Category: Digital Transformation

How AR and VR augment employee safety training programs in industries

Employee Safety has taken on a new meaning as the world totters and tries to wrap its head around COVID-19. The pandemic spared no prisoners as it touched every aspect of our life, including our work and our businesses. It has changed the way people work and accomplish their jobs and altered the way employers look at employee safety training.

For starters, traditional employee safety training usually takes one of two forms: on-the-job and classroom learning, which might be a problem at this time. Fortunately, the latest training methods that feature immersive technologies such as Augmented Reality (AR) and Virtual Reality (VR) demonstrate their ability to close the current gaps in employee safety training. This blog discusses the impact AR/VR has on employee safety training. Before we discuss that, it is crucial to understand why businesses require augmented and virtual realities now.

Read more: How Augmented Reality Can Simplify Equipment Maintenance

The increasing significance of AR and VR in employee safety training

Adapting to the new normal, most employees will continue to work from home. Others will face new measures and procedures when they return to workplaces. It can pose a challenge to employers as they struggle to find new methods to train new employees while following physical constraints like social distancing.

Before we look at the solution, let’s have a look at a few drawbacks of the traditional classroom training:

Drawbacks of the conventional classroom training

– Ineffective training procedures

Usually, safety procedures are taught with a combination of computer testing and classroom exercises. These methods do not allow repetition training. It is good but not good enough because it lacks effectiveness and does not encourage knowledge retention. Besides, social distancing norms make it difficult to arrange for classroom training.

– Doesn’t engage employees

As traditional learning techniques are not imparted in a realistic environment, they do not simulate the hands-on experience in scenarios that are tough to be recreated. Classroom learning is often not a useful or engaging teaching style for workers who are in highly mechanical roles. With such training, employers cannot risk a technician to perform their jobs effectively and safely on day one.

– Classroom trainings are expensive

According to the 2019 training industry report, on average, companies spent 1,286 dollars in 2019. The same report also mentions that, on average, employees received 42.1 hours of training. It proves that traditional training methods and materials are a significant expense for financials and lost work time. Employers must look for newer ways to train their employees. Thankfully, AR and VR technologies help support employee safety training.

Read more: How Augmented Reality Is All Set to Transform the Workplace

Top 7 ways AR and VR impact employee safety training

Workplace injuries cost businesses more than 59 billion dollars per year. However, companies cannot cut back on employee safety training under any circumstances. In professions where inadequate safety procedures are a huge risk to the employee, employers must ensure that safety training is practical and accessible.

1. No more trial and error

Specific jobs, such as working in power plants or manufacturing units, require that employees be trained before assuming full responsibility. Augmented and virtual reality help make simulations that allow for training that is safe and free of consequences. Employers can create an exact simulation of their operations and enable new employees to practice repeatedly. Such training allows them to see and correct their mistakes before they start using the actual equipment.

2. Risk-free immersive training

AR and VR technologies allow instructional designers, animation engines, and game designers to combine fun with practical learning. It raises levels of engagement in trainees. Besides attractive and fun components, AR and VR appeal to learners because of the risk-free training element. It eliminates the need for employees and trainees to be in the same location during the training session.

3. Increased retention and skill acquisition

Practice is the best way employees can sharpen their skills. It is a well-known fact that we retain much more information when we combine learning with “doing.” Compared to discussions, reading, lectures, or even audio-visual learning, hands-on-practice is the best way to retain information. AR and VR technologies allow for such training that increases knowledge retention and skill acquisition. These technologies enable employees to practice the concepts they have learned immediately.

4. Allows self-paced learning

Each employee is different with varying levels of learning abilities. AR and VR allow each person to learn at their own pace. It means they can work on the same concept multiple times without the risk of injury to themselves or the machinery. This risk-free approach allows for self-paced learning and the ability to take the training until they master a particular concept.

5. Enhance the effectiveness of learning

Most employers have deemed it unsafe for their workers to share headsets to receive safety training in the current situation. Augmented and virtual reality allows employers to develop solutions where an employee can point his phone camera to a portion of the training manual that opens up additional materials or resources on his screen. This technique allows companies to train their employees about specific products, solutions, or services.

Read more: Impact Of Augmented Reality In Education Industry

6. Prepare employees for emergencies

Augmented and virtual reality are ideal for training employees to handle real-life situations. This technology is apt for safety training. It can minimize damage to the equipment and the cost of training. AR and VR allow firms to train employees to handle emergencies or real-time threats such as controlling a shooting situation.

7. Easy to customize training

Each organization and its requirements are different. Employees may encounter unique challenges and problems because of location, weather, or just the project’s complexity. AR and VR provide a considerable advantage in terms of flexibility and costs to offer company-specific training. It can accommodate a more tailored training experience.

The future of AR and VR in employee safety training

The safety risk is a real challenge that all industries face. Whether it is theft or operating potentially dangerous machinery, employees face risks, including physical hazards. Besides, the pandemic has necessitated a transition to a new way of life. There is currently a desperate need for new solutions that allow businesses to continue with some semblance of normalcy. AR and VR technologies provide organizations effective ways to train their employees while still preserving physical distancing norms. The use of augmented and virtual reality in employee safety training will become the new normal!

Want to explore how you can start with Augmented Reality and Virtual Reality technologies? Talk to us right away.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Technology in Finance: An Overview of the 2025 Landscape

Technology in finance, along with evolving consumer behavior and regulations, are transforming the financial services industry. The COVID-19 pandemic is accelerating the industry’s focus on digital offerings. Government payment schemes, emergency loans, and personal finance management are the need of the hour.

With several bank branches shut and long waiting hours for phone assistance, financial institutions are forced to invest in better IT infrastructure, relevant automation, and technology in finance to deal with the growing consumer demands.

Read more: The impact and significance of digital transformation in financial services.

A study of financial institutions (FIs) by ISMG and OneSpan in North America revealed that providing customers with a top-notch experience is their main priority. 49% of the respondents feel that legacy and manual ID verification are the biggest obstacles to digital opening for FIs, while 35% found that knowledge-based authentication tools were obstacles to onboarding.

Some general FinTech statistics worth knowing are:

- By 2022, the global financial sector is expected to be worth USD 26.5 trillion with a CAGR of 6%.

- 49% of banks and 60% of credit unions in the US believe that FinTech partnerships are worth it.

- Digital payment is one of the most significant FinTech products and holds about 25% of the FinTech market.

That said, many banking and financial institutions are adopting the latest technologies such as artificial intelligence, blockchain, etc., into their operations to benefit their customers, stay competitive, and improve business growth.

Read more: FinTech: Safeguarding customer interest in the post-pandemic world

Here are the top five technologies that transform the financial services industry currently.

1. Artificial Intelligence

The most crucial advantage of Artificial Intelligence in the finance industry is cost savings, which is anticipated to be worth $447 billion by 2023.

AI systems are a game-changer for the finance industry as they can examine vast amounts of data and find patterns and trends that people may miss, and even predict future trends. AI technology makes it possible to automate processes and manage tasks such as comprehending new rules and regulations or generating personalized financial reports for individuals. For example, IBM’s Watson is capable of understanding complex regulations, including reporting of markets’ requirements in the Financial Instruments Directive and the Home Mortgage Disclosure Act.

Chatbots in banking are helping automate simple tasks such as opening a new account or transferring money between accounts and are proving to be a great money-saving tool.

Many financial institutions such as Bank of America and JP Morgan Chase use AI to streamline customer service. Additionally, AI facilitates mobile banking that allows 24/7 access to customers to conduct banking operations. AI is also helping financial institutions boost security and detect and prevent fraud.

2. Blockchain

Blockchain is a promising technology that will impact financial systems significantly. Blockchain technology is inspiring to create several P2P (peer to peer) online financing platforms that help monetary interactions happen in a more decentralized way. Blockchain technology can improve existing systems and processes and create cryptocurrencies.

Five typical applications of blockchain include:

- Make cross-border transaction processes faster, more accurate, and less expensive

- Banks can leverage trade finance to create smart contracts between participants, increasing transparency and efficiency

- Clearing and settlement procedures

- Protect against fraud and speed up the verification process with blockchain-enabled IDs

- Credit-reporting

3. RegTech

RegTech is a regulatory technology that uses cloud computing technology through SaaS (software-as-a-service) to help businesses comply with regulations efficiently and lower costs.

The various areas of RegTech intervention are:

- Data management

- Reframing regulations and implementing new governances

- Real-time reporting

- Data- analytics and decision

- Fraud and risk management

Non-compliance with mandatory government rules leads to fines and crisis. So most FIs want to do everything in their power to avoid non-compliance.

The need for RegTech solutions is growing as FIs grapple to stay compliant with new and existing regulations. RegTech solutions will create a layer that companies will rely upon significantly. Its high accuracy, single dashboard, data analytics, alerts, and insights will help companies optimize resources allocated to compliance and achieve better results.

4. Machine learning

Similar to AI, machine learning helps create a marketing campaign around the consumer. It enables you to understand what kind of services will attract your target market. For example, how people find a financial website, what page they clicked, and what services they need.

Machine learning algorithms and their capability for sentiment analysis will impact trading significantly in the future. It involves using enormous volumes of unstructured data such as photos, video transcriptions, social media posts, presentations, webpages, blogs, articles, and business documents to understand the market sentiment.

Sentiment analysis will transform the future financial markets, and many believe that machine learning will be central to developments.

5. Big Data

According to the IDC Semiannual Big Data and Analytics Spending Guide, currently, banking is one of the top investors in big data and business analytics solutions. Credit card transactions, ATM withdrawals, credit scores, etc., generate massive amounts of data. Deriving actionable insights from this data is crucial to optimize financial processes and make effective business decisions. It will increase the competency of financial institutions in the future.

Big data can help FIs learn more about customers and make business decisions in real-time. Big data analysis allows FIs to identify market trends and streamline internal processes and reduce risks.

Read more: FinTech Innovation: What Is In Store?

The Future of FinTech Adoption

82% of traditional financial organizations plan to collaborate with FinTech companies in the next five years as they fear losing out. 88% of established FIs believe that they may lose to standalone FinTech companies in the next five years if they fail to adopt FinTech innovation.

Financial companies will have to work towards providing a seamless digital experience for their consumers. To avoid the risk of losing out in the market, many FinTech startups, incumbent financial institutions, and technology companies are entering into new partnerships.

Read more: The New Untapped Opportunities for FinTech Companies in the Coming Years

Technology in finance is no different than other disruptive technologies across various industries. It would be wise for even small businesses to consider FinTech as an investment for the future. Fingent has developed end-to-end disruptive technologies and innovative FinTech solutions that will help your business thrive and stay relevant. Contact us for more details.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How AI is Transforming Businesses Worldwide

Post the PC and the dot-com revolution, the world is witnessing another significant disruption- Artificial Intelligence.

Businesses that implement AI applications will have better access to data across multiple functionalities such as customer relationship management, enterprise resource management, fraud detection, finance, people operations, IT management, and other crucial segments. AI in business finds solutions to complex problems in a more human-like way and automates processes. Organizations can redirect their resources towards more creative aspects such as brainstorming, innovating, and researching.

The COVID-19 pandemic required solutions in days, not weeks or months, and business leaders needed to act quickly. AI-based techniques and advanced analytics are helping organizations augment decision making during crises like the coronavirus. While machine learning models were a great choice, developing machine learning models or advanced analytical models would take around four-eight weeks. So, the pandemic accelerated the demand for developing minimum viable AI models quickly.

Despite the many naysayers who believe robots will take over human jobs in the future, AI is already revealing itself as more of an enabler than a disruptor. Here are nine examples of artificial intelligence transforming business.

Read more: How Will Artificial Intelligence Transform The World By 2030

1. Sales and Business Development

As lockdowns and stay at home orders continue, people are now moving from personal interactions to digital interactions such as online shopping and mobile banking. This shift has created many new and unstructured data that is hard to interpret. That’s where AI comes into the picture and helps understand what consumers feel and need.

AI-powered sales performance solutions can identify which customers are most likely to buy a company’s product or service. This model will help people in sales prioritize their customers and improve their productivity and effectiveness.

2. Demand and Supply

Most companies are interested in matching demand and supply. For instance, a steel company may have information about various factors that may influence steel demand. Typically, these demand measures depend on external data to match up with what the company’s supply chains can generate.

AI solutions help analyze these external data and ensure that the company is not producing more than you need to satisfy the demand and not leaving any request unfulfilled.

COVID-19 crisis is unprecedented, and companies have to make sure that they use data that is representative. Historical data allows you to gain insights into upcoming demand patterns and predict possible outcomes.

Make Your Business Smarter With AI

3. Back-office Tasks

Companies can leverage AI-powered cognitive assistants to perform their back-office tasks such as ordering new credit cards, canceling orders, or issuing refunds. If these assistants cannot handle complex tasks, human assistants can perform those tasks. It will ensure that the team members spend their time solving challenging problems and focus on productive activities.

As long as there are structured tasks, Robotic Process Automation can take care of back-office service operations. RPA is particularly useful for automating the claims processes of banks or insurance companies. Enterprise platforms like SAP offer Intelligent RPA that combines automation and artificial intelligence to augment business process automation.

4. Cash-flow Forecasting

As revenue systems dry up, cash flow is likely to be a severe concern for smaller businesses. However, several AI solutions can analyze data (only if representative) for cash-flow forecasting.

Read more: 6 Ways Artificial Intelligence Is Driving Decision Making

5. Document and Identity Verification

AI can identify and verify documents easily. For example, think of a bank that needs to verify customer data for onboarding and compliance. Human agents manually verify documents such as driving licenses or payslips and other relevant records. It is a costly and inefficient process.

AI is used to identify the type of ID document captured, perform face-matching, determine if the ID’s security features are present, and even determine if the person is physically present.

6. Travel and Transportation

The transportation industry forms an integral part of a country’s infrastructure. As many employees may have to self-isolate during the COVID-19 crisis, AI solutions can analyze the number of staff needed by a travel company to run its business in these unprecedented times. For example, a company can request AI to provide information on whether they have enough workers to staff a railroad. Here, AI can help identify demand and supply from the laborers’ standpoint.

AI is already being used in the transportation industry to reduce traffic congestion, avoid accidents, improve passenger safety, lower carbon emissions, and reduce overall financial expenses.

7. Healthcare

From robot-assisted surgeries to safeguarding personal records against cybercrime, Artificial Intelligence is transforming the healthcare industry like never before. The healthcare industry has suffered in terms of medical costs and inefficient processes.

AI-enabled workflow assistants are helping doctors free up 17% of their schedule. Virtual assistants are reducing redundant hospital visits, thereby giving nurses almost 20% of their time back. Also, AI helps pharmaceutical companies research life-saving medicines in a shorter time frame and reduce costs. More importantly, AI is being used to help improve healthcare in underdeveloped nations.

Read more: 7 Major Impacts of Technology in Healthcare

Examples of AI in healthcare:

- PathAI creates AI-powered technology for pathologists to help them analyze tissue samples and diagnose them more accurately.

- Atomwise uses AI and deep learning to improve drug discovery and to speed up the work of chemists.

- Pager is using artificial intelligence to help patients with minor pains, aches, and illnesses.

8. Finance

The financial sector relies on real-time reporting, accuracy, and processing of high volumes of quantitative data, where AI can enhance the processes. The finance industry is rapidly implementing chatbots, automation, algorithmic trading, adaptive intelligence, and machine learning into financial operations. For instance, Robo-advisor, an automated portfolio manager, was one of the biggest financial trends of 2018.

A few examples of how artificial intelligence transforms the financial industry:

- Betterment uses AI to learn about an investor and create a personalized investor profile based on their financial plans.

- Numerai is an AI-powered hedge fund that uses crowdsourced machine learning from many data scientists worldwide.

Read more: Artificial Intelligence and Machine Learning: The Cyber Security Heroes Of FinTech

9. Social Media

With over 3.6 billion active profiles and about $45 billion in annual revenue, social media is invariably in the battle to personalize and provide a better experience for users.

AI can organize massive amounts of data, recognize images, predict shifts in culture, and introduce chatbots. The technology has the potential to make or break the future of the social media industry.

Similarly, machine learning enables social media to identify fake news, hate speeches, and other anti-social activities in real-time.

Final thoughts

With the advancement in technologies, AI is improving possibilities taking businesses to the next level. These examples of artificial intelligence prove that artificial intelligence can transform business models if deployed correctly.

Case Study: Development of AI-enabled chatbots and teaching assistants – How Fingent helped a leading university to create an Automated Intelligence-driven ecosystem

Fingent top custom software development company helps you leverage AI to drive the smart reinvention of your business workflows, processes, and technology. If you are looking to develop an intelligent infrastructure for your business or improve the security process or enhance the customer experience, contact us today!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Manufacturing technologies set to hold the reins

From big data analytics to advanced robotics to computer vision in warehouses, manufacturing technologies bring unprecedented transformation. Many manufacturers are already leveraging sophisticated technologies for manufacturing such as the internet of things(IoT), 3D printing, Artificial Intelligence, etc., to improve operations’ speed, reduce human intervention, and minimize errors.

As 2024 rapidly approaches, manufacturers will have to move away from Industry 4.0 and embrace Industry 5.0. The latter is all about connecting humans and machines (smart systems). Interestingly, Industry 5.0 may already be here. The ongoing COVID-19 pandemic only accelerates its arrival.

Read more: Digital Transformation in Manufacturing

Here are the top 10 technologies that positively impact the manufacturing industry.

1. Robotics

With advances in robotics technology, robots are more likely to become cheaper, smarter, and more efficient. Robots can be used for numerous manufacturing roles and can help automate repetitive tasks, enhance accuracy, reduce errors, and help manufacturers focus on more productive areas.

Benefits of Using Robotics in Manufacturing:

- They improve efficiency right from handling raw material to finished product packing

- You can program robots to work 24/7, which is excellent for continuous production

- Robots and their equipment are highly flexible and can be customized to perform complex jobs

- They are highly cost-effective even for small manufacturing units

Collaborative assembly, painting, and sealing, inspection, welding, drilling, and fastening are a few examples of the jobs done by robots. Today, robots work in several industries, including rubber and plastic processing, semiconductor manufacturing, and research. While they are mainly used in high-volume production, robots make their presence felt in small to medium-sized organizations.

Read more: What Are Cobots and How Can They Benefit Industries?

2. Nanotechnology

Nanotechnology has grown to a great extent in the last few years. It involves the manipulation of nanoscopic materials and technology. Though its widespread use is relatively new, it will be indispensable to every manufacturing industry soon. Further research and experimental designs suggest that nanotechnology can be highly effective in the manufacturing industry.

Applications of Nanotechnology in Manufacturing:

- Create stable and effective lubricants that are useful in many industrial applications

- Car manufacturing

- Tire manufacturers are using polymer nanocomposites in high-end tires to improve their durability and make them wear resistance

- Nanomachines, though not used widely in manufacturing now, are, for the most part, future-tech

3. 3D Printing

Post its tremendous success in the product design field, 3D printing is set to take the manufacturing world by storm. The 3D printing industry was worth USD 13.7 billion in 2019 and is projected to reach USD 63.46 billion by 2025. Also known as additive manufacturing, 3D Printing is a production technology that is innovative, faster, and agile.

Benefits of Using 3D Printing in Manufacturing:

- Reduces design to production times significantly

- Offers greater flexibility in production

- Reduces manufacturing lead times drastically

- Simplifies production of individual and small-lot products from machine parts to prototypes

- Minimizes waste

- Highly cost-effective

Major car manufacturers use 3D printing to produce gear sticks and safety gloves.

Read more: 3D Printing: Fueling the Next Industrial Revolution

4. The Internet of Things (IoT)

IoT in manufacturing employs a network of sensors to collect essential production data and turn it into valuable insights that throw light into manufacturing operational efficiency using cloud software. This connectivity had brought machines and humans closer together than ever before and led to better communication, faster response times, and greater efficiency.

Benefits of Using IoT in Manufacturing

- Internet of Things (IoT) reduces operational costs and creates new sources of revenue

- Faster and more efficient manufacturing and supply chain operations ensure a shorter time-to-market. For instance, Harley- Davidson leveraged IoT in its manufacturing facility and managed to reduce the time taken to produce a motorbike from 21 hours to six hours.

- IoT facilitates mass customization by providing real-time data essential for forecasting, shop floor scheduling, and routing.

- When paired with wearable devices, IoT allows monitoring workers’ health and risky activities and making workplaces safer.

The ongoing pandemic has expanded the focus on IoT due to its predictive maintenance and remote monitoring capabilities. Social distancing makes it difficult for field service technicians to show up on short notices. IoT-enabled devices allow manufacturers to monitor equipment’s performance from a distance and identify any potential risks even before a malfunction occurs. Additionally, IoT has enabled technicians to understand a problem at hand and come up with solutions even before arriving at the job site so that they can get in and get out faster.

Read more: Upcoming IoT trends that can shape the business landscape

5. Cloud Computing

After making its presence felt in other industries, cloud computing is now causing ripples in manufacturing. From how a plant operates, integrating to supply chains, designing and making products to how your customers use the products, cloud computing is transforming virtually every facet of manufacturing. It is helping manufacturers reduce costs, innovate, and increase competitiveness.

IoT helps improve connectivity within a single plant, while cloud computing improves connectivity across various plants. It allows organizations across the globe to share data within seconds and reduce both costs and production times. The shared data also helps improve the product quality and reliability between plants.

Read more: Why It’s Time to Embrace Cloud and Mobility Trends To Recession-Proof Your Business?

6. Big Data

The manufacturing industry is complicated in terms of the variety and depth of the product. As far as opening new factories in new locations and transferring production to other countries is concerned, companies can leverage big data to tackle it.

As the process of capturing and storing data is changing, new standards in sharing, updating, transferring, searching, querying, visualizing, and information privacy are arising. Think of manufacturing software like MES, ERP, CMMS, manufacturing analytics, etc. When integrated with big data, these can help find patterns and solve any problems.

Benefits of Using Big Data:

- Improve manufacturing

- Ensure better quality assurance

- Customize product design

- Manage supply chain

- Identify any potential risk

Explore our use case: Adding New Dimensions to Equipment Maintenance with IIoT, AR, and Big Data

7. Augmented Reality

In manufacturing, we can use AR to identify unsafe working conditions, measure various changes, and even envision a finished product. Augmented Reality can help a worker view a piece of equipment and see its running temperature, revealing that it is hot and unsafe to touch with bare hands. An employee can know what’s happening around them, like what machinery is breaking down, a co-worker’s location, or even a factory’s restricted sites. Simply put, AR applications can help inexperienced employees to be informed, trained, and protected at all times without wasting significant resources.

AR has made it possible for technicians to provide remote assistance by sending customers AR and VR enabled devices and helping them with basic troubleshooting and repairs during the COVID-19 crisis. Also, more and more customers are open to allowing manufacturers to implement AR with the long-term goal of creating permanent solutions. After all, it helps both the customers and field technicians by reducing the risk of exposure.

Read more: How Augmented Reality Can Simplify Equipment Maintenance

8. 5G

5G will have a tremendous impact on the manufacturing industry. It will be more transformational for devices that drive automated industrial processes.

The amazing low-latency and connectivity of 5G will power sensors on industrial machines. It will help generate a lot of data that will open new avenues of cost savings and efficiency when combined with machine learning. Currently, China and South Korea are leveraging 5G this way. Soon the US and the UK are expected to compete with them.

Read more: From Remote Work to Virtual Work, 5G is Reinventing the Way We Work

9. Artificial Intelligence(AI)

Manufacturers are already employing automation on the plant floor and in the front office. In the future, AI-powered demand planning and forecasting will continue to develop that will help manufacturers align their supply chain with demand projections to get data that were not possible previously.

A study from IFS shows that 40% of manufacturers plan to implement AI for inventory planning and logistics and 36% for production scheduling and customer relationship management. 60% of the respondents are said to focus on productivity improvements with these investments.

Read more: The Future of Artificial Intelligence – A Game Changer for Industries

10. Cybersecurity

Moving manufacturing operations to the cloud and building and integrating systems using IoT will equally create opportunities and challenges. In an increasingly insecure digital era, there is a pressing need for heightened security.

Manufacturing experts are investing in secure cloud-based ERP like SAP and Odoo to resolve the security challenges. Enterprises-big or small- will soon increase their dependence on cloud-based ERP systems to address security glitches and save costs by paying for usage.

Read more: Top 6 Reasons Why You Should Move to a Cloud-Hosted ERP

White Paper: What difference does RPA bring to your business? How can you embrace this disruptive technology to remain competitive? Download to learn more!

Conclusion

Technologies for manufacturing will decrease labor costs, improve efficiency, and reduce waste, making future factories cheaper and more environment-friendly. Additionally, improved quality control will ensure superior products that will benefit both the consumers and the manufacturers.

COVID-19 has changed the way the manufacturing industry operates. If your business wants to remain competitive, you will have to embrace manufacturing technologies to shape your company’s future. To know more about the forward-thinking strategies that integrate the latest trends and technologies, please connect with us today.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

SAP Analytics Cloud: 7 proven ways it can help your business

From manufacturing to marketing, businesses worldwide face unforeseen challenges as they continue to meet the impact of the COVID-19 pandemic. Many organizations are accelerating digital transformation, establishing variable cost structures, and implementing agile operations to emerge from the pandemic stronger.

While most companies believe that the pandemic will negatively impact their business, some businesses feel that the consequences will be short-term. Although most firms have been affected by the pandemic, a survey shows that two-thirds of micro firms are severely affected by the crisis than 42% of the large companies.

Amidst this uncertainty, companies must consider how the pandemic’s continuation or return in different regions will impact their recovery strategies. Businesses must face this uncertainty by reassessing assumptions, re-evaluating scenarios, and strengthening their ability to respond.

Read more: 11 Practices Followed by Leaders to Build Resilience and Ensure Rapid Business Recovery

Simply put, now is the time for businesses to focus on supporting critical areas of their business that will help them stay relevant in the new environment and plan new strategies for what’s next.

Critical areas for businesses to focus presently

- Workforce

- Finances

- Operations and supply chain

- Strategy and branding

- Tax, trade, and regulatory

- Crisis management and response

What can businesses do?

- Leverage their crisis management team to focus on efforts in the wake of the crisis.

- Shift your focus on bringing back employees to work, assess your company’s response efforts to date, and evaluate areas for real-time course corrections.

- Use the insights the crisis has provided to help chalk out better strategies and capitalize on the opportunity for transformation.

SAP Analytics Cloud has changed the way businesses plan their strategies. It is a robust, agile analytics platform that helps firms arrive at faster and improved business decisions. Moreover, it delivers insights that can be used for enhanced decision-making and optimize resources across all processes.

Read more: How SAP Supports Effective Business Continuity Planning

Combining our functional and industry expertise with SAP Analytics Cloud, Fingent top custom software development company, delivers analytics solutions that drive your competitive advantage, reduce costs, and increase revenue.

What is SAP Analytics Cloud?

SAP Analytics Cloud or SAC is one of the best SaaS solutions that combines all the functionalities such as planning, predictive, business intelligence, and more in one user interface. It helps save time and effort while making improved decisions.

SAP Analytics Cloud comes in two modes: Private and Public. As the name suggests, the Private edition hosts only one customer while the Public edition offers multi-tenancy. Also, cost-wise, the public edition is less expensive than the private edition.

Also read: Fingent offers e-Invoicing integration for SAP ERP users in India – Stay compliant with GST India e-Invoicing

Top 7 business challenges solved by SAP Analytics Cloud

1. Planning and consolidating financial strategy in one solution

SAP Analytics Cloud puts together- planning, predictive, Business Intelligence, and augmented analytics competencies into a simple cloud environment that allows you to consolidate your finances, expenses, and revenues at a single source across your whole organization.

2. Discovering useful insights

SAP Analytics Cloud joins hands with machine learning and augmented analytics to help convert insights that deliver value across your business.

Augmented Analytics allows you to explore your data automatically, discover cycles and trends, and identify possible ways to effectively chalk-out your expenses and cost plans. These intelligent insights can be turned into an actionable plan using a personal sandbox environment that helps visualize your performance metrics and simulate potential budget outcomes.

3. Aligning plans across your business

There’s no denying that financial and operational planning is a must when working with multiple teams and stakeholders. SAP Analytics Cloud helps you make smart decisions. It comprises several collaborative enterprise planning tools that allow you to link and align your expense and cost plans across departments such as HR, sales, finance, marketing, IT, and supply chain in real-time. These benefits eliminate the need for sending out unnecessary emails enclosed with irrelevant plans and avoid collaborating without context.

SAP Analytics Cloud allows you to create and assign tasks with the calendar, communicate with your team in real-time with the discussion panel, and collaborate directly on your plans with the data point commenting tool.

4. Improving planning cycles with predictive analysis

Gone are the days of the tedious manual building of your expense forecasts. SAP Analytics Cloud includes exceptional machine learning and predictive analysis technology that can help you build accurate expenses and cost plans much faster.

You can use the predictive features to automate baseline expense planning forecasts based on previous data. You can then monitor plan attainment with real-time, up-to-date predictive forecasts. Its accuracy indicators enable data analysts (without any technical knowledge) to trust the data-driven predictions before including them into their planning process directly.

5. Enhancing strategic business decisions

With SAP Analytics Cloud machine learning technology, you can convert insight into action within seconds. Automated technology helps you avoid agenda-driven and biased decision-making as it provides you with insights that drive your business.

- Search to Insight – Natural language query generates visualizations to answer your questions instantly. Machine learning technology provides you with important trends quickly.

- Smart Insights – Machine learning technology helps you save time and focus more on high-value activities by allowing you to understand the significant contributors of data points without the need to pivot your data manually.

- Smart Discovery – This allows you to identify key influencers and relationships in your data to help you understand how business factors influence performance. Also, it can detect anomalies and help you take corrective measures. With machine learning projection, anyone can simulate the impact of strategic business decisions.

Case study: Automated Integration between SAP SuccessFactors-Employee Central and SAP S/4HANA – Find how Fingent helped the customer gain real-time insights for improved decision-making

6. Data modeling

SAP Analytics Cloud helps you plan and build the right model where your data is stored efficiently. With this end-to-end solution, you can immediately take action and start planning. The data modeling feature allows you to prepare your data for analysis. “Models” and “Stories” are the two key components of SAP Analytics Cloud’s BI function. Models allow you to enhance your data by cleansing, wrangling, establishing hierarchies, defining rules and conditions, and adding formulas. Stories give life to your data by letting you visualize your information through charts and graphs, which will help you gain valuable business insights.

7. End-to-end industry dashboards

SAP Analytics Cloud offers business content packages tailored to individual analytic scenarios. Each package entails aesthetically built dashboards, stories, and data models carefully designed for specific lines of business and end-to-end business scenarios. Also known as Analytics Content Network, this business content library offers tried and tested best practices for leveraging your available data and accelerating your go-live. The content network is customized to work with existing SAP data sources such as SAP S/4HANA or SAP C/4HANA.

Read more: SAP Focused Industry Templates & Automation Solutions

Today, businesses need to forecast changes ahead of time. SAP Analytics Cloud helps to anticipate and plan for the impact of the crisis on business. How a business responds to challenging situations determines its strength and potential to recover.

Fingent is an SAP Silver Partner. With our expertise in cloud computing and SAP services, we can support you through this critical time and help stabilize your business operations and strategize for the future. Get in touch with our expert to discuss your requirements.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

The Future of FinTech Looks Promising: Here’s Why!

The COVID-19 pandemic has caused significant disruption and has also cast doubts on the future and growth of the FinTech industry. Despite the devastating impact of the coronavirus pandemic on the global economy, FinTech leaders remain cautiously optimistic about the industry’s growth. They forecast that as people, businesses, and leaders tackle the ongoing outbreak of the pandemic, market fluctuations will experience stability. As soon as the crisis situation is settled, the market is forecasted to start experiencing growth. FinTech solutions are foundational to how we transact in the current scenario and tackle the future market. It is vital for financial institutions to up their game to deliver smarter, quicker, and safer solutions.

What are the upcoming FinTech opportunities that will impact everything in the financial ecosystem?

The ‘Digital-Only’ Era

1. Digital payment services

The coronavirus crisis has brought the significance of cash management to the forefront. There are massive technical and fundamental shifts taking place that are quickly becoming the new normal. Digital-only banks are one of the many such shifts and they increase efficiency and convenience. Nobody is expected to visit the bank physically, stand in long queues, and go through a lot of paperwork. With digital-only banks, you can create an account or transfer money at a location and time convenient for you. Some of the amazing features of digital-only banks are a quick review of account balance, account transaction history, bill payments, and real-time analytics. They offer P2P payments with no transaction fees. They also offer Ethereum and other cryptocurrency transactions. Digital-only banks have a deep connection with technologies such as blockchain.

Read more: How Digital Finance Could Boost Growth in Emerging Economies

2. Digital lending

Digital lending is one of the FinTech opportunities that’s prospering while shutdowns and layoffs across the globe resulted in a cash crunch for most individuals and households. Governments have provided some help. However, it is largely left up to financial institutions to provide loans to individuals and businesses. Fintech companies perform better than their traditional counterparts in the lending segment by leveraging AI technology. They can use AI to screen applicants and rate their credit-worthiness. It allows loan applicants to secure loans quickly and conveniently.

Financial institutions must partner with FinTech application development service providers to leverage self-service, multi-channel digital lending processes. This includes loan processing, screening, collection, and credit scores. As an end-to-end process, it will provide customers with a smooth onboarding and approval lending experience.

3. Digital investing

Retail investors around the world are more active in the stock market now than ever before. Access to information that was previously restricted to more advanced investors, has fueled an exponential increase in retail investing. This trend will continue.

Read more: FinTech Innovation: What Is In-Store?

The Era of Blockchain Technology

Identity theft and fraud have been the bane of financial institutions for many years. Blockchain technology plays a crucial part in saving the industry from these problems. The rapid growth and adoption of blockchain is making it an integral part of financial institutions’ operational infrastructure including digital payments, trading shares, smart contracts, and managing identities. Blockchain features such as global reach, speed, and security are motivating its faster adoption among financial institutions.

Companies must build trust and display transparency in contracts and the supply chain. Using blockchain helps them gain visibility throughout the supply chain. It also takes care of quality control and performance benchmarks. It is crucial that financial services quickly adopt blockchain into their systems and search for opportunities to increase FinTech partnerships.

Read more: Leveraging Blockchain Technology to Transform Supply Chain Industry

Impact of Regulation

Regulators are needed to balance innovation with customer interests. Regulators have been proactive in helping businesses deliver greater customer value by defining data privacy rules. This has fueled a massive shift in how people spend, buy, save, borrow, and invest. Given the enormous innovation in this sector, the FinTech arena is divided into five broad categories:

- Deposit, lending, and capital raising

- Payments, clearing, and settlement

- Investment management

- Insurance

- Market support

We know that compliance with regulations will become mandatory for banks. This makes it important that banks adopt a flexible and robust digital strategy in order to solve regulatory challenges. Leveraging digital transformation and FinTech innovation will help banks to evolve as a modular body that becomes highly responsive to political and social pressures.

Read more: Digital Transformation in Financial Services: All You Need to Know!

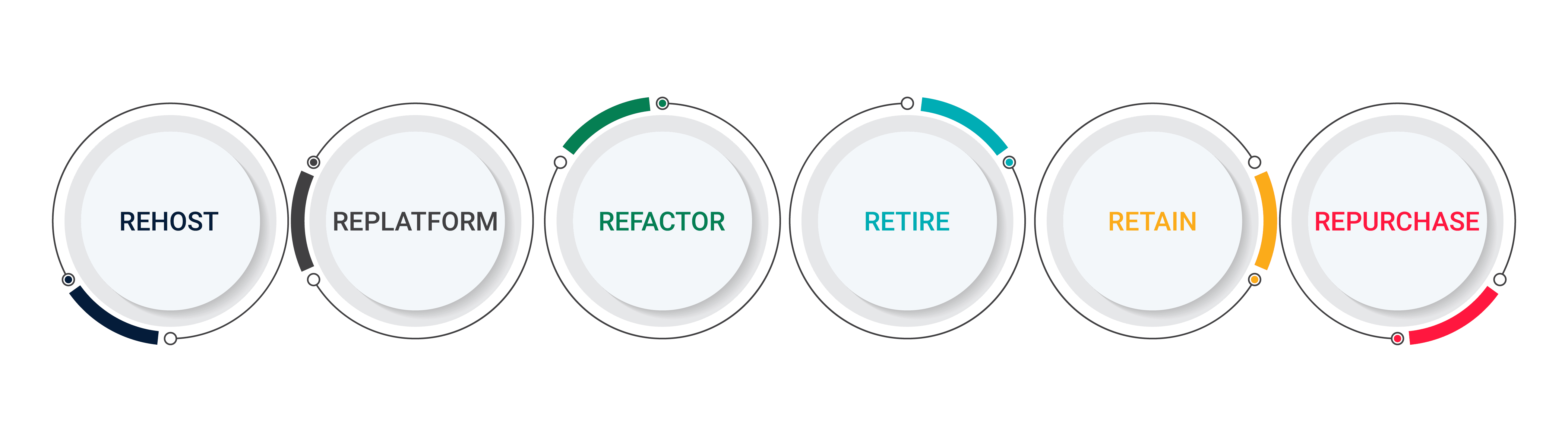

Robotic Process Automation

Robotic Process Automation (RPA) can automate repetitive processes in banking, insurance, and other financial services. This will lower the risk of common errors and inefficiencies while increasing productivity and ROI. RPA does not require programming. Efficiently programmed software robots can automate repetitive processes. Intelligent automation technology goes a step ahead to observe human actions and automate directly, the entire process. IA can be effectively used in the administrative section for the customer onboarding process, risk assessment, data analysis, security checks, and more.

Read more: How Robotic Process Automation Is Revolutionizing Industries?

What must you do to take advantage of these opportunities?

Here are a few things you can do to leverage the massive opportunities made possible by the digital-only era:

1. Infrastructure

Financial institutions must invest in the right technical infrastructure. With multiple technology options available in the market today, it is imperative for financial institutions to make the right decision based on the company’s needs and objectives.

2. Market proposition

Develop a clear market proposition. You must partner with FinTech companies to develop robust and scalable apps. Having them as trusted advisors will help you retain your customer base.

3. Partnership

Before partnering up with FinTech companies, you must examine their needs and plan on how they want to execute them. This will help you derive greater benefits from the partnership.

4. Product hierarchies

Incorrect product or service information can damage the good reputation of your company. Have a clear definition of products and services and outline their use and cost. This will minimize reputational risk and maximize the opportunity to retain and acquire customers.

5. Switching

Most bank customers may want to switch their accounts. You must allow switching and help your customers to switch seamlessly between products.

6. Educate your customers

Your customers may not be aware of the digital services you provide. Hence, it is important that you educate your customers regarding the use, safety, and implications of your digital technology.

Read more about our Case Study: How Fingent enabled NEC Financial Services to take advantage of the FinTech revolution?

Explore FinTech opportunities

Explore FinTech opportunities

Access to data presents new opportunities for growth. With continuous technology penetration, financial services will see steady growth resulting in the expansion of FinTech. In many ways, FinTech contributes to the revolutionization of the financial sector and the way customers interact with your business. It offers your customers a hassle-free experience and helps your employees to be more productive.

Read more: FinTech: Safeguarding customer interest in the post-pandemic world

FinTech will help you keep your focus on customer experience and personalization that can drive user loyalty. For a technology partner who will get you to reach new heights in this new era of Fintech, call us!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

The impact and significance of digital transformation in financial services

Changing customer expectations, increasing regulatory complexity, stiff competition, and other factors are constantly pushing businesses for renovation and innovation. Also, the rising number of FinTech companies and solutions over the last few years have completely transformed the financial services landscape. Rather than just technology, digital transformation in financial services has now become an integral part of a successful business strategy. Digital transformation in the financial industry has improved employee and customer experience by helping meet regulatory deadlines and ensure cost-effective operations while remaining highly competitive.

If you consider how banking has transformed over the years, you will understand how digital transformation in banking and financial services has grown to benefit everyone with convenience. From simple branch offices to ATM and mobile apps, digital transformation has offered greater convenience, choice, and experience. Today, customers are gravitating more towards digital experiences and products.

What is the importance of digital transformation in the financial industry?

According to a recent report by Global Economic Prospects, the global economy will contract by over 5% in 2020 due to the COVID-19 pandemic.

However, the crisis has accelerated economic transformation, leading to an increase in the adoption of digital financial services.

Although the digital transformation was a development priority even before the COVID-19 crisis, it has now become indispensable for both short-term as well as long-term sustainable recovery efforts.

Here are four fundamental shifts that are forcing financial institutions to accelerate the rate of digital adoption.

1. Forced adoption of online and mobile channels

Social distancing and lockdowns are forcing people to stay indoors or go outdoors only to buy essential items. This has forced the rapid adoption of digital technology across the globe.

Deloitte reports that the United States, which has traditionally lagged in digital adoption is experiencing an all-time high in the number of check deposits and mobile logins. Interestingly, the major contributors to this growth are baby boomers and senior citizens who have been typically slower to adopt the digital channels.

For example, Goldman Sachs reported a 25% increase in the number of active users on the bank’s institutional platform. Also, the country has seen a spike in call center interactions as customers seek protection from the financial crisis caused by the pandemic.

2. Digital and contactless payments

The lockdown has witnessed a race among retailers to set up e-commerce capabilities to capture sales. With consumers shifting to online purchasing, there has been an acceleration towards digital and contact payments.

While MasterCard reported over 40% growth in contactless payment across the globe, Visa reported a staggering 150% increase in the U.S alone. Hygienic payment modes such as digital wallets, scanning QR codes, click/tap-to-pay, etc. have taken off well to encourage contactless payments during the pandemic.

Read more: FinTech: Safeguarding customer interest in the post-pandemic world

3. Virtualization of the workforce and ways of working

Previously, financial institutions hardly imagined their workforce working remotely. But, the COVID-19 pandemic has forced financial services companies to build a remote work model.

Wells Fargo and Bank of America have pushed almost 70% of their employees to work from home and have established contingency locations for those employees who are into trading and operations. Standard Chartered Bank has kept most of its employees working from home, increasing its VPN system capacity to 600% to keep pace.

Bandwidth issues aside, this transition has been largely successful due to digital disruption in financial services. Most financial companies have even committed to making the remote working model permanent.

4. Evolution of economies and underlying market structure

Even though financial companies have been enjoying stability for years, the COVID-19 pandemic has fuelled margin pressures for companies.

On one hand, insurers are fighting lowered premiums and high claim costs due to the market scenario, while on the other hand, banks are affected by reduced interest rates. Though it is difficult to predict the duration of the economic downturn, it is forcing financial services companies to operate effectively and efficiently to remain competitive in the market.

Moreover, as the market dynamics continue to evolve, “big tech” is likely to reinforce its foray into financial services leveraging its scale, size, and expanding its role in the consumers’ day-to-day activities. Also, smaller FinTechs could be at risk with their funding models. All these evolutions will have a substantial impact on buying, building, and partnering decisions for many incumbents as well as start-up financial companies.

Top 6 digital transformation trends in the financial industry

1. Mobile banking

The digital banking environment allows customers to transfer funds, deposit checks, and apply for loans easily from their mobile devices. Today customers prefer to do online banking at their convenience instead of visiting the brick-and-mortar banks. More and more customers prefer to use mobile banking as it allows 24/7 access, almost negligible waiting time, and ease of use. Mobile banking has changed the functioning of banking and financial institutions to a great extent and is expected to grow further in the coming years.

2. Blockchain

Blockchain is gaining momentum steadily and will play a crucial role in digital payments, loan processing, escrow facilities, etc. Additionally, Blockchain will be used in RegTech (a new technology that uses information technology to streamline regulatory processes) to avoid unnecessary regulation breaches.

3. Big data

Big data is everything. Financial institutions including banks are using machine learning to process data and drive analytical solutions effectively. Big data helps banks and other financial institutions to serve their customers efficiently by tailoring their services based on the insights gathered. Eventually, this can help financial institutions to bring in more investment and create a great work environment for both employees as well as customers.

4. Mobile apps

While everything in banking and other financial services is going mobile, there are third-party financial service providers who are competing with the banks. They could be financial managers, unconventional leaders, or financial budgeting mobile apps. Banks will have to consider ways to integrate these third-party services- what information to provide, the companies they want to partner with, and which services they are likely to offer to their customers directly without the need of the middle-man.

Read more: Business Intelligence in Financial Services

5. Automated Wealth Managers

Artificial Intelligence (AI) is disrupting several industries with automation and numerous other possibilities. Wealth bots or automated wealth managers use complex algorithms to calculate the best investment opportunities, best loan providing institutions, best interest rate, etc. Automated wealth managers have made financial planning a breeze and are also helping people achieve their business objectives accurately and with great returns.

6. FinTech (Financial Technology)

FinTech is a modern technology adopted by banks and financial companies to deliver financial services efficiently. It has improved drastically since its ATM and credit card days to the latest digital banks and blockchain technology.

FinTech along with automated technology and machine learning algorithms are revolutionizing the world of finance. Digital technologies such as customer service chatbots, expenditure tracking, and online budgeting tools are some examples of how far financial services have come today.

How Fingent can help you?

As your digital solutions partner, we will help you navigate industry disruption and equip you for future challenges. We apply our extensive experience and deep industry knowledge in fintech to guide you to see digital transformation through fruition. Here, we top custom software development company ensures to maximize value with minimal disruption to your existing infrastructure to help achieve your goals. Get in touch with us to learn more.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How Technology is Transforming Classroom Learning

There’s no denying that technology has completely transformed the way we live and steadily it is becoming more and more predominant in the classroom as well. From improving the communication between teachers and students to enhancing presentations and lessons, to organizing curriculum calendars, there is no limit to the ways to use technology in classrooms to set up a successful life for students outside of school.

Today, many educational institutions are offering courses that no longer need students to study in a traditional classroom. 92% of teachers said that the internet has a significant impact on a student’s ability to access resources, content, and materials, according to the Pew Research Center.

Benefits of using technology in the classroom

Here are a few advantages of using technology in classrooms.

1. Improves collaboration

Many technology-based tasks involve aspects that require students to seek help from their friends or teachers. Teachers have observed that when students are assigned to tasks, the students who are more technologically advanced assist those who are not.

2. Incorporates different learning styles

Each child is different and it can be challenging to adjust a study plan to fit every student in the classroom. Thanks to technology in education, it is possible to modify the lessons. For instance, kids who might want to draw during the class can create an infographic to demonstrate their capabilities and understanding of the concept which a teacher might not have previously seen or assessed.

3. Creates an engaging environment

While most people consider technology to be just a distraction, it is not so. When used correctly, it can help encourage active participation in the classroom. Using laptops, computers, tablets, etc., in the classroom can help bring more interaction and fun into learning, thus making lessons more interesting.

Read more: Impact Of Augmented Reality In Education Industry

4. Students learn essential skills

Using technology in classrooms, students can gain the knowledge and skills essential for problem-solving, critical thinking, collaborating with others, and improving motivation and productivity. Technology can also help develop several practical skills such as creating presentations, writing emails, learning proper online etiquette, and understanding the difference between reliable and unreliable sources on the internet. These skills are very important and prepare the students for the future.

How to use technology in the classroom?

While traditional classroom learning is still prevalent, many educational institutions are willing to embrace technology. Here are nine creative ideas to use technology in classrooms to enhance learning.

1. Schedule your online classes

Google Calendar allows you to create and share a class calendar that will keep the students informed about the class, duration, announcements, and important dates. Teachers can easily email the class calendar link to the students. This will help both the teachers as well as the students to stay organized and come prepared for each class.

2. Use virtual manipulatives

While there are manipulatives such as blocks, ten blocks, coins, and tangrams to visualize mathematical concepts, virtual manipulatives are more effective.

Virtual manipulatives help students to comprehend complex concepts. So, incorporating virtual manipulatives in classrooms is not just going to benefit the students but also appealing to hands-on-learners.

3. Digital field tours

One of the popular and cost-effective ways to use technology in classrooms is to take digital field tours. Apps such as Google Streetview allow you to virtually explore parks, forests, and even national and international landmarks from the comforts of the classroom. For instance, a virtual tour of the Grand Canyon can help students learn about the location or the subject and help them learn beyond books.

4. Use Social Media

Much of our time is spent on social media today. So integrating social media into the classroom is a great way to use technology in classrooms. For example, creating a WhatsApp or Facebook Group for a particular class allow students to post discussion topics. You can even consider developing interesting Twitter hashtags students can use to discuss lessons or ask questions.

5. Create digital content

Digital content related to what students are learning helps them display their individual creativity as well as showcase learning. Provide options like blogs, videos, eBooks, podcasts, flyers, or other digital means that will help students to express themselves.

6. Gamified learning

Make learning fun by incorporating gamified learning. Simply create a virtual scavenger hunt by giving the students a list of questions for students to search and find the correct answers. You can even consider forming groups or pairs of students to encourage teamwork and collaboration.

7. Include videos

Videos help students remember important concepts longer than reading. Teachers can record videos such as whiteboard explainers, peer presentations, classroom activities, etc., and share it with the class via Google Classroom, YouTube, or Gdrive.

Videos will help visual learners to learn at their own pace. Also, videos will help establish a better connection between teachers and students while comprehending clarity.

8. Podcasts

Motivational podcasts, interviews, and online courses can aid the teaching process in the long run.

Some examples of podcasts that teachers can include in the classroom are;

- Podcasts blogs

- Lectures from other teachers

- Researches on academic topics

Teachers can take it to the next level by asking the students to create their podcasts.

9. Multimedia lessons and presentations

By incorporating visual effects, music, videos in the presentations, they can be made more enriching for students. Teachers can consider inviting virtual guest speakers via Skype, Google Hangouts, and Facetime to engage their class during the slideshow or digital presentations. This will boost engagement with lessons.

Some of the future trends in the education industry

1. Student-centered learning

The future of education will be student-centric learning. Teachers need to adopt personalized teaching and learning practices. Flexibility in learning will result in imparting quality education to students. Flexible learning patterns will gain prominence in future classrooms.

2. Edutainment

The concept of blending learning with entertainment is opening the doors to thinking forward. Technology can be used to focus on slide shows and online videos. Technology innovations like Augmented Reality (AR) are already replacing pens and chalk pieces in the field of education and will bring about significant changes soon. A study conducted by the University of Georgia has shown that the introduction of AR makes 72% of the students more likely to participate in classes. Building such participation is a critical aspect of education.

Media learning is helping students to hone their creative skills and stay in touch with educational events that are happening across the globe. Videos, educational podcasts, simulations, and recorded audio-visual lessons are trends that transform traditional classroom learning and teaching.

3. Adaptive learning

The adaptive learning curriculum is personalized learning that allows students to work on instant feedback given by their teachers and improves student engagement.

In the future, students will be categorized and trained based on their inherent strengths and capabilities. Appropriate learning tools can be recommended to reveal students’ budding talents and bring them to the fore. The adaptive learning pattern will not only keep the fundamental interests in mind but also the individual needs of the students.

Fingent helps schools, universities, colleges, educational institutions, NGOs, and training centers to develop customized LMS platforms that come with aptitude-based smart learning tools. This makes sure that you can have a more interactive learning atmosphere. Customized LMS allows you to cultivate more transparency and communication between the instructor and the learner, which works to improve performance significantly.

Read more: E-Learning Taking A New Front: How Can LMS Technology Help

Integrating technology into the classroom allows more effective communication between the teachers and students. It empowers students to take responsibility for their learning by participating in projects and learning activities, giving feedback on lessons, and understand how to use technology in classrooms creatively and safely. Get in touch with our custom software development experts today and know how we can help you bring technology in classrooms more effectively.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new