pushed almost 70% of their employees to work from home and have established contingency locations for those employees who are into trading and operations. Standard Chartered Bank has kept most of its employees working from home, increasing its VPN system capacity to 600% to keep pace.

Bandwidth issues aside, this transition has been largely successful due to digital disruption in financial services. Most financial companies have even committed to making the remote working model permanent.

4. Evolution of economies and underlying market structure

Even though financial companies have been enjoying stability for years, the COVID-19 pandemic has fuelled margin pressures for companies.

On one hand, insurers are fighting lowered premiums and high claim costs due to the market scenario, while on the other hand, banks are affected by reduced interest rates. Though it is difficult to predict the duration of the economic downturn, it is forcing financial services companies to operate effectively and efficiently to remain competitive in the market.

Moreover, as the market dynamics continue to evolve, “big tech” is likely to reinforce its foray into financial services leveraging its scale, size, and expanding its role in the consumers’ day-to-day activities. Also, smaller FinTechs could be at risk with their funding models. All these evolutions will have a substantial impact on buying, building, and partnering decisions for many incumbents as well as start-up financial companies.

Top 6 digital transformation trends in the financial industry

1. Mobile banking

The digital banking environment allows customers to transfer funds, deposit checks, and apply for loans easily from their mobile devices. Today customers prefer to do online banking at their convenience instead of visiting the brick-and-mortar banks. More and more customers prefer to use mobile banking as it allows 24/7 access, almost negligible waiting time, and ease of use. Mobile banking has changed the functioning of banking and financial institutions to a great extent and is expected to grow further in the coming years.

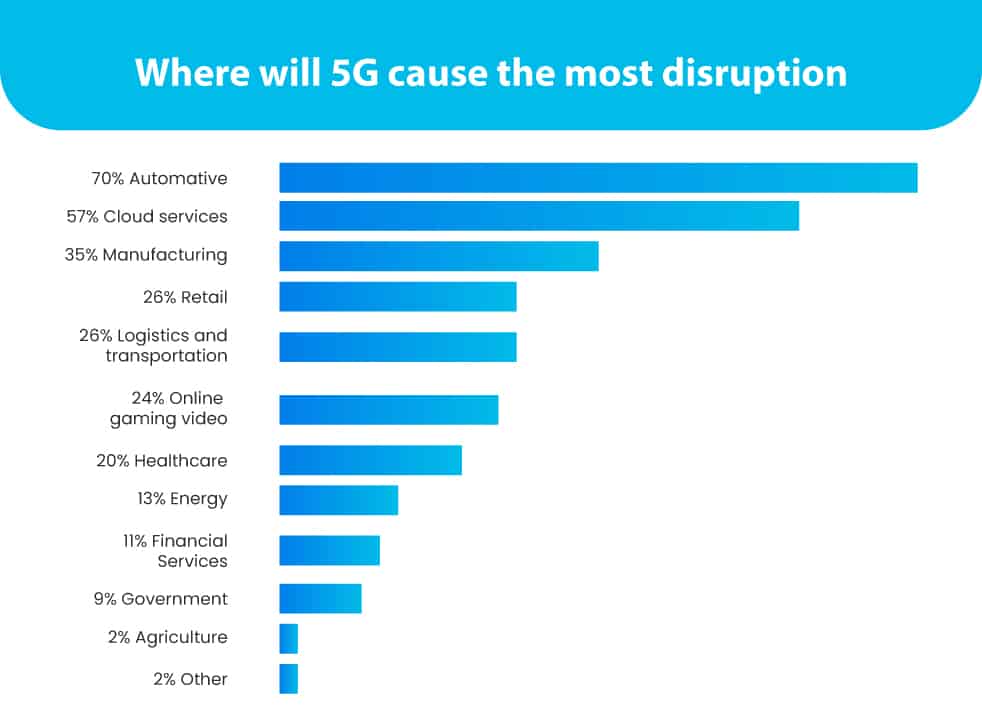

2. Blockchain

Blockchain is gaining momentum steadily and will play a crucial role in digital payments, loan processing, escrow facilities, etc. Additionally, Blockchain will be used in RegTech (a new technology that uses information technology to streamline regulatory processes) to avoid unnecessary regulation breaches.

3. Big data

Big data is everything. Financial institutions including banks are using machine learning to process data and drive analytical solutions effectively. Big data helps banks and other financial institutions to serve their customers efficiently by tailoring their services based on the insights gathered. Eventually, this can help financial institutions to bring in more investment and create a great work environment for both employees as well as customers.

4. Mobile apps

While everything in banking and other financial services is going mobile, there are third-party financial service providers who are competing with the banks. They could be financial managers, unconventional leaders, or financial budgeting mobile apps. Banks will have to consider ways to integrate these third-party services- what information to provide, the companies they want to partner with, and which services they are likely to offer to their customers directly without the need of the middle-man.

Read more: Business Intelligence in Financial Services

5. Automated Wealth Managers

Artificial Intelligence (AI) is disrupting several industries with automation and numerous other possibilities. Wealth bots or automated wealth managers use complex algorithms to calculate the best investment opportunities, best loan providing institutions, best interest rate, etc. Automated wealth managers have made financial planning a breeze and are also helping people achieve their business objectives accurately and with great returns.

6. FinTech (Financial Technology)

FinTech is a modern technology adopted by banks and financial companies to deliver financial services efficiently. It has improved drastically since its ATM and credit card days to the latest digital banks and blockchain technology.

FinTech along with automated technology and machine learning algorithms are revolutionizing the world of finance. Digital technologies such as customer service chatbots, expenditure tracking, and online budgeting tools are some examples of how far financial services have come today.

How Fingent can help you?

As your digital solutions partner, we will help you navigate industry disruption and equip you for future challenges. We apply our extensive experience and deep industry knowledge in fintech to guide you to see digital transformation through fruition. Here, we top custom software development company ensures to maximize value with minimal disruption to your existing infrastructure to help achieve your goals. Get in touch with us to learn more.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Why Does the Retail Industry Need to Embrace Digital Transformation?

The term digital transformation in the retail industry means disruption, new services, and improved functioning of the existing system using technology.

As the customer journey is evolving, retailers have to adapt and evolve as well. Also, with the shift towards personalized shopping, retailers have to go beyond focusing on a single technology in order to create new and innovative business models.

Location-based services, mobile apps, and big data analytics have brought about a significant change in the retail industry. This post details the significance of Digital Transformation in Retail.

What does digital transformation mean for retail?

Retailers will have to look beyond marginal enhancements and redefine processes to create a connected engagement using technology. Digital transformation is not only about agility, innovation, data intelligence, customer centricity, and new value propositions but also about streamlining processes, reducing costs, and improving productivity across the transactional cycle.

Now, more than ever before, retailers have to rethink every aspect of their business. Right from sourcing, pricing, inventory planning, employee training to customer experience management, retailers have to find new ways to drive revenues and create innovative business models.

McKinsey states that COVID-19 has accelerated the adoption of digital technologies in the retail industry. According to their report, e-commerce penetration in the United States which was supposed to reach 24% by 2024 has rapidly grown from 17% to 33% in just two months since the lockdown.

“Contactless retail that leverages digital transformation technologies such as Artificial Intelligence (AI), Internet of Things (IoT) and Virtual Reality (VR) increases customers’ confidence to shop during the COVID-19 pandemic”, says GlobalData. With changes in consumer behavior and consumption patterns, retail digital transformation trends are only likely to continue in the future.

Read more: Contactless services: The New Normal in Retail

Simply put, digital transformation in retail can improve customer retention and satisfaction by offering products and services according to their needs.

What are the benefits of digital transformation in the retail industry?

While digital transformation is not an easy one, a well-thought strategy can bring in the desired results. Also, it comes with several advantages such as:

1. Improved operations

Using cloud technologies helps improve operations within the company and enable the retail staff to respond to customers quickly which eventually improves client support. Availability of real-time data helps predict demands ahead of time and stock goods in advance.

2. Convenience

AI tools are helping customers to shop without a cashier and enabling retailers to sell their products in physical stores as well as websites and mobile apps. Thus, AI-powered automation of retail processes such as locating items, tracking inventory and replenishing stocks, remembering customer preferences, etc. will enhance the customer experience.

Read more: AI To Solve Today’s Retail Profit Problems

3. Better communication

Retailers can form a better connection and improve their communication with their customers via social media, mobile apps, websites, chatbots, etc.

4. Enhanced customer experience

Digital transformation influences customer experiences and makes them better. Technical tools help increase the productivity of the employees and make services more efficient. This helps customers get not just high-quality services but also ensures a pleasant buying journey. While digital transformation is customer-centered, it also helps your business become better and stay ahead of the competition.

Read more: Re-Imagining Customer Experience in Retail Industry

5. Boost revenue

Digital transformation offers retailers a chance to reach a wider target audience and thus increase their channels of income.

Why is the retail digital transformation more relevant now?

While the shift towards e-commerce is not new, the COVID-19 pandemic has only accelerated it. In the United States alone, approximately $600 billion represented online sales that accounted for 56% of overall retail growth in 2019.

Here are some more reasons why businesses have to mandate digital transformation and tweak their customer journey to respond effectively.

1. Life post-COVID will see a surge in online shopping

With increased emphasis on social distancing and personal safety, there will be several changes in consumer demands, saving patterns, spending style, and buying channels. Business leaders must plan their digital transformation and make profits in the post-COVID era. Business recovery and sustenance will depend on digital channels during the social distancing phase. Businesses should consider establishing digital channels and improving presence, invest in data, and improve models for customer demands. Additionally, business leaders can integrate pandemic outbreak models with supply chain demands and empower employees to work from home efficiently.

2. Transparency in supply chain

The pandemic has affected the supply networks across the globe and has caused many retailers to be unable to meet consumer demand for their products. So, retailers will have to be more transparent about their inventory and plan their online and offline customer experience.

3. Retailers with a digital presence will be more successful

Given the current pandemic situation, most people are indoors and spending only on essential items. So, retailers having a digital presence are already ahead of the competition. Such retailers are taking advantage of the pandemic situation and capturing the market share through innovation and customer acquisition. Businesses need to continue with their digital transformation program instead of closing their business and filing for bankruptcy.

4. Customers are rooting for their favorite brand

Most people are affected by social distancing, maintaining personal hygiene, queuing up for entry in stores, and other restrictions. So, customers are rooting for their favorite brands and expecting them to provide better services while taking safety measures. This increases the demand for digital transformation of retail more than ever.

Top 3 retail digital transformation trends to embrace

Retail digital transformation has already started and many companies have benefited from it. However, digital transformation is not a short-term process as technologies keep evolving and retailers will have to keep track of the latest trends. We have shared some of the latest trends to watch out for.

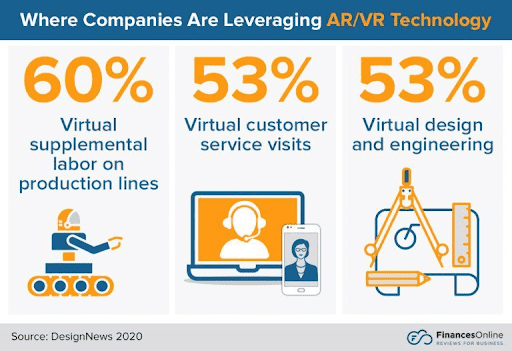

1. Augmented Reality (AR)

AR technologies and tools are helping customers to try and view things from the comfort of their homes. For instance, Toyota’s Augmented Reality shopping experience allows you to try 10 different cars before selecting the right one.

Another great example is IKEA. They let their customers choose furniture using their app. Customers just have to point the camera to the right place at home and the app will suggest options that suit your decor.

2. Mobile applications

Mobile apps help you connect with customers in a better way. It allows customers to check on the products, read reviews, etc. Additionally, customers can contact the support team in case of any issues.

Mobile apps are also good for further development as they allow you to add new features and enhance the services you provide.

Read more: 3 Must-Have Retail Mobile App Features to Boost Your Business

3. Virtual Reality (VR)

Virtual Reality technology has immense potential to develop and grow in the retail industry. VR can enhance customer experience and take it to the next level as it will allow customers to check homes, cars, etc., without even stepping inside. The retail giant Walmart employs VR headsets in over 4,500 of its stores for managing grand shopping events like Black Friday. VR training has boosted the confidence and productivity of Walmart’s associates and has increased their rate of retention.

Summing up

It can be said that simply having a retail store will not help you anymore. You must integrate digital transformation from your physical store to your online store and social media accounts.

Instead of spending days researching your options, we can help you save your time and money. Let us know about your retail business needs and we’ll come up with the best digital transformation strategies suited for you. Contact us today.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new